Business

Foreign buying interest in JKH stocks buoys bourse

By Hiran H.Senewiratne

CSE trading kicked off on a bullish note yesterday for the third consecutive day when foreign buying interest cropped up, especially in JKH stocks, when a US investor, International Development Finance Corporation, decided to invest US $ 553 million in the West Container Terminal Project through the Adani Group. JKH also has an interest in it, market analysts said.

Further, JKH is also planning to sign an agreement with an international gaming operator for their Cinnamon Life projects, which also attracted stock market investors, especially foreign investors in the company’s stock. Apart from that a US $ 750 million standalone wind power project in Sri Lanka also created some impetus to the market, market analysts said.

Analysts said there was a recovery in the market sentiment due to some of the earnings results announced. They said in addition to the two major crossings that went through, including JKH, there was more retail activity in the market.

Amid those developments turnover had crossed the Rs 1 billion mark before noon, driven mostly by trades in JKH shares, both in a crossing and onboard trading while both indices moved upwards. The All Share Price Index went up by 66.24 points and S and P SL20 rose by 39.15 points. Turnover stood at Rs 1.82 billion with two crossings. Those crossings were reported in JKH, which crossed 381,000 shares to the tune of Rs 74.3 million; its shares traded at Rs 195, Browns Investments 7.1 million shares crossed for Rs 37.6 million and its shares traded at Rs 5.30 and Windforce 1.4 million shares crossed for Rs 26.3 million; its shares traded at Rs 19.

In the retail market top seven companies that mainly contributed to the turnover were; JKH Rs 629 million (3.2 million shares traded), Sampath Bank Rs 171.1 million (2.5 million shares traded), Capital Alliance Rs 108 million (1.65 million shares traded), Lanka Milk Food Rs 51.7 million (274,000 shares traded), NDB Rs 47 million (694,000 shares traded), Browns Investments Rs 46.8 million (8.9 million shares traded) and First Capital Holdings Rs 44.3 million (1.2 million shares traded). During the day 77.3 million share volumes changed hands in 12328 transactions.

Yesterday, the rupee opened at Rs 327.50/328.25 to the US dollar, dealers said.

Business

SIA warns of 1,000 SME collapses, urges fair policies to protect Sri Lanka’s rooftop solar sector

By Sanath Nanayakkare

The Solar Industries Association (SIA), representing over 1,000 companies and employing 40,000 workers in Sri Lanka’s rooftop solar sector, issued a stern warning recently regarding threats to the industry’s survival and the nation’s renewable energy ambitions. The association condemned recent regulatory instability and called for urgent policy reforms to avert economic and social crises.

The SIA categorically rejected the Ceylon Electricity Board’s (CEB) claim that rooftop solar installations caused the recent island-wide power outage, calling the accusation “baseless and misleading.”

“Public trust is eroded when accountability is misdirected,” the SIA stated. “We demand an independent, transparent investigation led by experts appointed by the Ministry or the Public Utilities Commission (PUCSL). The CEB’s unilateral statements disregard the sector’s contributions and jeopardize Sri Lanka’s renewable energy transition,” they said.

“While acknowledging the formation of a tariff determination committee, the SIA criticized its narrow focus on financial parameters, ignoring the sector’s socioeconomic value. Rooftop solar empowers businesses and households with energy independence, reduces grid strain, and supports climate goals. However, proposed volatile tariff structures risk destabilizing over 100,000 installations—primarily owned by middle-class families—and deter future investment,” they noted.

“A rigid, equation-based tariff system is unsustainable,” the association warned. “Sri Lanka needs a stable policy framework to attract long-term investments. For instance, retirees could invest EPF savings into solar projects, securing income while advancing national energy targets. Without urgent action, 1,000 SMEs and 40,000 jobs face collapse, with dire consequences for employment, energy security, and economic stability,” they pointed out.

SIA urged policymakers to establish an independent committee to investigate the power outage fairly, expand the tariff committee’s mandate to include socioeconomic and environmental benefits and implement predictable policies to safeguard SMEs, households, and investor confidence.

“Sri Lanka stands at a crossroads,” the SIA emphasized. “Protecting rooftop solar isn’t just about energy—it’s about livelihoods, economic resilience, and a sustainable future. We urge stakeholders to collaborate on solutions that prioritize both people and progress,: they emphasized.

Business

SLT-MOBITEL partners with the Rush Lanka Group to power its apartment portfolio

SLT-MOBITEL has entered into a strategic partnership with Rush Lanka Group to provide exclusive SLT-MOBITEL Fibre connectivity solutions to their portfolio of luxury apartment developments in Colombo and the suburbs, enhancing the digital experience of all residents.

The agreement was signed between Imantha Wijekoon, Chief Business Officer of Consumer Business at SLT, and Zaid Ariff, Director of Construction at the Rush Group headquarters. Representatives from both companies also attended the ceremony.

Under the partnership, SLT-MOBITEL will serve as the exclusive digital service provider for five prestigious Rush Lanka developments including Street Rush Residencies and Rush Court 4 in Mt. Lavinia, Rush Tower 2, Rush Metropolis in Dehiwala, and Rush Court 5 in Colombo 14. The collaboration ensures residents will enjoy superior fibre connectivity speeds, enabling seamless digital experiences in modern smart homes. The partnership with the Rush Lanka Group aligns with SLT-MOBITEL’s commitment to offer ultra-fast, reliable connectivity solutions to residential developments. Delivering exclusive fibre connectivity to luxury apartments, SLT-MOBITEL ensures residents have access to world-class digital services that complement the living experience promised by Rush Lanka Group.

Powered by advanced fibre technology, SLT-MOBITEL network will provide the residences with seamless performance across digital activities. The SLT-MOBITEL Fibre backbone ensures lag-free experiences whether tenants are gaming online, attending virtual classes, working remotely, or streaming high-definition entertainment. SLT-MOBITEL Fibre will transform the lifestyles of all apartment users bringing greater convenience and superior quality of life.

Rush Lanka Group, established in 1992, is a property developer specializing in luxury and semi-luxury apartments.

Business

Sri Lanka makes outstanding appearance at OTM and SATTE 2025 in India

Starting its promotional work for 2025, Sri Lanka Tourism Promotion Bureau (SLTPB) added another feather into its cap of endorsements, by being recognized as the most innovative Tourism Board promotion in Outbound Travel Mart (OTM) . In parallel to that, several other sub events were held. The OTM was held in Jio World Convention Centre, Mumbai—India, from 30th January to 01st February 2025.Before OTM, the Global Village – Global Exchange & Trade Exhibition was held at the Surat International Exhibition & Convention Centre , Sarsana, Surat (Gujarat – India , from 25th to 27th January 2025. This travel fair was organized by Southern Gujarat Chamber of Commerce and Industry (SGCCI).

Sri Lanka participated in both OTM and South Asia’s Travel & Tourism Exchange (SATTE), held from 19th – 21st Feb 2025, in New Delhi, India . This was an excellent opportunity for Sri Lanka to promote it’s potential as a unique travel destination, especially for the Indian counterparts, as SLTPB has identified India as the number one source market for Sri Lanka, tourism bringing the largest number of tourist arrivals to the destination.

-

Editorial6 days ago

Editorial6 days agoRanil roasted in London

-

Latest News7 days ago

Latest News7 days agoS. Thomas’ beat Royal by five wickets in the 146th Battle of the Blues

-

Features6 days ago

Features6 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Opinion5 days ago

Opinion5 days agoInsulting SL armed forces

-

Features6 days ago

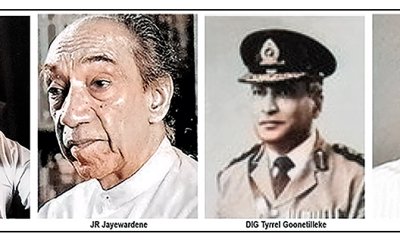

Features6 days agoMr. JR Jayewardene’s passport

-

News3 days ago

News3 days agoAlfred Duraiappa’s relative killed in Canada shooting

-

Features6 days ago

Features6 days agoAs superpower America falls into chaos, being small is beautiful for Sri Lanka

-

Opinion6 days ago

Opinion6 days agoBeyond Victory: sportsmanship thrives at Moratuwa Big Match