Business

Black, White and Grey Markets: The dynamics of foreign exchange and remittances in Sri Lanka

By Bilesha Weeraratne

Written Ahead of International Migrants’ Day on December 18, 2021

Despite the pandemic and related difficulties in remitting, remittances to Sri Lanka had picked up by December 2020 to record year-over-year growth of 5.8 %, contrary to all expectations.

The reasons for such a quick rebound include catching up on postponed remittances, accumulated terminal employment benefits and savings-related remittances of migrant workers laid off due to the pandemic, receipt of counter-cyclical remittances from less frequent remitters and the shift from informal to formal channels. In the current context of the foreign exchange crisis in Sri Lanka, the latter is the most critical factor to focus on.

From Informal to Formal Channels

The fundamental reason for remitters to shift from informal to formal channels was the accessibility issue during lockdowns or limited physical operations. Similarly, the increased risk of informal channels may have encouraged the use of formal channels. With adjustments to operate under the new normal and easing of lockdown measures, it is reasonable to assume that the informal remittance channels may have also evolved to function during the pandemic. As such, the Central Bank of Sri Lanka’s (CBSL’s) Special Deposit Accounts (SDA), with its 1-2% higher interest rate and the LKR 2 higher foreign exchange rate for remittances channelled through licensed commercial banks (LCBs), were woefully inadequate to retain such recently converted formal remitters.

Black, White and Grey Foreign

Exchange Rates

One of the key attractions of informal remittances is the relatively low cost, partly due to the more attractive exchange rate offered by informal channels. The recent movements in the official LKR/USD foreign exchange rate indicated high pressure towards further depreciation and the excess demand amidst the deteriorating supply of USDs within the Sri Lankan economy resulted in a wide divergence between the exchange rate offered by the LCBs – the white market, and non-bank but authorised money exchangers. The latter can be termed ‘the grey market’ because they are permitted to buy foreign exchange, albeit did at their own rate. The divergence was even more pronounced compared with those of the black market or kerb rate.

One of the key attractions of informal remittances is the relatively low cost, partly due to the more attractive exchange rate offered by informal channels. The recent movements in the official LKR/USD foreign exchange rate indicated high pressure towards further depreciation and the excess demand amidst the deteriorating supply of USDs within the Sri Lankan economy resulted in a wide divergence between the exchange rate offered by the LCBs – the white market, and non-bank but authorised money exchangers. The latter can be termed ‘the grey market’ because they are permitted to buy foreign exchange, albeit did at their own rate. The divergence was even more pronounced compared with those of the black market or kerb rate.

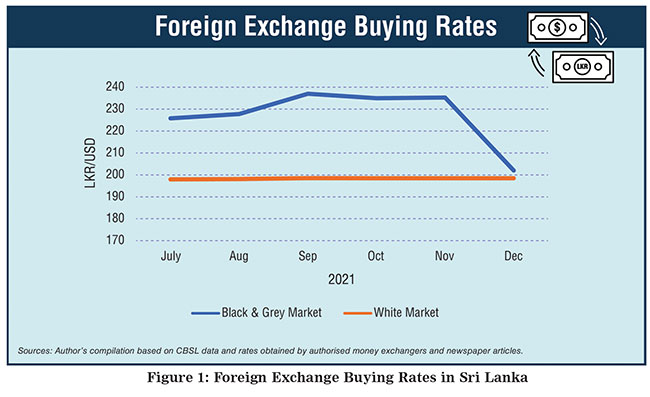

Figure 1 below indicates a wide gap exceeding LKR 25 across the different foreign exchange markets from July to November 2021. This gap created an opportunity for informal remittances exchanged in the Sri Lankan grey or black foreign exchange market to be more rewarding to remitters. The extra LKR 2 and the subsequent top-up to an extra LKR 10 offered by the LCBs paled in comparison! Finally, in early December 2021, those in the grey market were forced to adhere to the soft pegged LKR/USD 198-202 rate.

Sources: Author’s compilation based on CBSL data and rates obtained by authorised money exchangers and media articles.

(https://economynext.com/sri-lanka-rupee-quoted-at-225-226-50-to-us-dollar-in-kerb-market-amid-money-printing-83579/;

https://economynext.com/sri-lanka-rupee-weakens-to-227-228-50-to-dollar-in-kerb-market-bond-yields-up-85162/;

https://ceylontoday.lk/news/official-directive-strengthens-kerb-market;

https://economynext.com/sri-lanka-cb-expects-falling-remittance-to-reverse-trend-from-october-87157/)

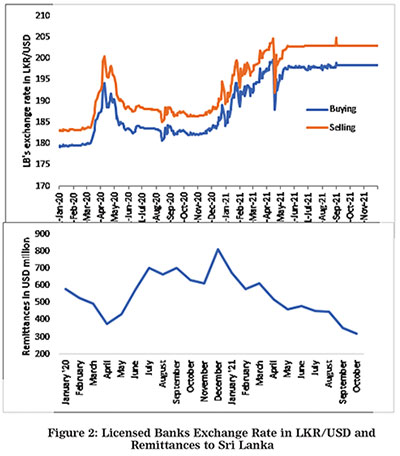

As seen in the top panel in Figure 2, when the CBSL intervention stabilised the LKR-USD exchange rate, formal remittances to Sri Lanka shown in the bottom panel continued on a steeper decline in October and November 2021.

Desperate Measures

In 2021 various mechanisms were rolled out to access foreign currency available in the economy. In May 2021, the CBSL directed that LCBs sell 10% of inward worker remittances converted to the CBSL. In October, a previous directive on the mandatory conversion of merchandise export proceeds was expanded to cover services. The change also shifted away from a 25% limit, to converting the “residual” after utilising goods and services export proceeds.

The Attractiveness of Informal Channels

This latest update has resulted in much confusion. Though the CBSL indicated that this directive would not affect worker remittances, operationally, this does not appear very likely. A single Personal Foreign Currency Account (PFCA) may receive foreign exchange as worker remittances from a family member or a well-wisher and payment for trade-in services. The method of distinguishing the two types of inward remittances is still unclear to many. At the same time, many individuals have already received correspondence from commercial banks requesting to convert the funds in their PFCAs.

This latest update has resulted in much confusion. Though the CBSL indicated that this directive would not affect worker remittances, operationally, this does not appear very likely. A single Personal Foreign Currency Account (PFCA) may receive foreign exchange as worker remittances from a family member or a well-wisher and payment for trade-in services. The method of distinguishing the two types of inward remittances is still unclear to many. At the same time, many individuals have already received correspondence from commercial banks requesting to convert the funds in their PFCAs.

Amidst the confusion and effort to protect workers’ foreign currency earnings, more migrant workers are seeking informal channels to remit, while others refrain from or delay remitting. Yet others are diverting their remittances to accounts held overseas.

Sources: Top panel https://www.cbsl.gov.lk/en/rates-and-indicators/exchange-rates; Bottom panel CBSL, Weekly Economic Indicators, various dates

Early Warning

Remittances are seasonal. As such, official remittances in December may increase. But it should not be prematurely considered an indicator of the success of the recent efforts to increase remittances or divert from informal to formal channels. The departures for labour migration during the first half of 2021 are a mere third of the pre-pandemic departures in the same period in 2019. Many migrant workers who return are unable to find foreign jobs and this depleted stock of Sri Lankan migrant workers is a weak base to prop up formal remittances.

Moreover, domestic economic hardship makes many migrants and families desirous of a possible extra return through informal remittance channels. As such, excessive regulations to clamp down on informal remittances may inadvertently create a breeding ground for even greater informal activities and black markets, thereby proving entirely counter-productive to the intended objectives.

Future efforts to increase remittances should not underestimate the resilience of informal remittance channels crafted along the centuries-old method of Undiyal or Hawala. Thus, instead of overly focusing on shifting from informal to formal channels of remittances, policies should mainly focus on ensuring a more realistic exchange rate. Similarly, it is important to encourage labour migration and trade in services and their remittances.

Link to original blog: https://www.ips.lk/talkingeconomics/2021/12/17/black-white-and-grey-markets-the-dynamics-of-foreign-exchange-and-remittances-in-sri-lanka/#

Bilesha Weeraratne is a Research Fellow at IPS focusing on internal and international migration and urbanisation. She is also interested in labour economics, economic development, and economics of sports. Prior to re-joining IPS in 2014, Bilesha was a Postdoctoral Research Associate at Princeton University, USA. Bilesha holds a MPhil and a PhD in Economics from the City University of New York, USA. (Talk to Bilesha – bilesha@ips.lk)

Business

CBSL keeps overnight policy rates unchanged; latest review of IMF program awaited

The Central Bank kept its overnight policy rate unchanged yesterday as it awaited the latest review of a US $2.9-billion International Monetary Fund programme.

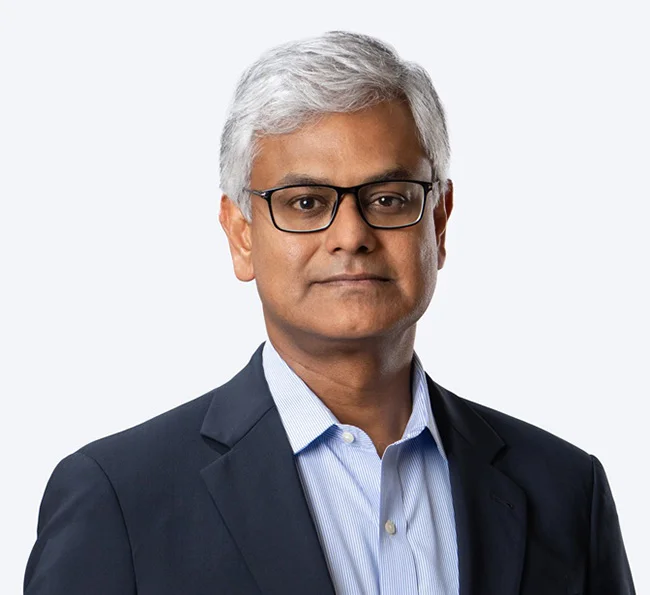

‘The Central Bank will maintain the overnight policy rate at 7.75 percent and stable inflation, healthy credit growth and steady economic expansion are the reasons for the decision, Central Bank Governor Dr Nandalal Weerasinghe said. The Central Bank Governor stated this yesterday at the monthly policy review meeting held at Central Bank head office in Colombo.

‘The Board arrived at this decision after carefully considering evolving developments and the outlook on the domestic front and global uncertainties, the Governor said.

Dr Weerasinghe said that the Board is of the view that the current monetary policy stance will support steering inflation towards the target of 5 percent

The CBSL Governor added: ‘Inflation measured by the Colombo Consumer Price Index (CCPI) remained unchanged at 2.1 percent in December 2025. However, food prices edged higher in December compared to November.

‘ This was due to supply chain disruptions caused by Cyclone Ditwah and higher demand for food during the festive season.

‘Inflation is projected to accelerate gradually and move towards the target of 5 percent by the second half of 2026. Core inflation, which excludes price changes in volatile food, energy and transport from the CCPI basket, has also shown some acceleration in recent months.

‘Core inflation is expected to accelerate further as demand in the economy strengthens. Meanwhile, inflation expectations appear to be well anchored around the inflation target.

‘The economy grew by 5.0 percent during the first nine months of 2025. Despite the slowdown in economic activity following Cyclone Ditwah in late 2025, early indicators reflect greater resilience.

‘Credit disbursed to the private sector by commercial banks and other financial institutions continued its notable expansion in late 2025.

‘This reflects increased demand for credit amid improving economic

activity and increased vehicle imports. Post-cyclone rebuilding is expected to sustain this momentum.

‘The external current account is estimated to have recorded a sizeable surplus in 2025, despite the widening of the trade deficit. Foreign remittances remained healthy during 2025.

‘Despite large debt service payments during the year, Gross Official Reserves were built up to USD 6.8 bn by the end of 2025.

‘This was mainly supported by the net foreign exchange purchases by the Central Bank and inflows from multilateral agencies. The Sri Lanka rupee depreciated by 5.6 percent against the US dollar in 2025 and has remained broadly stable thus far during this year. This includes the swap facility from the People’s Bank of China.

‘The Board remains prepared to implement appropriate policy measures to ensure that inflation stabilises around the target, while supporting the economy to reach its potential.’

By Hiran H Senewiratne

Business

Janashakthi Finance records 35% growth in Net Operating Income and LKR 389 Mn. PBT in Q3 FY26

Janashakthi Finance PLC, formerly known as Orient Finance PLC and a subsidiary of JXG (Janashakthi Group) announced a strong financial performance for the nine-month period ended 31 December 2025, driven by sustained growth in its core businesses, disciplined execution and continued focus on scale and efficiency.

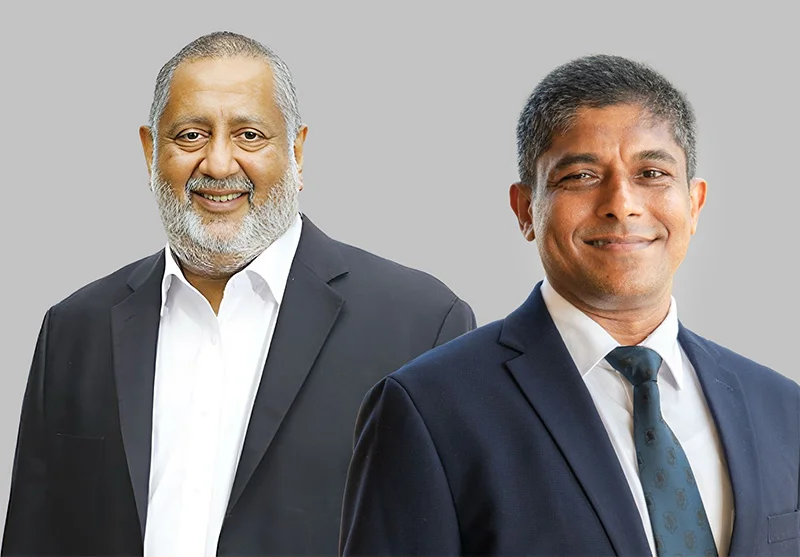

Commenting on the results, Rajendra Theagarajah, Chairman of Janashakthi Finance PLC, said, “The performance for the period reflects the clarity of our strategic priorities and the strength of our governance framework. With strong leadership in place that is confidently driving the business, we continue to grow steadily while maintaining balance sheet strength and stakeholder confidence.”

For the period under review, Profit Before Tax (PBT) rose by 39% year-on-year to LKR 389 million, supported by higher operating income and portfolio expansion. Net Operating Income increased by 35% year-on-year to LKR 2.2 billion, reflecting sustained lending activity and improved business scale.Net Profit After Tax (NPAT) amounted to LKR 240 million.

The Company’s Loans and Receivables portfolio grew by 49% year-on-year to LKR 29 billion, driven by demand across key lending segments and focused growth initiatives. Deposits increased to LKR 17 billion, recording a 14% year-on-year growth, reinforcing funding diversity and customer confidence.

Reflecting on the year’s progress, Sithambaram Sri Ganendran, Chief Executive Officer of Janashakthi Finance PLC, stated, “During the period, we focused on expanding our loan book responsibly, strengthening our funding base and enhancing operational capability. The growth achieved across our key indicators positions the Company strongly as we continue to execute our medium-term strategy and respond to market opportunities.”

Business

JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

The Group continued to deliver a strong performance, with all businesses reporting improved profitability.

The operationalisation of two of the Group’s largest projects, the City of Dreams Sri Lanka integrated resort and the West Container Terminal (WCT-1) at the Port of Colombo, continued to progress well. The encouraging quarter-on-quarter momentum demonstrates the strong ramp up potential of both projects.

The country faced an unexpected challenge in November with Cyclone Ditwah, which impacted parts of Southeast and South Asia. The cyclone caused loss of lives, affected a significant portion of the population, and resulted in considerable infrastructure damage in certain areas of Sri Lanka. While the operations of the Group were disrupted during the few days of the cyclone, there were no significant operational or financial impact as a direct result of the cyclone and related flooding.

The Group and its staff supported relief efforts through various initiatives, including a substantial contribution of Rs.500 million from John Keells Holdings PLC and its affiliate companies towards the Government’s ‘Rebuilding Sri Lanka’ initiative.

Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs.23.76 billion in the third quarter of the financial year 2025/26 is an increase of 68% against Group EBITDA of Rs.14.15 billion recorded in the third quarter of the previous financial year.

Cumulative Group EBITDA for the first nine months of the financial year 2025/26 at Rs.55.10 billion is an increase of 84% against the EBITDA of Rs.29.94 billion recorded in the same period of the financial year 2024/25.

During the quarter under review, the Group recorded fair value gains on investment property amounting to Rs.2.30 billion [2024/25 Q3: Rs.955 million], and net exchange losses of Rs.759 million [2024/25 Q3: gain of Rs.782 million], mainly due to the impact of the deprecation of the Rupee on the foreign currency denominated loan at City of Dreams Sri Lanka.

Profit attributable to equity holders of the parent is Rs.6.48 billion in the quarter under review, which includes fair value gains on investment property and net exchange losses amounting to Rs.1.45 billion. Profit attributable to equity holders of the parent for the corresponding period of the previous financial year was Rs.2.85 billion, which included fair value gains on investment property and net exchange gains amounting to Rs.1.70 billion.

The second interim dividend for FY2026 of Rs. 0.10 per share is aligned with the first interim dividend paid in November 2025. This reflects the expectation that the current momentum of performance will sustain or further improve going forward. The outlay for the second interim dividend is Rs.1.77 billion, which is an increase compared to Rs.881 million in the previous year.

(JKH)

-

Business4 days ago

Business4 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business5 days ago

Business5 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion5 days ago

Opinion5 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Opinion7 days ago

Opinion7 days agoA puppet show?

-

Opinion4 days ago

Opinion4 days agoLuck knocks at your door every day

-

Business6 days ago

Business6 days agoDialog Brings the ICC Men’s T20 Cricket World Cup 2026 Closer to Sri Lankans

-

Features7 days ago

Features7 days ago‘Building Blocks’ of early childhood education: Some reflections

-

News5 days ago

News5 days agoRising climate risks and poverty in focus at CEPA policy panel tomorrow at Open University