Business

Adani wind farms in Mannar and procedural challenges in Swiss auction

India’s Adani Group, which has committed SL’s single largest FDI in the power sector by committing to invest over a billion dollars in setting up ~500MW wind projects in Mannar and Pooneryn region, is facing resistance from a lobby group. The reason is unclear, says Vinayak Maheswaran – an equity and economic analyst at an equity markets platform who was also a former analyst at Wells Fargo Advisors.

He puts forward his argument as follows.

“Initially they said the project harms the environment. This when the Environment Impact Assessment (EIA) was done by a renowned professor and the government promised to implement the suggestions made in it and by public to minimize environmental impact. Several other Renewable Energy Organizations, Climate Organizations, environment organisations like the National Environment Caucus, Youth for Renewable Energy Organization, Sri Lanka Blue Green Alliance too conducted their own studies and have decided to back the project.”

“Then they raised questions on process not being followed. Sri Lanka’s Electricity Act allows proposals under G-2-G mechanism and the Adani’s project falls under this. The laid down process being followed for ages is government floats an RFP (Request for Proposal) and developers respond against it. As per procurement guidelines, any tender needs to go through the same process of Technical Evaluation by Project Committee of CEB & thereafter tariff negotiation by Cabinet Appointed Negotiation Committee (CANC). This was followed and done for the Adani project, which has been approved by the Public Utilities Commission of Sri Lanka (PUCSL). So where is the question of process not being followed?”

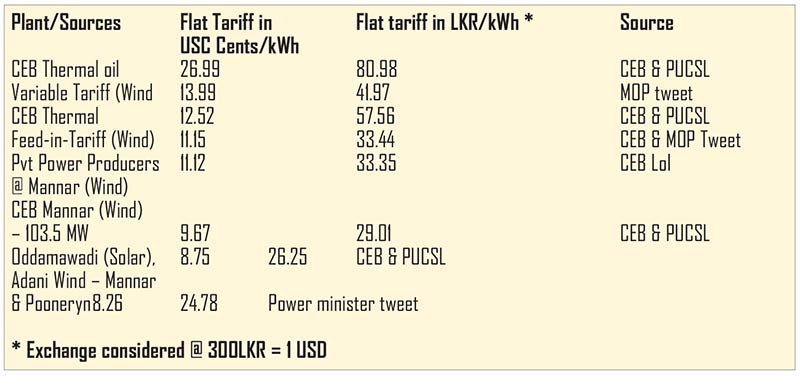

“In spite of the government negotiating an extremely competitive tariff (USC 8.26 or LKR 24.78/ unit), those against it are complaining on it being high and are seeking a Swiss auction (where new players are allowed to bid below the finalized tariff). Are they aware that Swiss auction is illegal in SL, and like most nations, SL too has put an end to this practice, citing procedural challenges? Incidentally, the same Swiss auction is not being demanded on other similar projects which have been cleared in the recent past and at a higher tariff. Double standards, anyone?”

Tariff negotiated by the government is clearly the best SL is getting currently is evident from the table below.

“None of the other recently approved projects are facing any opposition, inspite of their tariffs being higher. Take the example of an Australian firm which has proposed a 700 MW of Solar + Battery capacity with a tariff of 16 cents. Applying the same argument levelled against Adani that global benchmark tariffs for wind projects is lower than the finalized tariff, then this project’s global benchmark tariff is 9-11 cents. Has SL agreed to pay an extra US$ 1.9 billion over 25 years on this project? There is no whimper of protest for that.”

“Another example is the 100 MW Odamavadi Solar project, whose tariff too has been approved at 8.75 cents. As per the argument being made, when benchmarking with global benchmark of 2-3 cents, have we have agreed to pay an extra US$ 350 million over 25 years on this project?

What’s the real reason behind those opposed to the project? Why do we want to chase Adani away, which is reposing tremendous faith in the country by investing in during our time of crisis. Its success will attract fresh investments and will also help SL meet its sustainability goals. On government and civil society’s end, we must ensure the environment and CSR commitment made by it is met.”

“Policymakers and concerned citizens need to look at the larger picture of if somebody has the appetite for implementing such large scale RE projects, why aren’t they doing so, instead of delaying the existing ones? Does it not show that they are not interested in making any investments but rather derailing the projects coming on ground? There are many other wind & solar sites available in the country. Why aren’t they putting money where their mouth is and set up projects there at global benchmark tariffs they themselves are quoting?”

“SL needs RE energy and needs it quick. It needs partners who will offer competitive tariffs and set up projects in time and budget. Hence their antecedents are important. Adani Group is amongst world’s largest RE players and is setting up world’s largest RE park in India. It has a reputation to keep by completing the project in time and budget.”

“SL hasn’t seen a project of this scale which can potentially upend its energy dynamics and take the country closer to self-reliance and reduce dependence on fossil fuels. The Mannar + Pooneryn projects will save US$ 270+ Mn annually by displacing higher cost fuel-based tariffs. The project will generate ~1,500 million units of power per year – corresponding to meeting energy demand of 0.6 million households and equivalent to cutting 1.06 Mn tons of CO2 emission per year,” Maheswaran argues.

Business

Dilmah Champions Sustainable Supply Chains in Sri Lanka

Dilmah invited to be Patron of the UN Global Compact Network Sri Lanka Supply Chain Working Group

For over three decades, Dilmah has been more than a tea company. It has been the custodian of a philosophy that its Founder, Merrill J. Fernando, described simply: “Business is a matter of human service.” That conviction has guided every decision, from how Dilmah grows its tea to how it engages with the people and communities that make its story possible. Today, that philosophy is once again at the heart of a new milestone, as Dilmah Ceylon Tea Company PLC has been invited to be Patron of the Supply Chain Working Group of the UN Global Compact Network Sri Lanka (Network Sri Lanka).

This invitation recognizes Dilmah’s leadership in reimagining supply chains – not just as pathways of commerce, but as ecosystems of fairness, transparency, and responsibility. It also spotlights the company’s commitment to ensuring that sustainability is embedded in every step of its journey, from the tea fields of Sri Lanka to consumers worldwide.

Building Ethical and Responsible Supply Chains

Dilmah’s supply chain is both local and global. In Sri Lanka, the company works with trusted partners to source tea, herbs, flavours, and packaging materials, while partnering with reputable international suppliers for specialized inputs and machinery. This blend ensures quality, compliance, and alignment with international standards. Significantly, 79 percent of Dilmah’s suppliers are based in Sri Lanka, reflecting its long-standing commitment to local communities. In 2024/25 alone, 71 percent of its total supplier spend – amounting to Rs. 14,494 million out of Rs. 20,440 million – was directed to local businesses, reinforcing its role as an anchor for the national economy.

Supply chain sustainability is not simply an operational goal for Dilmah; it is seen as essential to business continuity itself. With more than 85 percent of the company’s Scope 3 emissions situated within the upstream and downstream value chain, transforming supplier relationships into vehicles for climate action and ethical business is both a responsibility and a necessity.

Supplier Assessments and Accountability

To ensure this transformation, Dilmah has built robust systems for evaluating and engaging suppliers. The Supplier Capability Assessment Form forms the foundation of supplier selection, requiring compliance across a wide spectrum of criteria – business ethics (prohibiting bribery and corruption), labour standards, environmental requirements, food safety and quality assurance, and brand protection.

Suppliers are subject to biannual reviews against a marking scheme developed with input from key departments, while an annual Supplier Sustainability Self-Assessment is used to measure and rate performance. Where gaps are identified, suppliers are supported with extended timelines, mentoring, and follow-ups until they reach the required standards.

This approach reflects Dilmah’s belief that supply chains must be strengthened through collaboration rather than exclusion. As Rishan Sampath, Head of Sustainability and Conservation at Dilmah, explained: “Our approach to supply chains is the same as our approach to tea. It must be authentic, ethical, and respectful of the people and ecosystems that sustain it. A supply chain that is purely transactional cannot endure – it must also be transformational.”

Stronger Together: Supplier Development

To embed sustainability across its supply network, Dilmah launched the Stronger Together initiative, a supplier sustainability roadmap designed to raise awareness and build capacity. This program supports suppliers in areas such as decarbonization, humanitarian action, and compliance with global sustainability requirements, while also providing targeted financial and technical assistance.

The initiative has unfolded in phases. In Phase 1, Dilmah convened a series of supplier conferences tailored to key supply chain segments. Sessions included a July 2023 engagement with packaging suppliers on sustainable packaging innovations, a December 2023 session with the tea sector on climate resilience and ethical labour practices, and a February 2025 forum with ingredient, logistics, and other partners to address global regulations and cross-cutting sustainability challenges.

Phase 2 – Stronger Together 2.0 builds on this foundation, focusing on implementation. It provides practical tools and training across ESG pillars, from carbon foot printing and waste management to human rights and anti-bribery practices. Training sessions also address compliance with emerging standards such as the new EU sustainability regulations. Suppliers are additionally supported with resources for decarbonization projects and humanitarian efforts, particularly in the tea sector. To foster transparency and peer learning, an online platform is being created where suppliers can interact and showcase their sustainability stories.

Recognition of Leadership

Dilmah’s commitment to sustainable supply chains has already earned international recognition. The company was named a finalist at the Reuters Global Sustainability Awards 2025 in the Net Zero: Supply Chain Decarbonization category, making it the only Sri Lankan brand recognized at this level. This acknowledgment reflects Dilmah’s ambitious, science-based climate commitments, validated by the Science Based Targets initiative (SBTi), and its leadership in driving supplier-level decarbonization.

Scaling Impact with Network Sri Lanka

While Dilmah’s internal programmes set a high standard, the company’s ability to influence wider change is magnified through its collaboration with Network Sri Lanka. The Supply Chain Working Group provides a platform for collaboration, shared learning, and collective action, enabling Dilmah to align with global frameworks while strengthening local practice.

“Through Network Sri Lanka, we are not just advancing our own practices – we are part of a larger movement,” said Rishan. “The Network connects us with peers across industries, fosters shared learning, and helps us benchmark against global frameworks. That context is invaluable in ensuring our efforts have both local relevance and international credibility.”

By serving as Patron, Dilmah is helping to catalyze progress on responsible sourcing, human rights due diligence, and decarbonization into supply chains. Its vision is not only to raise the bar within its own operations but also to inspire and enable others to do the same.

The Road Ahead

Looking ahead, Dilmah is committed to building resilient and regenerative supply chains – ones that support farmer livelihoods, strengthen smallholder climate adaptation, and ensure dignity and fairness for workers at every stage. Integrating renewable energy, reducing waste, and scaling decarbonization efforts across the supply network remain priorities.

At the heart of this journey is the same principle that has always guided Dilmah: business must exist to serve humanity. By embedding that belief into the fabric of its supply chain – and by working with Network Sri Lanka to translate global principles into local impact – Dilmah is helping build supply chains that are ethical, transparent, and resilient. Through its actions, the company continues to uphold the Ten Principles of the UN Global Compact – from advancing human rights and fair labour practices to protecting the environment and fostering integrity in all business dealings – ensuring a future where commerce and compassion move hand in hand.

Business

ComBank and Mastercard launch Sri Lanka’s first Dynamic Currency Conversion for online payments

As part of Commercial Bank of Ceylon’s sustained efforts to strengthen tourism-related businesses and improve convenience for foreign travellers, the Bank has partnered with Mastercard to introduce Sri Lanka’s first Dynamic Currency Conversion (DCC) capability for online payments, marking a significant milestone in the country’s digital payments landscape.

Enabled via the Mastercard Payment Gateway Services (MPGS) platform, the new DCC feature allows international cardholders making online purchases from Sri Lankan merchants and to pay in their home currency at checkout.

This first-of-its-kind capability for online payments in Sri Lanka is designed to help local merchants grow their business by making it easier for foreign travellers to book and pay online with confidence. By enabling Mastercard Payment Gateway Services (MPGS) with Dynamic Currency Conversion (DCC), Sri Lankan merchants, particularly in travel, hospitality and leisure can offer overseas customers a more transparent checkout experience when making reservations for flights, accommodation and related services.

DCC offers foreign cardholders the option to view and confirm the final transaction amount in their home currency before completing an online purchase, rather than being charged in Sri Lankan Rupees. The exchange rate and any associated fees are displayed upfront and processed in real time, removing uncertainty caused by fluctuating exchange rates or unexpected charges after the transaction is completed.

The solution is delivered in collaboration with global DCC provider FEXCO, with Euronet Worldwide providing the advanced switching and processing infrastructure that supports real-time currency conversion, transaction processing, clearing and settlement. Together, the partners enable a seamless, transparent and secure payment experience for cross-border online transactions, extending a capability that Commercial Bank has successfully offered for point-of-sale and in-store payments since 2019, into the fast-growing e-commerce space.

Commenting on this latest milestone, Sanath Manatunge, Managing Director/CEO of Commercial Bank said: “We have always been at the forefront of digital innovation, and introducing Sri Lanka’s first Dynamic Currency Conversion service for the Mastercard Payment Gateway is a testament to our commitment to merchants and the national economy. This collaboration with Mastercard enables us to offer our merchant base a competitive advantage, a new revenue stream, and a world-class payment experience that is transparent and convenient for every international shopper. This is a crucial step in supporting Sri Lanka’s drive to attract more digital foreign revenue and promote tourism.”

Sandun Hapugoda, Country Manager, Sri Lanka and Maldives at Mastercard, said: “Mastercard congratulates Commercial Bank of Ceylon for pioneering this milestone. The introduction of DCC brings global payment best practices to Sri Lanka, empowering international cardholders with choice and transparency when making payments. The bank has fully leveraged MPGS capabilities, including advanced features like Transaction Risk Management (TRM). MPGS serves as a versatile solution for merchants of all sizes, from small businesses to complex models such as payment aggregators and facilitators. This achievement is the result of seamless collaboration and technology integration with partners like FEXCO and Euronet, making this much-needed solution a reality for the market.”

The launch of DCC for online payments further reinforces Commercial Bank’s leadership in digital payments. The Bank was the first local bank to introduce MPGS in Sri Lanka in 2007 and today supports a large and diverse merchant base with the ability to accept online payments globally. Commercial Bank currently facilitates multi-currency transactions in more than 10 international currencies and provides built-in fraud monitoring within MPGS to ensure high standards of security and trust for merchants and customers alike.

By extending DCC to online payments, the Bank enables Sri Lankan merchants to deliver a world-class checkout experience comparable to global e-commerce standards, while giving international customers clarity over costs and greater control over how they pay.

The first Sri Lankan bank with a market capitalisation exceeding US$ 1 Bn., Commercial Bank was also the first bank in the country to be listed among the Top 1000 Banks of the World, and has the highest Tier I capital base among all Sri Lankan banks. The Bank is the largest private sector lender in Sri Lanka and the largest lender to the country’s SME sector. Commercial Bank is also a leader in digital innovation and is Sri Lanka’s first 100% carbon-neutral bank.

Commercial Bank operates a network of strategically located branches and automated machines island-wide, and has the widest international footprint among Sri Lankan banks, with 20 branches in Bangladesh, a fully-fledged Tier I Bank with a majority stake in the Maldives, a microfinance company in Myanmar, and a representative office in the Dubai International Financial Centre (DIFC). The Bank’s fully owned subsidiaries, CBC Finance Ltd. and Commercial Insurance Brokers (Pvt) Limited, also deliver a range of financial services via their own branch networks.

Business

The Kingsbury welcomes 2026 with spectacular New Year’s eve celebration

The Kingsbury, Colombo, welcomed the New Year with a celebration that captured the very essence of festivity, bringing together music, movement and unforgettable city views for one remarkable night. As guests arrived to welcome the New Year, the hotel transformed into a vibrant destination; every space alive with energy and anticipation.

The excitement peaked at Honey Beach Club, where guests danced their way into the New Year to live performances by Infinity and beats from DJ E2, creating a lively, high-energy celebration that continued late into the night. Meanwhile, Sky Lounge offered an elevated and equally electric experience, with live entertainment by The Kingdom and uninterrupted views of Colombo’s skyline. As midnight approached, guests gathered to witness the city’s fireworks from one of the best vantage points in Colombo, a moment that perfectly captured the magic of New Year’s Eve.

Complementing the celebrations was an array of exceptional dining experiences across the hotel. Guests marked the occasion with festive menus, curated tasting experiences and celebratory feasts, each delivered with The Kingsbury’s signature warmth and attention to detail. Whether dining, dancing, or simply soaking in the atmosphere, every moment was designed to feel meaningful and memorable.

As the New Year dawned, The Kingsbury stood at the centre of Colombo’s celebrations, having created a night filled with lasting memories. It was a New Year’s Eve that reflected the spirit of celebration and the promise of the year ahead at one of Colombo’s best five-star hotels.

-

Sports6 days ago

Sports6 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne

-

News1 day ago

News1 day agoHealth Minister sends letter of demand for one billion rupees in damages

-

News4 days ago

News4 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Features5 days ago

Features5 days agoIt’s all over for Maxi Rozairo

-

Opinion3 days ago

Opinion3 days agoRemembering Douglas Devananda on New Year’s Day 2026

-

News5 days ago

News5 days agoDr. Bellana: “I was removed as NHSL Deputy Director for exposing Rs. 900 mn fraud”

-

News4 days ago

News4 days agoDons on warpath over alleged undue interference in university governance

-

Features5 days ago

Features5 days agoRebuilding Sri Lanka Through Inclusive Governance