Business

Ceylinco Insurance ranked as Sri Lanka’s most Respected insurer

Ceylinco Insurance was ranked as the nation’s most admired and respected insurer as announced by the LMD magazine in its 16th annual edition of the nation’s Most Respected and admired entities. Ceylinco Insurance PLC comprises of the two dominant insurers in the country, Ceylinco General Insurance Ltd and Ceylinco Life Insurance Ltd. Both, Ceylinco General Insurance and Ceylinco Life Insurance maintain their supremacy as the market leaders in General and Life insurance respectively. Having climbed 14 positions from the previous year, Ceylinco Insurance remains in the 12th position amongst the Most Respected and admired entities in the country.

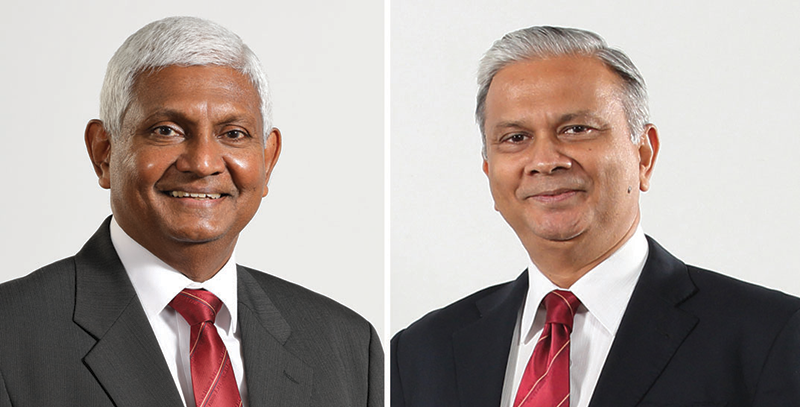

Mr. Ajith Gunawardena, Executive Chairman and Chief Executive Officer of Ceylinco Insurance PLC said, “An organization that practices innovation can elevate the entity to become a powerhouse of creativity, where pioneering ideas are born and given expression to become fully fledged products and services that enhance people’s lives. We are proud to be one such entity that has repeatedly set benchmarks and set trends for the rest of the industry to follow. Some of our innovative products have reached the grassroots level and their benefits have been reaped by people who would have never thought of getting insurance if it were not offered through convenient channels such as mobile operators and the postal service.”

Mr Rajkumar Renganathan, Chairman of Ceylinco Life said: “The LMD-Nielsen survey covers a well-informed sample of 800 senior executives of listed companies. It is therefore a credible barometer of public perception, which is essential to business success. Ceylinco Life’s view of its business as ‘A Relationship for Life’ with policyholders is practiced in every aspect of its engagement with customers as well as other stakeholders, and is, we believe, the foundation for its 16 consecutive years of market leadership in the life insurance sector.”

Commenting further on the achievement, Mr. Patrick Alwis, Managing Director/Chief Executive Officer said, “Ceylinco General Insurance is led by a strong customer-centric culture and this is a testimonial to this claim. Delivering protection and satisfaction to customers is the bedrock on which our company is founded. We will continue to deliver best-in-class insurance solutions to cater to every need of customers from all walks of life.”

Ceylinco Life Managing Director/CEO Mr Thushara Ranasinghe added: “Respect is based on trust, a truly precious attribute to any business, but more so for a company in the financial services sector. The trust that Ceylinco Life has earned from the masses over three decades is evident in the Company’s position as the vanguard of the industry, and our parent company’s latest movement up the LMD Most Respected Entities ranking is a reaffirmation that public trust in Ceylinco Insurance remains steadfast.”

Earlier this year, Ceylinco General Insurance and Ceylinco life Insurance were chosen as the ‘People’s Insurance Brand of The Year’ for general insurance and life insurance respectively at the 2020 SLIM Nielson People’s Awards, for an unprecedented 14th consecutive year. Similarly for the year 2018/19, Ceylinco Insurance PLC, reinforcing its dominance in the insurance industry, moved up to the 6th position amongst Sri Lanka’s top 30 companies.

Business

Banking data theft attacks on smartphones triple in 2024, Kaspersky reports

The number of Trojan banker attacks on smartphones surged by 196% in 2024 compared to the previous year, according to a Kaspersky report “The mobile malware threat landscape in 2024” released at Mobile World Congress 2025 in Barcelona. Cybercriminals are shifting tactics, relying on mass malware distribution to steal banking credentials. Over the past year, Kaspersky detected more than 33.3 million attacks on smartphone users globally, involving various types of malware and unwanted software.

The number of Trojan banker attacks on Android smartphones increased from 420,000 in 2023 to 1,242,000 in 2024. Trojan banker malware is designed to steal user credentials for online banking, e-payment services and credit card systems.

Cybercriminals trick victims into downloading Trojan bankers by spreading links via SMS or messaging apps, as well as through malicious attachments in messengers, and by directing users to malicious webpages. They can even send messages from a hacked contact’s account, making the fraud appear more trustworthy. To deceive users, attackers often exploit trending news and hype topics to create a sense of urgency and lower victims’ guard.

“Scammers have started to scale down their efforts to create unique malware packages, focusing instead on distributing the same files to as many victims as possible. It is more important than ever to be cyber-literate and educate your loved ones – from children to the elderly – because no one is completely safe from well-crafted scams and psychological tricks designed to steal banking data,” says Anton Kivva, a security expert at Kaspersky.

Although Trojan bankers are the fastest-growing type of malware, they rank fourth overall in terms of the share of attacked users at 6%. The most widespread category remains AdWare, accounting for 57% of attacked users, followed by general Trojans (25%) and RiskTools (12%). The ranking includes malware, adware and unwanted software.

In 2024, cybercriminals launched an average of 2.8 million malware, adware, and unwanted software attacks on mobile devices each month. Over the year, Kaspersky products blocked a total of 33.3 million attacks.

In 2024, Fakemoney, a group of scam apps designed for fake investments and payouts, was the most active threat. Another major concern was modified versions of WhatsApp that contained the Triada-type Trojan – a malware that can download and execute additional malicious or adware modules, for example, to display advertisements or perform other unwanted actions. These unofficial WhatsApp mods ranked third in activity, just behind a general category of cloud-based generic threats.

Learn more about the mobile malware threat landscape in 2024 on Securelist. To protect yourself from mobile threats, Kaspersky shares the following recommendations.

Downloading apps from official stores like the Apple App Store and Google Play is not always risk-free. Kaspersky recently discovered SparkCat, the first screenshot-stealing malware to bypass the App Store’s security. The malware was also found on Google Play, with a total of 20 infected apps across both platforms, proving that these stores are not 100% foolproof. To stay safe, always check app reviews and download numbers when possible, use only links from official websites, and install reliable security software, like Kaspersky Premium, that can detect and block malicious activity if an app turns out to be fraudulent.

Check the permissions of apps that you use and think carefully before permitting an app, especially when it comes to high-risk permissions such as Accessibility Services. For example, the only permission that a flashlight app needs is the flashlight (which doesn’t even involve camera access). A good piece of advice is to update your operating system and important apps as updates become available. Many safety issues can be solved by installing updated versions of software.

Business

EMSOL wins Best National Industry Brand Award at Brand Excellence Ceremony

Emboldened by its innovation in reducing smoke emissions from diesel, petrol, and kerosene internal combustion engines, Eminent International’s fuel additive EMSOL has been awarded the Best National Industry Brand in the Vehicles, Automobile Assembly, and Automotive-Related Products category for the Small Scale Industry Sector. The prestigious award was presented at the inaugural Brand Excellence Award ceremony held by the Industrial Development Board of Ceylon.

The event, organized under the Ministry of Industries and Entrepreneurship Development, took place at Eagles’ Lakeside in Attidiya. Key attendees included Prime Minister Dr. Harini Amarasooriya, Minister Sunil Handunnetti, and Deputy Minister Chathuranga Abeysinghe.

Business

Ceylinco Life retains No 1 spot in life insurance with premium income of Rs 37.14 bn. In 2024

Ceylinco Life has emphatically reaffirmed its continuing supremacy in Sri Lanka’s life insurance industry with gross written premium income of Rs 37.14 billion and total income of Rs 65.54 billion in 2024, the company’s 21st year of unbroken market leadership.

Premium income grew by a healthy 11.16 per cent, while investment income at Rs 28.4 billion reflected growth of 1.5 per cent, resulting in consolidated income for the year improving by 6.7 per cent, according to the company’s audited financial statements for the 12 months ending 31st December 2024.

The growth in life insurance business as represented by gross written premium income confirms that Ceylinco Life retained its position as the largest life insurer in Sri Lanka in 2024, by a margin of more than Rs 5.5 billion over the second-placed life insurance company.

“The figures tell the story,” commented Ceylinco Life Executive Chairman R. Renganathan. “We have completed the first year of our third decade of market leadership in Sri Lanka’s life insurance industry, thanks to the unwavering trust and confidence of the millions of lives we protect and touch. Ceylinco Life’s demonstrated financial strength and stability, its uncompromising adherence to the core values and principles of its business, and its deep-rooted commitment to the community, remain the bedrock of the company’s growth and progress.”

Ceylinco Life paid Rs 25 billion in net claims and benefits to policyholders for the year under review, an increase of 8.2 per cent over the preceding year, and transferred Rs 23 billion to its Life Fund. As a result, the Life Fund grew by a noteworthy 14.8 per cent to Rs 180.89 billion as at 31st December 2024.

The company’s total assets grew by Rs 26.69 billion or 11.8 per cent over the year at a monthly average of more than Rs 2.2 billion to cross the milestone of Rs 250 billion (Rs 251.43 billion) at the end of 2024, while its investment portfolio recorded an increase of 12.32 per cent in value over the 12 months to total Rs 222.5 billion as at 31st December 2024.

Ceylinco Life transferred Rs 3 billion to the shareholders’ fund in respect of the 12 months, and shareholders’ equity grew to Rs 60.74 billion at the end of the year.

The Company posted profit before tax of Rs 10.05 billion for FY 2024, reflecting an increase of 19.1 per cent over the previous year. Net profit after tax for the 12 months reviewed was Rs 7.07 billion, an improvement of 21.88 per cent over 2023.

Ceylinco Life’s basic earnings per share for the year amounted to Rs 141.43, while net assets value per share stood at Rs 1,214.91 as at 31st December 2024, representing growths of 21.8 per cent and 11.7 per cent respectively. Return on assets for the year was 2.81 per cent and return on equity 11.64 per cent.

Significantly, Ceylinco Life’s Risk-based Capital Adequacy Ratio (CAR) improved to 448 per cent at end 2024, more than 3.7 times the minimum CAR of 120 per cent required by the industry regulator.

-

News2 days ago

News2 days agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

News7 days ago

News7 days agoLawyers’ Collective raises concerns over post-retirement appointments of judges

-

Sports5 days ago

Sports5 days agoThomians drop wicket taking coloursman for promising young batsman

-

Editorial4 days ago

Editorial4 days agoCooking oil frauds

-

Features6 days ago

Features6 days agoBassist Benjy…no more with Mirage

-

Features3 days ago

Features3 days agoShyam Selvadurai and his exploration of Yasodhara’s story

-

Editorial7 days ago

Editorial7 days agoHobson’s choice for Zelensky?

-

Features6 days ago

Features6 days agoNawaz Commission report holds key to government response at UNHRC