Business

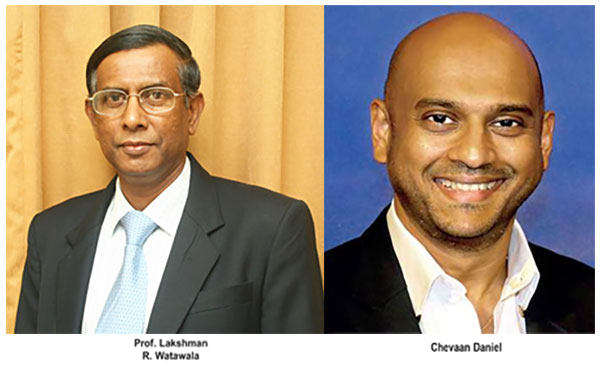

Reckless spending by governments and public sector created debt crisis – Prof. Lakshman Watawala

By Hiran H.Senewiratne

The entire government/ public sector ran on without accountability to their spending on various development projects, despite having a huge number of government servants, which runs into 1.5 million. That is why the country encounters a huge debt crisis that amounts to US $ 60 billion or Rs 70 trillion, Prof. Lakshman R. Watawala said.

‘The private sector’s accountability is a key area and without accountability we cannot exist. Unfortunately, we don’t see any accountability in the government/public sector. If they are accountable they will know how borrowed funds are utilized for various development projects. Due to that not only politicians but the public sector too should be responsible for this debt crisis, Prof. Watawala who is the Founder/President, Institute of Certified Management Accountants of Sri Lanka (CMA) said.

Watawala made these observations at a zoom forum organized by CMA Sri Lanka recently on the subject, “A Solution to Debt Crises Using Nature”.

Extracts from Watawala’s presentation:” We are planning to go to the IMF to get dollars. We can’t really imagine how we got into debt and therefore no one is ready to take responsibility for it. Therefore, our huge 1.5 million strong public sector is eating up our money, in other words tax payer’s money.

‘When Sri Lanka graduated to a developed country from a developing nation we were able to raise money from lending agencies and even from International Sovereign Bonds for different projects with liberty, sometimes with high interest rates. In the absence of a proper accountability mechanism nobody knows what happens to those funds. The respective governments never consider the repayment methods and the viability of those projects.

‘Our government departments spend colossal amounts money as if it has to be borne by society. In that sense money that was borrowed was never properly accounted for. Therefore, that money was wasted and some corrupt political and public servants robbed them.

‘In a landmark Indian Supreme Court judgment, the latter ruled that when a government imposes any taxes it should consult the Taxpayers Association on why it imposes taxes or on what and how that money is to be spent. Therefore, it is the need of the hour to have some system for the country to enable financial discipline.’

The Group Director Capital Maharaja Group Chevaan Daniel in his presentations said that Sri Lanka’s 3,000 year-old system still serves its people. Sri Lanka’s hydraulic heritage must be understood in order to be protected. Our ancient philosophy of water and soil conservation is amongst the greatest in the world. He talked on, ‘The Sea of Sri Lanka and Sri Lanka’s Water Heritage’.

Daniel added: “While the West has woken up to the importance of sustainability of late, the Sri Lankan civilization was built on a culture of sustainability that lasted for thousands of years. A key misconception that must be righted is the fact that we often think our water heritage is limited to our irrigation systems.

‘ An irrigation system is a function of hydraulic engineers who will see water as ‘inanimate and active’ but the conservationist and farmer will see water from the perspective of it being animate and passive.

‘The famous scholar, Joseph Needham once noted that the development of a water management system in ancient Sri Lanka in its technology and organization has been unparalleled in its sophistication elsewhere in the world.’

Business

CB Governor underscores rating agencies’ critical role in post-debt restructuring recovery

Sri Lanka’s Central Bank Governor, Dr. Nandalal Weerasinghe, has underscored the critical role of sovereign credit rating agencies in helping debt-distressed nations smoothly transition out of default status after successful debt restructuring.

Speaking at the Global Sovereign Debt Roundtable (GSDR) in Washington DC on the sidelines of the IMF and World Bank Spring Meetings, Dr. Weerasinghe shared Sri Lanka’s ongoing debt restructuring experience.

He highlighted that while restructuring is a crucial step toward economic recovery, rating agencies must play a proactive role in reassessing countries’ creditworthiness fairly and promptly once restructuring is completed.

The GSDR, co-chaired by the IMF, World Bank, and G20 Presidency, serves as a key platform for debtor nations and creditors to address debt challenges.

Sri Lanka, a country which has undergone complex debt negotiations, has been an active participant in these discussions.

Governor Weerasinghe’s remarks come at a pivotal time, as Sri Lanka seeks to restore international investor confidence post-restructuring.

His call aligns with broader discussions at the GSDR on improving coordination between debtors, creditors, and financial institutions to ensure sustainable debt solutions, and help restore international investor confidence in countries such as Sri Lanka.

The roundtable also highlighted the newly introduced Sovereign Debt Restructuring Playbook, designed to guide countries through restructuring processes.

The Central Bank’s push for more responsive and supportive rating agency policies could set an important precedent for other debt-distressed economies as well.

Speaking at the GSDR, Treasury Secretary K M M Siriwardana acknowledged the International Monetary Fund (IMF) as instrumental in stabilising Sri Lanka’s crisis-hit economy, as the country prepares to receive its fifth IMF tranche of $344 million in the coming weeks.

Siriwardana reflected on Sri Lanka’s ‘extremely challenging journey’ since its 2022 economic collapse marked by severe shortages, public unrest, and a loss of confidence in governance.

“Seeking IMF support was a strength, not a weakness,” he asserted, crediting the Fund’s policy framework and technical assistance for reversing the economic freefall.

He highlighted over 200 IMF training programmes conducted to strengthen institutional capacity, stating, “The IMF laid the foundation for stability.”

Notably present at the discussion was Peter Brewer, the IMF’s former Senior Mission Chief for Sri Lanka, underscoring the close collaboration between Sri Lanka and the Fund.

Siriwardana traced the roots of the crisis to political instability between 2017–2019, the 2019 Easter attacks, and contentious tax policies, which collectively deepened Sri Lanka’s economic vulnerabilities. “Yet,” he noted, “Difficult reforms are now yielding positive results.”

By Sanath Nanayakkare

Business

Calcey earns ISO 27001 certification, strengthening data security commitment

Calcey, a global software services provider, has achieved ISO 27001:2013 certification, the international benchmark for Information Security Management Systems (ISMS). This certification highlights Calcey’s strong measures in safeguarding client data and managing security risks.

The rigorous audit covered Calcey’s security protocols, risk management, and operational processes across its offices in Singapore, Sri Lanka, and the U.S.

Mangala Karunaratne, CEO of Calcey Technologies, stated that this milestone underscores their dedication to top-tier data security, reinforcing trust among clients in the U.S., Europe, and the Nordic regions.

The certification ensures compliance with global security standards, benefiting Calcey’s diverse clientele, from startups to large enterprises.

Business

Chinese Dragon Café Nuwara Eliya seasonal outlet remains open until April 30

Chinese Dragon Café, a leading Sri Lankan-style Chinese restaurant, has announced that its temporary outlet at Alpine Hotel in Nuwara Eliya will remain open until April 30, catering to both loyal customers and tourists during the Avurudu season.

The seasonal branch has already gained popularity among locals and visitors, offering signature dishes like seafood fried rice, fried noodles, tom yum soup, hot butter cuttlefish, and crispy spring rolls. To enhance convenience, the café provides free delivery within Nuwara Eliya for hotel guests and holidaymakers.

This marks the brand’s first seasonal expansion to Nuwara Eliya, capitalizing on the influx of tourists especially from Colombo, enjoying the cool climate and festive atmosphere.

-

News6 days ago

News6 days agoOrders under the provisions of the Prevention of Corruptions Act No. 9 of 2023 for concurrence of parliament

-

Features7 days ago

Features7 days agoRuGoesWild: Taking science into the wild — and into the hearts of Sri Lankans

-

Business2 days ago

Business2 days agoPick My Pet wins Best Pet Boarding and Grooming Facilitator award

-

News6 days ago

News6 days agoProf. Rambukwella passes away

-

Opinion7 days ago

Opinion7 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part IX

-

Features2 days ago

Features2 days agoKing Donald and the executive presidency

-

Business2 days ago

Business2 days agoACHE Honoured as best institute for American-standard education

-

Features4 days ago

Features4 days agoThe Truth will set us free – I