Business

Rotary Colombo joins hands with NCCP to fight breast cancer through early detection and prevention

October is designated as ‘Breast Cancer Awareness Month’, worldwide. Cancer ranks among the three leading Non Communicable Diseases (NCD)in Sri Lanka and is on the rise with over 15,000-20,000 new cases detected every year. Breast cancer has the highest incidence among all cancers and is the leading cancer among females in Sri Lanka.

16 years ago, the Rotary Club of Colombo, launched their life saving project in partnership with the National Cancer Control Programme, for free screening and early detection of cancer, with a focus on early detection of breast cancer which accounts for over 25% of all cancers in Sri Lanka. According to studies, 30-40% of cancers can be prevented, and another one third cured with screening, early detection and timely follow up treatment. This would mean saving several thousand lives every year. Todate almost 80000 individuals , mainly women , have been screened, with over 18000 showing abnormalities requiring further investigation- these are all cases which may otherwise have gone undetected until the late stages where the chances of being saved would then be greatly reduced.

The Centre operates a comprehensive cancer screening facility complete with a mammography machine and ultra sound scanner donated by the Rotary Club of Birmingham Alabama, USA. A radiographer is also available at the Centre to operate this facility. Cervical cancer is screened through a HPV/DNA testing machine funded by The Rotary Foundation USA. The Centre is presently seeking a donor for a colposcopy machine to replace the existing machine used for diagnostic screening of cervical cancer which has the second highest incidence of cancers in females. The Centre also operates an oral cancer screening unit for detection of oral cancer, in view of this cancer having the highest incidence among males.

Education and awareness building activities are also carried out by a Health Education Unit in the Centre, aimed at early detection through screening and the prevention of cancer through healthy life style. This is supported by a mobile screening unit operating islandwide. Meanwhile counselling is also undertaken for those cases diagnosed positive.

Education and awareness building activities are also carried out by a Health Education Unit in the Centre, aimed at early detection through screening and the prevention of cancer through healthy life style. This is supported by a mobile screening unit operating islandwide. Meanwhile counselling is also undertaken for those cases diagnosed positive.

The Cancer Prevention and Early Detection Centre is presently the only national facility dedicated for screening, early detection and prevention of cancer, offering its services entirely free of charge to the public.The Centre is supported by leading telecommunication provider and Corporate Partner Dialog Axiata PLC.

Due to the rapidly rising numbers seeking screening, as well as the need to expand and upgrade the present screening facilities, the Rotary Club of Colombo requires to relocate the Centre in a permanent, more spacious building in the same area, now well known for cancer screening and which provides easy access and visibility to those coming from near and far to seek the services of this life saving facility. This is presently a pressing and urgent priority for the project.

Once a new building is in place, the numbers screened and lives saved through early detection and prevention activities, could be greatly increased. Meanwhile the Club, together with NCCP, extended breast cancer screening and early detection facilities 4 years ago, to the outlying regions commencing with a Breast Cancer Early Detection Unit at Kurunegala Teaching Hospital with equipment funded by The Rotary Foundation. This will enable the community in that area and surrounding regions, particularly the less privileged, to have greater accessibility to this life saving service.

Contact details as follows:

Tel : 0113159227

Email – cedc. nccp@gmail.com

Business

Cheaper credit expected to drive Sri Lanka’s business landscape in 2026

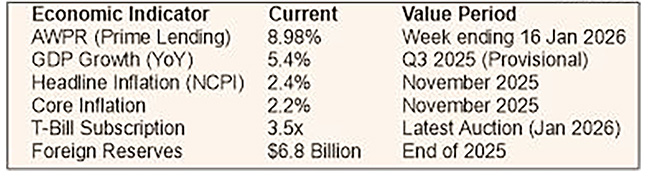

The opening weeks of 2026 are offering a glimmer of cautious hope for the business community weary from years of economic turbulence and steep financing costs. The Central Bank’s latest weekly economic indicators signal more than just macroeconomic stability. They point to early signs of a long-awaited trend; a measurable dip in borrowing costs.

“If sustained, this shift could transform steady growth into a robust, investment-led expansion,” a senior economist told The Island Financial Review.

The benchmark Average Weighted Prime Lending Rate (AWPR) declined by 21 basis points to 8.98% for the week ending 16 January, according to the Central Bank.

“For entrepreneurs and CEOs, this is not just another statistic. It could mean the difference between postponing an expansion and hiring new staff. Across boardrooms, the hope is that this marks the start of a sustained downward trend that holds through 2026,” he said.

When asked about the instances where Treasury Bills are not fully subscribed by the investors, he replied,” Treasury Bill yields remained broadly stable, with only minimal movement across 91-day, 182-day, and 364-day tenors. Strong demand was clear, with the latest T-Bill auction oversubscribed by about 3.5 times. This sovereign-level stability creates room for the gradual easing of commercial lending rates, allowing the Central Bank to nurture a more growth-supportive monetary policy.”

Replying to a question on how he views the inflation numbers in this context, he said, “The year-on-year increase in the National Consumer Price Index stood at a manageable 2.4% in November, with core inflation at 2.2%. Such an environment should allow interest rates to fall without sparking a price spiral. For businesses, it means the real cost of borrowing adjusted for inflation, and it is becoming more favourable for them. While consumers still face weekly price shifts in vegetables and fish, the broader disinflation trend gives policymakers leeway to keep credit affordable.”

Referring to the growth trajectory, he mentioned, “With GDP growth provisionally at 5.4% in the third quarter of 2025 and Purchasing Managers’ Indices signalling expansion in both manufacturing and services, the economy is in a growth phase. However, to accelerate this momentum businesses need capital at lower cost to modernise machinery, boost export capacity, and spur innovation. Affordable credit is, therefore, not merely helpful, it is essential to shift growth into a higher gear.”

In conclusion , he said,” The coming months will be watched closely, because for Sri Lankan businesses, a sustained decline in borrowing costs isn’t just an indicator; it’s the foundation for growth. There’s hope that this easing in the cost of money will prevail through most of the year.”

By Sanath Nanayakkare ✍️

Business

Mercantile Investments expands to 90 branches, backed by strong growth

Mercantile Investments & Finance PLC has expanded its national footprint to 90 branches with a new opening in Tangalle, reinforcing its commitment to community accessibility. The trusted non-bank financial institution, with over 60 years of service, now supports diverse communities across Sri Lanka with leasing, deposits, gold loans, and tailored lending.

This physical expansion aligns with significant financial growth. The company recently surpassed an LKR 100 billion asset base, with its lending portfolio doubling to Rs. 75 billion and deposits growing to Rs. 51 billion, reflecting strong customer trust. It maintains a low NPL ratio of 4.65%.

Chief Operating Officer Laksanda Gunawardena stated the branch network is vital for building trust, complemented by ongoing digital investments. Managing Director Gerard Ondaatjie linked the growth to six decades of safeguarding depositor interests.

With strategic plans extending to 2027, Mercantile Investments aims to convert its scale into sustained competitive advantage, supporting both customers and Sri Lanka’s economic progress.

Business

AFASL says policy gap creates ‘uneven playing field,’ undercuts local Aluminium industry

A glaring omission in the Board of Investment’s (BOI) Negative List is allowing duty-free imports of fully fabricated aluminium products, severely undercutting Sri Lanka’s domestic manufacturers, according to a leading industry association.

The Aluminium Fabricators Association of Sri Lanka (AFASL) warns that this policy failure is threatening tens of thousands of jobs, draining foreign exchange, and stifling local industrial capacity.

“This has created an uneven playing field,” the AFASL said, adding that BOI-approved developers gain cost advantages over local fabricators, while government revenue and foreign exchange are lost through imports of products already made in Sri Lanka.

The core of the issue lies in a critical policy gap. While raw aluminium extrusions are protected on the BOI’s Negative List – which restricts duty-free imports – finished products like doors, windows, and façade systems are not. Furthermore, the list’s lack of specific Harmonised System (HS) codes allows these finished items to be imported under varying descriptions, slipping through duty-free.

This loophole, the AFASL argues, disadvantages a robust local industry that employs over 30,000 people directly and indirectly. Supported by five local extrusion manufacturers, a skilled NVQ-certified workforce, and a well-established glass-processing sector, the industry has been operational since the 1980s.

The association highlights that the damage extends beyond fabrication. The imported systems often include glass, hinges, locks, and accessories, all of which are produced locally, thereby cutting off demand across the entire domestic value chain. Small and medium-sized enterprises (SMEs), a segment government policy aims to support, are feeling the impact most acutely.

Since May 2025, the AFASL has been engaged in talks with the BOI, Finance Ministry, and Industries Ministry. Their key demand is to include specific HS codes on the Negative List and to list fabricated aluminium doors, windows, and curtain wall systems under HS Code 7610 to close the loophole.

While welcoming supportive recommendations from the Industries Ministry to add these products to an updated Negative List, the AFASL sounded a note of caution. It warned that proposed reductions in the CESS levy could further incentivise imports, undermining the sector’s recovery from the economic crisis.

The association also pointed to an inequity in the current framework. With most subsidies withdrawn, BOI-registered property developers continue to benefit from duty-free imports, while locally made products remain subject to heavy taxes for the general population.

The AFASL is urging policymakers to align investment incentives with national industrial policy, protect domestic manufacturing, and ensure fair competition across the construction supply chain to safeguard an industry vital to Sri Lanka’s economy.

By Sanath Nanayakkare ✍️

-

Editorial1 day ago

Editorial1 day agoIllusory rule of law

-

News2 days ago

News2 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business4 days ago

Business4 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial2 days ago

Editorial2 days agoCrime and cops

-

Editorial3 days ago

Editorial3 days agoThe Chakka Clash

-

Features1 day ago

Features1 day agoDaydreams on a winter’s day

-

Business4 days ago

Business4 days agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App

-

Features3 days ago

Features3 days agoOnline work compatibility of education tablets