Business

ComBank one of 10 ‘Most Admired Companies’ in Lanka for 4th consecutive year

The Commercial Bank of Ceylon has once again been included among the 10 ‘Most Admired Companies in Sri Lanka’ in the annual list compiled by the International Chamber of Commerce Sri Lanka (ICCSL) in collaboration with the Chartered Institute of Management Accountants (CIMA).

This is the fourth consecutive year that Sri Lanka’s biggest private sector bank has been ranked among the top 10 companies in this list, which was launched in 2018.

Commenting on this prestigious accolade, Commercial Bank Managing Director, S. Renganathan said: “The past year has been adverse for companies in general, but we believe it is how we have responded to the challenges of the pandemic and its impacts on our customers, that has earned us the admiration of the people. Our performance was achieved with an extremely balanced approach that considered the interests of all stakeholder groups, with an emphasis on those most vulnerable.”

Open to both listed and unlisted companies, the ICCSL-CIMA Most Admired Company Awards recognise entities that are a cut above the rest in terms of not just their financial performance but also the value they create for their shareholders, customers, employees, and the wider community in general. Commercial Bank was recognised as a company that inspires other organisations and entrepreneurs by proving its mettle with consistency, authority and sustainable growth, creating excellent business performance.

Ranked Sri Lanka’s Strongest Bank Brand in 2021 by Brand Finance, Commercial Bank of Ceylon ended 2020 with total assets of Rs 1.763 trillion, gross income of Rs 151.966 billion, net profit of Rs 16.373 billion, a deposits base of Rs 1.287 trillion and a loan book of Rs 961.859 billion. In the second quarter of 2021, the Bank had the distinction of becoming the first private bank in the country to have three key balance sheet indicators exceeding Rs 1 trillion, with total assets of Rs 1.935 trillion, total deposits of Rs 1.4 trillion and a loan book of Rs 1.034 trillion as at 30th June 2020.

One of the highlights of the Bank’s performance in 2020 was the confirmation by the Ministry of Finance that it was the biggest lender to Sri Lanka’s SME sector among all state-owned, private and specialised banks in the country, accounting for more than a fifth of all loans in terms of value and number. Commercial Bank lent Rs 163.98 billion or 21.57% of the Rs 759.7 billion in loans provided to SMEs by 19 institutions, while the 58,584 loans provided by the Bank represented 23.82% of the total of 245,883 loans granted in the pandemic-impacted year.

Commercial Bank was also the leader in providing financial relief, especially to SMEs, under the Government stimulus package during the first wave of the pandemic in 2020.

Another noteworthy recent milestone was the Bank’s achievement of carbon-neutral status, becoming the first Bank in Sri Lanka to have completely balance its environmental footprint.

The first Sri Lankan bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 11 years consecutively, Commercial Bank operates a network of 268 branches and 931 automated machines in Sri Lanka. The Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.

Business

NDB reports all-time high earnings; doubles PAT on a normalised basis

National Development Bank PLC (hereinafter ‘the Bank’) announced its results for the financial year ended December 31, 2025 to the Colombo Stock Exchange recently. Full year results tabled by the Bank showcase a strong growth across all business lines with Net Banking Revenue increasing by a 45.2% on a comparable basis.

Like most other peers, the Bank’s 2024 financial performance was positively impacted following the successful conclusion of the ISB debt restructure with a one-off impact on interest income, fee income and net impairments amounting to LKR 1.4 billion, LKR 0.7 billion and LKR 9.4 billion, respectively for the said year.

Fund based income

Net interest income (NII), which accounts for close to 75.0% of Bank’s total operating income, grew by 6.5% on a normalised basis. Despite pressure on interest-earning assets arising from the lower interest rate environment, the Bank’s disciplined margin management helped stabilise Net Interest Margin (NIM) at 4.0% for the year. On a comparable basis, excluding one-off exceptional items, NIM stood at 4.2%, compared to 4.3% for both scenarios in 2024. By the end of the year, the Bank had close to LKR 29.3 billion in Loans and Deposits under a special arrangement with its customer(s) with a netting-off feature (end 2024: LKR 19.6 billion).

Non-fund based income

Net fee and commission income reached LKR 8.1 billion for the year – representing a growth of 14.3% from LKR 7.1 billion in 2024 excluding ISB restructuring related fees. Key growth drivers for the current year were trade finance, credit and lending, digital banking and credit and debit cards.

Credit and operating costs

Credit costs for the year amounted to LKR 5.7 billion, reflecting a substantial reduction of 57.1% compared to LKR 13.2 billion in 2024, a testament to the Bank’s strong credit underwriting practices and focused efforts on collections and recoveries. The Bank’s success on account of the latter is best reflected in notably improved stage 2 and 3 loan stock which stood at 7.9% and 10.8% respectively at end 2025 as compared with 16.6% and 14.0% at end 2024. Stage 3 provision coverage also saw further improvement to 59.1% from 54.5% during 2024 showcasing the Bank’s prudent management of credit risk.

Operating expenses closed at LKR 19.0 billion for the year, marking a 13.1% YoY increase. This increase was primarily driven by routine staff-related increments and necessary market realignments, along with higher investments in IT infrastructure and business development undertaken during the year.(NDB)

Business

PMF Finance appoints Nishani Perera as Non-Executive Independent Director

PMF Finance PLC has announced the appointment of Ms. Nishani Perera as a Non-Executive Independent Director, further strengthening the Company’s strategic oversight, governance framework, and board-level expertise as it continues to advance its transformation and long-term growth agenda.

Ms. Perera is a Fellow Member of the Institute of Chartered Accountants of Sri Lanka and brings over 19 years of experience across audit, assurance, advisory, risk management, and corporate governance. She currently serves as Partner – Audit & Assurance at Moore Aiyar and as Director of Moore Consulting (Pvt) Ltd.

Over the course of her career, Ms. Perera has gained substantial exposure to listed companies, banks, finance companies, and other regulated entities. Her areas of expertise include financial reporting under SLFRS/LKAS, audit and risk oversight, regulatory compliance, and the implementation of quality management standards. She has worked closely with Boards of Directors and Audit Committees on matters relating to financial reporting integrity, internal control frameworks, enterprise risk governance, and adherence to evolving regulatory requirements.

Ms. Perera holds a Master of Laws (LL.M.) from Cardiff Metropolitan University in the United Kingdom and a Bachelor of Science in Business Administration (Special) from the University of Sri Jayewardenepura. She is also an Associate Member of ACCA and CMA Sri Lanka, and a Fellow Member of AAT Sri Lanka.

Business

Capital Alliance deepens capital market presence with third Closed-End Fund Listing at the CSE

The units of the “CAL Three Year Closed End Fund” were officially listed on the Colombo Stock Exchange (CSE) recently. Accordingly, a total of 841,263,375 units of the ‘CAL Three Year Closed End Fund’ were listed by Capital Alliance Investments Ltd (CALI), a member of the Capital Alliance Ltd Group (CAL Group). The listing was commemorated by way of a special bell ringing ceremony on the CSE trading floor.

CSE CEO Rajeeva Bandaranaike speaking at the occasion remarked upon the rising demand for Unit Trusts: “When you look at funds, particularly unit trusts in today’s active capital market, we see a lot of domestic interest in the market with more investors entering. Funds, not only fixed income funds but also growth and balanced funds, can be the ideal vehicle through which new investors can enter the market. We see this interest reflected in the success of CAL’s Three Year Closed End Fund. More people are seeking to invest their money through professional fund managers.”

-

Features4 days ago

Features4 days agoWhy does the state threaten Its people with yet another anti-terror law?

-

Features4 days ago

Features4 days agoReconciliation, Mood of the Nation and the NPP Government

-

Features4 days ago

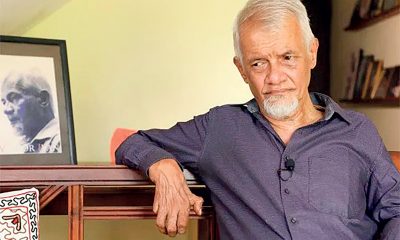

Features4 days agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features3 days ago

Features3 days agoLOVEABLE BUT LETHAL: When four-legged stars remind us of a silent killer

-

Features4 days ago

Features4 days agoVictor, the Friend of the Foreign Press

-

Latest News5 days ago

Latest News5 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Latest News5 days ago

Latest News5 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News6 days ago

Latest News6 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction