Business

Aitken Spence among CPM’s Top 10 Companies with the ‘Best Management Practices’

The Institute of Chartered Professional Managers of Sri Lanka (CPM) recognised Aitken Spence PLC among the 10 best managed companies in Sri Lanka in a programme themed ‘Back to Business in the New Normal’. The awards recognised companies with proven best practices for demonstrating back-to-business resilience and employee welfare in the Covid 19 transition within the Sri Lankan business community.

Apart from recognising novel and value-adding best management practices that have evolved from Sri Lankan organisations, it is expected to fill the lacuna that prevails in the sphere of literature on best management practices in the country.

From the onset of the pandemic, Aitken Spence companies rolled out procedures to ensure the safety of all employees and its stakeholders. For example, a new HR architecture was launched at Aitken Spence companies for ‘Semi-Virtual Mobility (SVM)’ where employees were given support systems to work from home and from the workplace on rotation to ensure the employees were engaged and motivated during the time. Despite the pandemic, the company launched the country’s first waste-to-energy project at a crucial juncture where domestic, municipal solid waste generation was escalating due to the lockdown in the country. Aitken Spence also expanded its renewable energy portfolio by increasing their investments in hydropower and launched a new brand for locally grown berries, the first in Sri Lanka to grow four types of berries in the country. The Group also took strategic measures to ensure financial stability by working closely with longstanding partners and form new partnerships beyond Sri Lankan borders.

Aitken Spence’s proactive diversification strategy also cushioned the blow as its non-tourism sectors reported the strongest performance in the last five years. The tourism sector also bounced back showing positive momentum. Another driving factor is the Group’s integrated strategies led by the top management and its winning teams that have executed them well by demonstrating purposeful leadership. These best practices have enabled the organisation to be among the best in business.

Listed in the Colombo Stock Exchange since 1983, Aitken Spence is anchored to a heritage of excellence spanning over 150 years and driven by more than 12,000 employees across 16 industries in 8 countries: Sri Lanka, Maldives, Fiji, India, Oman, Myanmar, Mozambique and Bangladesh.

Business

CEB urged to revise Draft Long Term Generation Expansion Plan, in view of renewable energy needs

By Ifham Nizam

The Public Utilities Commission of Sri Lanka (PUCSL) has instructed the Ceylon Electricity Board (CEB) to revise its Draft Long-Term Generation Expansion Plan (LTGEP) 2025-2044, incorporating more robust projections for renewable energy and battery storage, while also reassessing LNG infrastructure and procurement strategies.

The Island Financial Review reliably learns PUCSL Director General Damitha Kumarasinghe emphasized the need for “more robust and realistic cost assumptions for Renewable Technologies and Battery Energy Storage Systems (BESS).”

The Commission stressed that BESS should be valued not just as a renewable integration tool but also for its potential to mitigate power shortages.

The directive also calls for revisions in LNG infrastructure planning, including “a comprehensive analysis covering LNG fuel cost calculation, infrastructure development, procurement contracting options, and risks associated with supply and procurement.” PUCSL has specifically highlighted the importance of evaluating the financial and economic feasibility of a natural gas pipeline from Kerawalapitiya to Kelanitissa.

Kanchana Siriwardena, Deputy Director General – Industry Services, reinforced the Commission’s stance on renewable energy, stating that “further reductions in renewable energy curtailment should be explored by incorporating more BESS.”

The PUCSL’s instructions also mandate incorporating clauses from the Memorandum of Understanding (MoU) with Petronet India, which includes a temporary LNG supply for the Sobadhanavi Plant. The revised LTGEP must also factor in infrastructure costs related to the Floating Storage Regasification Unit (FSRU) and pipeline networks as part of the overall LNG cost calculation.

The CEB is expected to resubmit the revised plan for PUCSL’s approval, ensuring alignment with Sri Lanka’s long-term energy security and sustainability goals.

The PUCSL directive also calls for a comprehensive evaluation of various LNG procurement options and associated risks. These include:

LNG infrastructure development and expansion

Contracting options for LNG procurement

Risks related to LNG supply and procurement stability

Robustness of natural gas demand calculations

Economic feasibility of the proposed natural gas pipeline from Kerawalapitiya to Kelanitissa, given the low plant factors of power stations at Kelanitissa.

Business

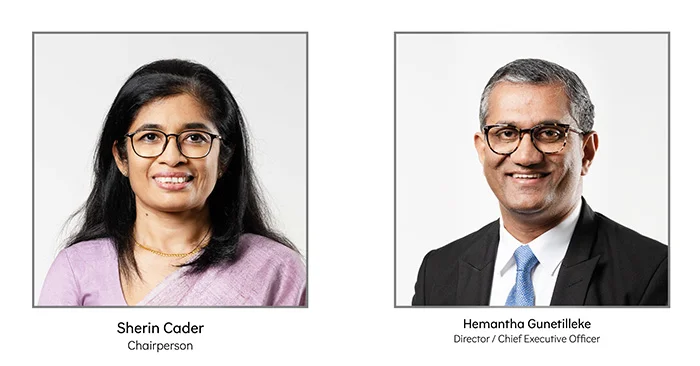

Nations Trust Bank ends 2024 with strong performance, achieving 24% ROE

Nations Trust Bank PLC reported strong financial results for the twelve months ending 31st December 2024, achieving a Profit After Tax (PAT) of LKR 17 Bn, up 46% YoY.

Nations Trust Bank, Director & Chief Executive Officer, Hemantha Gunetilleke, stated, “The Bank’s performance for the twelve months ending 31st December 2024 showcases our continued growth and expansion across diverse customer segments. Our solid capital position, strong liquidity buffers, effective risk management frameworks, and steadfast commitment to service excellence and digital empowerment remain the key drivers of our success.”

Improvements in the macro-economic environment and successful management of the Bank’s credit portfolio resulted in total impairment charges decreasing by 69% and the Net Stage 3 ratio reducing to 1.6%.

The Bank’s financial performance is supported by its strong capital buffers, with Tier I Capital at 21.47% and a Total Capital Adequacy Ratio of 22.66%, well above the regulatory requirements of 8.5% and 12.5%, respectively.

A strong liquidity buffer was maintained with a Liquidity Coverage Ratio of 320.56% against the regulatory requirement of 100%.

The Bank reported a Return on Equity (ROE) of 24.22%, while its Earnings Per Share for the twelve months ending 31st December 2024 increased to LKR 50.82, against LKR 34.70 recorded during the same period last year.

Nations Trust Bank PLC serves a diverse range of customers across Consumer, Commercial and Corporate segments through multi-channel customer touch points spanning both physical and digital. The Bank is focused on digital empowerment through cutting-edge digital banking technologies, and pioneered FriMi, Sri Lanka’s leading digital banking experience. Nations Trust Bank PLC is an issuer and sole acquirer of American Express Cards in Sri Lanka with market leadership in the premium segments.

Business

Modern Challenges and Opportunities for the Apparel Industry: JAAF drives industry dialogue

The Joint Apparel Association Forum (JAAF), in collaboration with Monash Business School and the Postgraduate Institute of Management (PIM) successfully hosted the International Conference on the Apparel Industry 2025 recently in Colombo. This was the second time the event was held, following its inaugural edition in 2018, as part of JAAF’s commitment to fostering dialogue and collaboration within the global apparel sector.

Themed “Modern Challenges and Opportunities for the Apparel Industry”, the three-day event brought together industry leaders, academics, and sustainability experts to discuss pressing issues such as ESG (Environmental, Social, and Governance) compliance, circular economy strategies, technological advancements, and workforce transformation.

A key highlight of the event was the panel discussion on “Current Actions and Their Impact on ESG-Related Outcomes in the Apparel Industry,” featuring:

Felix A. Fernando – CEO, Omega Line Ltd.

Nemanthie Kooragamage – Director Group Sustainable Business, MAS Holdings

Gayan Ranasinghe – Control Union,

Chamindry Saparamadu – Director General/CEO, Sustainable Development Council

Pyumi Sumanasekara – Principal Partner, KPMG Sri Lanka

Discussions emphasized how Sri Lanka’s apparel industry is adapting to global ESG standards, incorporating sustainable production methods, and aligning with evolving regulatory frameworks.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

Sports7 days ago

Sports7 days agoSri Lanka face Australia in Masters World Cup semi-final today

-

News7 days ago

News7 days agoCourtroom shooting: Police admit serious security lapses

-

News7 days ago

News7 days agoUnderworld figure ‘Middeniye Kajja’ and daughter shot dead in contract killing

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

Features4 days agoThe Murder of a Journalist