Business

An overview of new Securities and Exchange Commission Act

By Viraj Dayaratne PC

Chairman Securities and Exchange Commission of Sri Lanka

The new Securities and Exchange Commission Act No. 19 of 2021 (‘the Act’) has been certified by the Speaker on 21st September 2021 and has thus become law. It repeals and replaces the Securities and Exchange Commission Act No. 36 of 1987.

The Act which has been in the pipeline for a considerable period of time contains well thought out provisions which have factored in latest developments in securities markets around the world and adheres to principles and standards propounded by the International Organization of Securities Commissions (IOSCO). It enables robust regulation whilst facilitating market development and will cater to both the present as well as future needs of Sri Lanka’s securities market.

The process of drafting the Act

The process of drafting a new law began in the year 2007, consequent to a gap analysis and extensive research carried out on the laws of other jurisdictions. The initiative received technical assistance from the World Bank as well as experts in Sri Lanka. The first draft had been completed in 2013 and approved by the Commission at the time. Since that had not been proceeded with, improvements had been made to that draft by the subsequent Commission and having received Cabinet approval, the Bill had been tabled in Parliament in 2018 but was not taken up for debate. Further changes had been made to that Bill by the previous Commission during the 2018/2019 period. In finalizing the Act, whilst retaining the core provisions found in the previous versions, the present Commission has taken steps to eliminate ambiguities and grey areas in order ensure that there will be no difficulties in its application and implementation. It must be acknowledged that there have been numerous consultations with all stakeholders as well as the public in this long drafting process and their contributions have been of immense assistance in the formulation of this law.

The structure of the Act

The SEC Act comprises of seven Parts which are further divided into a number of Chapters. A significant feature is that at the beginning of each Part, the ‘object and purpose’ of that particular Part is described in broad terms. This gives an indication of what is sought to be achieved through the provisions contained in such Part.

Part I deals with preliminary matters such as the application and objects and purpose of the Act, establishment of the Commission and its powers, duties and functions as well as matters pertaining to the Director General and staff of the Commission. Part II titled ‘Markets and Market Institutions’ provides for the establishment of Exchanges, Clearing Houses and a Central Depository. Part III titled ‘Issue of Securities’ deals with Public Offer of Securities, Market Intermediaries and the Protection of Clients’ Assets. Part IV deals with ‘Trade in Unlisted Securities’. Part V titled ‘Market Misconduct’ deals with Prohibited Conduct and Insider Trading. Part VI contains provisions in relation to the finances of the Commission and Part VII provides for general matters such as the implementation of the Act and punishments and enforcement mechanisms.

The salient features of the Act

The Act contains many salutary provisions that will ensure efficiency, predictability and consistency in the regulation of the country’s securities market. Further, it enables the use of state of the art infrastructure and provides for the different fund raising requirements of issuers whilst the ability to introduce a variety of products offers investors a wider choice depending on their risk return characteristics.

Markets and Market Institutions

Part II which is specifically dedicated to Markets and Market Institutions is an important part of the new law since the provisions contained therein are expected to ensure that these vital institutions perform their functions properly which in turn will help the effective and efficient functioning of the securities market as well as help mitigate systemic risks.

These provisions stipulate in great detail the rights and duties of an Exchange, a Clearing House and a Central Depository, the requirements that have to be fulfilled if a license is to be obtained, when a license may be cancelled and the right of recourse if a license is cancelled, the effect of the Rules of these market institutions, appointment of directors, duties of an auditor etc.

An important feature is that a licensed Exchange can list its securities on its own Exchange. There is recognition of a Clearing House acting as a Central Counter Party (CCP) and a CCP has been defined. Further, detailed provisions dealing with default rules and proceedings have been included in order to cater to situations where a clearing member is unable to meet its obligations regarding unsettled market contracts. The default proceedings have been designed to bring about finality to trades.

Market Intermediaries

It is also pertinent to note that the Act has redefined ‘Market Intermediaries’ and has added a few more categories of persons. They are‘corporate finance advisor’, ‘market maker’, ‘derivatives broker’ and ‘derivatives dealer’. The introduction of market makers is important since that will ensure continued and efficient exchange of securities between buyers and sellers.

As in the case with market institutions, their duties, requirements that have to be fulfilled if a license is to be obtained and renewed, grounds on which a license may be refused, suspended or cancelled, trading in securities by market intermediaries, duty of an auditor etc. have been spelt out in great detail.

Market intermediaries play a pivotal role in the functioning of the market. Since they operate at the forefront of the market and thus are directly in contact with investors, it is imperative to ensure their credibility. Towards achieving this and to ensure that they conduct their functions more efficiently, certain requirements have been identified under the head of ‘Protection of clients’ assets’. They require that market intermediaries disclose certain interests they have in securities, establish and maintain certain internal procedures and processes and conform to business conduct that the Commission may spell out by way of rules. These are meant to minimize their own risk and exposure and to monitor compliance and are neither new obligations nor measures that will result in additional effort or expenditure to them. Such requirements exist even at present in the form of rules and standards introduced by the Commission from time to time. In contrast to the previous Act, the Act has incorporated these specific requirements in relation to market intermediaries in the body itself.

In addition to market intermediaries, the Commission can, by way of rules, require the registration of those who ‘deal with clients for and on behalf of a market intermediary’. The Act has also recognized ‘Supplementary Service Providers’ such as actuaries, custodians, trustees and valuers on whom the Commission may exercise supervision in the future thereby fortifying public confidence.

Issue of securities and maintenance of good corporate governance practices

Part III deals with ‘Issue of Securities’ and the purpose of this Part amongst others, is to ensure timely disclosure of financial information by listed public companies and compliance with best corporate governance practices.

In order to ensure accountability of funds solicited from the public, the Commission will be entitled if it considers that such a step is necessary, to make Rules that will require unlisted companies to obtain its approval prior to certain types of public offers. Such requirement may be introduced taking in to consideration ‘the volume of securities, class of securities, the number and type of investors, the nature of the issuer or the nature of the securities market’.

Based on disclosures made to the public, if any wrongdoing is detected, the Commission or the market institutions will be entitled to call for information from listed companies. The Commission has been empowered to take any enforcement action that is considered appropriate if ‘after due inquiry or investigation’ it is found that the listed company has contravened or failed to comply with any provision of the Act, regulations, rules or directives. Here again it must be stressed that this is part of oversight that is presently carried out by the Colombo Stock Exchange and the Commission through its corporate affairs division to ensure compliance with the Listing Rules and is nothing new. What has been done is to have these provisions specifically included in the Act in order to ensure adherence to best corporate governance practices.

It will be necessary for a person to obtain the approval of the Commission prior to accepting appointment as a director, chief executive officer or chief regulatory officer of a market institution and the grounds upon which such approval will not be granted have been spelt out. Further, directors or the chief executive officer of a listed company are required to comply with the fit and proper criteria specified by the Commission by way of rules made by it or the rules of an Exchange which have been approved by the Commission. Another new feature is that Auditors of listed companies, market institutions and market intermediaries have been obligated to report certain irregularities that he becomes aware of ‘during the ordinary course of the performance of his duties’. As to what they are and to whom it has to be reported have been specifically stated.

It must be appreciated that these requirements have been introduced in order to ensure proper corporate governance in the said institutions and to mitigate systemic risk considering the pivotal role they play in the securities market. At a time when most of these practices have been embraced by the business community as part of the corporate governance framework that is being presently finalized, they cannot be construed as impediments to the smooth conduct of their businesses.

Main Market Offences

Part V of the Act which encompasses the main market offences could be considered as a progressive step taken towards the regulation of the securities market of the country. This Part has been divided into two Chapters containing ‘Prohibited Conduct’ and ‘Insider Trading’.

Prohibited Conduct

Five different offences have been identified under Prohibited Conduct. They are ‘false trading and market rigging’, ‘stock market manipulations’, ‘making false or misleading statements’, ‘fraudulently inducing persons to deal in securities’ and ‘use of manipulative and deceptive devices’

The most significant introduction to this category of offences which is commonly known as market manipulation are the two offences found respectively in Sections 130 and 131 respectively. Whilst Section 130 precludes a person from making a statement or disseminating information that is false or misleading in a material particular which is likely to have an effect of raising or lowering the market price or volume of securities, Section 131 precludes a person from inducing or attempting to induce another person to trade by making or publishing any statement or by making a forecast that is misleading, false or deceptive.

As to what conduct is prohibited has been spelt out with utmost clarity. It therefore is not difficult to understand as to what ingredients have to be present to establish the commission of an offence under this Part.

Insider trading

All aspects pertaining to insider trading have been described with precision. As to when a person is considered to be an ‘insider’ has been clearly defined and what exactly such person is prohibited from doing has been spelt out with certainty. In addition, as to what would amount to information, when such information is generally available, what would be information which has a material effect on price or value of securities, when will a person be considered to have procured another, when information is deemed to be in possession as well as specific exceptions and defenses available in respect of a charge of insider trading have been outlined in great detail.

These elaborate provisions have been included with the intention of taking away any uncertainty or ambiguity and to clearly demonstrate as to what conduct is permitted and what is prohibited so that those involved in the activities of the market are fully and well aware of the framework within which they ought to operate. Further, the fact that the commission of any such offence would give rise to the imposition of stringent penalties is intended to act as a deterrent and not as a means to stifle or discourage the activities of market participants.

Unlike the previous Act where charges were to be filed in the Magistrate’s Court, henceforth these offences are to be tried in the High Court and any person convicted of such offence would be subject to a penalty which could be either a fine of not less than ten million rupees or to imprisonment for a term not exceeding ten years or to both such fine and imprisonment.

Business

Redefining Industry Standards: Home Lands Group Emerges as Sri Lanka’s Premier Force in Lifestyle and Developer Leadership

At a time when Sri Lanka’s property landscape is experiencing rapid transformation, one organisation continues to define the direction of the market through scale, innovation, and an unwavering commitment to quality. At the 2025 PropertyGuru Asia Property Awards (Sri Lanka), the Home Lands Group of Companies maintained its place at the peak of the industry, acquiring two of the most influential awards of the year: Best Developer for the Group and Best Lifestyle Developer for Home Lands Skyline (Private) Limited.

These distinctions signify more than just project-level success. They reflect the organisation’s leadership in shaping how Sri Lankans aspire to live, work, and invest.

The Home Lands Group has built a broad presence throughout Sri Lanka’s most active corridors, from the rapidly evolving suburbs of Colombo to the developing lifestyle hubs of Negombo, Malabe, and Kahathuduwa, guided by extensive market research. The Group has transformed its in-depth knowledge of the property market into a portfolio of assets embodying superior residential living experiences, supported by strategically located branches that deliver an integrated suite of real estate services for buyers nationwide.

Home Lands Skyline, the Group’s flagship development arm and the 2025 Best Lifestyle Developer, is responsible for this on-ground reach. The company was commended for shaping communities through visionary residential environments and for its ability to combine cutting-edge sustainability with expansive lifestyle amenities. With 19 completed projects, including the largest integrated golf community in Sri Lanka and nine sustainable developments, Home Lands Skyline keeps raising the bar for efficiency, design, and placemaking.

Both ambition and operational strength are evident in its recent accomplishments. The company completed a number of landmark projects such as Elixia 3C’s Apartments, Santorini Resort Apartments & Residencies, and the 1,200-unit Canterbury Golf Resort Apartments & Residencies, which has more than 50 resort amenities that meet international standards and the nation’s first day-and-night golf course. In addition, the Group’s remarkable 58% market share earned it the title of Sri Lanka’s Most Preferred Residential Real Estate Brand in the RIU Brand Health Survey.

This growth is supported by a sustainability-first philosophy. The company incorporates environmental responsibility into every stage of development, from modular construction, renewable energy integration, and ethical sourcing throughout its supply chain to passive design principles that improve natural light and ventilation. This dedication is demonstrated by its Platinum Award at the CIOB Green Awards 2024.

The Home Lands Group is at the forefront of creating new lifestyle expectations as demand for well-planned, resort-style communities rises. In addition to confirming past achievements, the Group’s 2025 victories at the PropertyGuru Asia Property Awards (Sri Lanka) indicate a trajectory of ongoing leadership, positioning it as a transformative force in the future of Sri Lankan real estate.

Business

Cheaper credit expected to drive Sri Lanka’s business landscape in 2026

The opening weeks of 2026 are offering a glimmer of cautious hope for the business community weary from years of economic turbulence and steep financing costs. The Central Bank’s latest weekly economic indicators signal more than just macroeconomic stability. They point to early signs of a long-awaited trend; a measurable dip in borrowing costs.

“If sustained, this shift could transform steady growth into a robust, investment-led expansion,” a senior economist told The Island Financial Review.

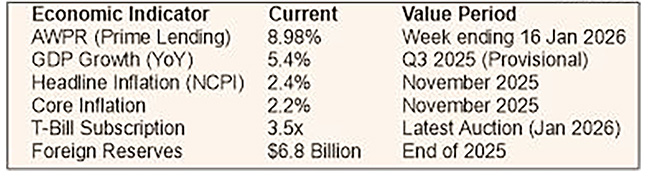

The benchmark Average Weighted Prime Lending Rate (AWPR) declined by 21 basis points to 8.98% for the week ending 16 January, according to the Central Bank.

“For entrepreneurs and CEOs, this is not just another statistic. It could mean the difference between postponing an expansion and hiring new staff. Across boardrooms, the hope is that this marks the start of a sustained downward trend that holds through 2026,” he said.

When asked about the instances where Treasury Bills are not fully subscribed by the investors, he replied,” Treasury Bill yields remained broadly stable, with only minimal movement across 91-day, 182-day, and 364-day tenors. Strong demand was clear, with the latest T-Bill auction oversubscribed by about 3.5 times. This sovereign-level stability creates room for the gradual easing of commercial lending rates, allowing the Central Bank to nurture a more growth-supportive monetary policy.”

Replying to a question on how he views the inflation numbers in this context, he said, “The year-on-year increase in the National Consumer Price Index stood at a manageable 2.4% in November, with core inflation at 2.2%. Such an environment should allow interest rates to fall without sparking a price spiral. For businesses, it means the real cost of borrowing adjusted for inflation, and it is becoming more favourable for them. While consumers still face weekly price shifts in vegetables and fish, the broader disinflation trend gives policymakers leeway to keep credit affordable.”

Referring to the growth trajectory, he mentioned, “With GDP growth provisionally at 5.4% in the third quarter of 2025 and Purchasing Managers’ Indices signalling expansion in both manufacturing and services, the economy is in a growth phase. However, to accelerate this momentum businesses need capital at lower cost to modernise machinery, boost export capacity, and spur innovation. Affordable credit is, therefore, not merely helpful, it is essential to shift growth into a higher gear.”

In conclusion , he said,” The coming months will be watched closely, because for Sri Lankan businesses, a sustained decline in borrowing costs isn’t just an indicator; it’s the foundation for growth. There’s hope that this easing in the cost of money will prevail through most of the year.”

By Sanath Nanayakkare ✍️

Business

Mercantile Investments expands to 90 branches, backed by strong growth

Mercantile Investments & Finance PLC has expanded its national footprint to 90 branches with a new opening in Tangalle, reinforcing its commitment to community accessibility. The trusted non-bank financial institution, with over 60 years of service, now supports diverse communities across Sri Lanka with leasing, deposits, gold loans, and tailored lending.

This physical expansion aligns with significant financial growth. The company recently surpassed an LKR 100 billion asset base, with its lending portfolio doubling to Rs. 75 billion and deposits growing to Rs. 51 billion, reflecting strong customer trust. It maintains a low NPL ratio of 4.65%.

Chief Operating Officer Laksanda Gunawardena stated the branch network is vital for building trust, complemented by ongoing digital investments. Managing Director Gerard Ondaatjie linked the growth to six decades of safeguarding depositor interests.

With strategic plans extending to 2027, Mercantile Investments aims to convert its scale into sustained competitive advantage, supporting both customers and Sri Lanka’s economic progress.

-

Editorial1 day ago

Editorial1 day agoIllusory rule of law

-

News2 days ago

News2 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business4 days ago

Business4 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial2 days ago

Editorial2 days agoCrime and cops

-

Features1 day ago

Features1 day agoDaydreams on a winter’s day

-

Editorial3 days ago

Editorial3 days agoThe Chakka Clash

-

Features1 day ago

Features1 day agoSurprise move of both the Minister and myself from Agriculture to Education

-

Business4 days ago

Business4 days agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App