Business

Amidst unprecedented disruption brought by the Covid 19 impact, Vallibel Finance has been able to record steady performance weathering many challenges

Vallibel Finance continued to set the bar soaring with profits before tax (PBT) reaching a high of Rs. 890 Million for the first six months ending September 2020. Total assets crossed Rs. 52 billion growing by 4 percent; resulting in an impressive Balance Sheet, placing the company among Sri Lanka’s largest in terms of assets.

“Vallibel Finance has shown its resilience, owing to prudent management skills and sustainable pursuit of growth. Nevertheless, we consistently remain a step ahead of such external challenges by adopting prudent practices, anticipating customer needs and seeking opportunities to maintain sustainable competitive advantage,” says Vallibel Group Chairman Dhammika Perera.

Deposits, the barometer of public confidence amassed to Rs. 30 Billion, growing exponentially by 8.81% over the previous period. “The first half of the year was turbulent, testing the resilience of the entire country. Yet Vallibel Finance has sailed swiftly through the storm, bettering its own benchmarks, both qualitative and quantitative during a very challenging and daunting period of time. In-timely responses to challenges our staff admirably performed well in implementing our tried and tested strategies well.” says Managing Director Jayantha S. B. Rangamuwa.

He further added “It has been yet another satisfactory performance against the odds, thanks to Vallibel Finance’s home-grown ability of being able to respond to adversity with an aptly resourceful and innovative strategy.”

Meanwhile, the company grew its loan book even during very challenging times by 4 percent reaching Rs. 41.8 billion from a previous Rs. 40.2 billion. Non-performing loans (NPL) ratio of 6.68% mutes testimony to the company’s legacy of financial stewardship during exceedingly challenging times which is far better than the industry average.

Being very optimistic about the outlook, despite the current uncertain situation Vallibel Finance commenced its landmark seventeen story head office complex along with an uninterrupted branch expansion extending its roots to Ambalantota, Thambuththegama, Kohuwala and Ja-ela during the period.

Notably, Vallibel Finance has been honored and awarded as the Brand of the Year 2020 in Sri Lanka, while upgrading its brand rating to “A+”, being a strong and respected industry name.

Also, Vallibel Finance has once again been listed as one of the Great Workplaces to work in Sri Lanka for the second successive years of 2019 and 2020.

Business

‘Notable drop in SL’s 2025 tourism sector earnings compared to those of 2018’

The revenue that was earned from the tourism sector in 2025 was US $ 3.2 billion, which is a significant drop compared to the 2018 figure , which is US$ 4.3 billion, a top tourism sector specialist said.

‘Comparatively there is a revenue deficit of US $ 1.2 billion, which we cannot be satisfied with at any cost, ‘Island Leisure Lanka’ founder chairman Chandana Amaradasa said.

Amaradasa made these observations at a Rotary Club joint meeting organised by Rotary Club Colombo South, featuring also the Rotary Clubs of Kolonnawa and Sri Jayawardenapura, at the Kingsbury Hotel on Tuesday.

Amaradasa added: ‘To develop the tourism sector the government has to do many things which previous governments comprehensively failed to take up.

‘The revenue that comes from the local tourism sector is four to five percent of the GDP, while in Dubai it is more than 45 percent of the GDP.

‘At present the country has 51000 rooms, out of which not more than 10000 rooms are at the four to five star level. Of that number 6000 rooms are located in Colombo, which is a major issue for tourism promotion in tourism potential areas.

‘Sri Lanka should focus on high quality standards in tourism and also develop the East Coast with the necessary infrastructure; especially having an international airport is absolutely necessary.

‘Colombo could be developed as a MICE tourism hub in the region. But not having an international level conference/convention hall is a another bottle neck in promoting that market as well.’

By Hiran H Senewiratne ✍️

Business

A Record Year for Marketing That Works: SLIM Effie Awards Sri Lanka 2025 crosses 300+ entries

The Sri Lanka Institute of Marketing (SLIM) announces a defining milestone for the country’s marketing, advertising, and creative sectors, as Effie Awards Sri Lanka 2025 records the highest number of entries in its history, crossing 300+ submissions. The unprecedented response reflects a stronger, more confident industry, one that is increasingly committed not only to bold creativity, but to creativity that can prove its value through measurable business and brand outcomes.

Now in its 17th year in Sri Lanka, the Effie Awards remain the most recognised benchmark for marketing effectiveness, honouring campaigns that bring together creative excellence, strategic discipline, and results. As the industry evolves, the Effies have become a space where the agency community, brand teams, media and creative partners are collectively challenged to raise the bar, moving beyond attention and awards, toward work that drives growth, shapes behaviour, and delivers real impact.

The record volume of entries this year also signals a healthy shift in the market: more brands and agencies are willing to be evaluated against rigorous effectiveness criteria, and to put forward work that demonstrates clear thinking, strong execution, and proof of performance. SLIM notes that this momentum highlights the expanding role of marketing and advertising in Sri Lanka, not simply as communication, but as a strategic driver of competitiveness and value creation.

SLIM confirms that the judging process will commence soon, guided by the established Effie evaluation framework that assesses entries on insight, strategy, execution, and measurable outcomes. The Grand Finale is scheduled for end-February 2026, where Sri Lanka’s most effective marketing work will be recognised on a national platform.

For inquiries, entries, and sponsorship opportunities, please contact the SLIM Events Division: +94 70 326 6988 | +94 70 192 2623.

Business

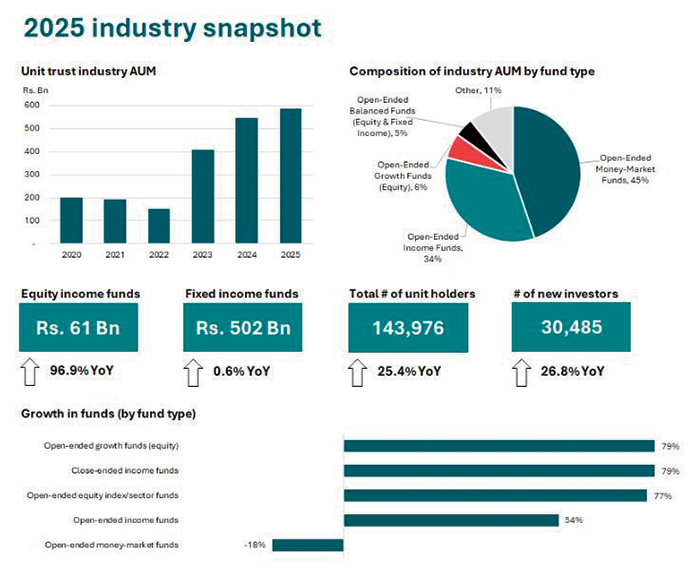

The Unit Trust industry closes 2025 with Rs. 587 Bn assets under management

The Unit Trust industry of Sri Lanka reported a 7.8% year-over-year growth of its assets under management (AUM) to Rs. 587 Bn by the end of 2025. During the year, the AUM reached a high of Rs. 613 Bn, indicating continued interest in the asset category. These assets are currently managed across 86 funds by 16 management companies.

While fixed-income funds accounted for the largest share of AUM, equity-related funds saw strong inflows, increasing by Rs. 30 Bn in 2025 compared to just Rs. 2 Bn for fixed-income funds. This reflects improved investor sentiment, with a clear shift from a capital preservation mindset toward long-term capital growth.

The year also saw a move from ultra-safe short-term instruments to medium-term growth, with strong inflows into open-ended income funds, open-ended equity index/sector funds, and balanced funds, accompanied by a decline in inflows to money-market funds. Additionally, open-ended growth funds (equity) recorded a 79% year-over-year increase, signalling a rising risk appetite among investors.

Commenting on the full-year industry performance, Secretary of the Unit Trust Association of Sri Lanka (UTASL) and Director/CEO of Senfin Asset Management Jeevan Sukumaran noted: “Post-economic crisis, the unit trust industry has been on a strong upward trend with the AUM surpassing Rs. 600 Bn last year.

‘’The steady growth of the unit trust industry in 2025 is a strong indication of increasing investor confidence in professionally managed and well-regulated investment products. Beyond the growth in fund flows, we have also seen encouraging progress in expanding the investor base — not only in terms of unit holder numbers, but also in the broadening of investor demographics — reflecting a gradual shift towards long-term, market-linked investing.”

-

Editorial6 days ago

Editorial6 days agoIllusory rule of law

-

Features6 days ago

Features6 days agoDaydreams on a winter’s day

-

Features6 days ago

Features6 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features5 days ago

Features5 days agoExtended mind thesis:A Buddhist perspective

-

Features6 days ago

Features6 days agoThe Story of Furniture in Sri Lanka

-

Opinion4 days ago

Opinion4 days agoAmerican rulers’ hatred for Venezuela and its leaders

-

Features6 days ago

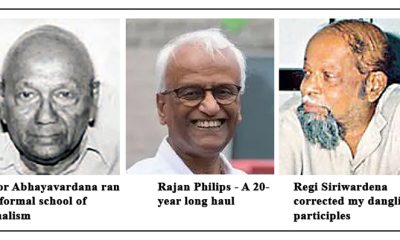

Features6 days agoWriting a Sunday Column for the Island in the Sun

-

Business2 days ago

Business2 days agoCORALL Conservation Trust Fund – a historic first for SL