Business

Learning for Sri Lanka on SOE Reforms – Malaysia’s Khazanah Nasional Berhad

Introduction

A super-holding company for managing State-Owned Enterprises (SOEs) has been identified as a globally successful model for SOE management. This model allows the government to adopt a more arms-length approach to SOEs’ operational decision-making, relieving it of the direct responsibility of overseeing all SOEs dispersed across various industries, and redirect its budget and energy elsewhere. The merits of this model have enabled countries such as Malaysia and Singapore, which employ similar holding company structures, to ensure impressive performances of their SOEs.

This article is the second of a three-part series where part one and two provide an in depth analysis of the case of Singapore’s and Malaysia’s SOE holding company models (Singapore’s Temasek Holdings and Malaysia’s Khazanah Nasional), and their role in enabling economic growth and development for the respective countries. Part three will provide learnings for Sri Lanka, which can be adopted for the country’s SOE reform process. This series of articles is a joint effort by the Ceylon Chamber of Commerce (CCC) and the Colombo Stock Exchange (CSE).

Part Two: Malaysia’s Khazanah Nasional Berhad

Overview

Khazanah is a Malay word that originated from an Arabic word, which means ‘treasure’ so, Khazanah Nasional translates to ‘national treasure’. Khazanah was incorporated under the Companies Act in Malaysia in 1993 as a public limited company, that manages state assets in selected sectors on behalf of the Malaysian government. It also takes investment decisions on behalf of the government, including listing, divestment, and acquisition of shares.To balance the dual objectives required by the Malaysian economy, two separate funds have been established, namely; Commercial Fund (CF) and the Strategic Fund (SF) with distinct objectives, policies and strategies.The SF undertakes investments to deliver impactful and measurable economic and societal returns for Malaysia and its people, while CF focuses on investing responsibly and commercially to preserve and grow the long-term value of assets.

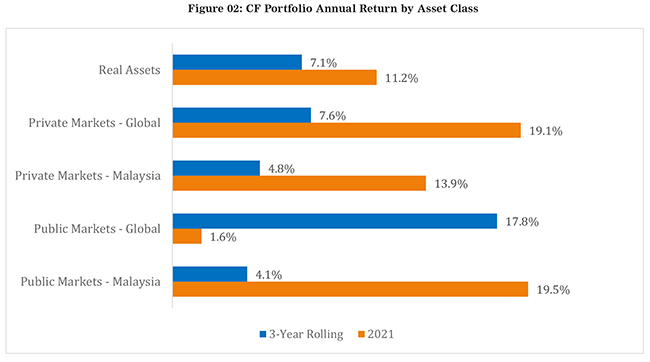

The CF generated a three-year rolling Time-Weighted Rate of Return (TWRR) of 7.0% against the targeted return of the Malaysian Consumer Price Index (CPI) at 3% on a five-year rolling basis. In 2021, the TWRR stood at a significant 19%. This was led by asset classes such as global private markets and public markets in Malaysia, which outperformed in 2021 when compared to the 3 year rolling of 7.6% and 4.1% respectively of the same asset classes (refer figure 02).

Source: Khazanah Nasional Berhad The two funds were valued RM 106 billion (around USD 25 billion) and RM 28 billion (around USD 7 billion) for CF and SF, respectively at the end of 2021. A majority of the investments (63.5%) were made within Malaysia, with the rest in China (14.8%), Asia – excluding China (12%), and around 10% in Europe, the Middle East, Africa (EMEA) and North America by the end of 2021.Consumer Goods, Energy, Financials, Healthcare, Industrials, Information Technology, Media, Real Estate, Telecommunications and Utilities are among the sectors Khazanah has invested in.

Why was Khazanah Successful?

Post the Asian Financial Crisis, most SOEs in Malaysia were not performing well. To address this Khazanah was revamped in 2004 to play an active role from the previous passive role to enable efficiency and to drive growth of the SOEs. This was coupled with major corporate restructuring and institutional reforms through the GLC Transformation Program (2005-2015) for which Khazanah functioned as the secretariat.

The revamp shifted Khazanah’s focus from a Sovereign Wealth Fund (SWF) to a Sovereign Development Fund (SDF). The salient feature of a SDF is that it not only delivers high financial performance but also fosters development. Today, Khazanah comprises two funds (CF and SF) which aim to achieve the dual objectives and its total Net Asset Value (NAV) has grown from RM79 billion to RM86 billion in 2021. The 10 key factors that were critical to its success are outlined below:

1. Clear Objectives

Khazanah focused on three clear objectives to drive its financial, economic and societal returns as given below. Performance – focusing on corporate restructuring to improve efficiency, productivity and value creation. This was achieved by issuing guidelines on KPIs and anchoring KPI’s to performance. Relevant KPIs were developed together with appropriate benchmarks and targets, and rewards were linked to performance coupled with time based contracts such as 3-year contracts. This was also enabled through reconstituting the senior management and implementing board composition reforms. National Development – focusing on national development goals such as creating jobs and economic multipliers. Supporting government policy formation and adopting a long-term view in catalysing social progress in Malaysia to deliver high social impact in communities.

Good Governance –took a holistic and multipronged approach to measure how public institutions conduct and manage public resources.

2. National Support

A degree of national consensus is vital with all relevant stakeholder groups involved and powered by political will. The reform process was carried out over 10 years from 2005 onwards where the reform of Khazanah started under the 4th Prime Minister of Malaysia, the GLC Transformation (GLCT) Programme under the 5th Prime Minister and continued under the 6th Prime Minister.

3. Communications, transparency, public accountability

Transparency and consistent periodic reporting are vital to the success of the programme. KPIs were announced publicly with regular public updates, with internal KPIs being identical to external KPIs. This was followed by consistent and relevant stakeholder engagement across multiple categories.

4. Active, competent, and empowered Holding Company

Khazanah was revamped as an active and strategic SDF (Sovereign Development Fund). Khazanah was also tasked to come up with an overarching programme for other funds from 2005 to 2015. This programme was known as the GLC Transformation Program (GLCT) with Khazanah acting as its Secretariat.

5. A robust Programme Management approach over 10 to 15 years

The GLCT Programme was carried out for 10 years with a careful designed implementation structure. It consisted of 22,981 man days of programme management and 29 meetings were chaired by the Prime Minister to review progress over the 10-year period. It is imperative to stay the course since the prize of seeing it through and the price of not doing so is large. However, it must be ensured that it’s done correctly.

6. Talent and Leadership

Right leadership is critical. Therefore, the Chief Executive Officer. the Board and the Senior Management should be selected under specified criteria to appoint individuals based on their capacity and knowledge to deliver in their role. This should also be followed by a robust selection process.

7. Transformation Acupuncture

Targeted 10 critical areas for improvement in corporate restructuring in key companies. The critical areas included Board governance, CSR, procurement, leadership development, performance based compensation, regulation, operational improvement and finance.

8. Accountability

This included headline KPIs, performance-based compensation, senior management limited to 3-year performance based contracts and a robust appointment process, emulating a carrot and stick approach.

9. Getting key sectors right in terms of the policy mix

It is important to identify the critical sectors such as electricity, telecom, banks, aviation, infrastructure, etc. that play a vital role in the economy. Planning the sector strategy, regulation, pricing, social policy, etc. for the selected sectors instead of reforming all the sectors will also divert resources to effective and efficient use.

10. Using the levers of ownership, financing and controls

Sorting between principally commercial and principally social enterprises is also pertinent. Understanding which particular category enterprises come under will provide clarity on how to run these enterprises such as whether to list or delist, to conduct partial or full asset sales and to understand the required capital structure controls, debt discipline, and external audits.

How has it contributed to Development Goals?

Khazanah’s principal funding is from shareholder equity. It utilises debt financing and proceeds from divestment activities to fund its investment activities. Khazanah’s ultimate holding body and hence the sole shareholder, is the Ministry of Finance (MoF).In terms of contribution, between 2004 and 2021, Khazanah paid RM15.6 billion in dividends to the government (or MoF) averaging RM 1.3 billion a year over the past five years. Dividends of RM2 billion each had been declared in 2020 and 2021.

Investment income contributed to 16.3% of total government revenue in 2021, of which Khazanah contributed to about 6% of investment income through its dividends. Though the contribution to government revenue through dividends remains marginal when compared to other tax revenue streams, Khazanah continued to deliver societal value and impact through various other initiatives.

During the pandemic, RM20 million was contributed by Khazanah as COVID-19 relief to the government. Therefore, Khazanah acts as a buffer against future pandemics and can assist the government in its relief measures.One of Khazanah’s foundations – Yayasan Hasanah – directly and indirectly assisted 1.5 million people through Covid-19 relief efforts and various other programmes, with an allocation of RM554 million in 2021.The Khazanah Research Institute was set up to undertake analyses and research on the pressing issues of the nation, and based on the research, provide policy recommendations to improve the well-being of Malaysians. A total of 30 publications were released in 2021.

Khazanah also works on development projects for the improvement of the Malaysian economy. This includes Dana Impak, which is a newly created project with an allocation of RM6 billion over 5 years. This is carried out to increase Malaysia’s economic competitiveness and build national resilience. This focuses on 6 areas namely; digital society and technology hub, quality health and education for all, decent work and social mobility, food and energy security, building climate resilience, and competing in global markets.The full brief can be accessed at: Holding Company for SOEs: Learnings for Sri Lanka

This article was developed as part of the Strategic Insight Series of the Economic Intelligence Unit (EIU) of the Ceylon Chamber of Commerce (CCC) in collaboration with the Colombo Stock Exchange (CSE). The Strategic Insight Series are a series of briefs that focuses on key contemporary topics that matter to the private sector.

Business

Sri Lanka sets bold target to slash cash use, seeks unified Fintech regulator

The inaugural Sri Lanka Fintech Summit 2025 concluded with industry leaders and regulators establishing two critical national priorities: a bold target to reduce physical cash usage and a push for consolidated regulatory oversight.

In a key decision, participants set a clear three-year goal to lower the ratio of cash in circulation to GDP from 4.5% to 3.5%. The strategy will focus on digitizing high-cash sectors like transport, utilities, and SME payments, while expanding digital access through post offices and cooperatives.

For the long-term health of the ecosystem, stakeholders agreed to lobby for the creation of a single, unified regulatory authority dedicated to fintech oversight. This aims to streamline approvals and provide clearer guidance for innovators.

“Our members needed to leave with concrete action points,” said Channa de Silva, Chairman of the Fintech Forum, Sri Lanka. The summit, designed as a series of closed-door roundtables with regulators including the Central Bank, produced actionable frameworks. “It was about defining KPIs, setting targets, and giving the industry a shared direction,” de Silva explained.

The outcomes signal a concerted shift from discussion to execution, aiming to build a more inclusive, efficient, and secure digital financial economy for Sri Lanka.

By Sanath Nanayakkare ✍️

Business

Kukus Group plans 18 outlets across three distinct Sri Lankan hospitality concepts

A new force in Sri Lanka’s food industry, Kukus Group, is gaining momentum with a clear vision to deliver authentic cuisine, high hygiene standards, and affordability. Founded by young entrepreneurs Nadeera Senanayaka, Lakmini Gurusinghe, and Randila Gunasinghe, the group has successfully launched its pilot outlet and is now preparing for a significant nationwide expansion.

The inaugural in Kotte has served as a successful proof of concept. Operating for five months, this modern street-food outlet has garnered a strong customer response, confirming market demand and providing the confidence to fund the group’s ambitious growth strategy.

“The positive reception has been overwhelming and has solidified our plans,” said Lakmini Gurusinghe and Randila Gunasinghe. “Our Kotte outlet is the operational model we will replicate – ensuring consistent quality, disciplined operations, and excellent service across all future locations.”

The group’s expansion strategy is built on three distinct thematic brands:

Kukus Street: Targeting young urban customers, these outlets offer a vibrant, casual dining experience with a menu of Sri Lankan rice and curry, kottu, snacks, and BBQ, with most meals priced under Rs. 1,500. Services include dine-in, takeaway, and delivery.

Kukus Beach: Planned for coastal areas, beginning in the South, this concept will feature an urban-style beach restaurant and pub designed for relaxed social dining.

Kukus Bioscope: Celebrating Sri Lanka’s cinematic heritage, this dedicated restaurant concept will create a nostalgic cultural space inspired by the golden eras of Sinhala cinema, with the first outlet slated for Colombo.

The immediate plan includes transforming the flagship Kotte location into Kukus Pub & Bar, pending regulatory approvals. The long-term vision is to develop 18 outlets nationwide: 10 Kukus Street locations, 5 Kukus Beach venues, and 3 Kukus Bioscope establishments.

“Kukus Group is more than a hospitality brand; it’s a celebration of Sri Lankan flavors and culture,” the founders concluded. “Our mission is to build trusted, recognizable brands that connect deeply with communities and offer lasting cultural value alongside authentic cuisine. We are dynamic and excited to proceed with this strategic expansion,” they said.

By Sanath Nanayakkare

Business

Fcode Labs marks seven years with awards night

Fcode Labs marked its seventh anniversary by hosting its annual Awards Night 2025 at Waters Edge, celebrating team achievements and reinforcing its organizational values.

The event featured keynote addresses from Co-Founders & CEOs Buddhishan Manamperi and Tharindu Malawaraarachchi, who reflected on the company’s annual progress and future strategy. Chief Operating Officer Pamaljith Harshapriya outlined operational priorities for the next phase of growth.

Awards were presented across three key categories. Prabhanu Gunaweera and Dushan Pramod received Customer Excellence awards for partner collaboration. Performance Excellence awards were granted to Munsira Mansoor, Thusara Wanigathunga, Thushan De Silva, Adithya Narasinghe, Avantha Dissanayake, Amanda Janmaweera, Sithika Guruge, and Sandali Gunawardena. The Value-Based Behaviour awards were given to Thilina Hewagama, Udara Sembukuttiarachchi, and Kavindu Dhananjaya for exemplifying company values.

-

News1 day ago

News1 day agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Business1 day ago

Business1 day agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

Features1 day ago

Features1 day agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

News6 days ago

News6 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

Features1 day ago

Features1 day agoSubject:Whatever happened to (my) three million dollars?

-

News1 day ago

News1 day agoLevel I landslide early warnings issued to the Districts of Badulla, Kandy, Matale and Nuwara-Eliya extended

-

News6 days ago

News6 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

News1 day ago

News1 day ago65 withdrawn cases re-filed by Govt, PM tells Parliament