Features

Challenging the Auditor General and Other Stories

LESSONS FROM MY CAREER: SYNTHESISING MANAGEMENT THEORY WITH PRACTICE – PART 22

Awardee of the APO Regional Award for promoting Productivity in the Asia Pacific Region

Recipient of the “Order of the Rising Sun, Gold and Silver Rays” from the Government of Japan.

He can be contacted through email at bizex.seminarsandconsulting@gmail.com)

Today I continue with further stories during my stint as Chairman at the ETF Board

Synchronising the definitions with the EPF and differentiating from the EPF

During my first few months at the ETF Board, several people complained about the differing interpretations of definitions, including ‘earnings’, ‘allowances’, ‘meal subsidies’, and ‘covered employees’, between the EPF and the ETF.

I reviewed our forms alongside those of the EPF and identified some glaring discrepancies. While the labour department does not include overtime as a part of earnings, we at ETF ask for and include overtime. This was wrong and was corrected immediately. We set up a team with me heading the ETF side and the Commissioner of Labour heading the EPF side, and reconciled all the differences. Employers adopted various ruses by granting fixed allowances without including them as part of the earnings, which were actually included in the earnings. These, too, were clarified.

Many were confused about the two funds and why we needed two superannuation funds. We had lengthy discussions at the Board level, delving into the written and unwritten details of the fund’s creation. I have written extensively on this topic and have also made presentations at seminars. In summary, the Employees’ Provident Fund (EPF) is a superannuation Fund that would benefit employees at the time of retirement.

At the same time, the Employees’ Trust Fund (ETF) is expected to provide benefits to employees throughout their working life and also serve as a fund that spurs economic growth through investments in industry and commerce. It is not a pure superannuation fund. This is why there are so many benefit schemes by the ETF. It is believed that Hon. Lalith Athulathmudali’s idea was to allocate an amount equivalent to 3% of the employees’ earnings to the ETF, thereby funding industrial and commercial ventures and spurring economic growth. The dry docks in Colombo would never have seen the light of day if not for the investment by the ETF.

Mostly, people were confused because the EPF and ETF bi-annual statements looked very similar. We decided to print our statements in a beige-pink colour and have the benefits printed overleaf. We even embarked on an advertising programme to make people aware of the benefits. People noticed the difference.

The imposition of penalties became a bone of contention

Penalties for delayed payments were another bone of contention. Our Act allows a waiver of a penalty for late payments only if the delay was due to circumstances beyond the employer’s control. Beyond the employer’s control would be events such as floods, fires, other natural disasters, and the closure of a business, among other unforeseen circumstances. I would receive many requests to waive penalties for spurious reasons.

Some were hilarious, like the payment cheque was given to a peon who had forgotten to bank it, or the bank closed one minute earlier than usual, or the vehicle that took the cheque broke down on the way. Many of my friends were quite upset with me for not providing them with the expected waivers. My hands were tied; I had to implement the law.

Some CEOs argued with me at a meeting that, with many operational units, they were unable to meet the deadline in one month because all figures from branches and units had to be consolidated. Further, they accused me of not understanding the difficulty, because I was a public officer.

I had a fantastic opening. I told them that I managed an operation with 4,500 employees, over twenty production units spread across the country, plus more than 15 retail units, and that I had consolidated and paid without any delay, except during the insurgency. I was referring to the Ceylon Ceramics Corporation, where I was the General Manager. Realising I had been on their side as an employer and that I came from the industry, they were shocked, and there were no more arguments.

When estates were privatised and handed over to private sector management companies, they had huge cash flow problems in the first months. The treasury didn’t bail them out when they were under Government management. All estate companies paid late, and an automatic penalty was imposed. One company contacted me, and I advised them on how to respond to the penalty notice, providing complete details of the circumstances and explaining why it was beyond their control.

I used the powers vested in me and waived the penalty, covering myself in the process, because the detailed explanation for the delay was clear. Other companies requested a meeting with Mr Paskaralingam, Secretary to the Treasury, who called a meeting, and I was summoned. I explained the process, informed them of the correct procedure that should have been followed, and described the solution I provided to the company that contacted me.

I asked them not to run to Mr Paskaralingam for everything, but to call me first, because I am the Chairman and I can provide a solution within the law. Mr Paskaralingam reiterated what I said. Some very senior chairmen of plantation companies did not expect this response from a young Chairman of the ETF. The matter was resolved to the satisfaction of everyone.

Getting a new computer

The IBM System 34 computer we had was a disaster. It was seriously outdated, and the computerisation of member accounts was far behind. As a result, we were processing claims manually. Data entry was handled by 6 operators who were unable to cope with the workload.

I initially decided to outsource data entry to clear the backlog, discussed a solution with IBM, obtained Cabinet approval, and after a long delay due to technical committee deliberations and tender Board deliberations, we ordered a new IBM machine. We had taken so long that the quoted machine was already outdated, and IBM was kind enough to offer the newer model at the same price. We had our tender board decisions challenged, and another committee was established to deliberate on the matter. It was such a hassle that not many people would want to go through such an exercise.

Commissioning was another hassle, and the number of members was continuing to grow in the meantime. The arrears were never completed during my tenure. It continued to be a headache for many other Chairmen after me. We made some progress, though. The office had to be completely refurbished, including the installation of false floors to accommodate the data cables. I was disappointed that I couldn’t finish what I had started. The new machine cost around LKR 25 million, and I was tasked with keeping the price within that range. We struggled to keep up with the workload. My instinct was to opt for a higher-capacity machine, but even the Ministry was hesitant to approve anything more. Our specifications were found to be short of what we actually needed. Many Ministry officials felt that I wanted a toy and said processing should be done manually, “without wasting members’ money”. It was a different era.

Disagreement with the Auditor General’s Office

Since our fund was substantial, the Auditor General had a permanent office in our premises. Almost every week or two, we would receive an audit query. I was pleased with this because I felt safer with the oversight of another department. There were many issues that I had not been aware of and were able to remedy them.

What irked me most were some comments in the draft report of the Auditor General after my first year in office. One comment was that I had sent my car for all repairs to Associated Motorways (AMW) without obtaining quotations from other garages. My vehicle was a Nissan Bluebird, and I always sent it for service and repairs to the agent AMW. I would have been insane if I had sent it to a roadside garage, considering it was an expensive car at the time. The second was that I had purchased a transportable cellular phone, which was hardly used, and it was termed an uneconomic transaction. It was a time when cellular phones were just being introduced and were so huge that they did not fit into a pocket.

The transportable telephone was placed on a side table in my office for taking and receiving calls, only if the phones in the office or the entire building were out of order. Having to get daily quotations for 7-day call money rates from 26 banks when the phones went dead, we could use this telephone instead. In fact, in one instance, before this purchase, all the phones went dead, and we lost out on getting the best rates due to connectivity issues. Only the telex worked that day. Unfortunately, since we purchased the new cellular phone, we have not had a single telephone problem. It cost Rs 80,000/-.

The third issue was the purchase of shares. Before my time, shares of Sampath Bank and Seylan Bank had been purchased. The ETF was expected to buy shares because one of its objectives was to promote economic growth through investments. These were new ventures, and anyone who has a smattering of commercial knowledge knows that a new venture takes a few years to build reserves and consolidate before declaring dividends. The Auditor General classified this as an uneconomic transaction because dividends were not received within 12 months.

I met the Auditor General himself and challenged these findings. I asked the Audit Superintendent, who had conducted the audit, why it was uneconomic to go to the agent for repairing my official car, and asked him whether it wouldn’t be worse if an unprofessional garage used counterfeit parts? I further asked him whether he too wouldn’t consult a well-known doctor if he were confronted with a heart ailment, rather than seeking quotations from different doctors?

The Auditor General immediately asked that the comment be deleted. The next was the cellular telephone, where I explained that it was for emergency use only. If there were a telecom failure and we lost just 0.5% because we were unable to obtain the best rates of the day, the loss would amount to millions of rupees. This, too, was accepted. However, the Auditor General refused to delete the comment about the share investments despite my proof that we had received additional shares through bonus shares and that the market price was higher than our original investment.

However, he finally agreed to insert a comment stating that I had met him and explained that investments should not be judged solely by dividends, but also by the increase in market value, etc. The classification as an uneconomic transaction remained but my statement was included without comment, as seen in the published in the Annual Report of the ETF that year. The lesson is that although delegation is recommended in most management literature, some activities should not be delegated.

It is situational. No subordinate of mine could have argued with the Auditor General due to their status level. Additionally, in both the private and state sectors, CEOs unfamiliar with functional skills are at the mercy of subject specialists. This is why I venerated the MBA at PIM at an early age, which transformed my management thinking and style.

The Minister cancels the Religious Ceremonies

To celebrate the 10th anniversary, as a unifying mechanism for the staff, and as a means of blessing our institution, I suggested a pirith ceremony and a Catholic service instead of a tamasha. This was taken up well by our employees and they were in the process of organising both ceremonies when I was removed from my post due to fake information going to the President. This is fully described in a previous episode. The Minister then took control, and both religious ceremonies were cancelled; instead, he organised a tamasha with several Ministers and dignitaries, accompanied by numerous speeches.

I was reappointed and returned in about two months. Strange things were happening now with staff members meeting with accidents, one lady dying during childbirth, and similar disasters. Many staff members told me that it was because we cancelled the religious ceremonies.

I decided to restart organising the religious ceremonies. The Pirith was attended by the Prime Minister himself. On a side note, during the entire maha piritha that day, the PM tried to convince me to enter politics and work with him, saying that he had started as an apprentice under the Honourable A. Ratnayake, a former well-respected Minister. He failed to convince me. The catholic mass was attended by the archbishop himself and was a great success.

Thereafter, all disastrous events came to a complete stop. No one in our office even got a scratch after the religious ceremonies. My belief in divine powers continued.

Advertising Success

Having realised that many in the private sector were unaware of the ETF benefit schemes, I devised several action plans to bring these schemes to the attention of members. I was instrumental in introducing several new benefit schemes, supplementing the existing death insurance and total disability insurance schemes. The new initiatives included free heart surgery at Sri Jayewardenepura Hospital, free intraocular lens implants after cataract surgery, and the grade 5 scholarship scheme. The last one was as a result of many of my friends and colleagues asking me how they could benefit from ETF schemes. My answer would surprise them.

I said “I hope you will never qualify for benefits because you must either die, or be totally and permanently disabled or need a cataract surgery, or heart surgery” This made me think. We had schemes for “negative” matters and none for “positive” things. Then one of our employees suggested a new scheme to reward excellent performers of the grade 5 scholarship examination for children of members with a monetary gift deposited in a prescribed bank, to be used when the child reaches a particular age. This was also supported by the Minister, and it was implemented soon.

When our advertising became successful, explaining coverage and earnings, our rate of membership growth surpassed that of the EPF. Workers were questioning the management whether the ETF is being paid on their behalf. Many ladies who managed their private estates would argue that they were unaware of EPF and ETF, and thus they were in violation of the law. I would tell them that the ignorance of the law is no excuse.

I was told by some CEOs who were defaulters that I was disrupting their hitherto good industrial relations. Suddenly, I was summoned to the Cabinet subcommittee on investments and instructed to halt the campaign.

I was told that the advertising campaign was scaring off foreign investors. The campaign was stopped, but the results continued to follow. With lunchtime programmes in companies relayed on the radio, and seminars to educate the private sector, the knowledge had diffused widely by then. Although the advertising was stopped, the number of new registrations increased notably. Years later, we were once again allowed to advertise.

The next episode will continue with further stories and how a life was saved.

by Sunil G Wijesinha ✍️

(Consultant on Productivity and Japanese Management Techniques

Retired Chairman/Director of several Listed and Unlisted companies.

Features

The middle-class money trap: Why looking rich keeps Sri Lankans poor

Every January, we make grand resolutions about our finances. We promise ourselves we’ll save more, spend less, and finally get serious about investments. By March, most of these promises were abandoned, alongside our unused gym memberships.

Every January, we make grand resolutions about our finances. We promise ourselves we’ll save more, spend less, and finally get serious about investments. By March, most of these promises were abandoned, alongside our unused gym memberships.

The problem isn’t our intentions, it’s our approach. We treat financial management as a personality flaw that needs fixing, rather than a skill that needs the right strategy. This year let’s try something different. Let’s put actual behavioural science behind how we handle our rupees.

Based on the article ‘Seven proven, realistic ways to improve your finances in 2026’ published on 1news.co.nz, I aim to adapt these recommended financial strategies to the Sri Lankan context.” Here are seven money habits that work because they’re grounded in how humans actually behave, not how we wish we would.

While these strategies offer useful direction for strengthening personal financial management, it is important to acknowledge that they may not be suitable for everyone. Many households face severe financial pressure and cannot realistically follow traditional income allocation frameworks, such as the well-known but outdated Singalovada Sutta guidelines, when even meeting daily food expenses has become a struggle. For individuals and families who are burdened by escalating costs of essentials, including electricity, water, mobile connectivity, transport, and other non-negotiable commitments, strict adherence to prescriptive models is neither practical nor fair to expect. Therefore, readers should remain mindful of their own financial realities and adapt these strategies in ways that align with their income levels, essential obligations, and broader personal circumstances.

1. Your Money Problems Aren’t Moral Failures, They’re Data Points

When every rupee misspent becomes evidence of personal failure, we stop looking for solutions. Shame is a terrible problem-solver. It makes us hide from our bank statements, avoid difficult conversations, and repeat the same mistakes because we’re too embarrassed to examine them.

Instead, try replacing judgment with curiosity. Transform “I’m terrible with money” into “That’s interesting, why did I make that choice?” Suddenly, mistakes become information rather than indictments. You might notice you overspend at Odel or high-end restaurant when stressed about work. Or that you commit to expensive plans when feeling socially pressured. Perhaps your online shopping peaks during power cuts when you’re bored and frustrated.

2. Forget the Year-Long Marathon, Focus on 90-Day Sprints

A Sri Lankan year is densely packed with financial obligations: Sinhala/Tamil Avurudu, Christmas, Vesak, and Poson celebrations; recurring school fees; seasonal festival shopping; wedding and almsgiving periods; yearend festivities; and an evergrowing list of marketing-driven occasions such as Valentine’s Day, Father’s Day, Mother’s Day, and many others. Each of these events carries its own financial weight, often placing additional pressure on already-stretched household budgets.

Research consistently shows that shorter time frames work better. Ninety days is long enough to create a meaningful change, but short enough to maintain focus and momentum. So instead of one overwhelming annual goal, give yourself four quarterly upgrades.

In the first quarter, the focus may be on organising your contributions toward key duties and responsibilities, while also ensuring that you are maximising the available benefits for your designated beneficiaries. Quarter two could be about building a small emergency fund, even Rs. 10,000 provides breathing room. Quarter three might involve auditing your bills and subscriptions to eliminate unnecessary expenses. Quarter four could be when you finally start that investment you’ve been postponing. You don’t need superhuman discipline or complicated spreadsheets, just focused attention, one quarter at a time.

3. Make One Decision That Eliminates Weekly Worry

The best money decisions are the ones you make once but benefit from repeatedly. These are decisions that permanently reduce what behavioural economists call “decision fatigue”, the mental exhaustion that comes from constantly managing money in your head. What’s one choice you could make today that would remove a recurring financial worry?

It might be setting up an automatic standing order to transfer Rs. 10,000 to savings the day your salary arrives, before you can spend it. Maybe it’s consolidating your scattered savings accounts into one that actually pays decent return.

These aren’t dramatic moves that require personality transplants. They’re structural decisions that work with your human tendency toward inertia rather than against it. Most banks now offer seamless digital automation. You can set it up once and benefit from that decision every single month without additional effort or willpower. You make the decision once. You benefit all year. That’s leveraging your energy intelligently.

4. Stop Spending on Who You Think You Should Be

Sri Lankan society comes with heavy expectations. The car you drive, the school your children attend, the hotels you patronise, the brands you wear, all communicate your worth, or so we’re told. Much of our spending isn’t about actual enjoyment. It’s about meeting unspoken expectations, keeping up appearances, or aspiring to a version of us that doesn’t actually exist.

We buy expensive saris we’ll wear once because everyone does. We maintain memberships to clubs we rarely visit because it looks good. We say yes to weekend plans at overpriced restaurants because declining feels like admitting we can’t afford it. We upgrade phones not because ours stopped working, but because others have.

Before your next purchase, ask yourself: do I actually want this, or do I want to want it? If it’s the second one, walk away. You won’t miss it. This isn’t about deprivation, it’s about precision. When you stop spending to perform and start spending to support the life you genuinely enjoy, money pressure eases dramatically. Your resources align with your actual values rather than imagined expectations.

Maybe you don’t care about fancy restaurants, but you love long drives along the southern coast. Maybe branded clothing leaves you cold, but you’d spend any amount on art supplies or books. That’s fine. Spend accordingly.

5. Break One Habit, See If You Actually Miss It

We’re creatures of routine, which serves us well until those routines outlive their usefulness. Sometimes we spend money on habits that started for good reasons but no longer serve us. Alpechchathava, in Buddha’s teaching, means living contentedly with few desires. It guides a person to manage money wisely by avoiding excess spending, unnecessary debt, and craving, and by focusing on essential needs and wholesome priorities. In this way, wealth supports mental cultivation, generosity, and spiritual progress.

The daily kottu roti that once felt like a convenient solution after working late may now have turned into an unnecessary routine. Similarly, frequent P&S or Caravan snack runs, and the habit of picking up sugary treats like cakes and sweets, are not only costly but also wellknown to be unhealthy, as nutritionists consistently point out. Beyond food, other expenses such as magazine subscriptions, the monthly coffee meetup, or weekend mall browsing often continue on autopilot without us realising how much they add up. These seemingly small, habitual expenses can quietly drain your budget while offering very little longterm value.

Try this experiment: keep a money diary for one week. Note every expense, no matter how small. Then identify one regular spend and eliminate it for the following week. If you don’t miss it? Excellent, keep it gone. If you genuinely miss it? Add it back without guilt. This isn’t about permanent sacrifice.

It’s about snapping yourself out of autopilot and checking whether your spending still reflects your current reality, priorities and purchasing power. You might discover you’re spending Rs. 15,000 monthly on things you barely notice.

6. Create Your Crisis Playbook on a Good Day

Many financial disasters don’t happen because we’re careless, they happen because we’re panicked. When crisis strikes, job loss, medical emergency, unexpected business downturn, fear hijacks our decision-making. Our rational brain exists while panic makes expensive choices: high-interest personal loans, selling investments at losses, making commitments we can’t sustain.

The solution? Make your crisis plan before the crisis arrives. On a calm day, sit down and document: If I lost my income tomorrow, what would I do first? Which expenses are truly essential? What’s the absolute minimum I need to function? Who could I call for advice? Which savings are untouchable, which could be accessed if necessary? What government support or loan restructuring options exist (Not in Sri Lanka)? This is a sort of preparation for sudden shocks.

7. Question the Money Stories You Inherited

Sometimes our biggest financial obstacles aren’t failed attempts, they’re the attempts we never make because we’ve internalised limiting stories. “Our family was never good with money.” “Investing is for rich people.” “I’m just not the type who earns more.” “Women don’t understand finance.” These narratives, absorbed from family, culture, or past experiences, become invisible fences.

Question them. Where did this belief originate? Is it actually true, or is it a story you’ve been telling yourself for so long, it feels like fact? What would happen if you tested it? Often, these stories protect us from the discomfort of trying and potentially failing. But they also protect us from the possibility of succeeding. And that’s a far costlier protection than most of us realise.

The Bottom Line

Improving your finances in 2026 doesn’t require becoming a different person. It requires understanding the person you already are, your patterns, triggers, and tendencies, and working with them rather than against them.

These aren’t magic solutions. They’re evidence-based approaches that acknowledge a simple truth: you’re not broken, and your money management doesn’t need fixing through willpower alone. It needs better systems, clearer thinking, and a lot less shame.

Features

Public scepticism regarding paediatric preventive interventions

A significant portion of the history of paediatrics is a triumph of prevention. From the simple act of washing hands to the miracle of vaccines, preventive strategies have been the unsung heroes, drastically lowering child mortality rates and setting the stage for healthier, longer lives across the globe. Simple measures like promoting personal hygiene, ensuring the proper use of toilets, and providing Vitamin K immediately after birth to prevent dangerous bleeding, have profound impacts. Advanced interventions like inhalers for asthma, robust trauma care systems, and even cutting-edge genetic manipulations are testament to the relentless and wonderful progress of paediatric science.

A shining beacon that has signified increased survival and marked reductions in mortality across the board in all paediatric age groups has been the development of various preventive strategies in the science of children’s health, from newborns to adolescents. The institution of such proven measures across the globe, has resulted in gains that are almost too good to be true. From a Sri Lankan perspective, these measures have contributed towards the unbelievable reduction of the under-5-year mortality rate from over 100 per 1000 live births in the 1960s to the seminal single-digit figure of 07 per 1000 live births in the 2020s.

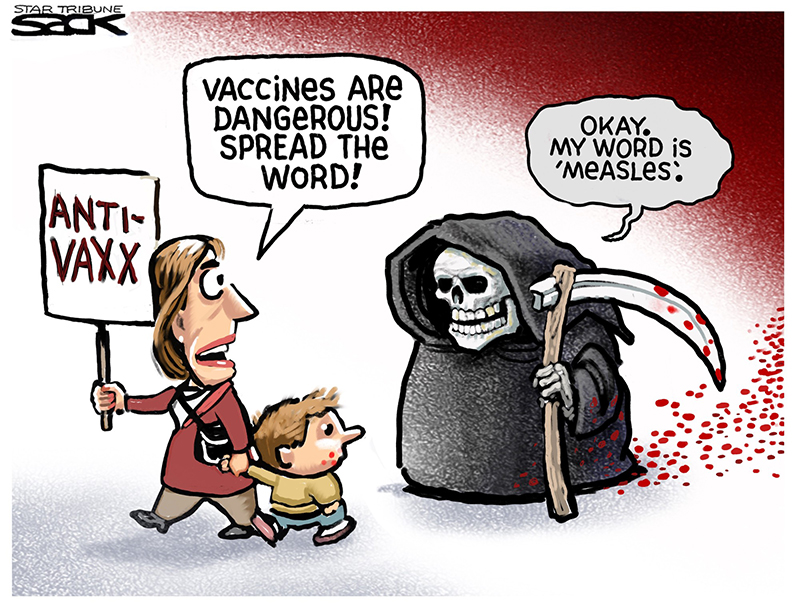

Yet for all this, despite the overwhelming evidence of success, a most worrying trend is emerging. That is public scepticism and pessimism regarding these vital interventions. This doubt is not a benign phenomenon; it poses a real danger to the health of our children. At the heart of this challenge lies the potent, often insidious, spread of misinformation and disinformation.

The success of any preventive health strategy in paediatrics rests not just on its scientific efficacy, but on parental cooperation and commitment. When parents hesitate or refuse to follow recommended guidelines, the shield of prevention is compromised. Today, the most potent threat to this partnership is the flood of false information.

Misinformation is false information spread unintentionally. A well-meaning friend sharing a rumour about a vaccine side-effect they heard online is spreading misinformation.

Disinformation is false information deliberately created and disseminated to cause harm or sow doubt. This often comes from organised groups or individuals with vested interests; sometimes financial, sometimes ideological, who seek to undermine public trust in medical institutions and scientific consensus.

The digital age, particularly social media, has become the prime breeding ground for these falsehoods. Complex scientific data is reduced to emotionally charged, simplistic, and often sensationalist soundbites that travel faster and farther than the truth.

The most visible battleground is childhood vaccination. Decades of robust, high-quality research have confirmed vaccines as one of the most cost-effective and successful public health interventions ever conceived. Global vaccination efforts have saved an estimated 150 million lives in the past 50 years, eradicating or drastically controlling diseases like polio, measles, diphtheria, and tetanus.

However, a single, long-retracted, and scientifically debunked paper claiming a link between the Measles-Mumps-Rubella (MMR) vaccine and autism continues to be weaponised by disinformation campaigns. This persistent myth, despite being soundly disproven, taps into deep-seated fears about children’s development. Other common vaccine myths target ingredients such as trace amounts of aluminium or mercury, which are harmless in the quantities used and often less than what is naturally found in food or the idea that “natural immunity” from infection is superior, totally ignoring the fact that natural infection carries the devastating risk of severe complications, long-term disability, and even death. The tangible consequence of this doubt is the dropping of childhood vaccination rates in various communities, leading to the wholly unnecessary re-emergence of vaccine-preventable diseases like measles.

Scepticism is not limited to vaccines. It can touch any area of paediatric preventive care where an intervention might seem unnecessary, invasive, or have perceived risks. Routine screenings for speech disorders, motor skills, or mental health issues can sometimes be perceived as medicalising normal childhood variations or putting a “label” on a child. Parents may resist or delay screening, missing the critical window for early intervention of proven measures that are likely to help. Advice on managing childhood obesity, reducing screen time, or adopting a balanced diet can be viewed by some parents as intrusive or judgmental, leading to poor adherence to essential health-promoting behaviours.

The regular use of inhalers for asthma or other chronic conditions might be looked down upon due to the fear of “dependency”, “addiction”, or long-term side effects, despite medical consensus that these preventive measures keep conditions controlled and prevent life-threatening exacerbations.

The common thread is a lack of understanding of the risk-benefit ratio. Parents, bombarded by fear-mongering narratives, often overestimate the rare, mild risks of an intervention while catastrophically underestimating the severe and permanent risks of the disease or condition itself.

The power of paediatric preventive medicine is not in a single shot or pill, but in the consistent, committed partnership between healthcare providers and parents. Paediatric science, driven by rigorous evidence-based medicine, do continue to refine guidelines, conduct transparent research, and communicate its findings clearly. When guidelines are confusing or lack robust evidence, it naturally creates openings for doubt. The scientific community’s commitment to continuous quality improvement and accessibility is paramount.

Ultimately, the success of prevention rests with the parents. Parenting, as a vital form of preventive care, includes all activities that raise happy, healthy, and capable children. The simple, non-medical steps mentioned in the introduction, proper handwashing, good sanitation, and encouraging exercise, are all forms of parental preventive intervention.

For more complex interventions, parental commitment requires several actions. They need to seek and trust the guidance provided by qualified healthcare professionals over anonymous, unsubstantiated online claims. They need to engage in an open dialogue by asking relevant questions and expressing concerns to doctors in an open, non-confrontational manner. A good healthcare provider will use this as an opportunity to educate and build trust, and not a portal to simply dismiss concerns. Then, of course, there is the spectre of adherence to various protocols and actions by the parents. These include consistently following recommended schedules, whether for well-child checkups, vaccinations, or daily medication protocols.

Addressing public scepticism requires a multi-pronged, collaborative strategy. It is not just about correcting false facts (debunking), but about building resilience against future falsehoods (prebunking). The single most influential voice in a parent’s decision-making process is their paediatrician or primary care provider. Clinicians must move beyond simply reciting facts. They need to use empathetic communication techniques, like Motivational Interviewing (MI), which focuses on active listening, validating parental concerns, and then collaboratively guiding them toward evidence-based decisions. For example, responding with, “I hear you’re worried about the side-effects you read about. Can I share what we know from decades of safety monitoring?” Being open about common, minor side effects such as a short-lasting fever after a vaccine pre-empts the shock and distrust that occurs when an expected, yet unmentioned, reaction happens.

Public health campaigns must go on the offensive, not just a defensive fact-checking spree. Teaching the general public how disinformation works, the use of “fake experts”, selective cherry-picked data, and conspiracy theories all add up to a most powerful form of inoculation (prebunking) against future exposure. Health institutions must simplify their communications and make verified, high-quality information easily accessible on platforms where parents are already looking.

Parents often trust their peers as much as their doctors. Engaging local community leaders, faith leaders, and even trusted social media influencers to share accurate, positive messages about paediatric health can shift the public narrative at a grassroots level. While protecting privacy, sharing aggregate data and stories about the dramatic decline in childhood diseases thanks to prevention can re-emphasise the collective good.

The battle against child mortality and morbidity has been one of the great human achievements, a testament to scientific ingenuity and collective effort. Today, the greatest threat to maintaining these gains is not a new virus, but a breakdown of trust fuelled by unchecked falsehoods.

Paediatric preventive interventions, from a cake of soap and a proper toilet to the most sophisticated genetic therapies, are the foundation of a healthy future for every child. To secure this future, the scientific community must remain transparent, the healthcare system must lead with empathy, and the public must commit to informed, critical thinking. By rejecting the noise of disinformation and embracing the clear, evidence-based consensus of science, we can ensure that every child continues to benefit from the life-saving progress that defines modern paediatrics. The well-being of the next generation demands nothing less than this renewed commitment.

Little children are not in a position to make abiding decisions regarding their health, especially regarding preventive strategies in health. It is ultimately the crucial decisions made by responsible parents regarding the health of their children that really matter. As doctors, our commitment is never to leave any child behind.

by Dr B. J. C. Perera ✍️

MBBS(Cey), DCH(Cey), DCH(Eng), MD(Paediatrics), MRCP(UK), FRCP(Edin), FRCP(Lond), FRCPCH(UK), FSLCPaed, FCCP, Hony. FRCPCH(UK), Hony. FCGP(SL)

Specialist Consultant Paediatrician and Honorary Senior Fellow, Postgraduate Institute of Medicine, University of Colombo, Sri Lanka.

Joint Editor, Sri Lanka Journal of Child Health

Section Editor, Ceylon Medical Journal

Features

Attacks on PM vulgar, misogynistic; education reforms welcome

We express our profound concern and deep outrage at the vulgar, misogynistic, and defamatory attacks being directed at the Prime Minister and Minister of Education, Dr. Harini Amarasuriya.

Dr. Harini Amarasuriya is not merely a political leader; she is a scholar, public intellectual, and lifelong advocate of social justice, equality, and education. Attempts to discredit her through personal abuse rather than reasoned policy debate are not only an insult to her, but an assault on democratic values, women’s leadership, and intellectual integrity in public life.

Such attacks are unjust and unethical, and they corrode democratic discourse. We are deeply disappointed that certain political actors and their supporters continue to rely on misinformation, prejudice, and emotional manipulation, instead of engaging in rational, evidence-based, and constructive debate.

Sri Lanka has already paid a heavy price for decades of politics rooted in fear, communal division, and sentiment-driven populism. The country’s economic collapse and social breakdown are the direct consequences of these failed approaches. The people decisively rejected this style of politics through the Aragalaya, signaling a clear demand for change. Sri Lanka now stands at a historic turning point. After decades of corruption, ethnic manipulation, and policy paralysis, the people have given a clear mandate for systemic reform.

At this critical moment, Sri Lanka urgently needs structural reforms, particularly in education, which is the foundation of long-term national development, social mobility, and global competitiveness. Yet we observe that the very forces responsible for the country’s decline are once again attempting to block or derail reforms by exploiting religious, cultural, and emotional narratives.

We strongly affirm that no nation can be rebuilt through hatred, fear, or division. Education reform is not a political threat; it is a national necessity. Efforts to undermine reform through personal attacks and manufactured controversies serve only those who seek to return to power by keeping the country weak, divided, and intellectually impoverished.

Those who now attack Dr. Harini Amarasuriya are not defending culture or morality. They are defending privilege and political survival. Having failed the country for over seventy-five years through communalism, patronage, and anti-intellectualism, they now fear that an educated, critical, and empowered generation will render their outdated politics irrelevant.

This is why they target:

=a woman,

=an academic,

=and a reformer.

We therefore state clearly that we:

1. Condemn all forms of character assassination, gender-based attacks, and hate propaganda against the Prime Minister and Minister of Education.

2. Affirm our full support for Dr. Harini Amarasuriya’s leadership in advancing Sri Lanka’s education reforms.

3. Urge the government to proceed firmly and without retreat in implementing the proposed education reforms, in line with national policy and the public mandate.

4. Call upon academics, professionals, teachers, parents, and citizens to stand together against reactionary forces that seek to sabotage reform through fear mongering and disinformation.

A country cannot be rebuilt by those who destroyed it. A future cannot be created by those who fear education reforms.

Sri Lanka’s future must not be sacrificed for the ambitions of a few.Sri Lanka must move forward — with knowledge, dignity, and courage.

Signatories:

1. Markandu Thiruvathavooran, Attorney at law

2. S. Arivalzahan, University of Jaffna

3. Dr S.Ramesh, University of Jaffna

4. Dr. Mariadas Alfred, Former Dean, University of Peradeniya

5. Prof B.Nimalathasan, Senior Professor, University of Jaffna

6. S. Srivakeesan, Station Master, SriLankan Railways

7. A. T. Aravinthan, Branch Manager, Commercial Bank

8. Dr. S. Niththiyaruban, Paediatrician, Teaching Hospital, Jaffna

9. Dr. S. Selvaganesh, Plastic and Reconstructive Surgeon, Teaching Hospital, Jaffna

10. Dr. S. Mathievaanan, Consultant Surgeon, Teaching Hospital, Jaffna

11. Prof. P. Iyngaran, University of Jaffna

12. Eng. M. Sooriasegaram, President, Education Development Consortium

13. Dr. S. Raviraj, Senior Consultant Surgeon, Former Dean, Faculty of Medicine, University, Jaffna.

14. Mr. Saminadan Wimal, University of Jaffna

15. Dr. A. Antonyrajan, University of Jaffna

16. P. Regno, Attorney at Law

17. Prof. J. Prince Jeyadevan, University of Jaffna

18. Prof. S. Muhunthan, University of Jaffna

19. Prof. R. Kapilan, University of Jaffna

20. Dr. S. Jeevasuthan, University of Jaffna

21. J.S. Thevaruban, University of Jaffna

22. S. Balaputhiran, University of Jaffna

23. Dr. N. Sivapalan, Retired Senior lecturer, University of Jaffna

24. I. P. Dhanushiyan, University of Jaffna

25. Dr. K. Thabotharan, University of Jaffna

26. Dr. Bahirathy J. Rasanen, University of Jaffna

27. Perinpanayagam Ronibus, Vice Secretary, Change Charitable Trust, Jaffna

28. Dr. S. Maheswaran, University of Peradeniya

29. Mr. S. Laleesan, Principal, Kopay Teachers’ College

30. Victor Antany, Teacher, Kilinochchi

31. K. Shanthakumar, Principal, Technical College, Vavuniya

32. S. Thirikaran, Principal, J/ Puttur Srisomaskanda College

33. Dr. T. Vannarajan, Advanced Technical Institute, Jaffna.

34. X. Don Bosco, Resource person, Piliyandala Educational Zone

35. K. Ravikumar, Regional Manager, Powerhands Pvt Ltd

36. Sathiyapriya Jeyaseelan, DO, Economist

37. A. Kalaichelvan, Chief Accountant, Animal Productive & Health

38. C. Vathanakumar, Retired Project Director

39. P. Kirupakaran, Department of Buildings (NP)

40. A. Antony Pilinton, David Peris Company, Jaffna

41. A. Muralietharan, Social Activist

42. Sinthuja Sritharan, Independent Researcher

43. T. Sritharan, Social Activist

44. Ms. Gnasakthi Sritharan, Social Activist

45. P. Thevatharsan, Management Service Officer

46. . S. Mohan, Social Activist

47. K. Jeyakumaran, Social Activist

48. Dr. N. Nithianandan, Chairman, Ratnam Foundation

49. George Antony Cristy, Social Activist

50. S. Thangarasa, Social Activist

51. N. Bhavan, Retd. Deputy Principal, Mahajana College

52. P. Muthulingam, Executive Director, Institute of Social Development, Kandy

53. M.K. Sivarajah, Social Activist

54. Mr. V. Sivalingam, Human Rights Activist

55. S. Jeyaganeshan, Samuthi Development Officer

-

Editorial3 days ago

Editorial3 days agoIllusory rule of law

-

News4 days ago

News4 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business6 days ago

Business6 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial4 days ago

Editorial4 days agoCrime and cops

-

Features3 days ago

Features3 days agoDaydreams on a winter’s day

-

Editorial5 days ago

Editorial5 days agoThe Chakka Clash

-

Features3 days ago

Features3 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features2 days ago

Features2 days agoExtended mind thesis:A Buddhist perspective