Features

Sri Lanka’s 2026 Budget: Fiscal balance meets economic progress

The government budget is the nation’s key economic policy document — the primary instrument through which a state translates its political priorities into concrete economic action. Sri Lanka’s 2026 Budget comes at a crucial juncture, following the severe macroeconomic crisis of 2022, the implementation of an IMF-supported stabilization programme, and the ongoing debt restructuring process. As the country enters a phase of gradual recovery, the government faces the delicate task of balancing fiscal discipline, social protection, and growth-oriented investment.

A government budget functions both as a financial plan and a policy document. It outlines projected revenues and planned expenditures for a fiscal year, sets tax and spending priorities, and articulates the government’s broader macroeconomic objectives — economic growth, price stability, social equity, and debt sustainability. Unlike a corporate budget focused purely on profits and losses, a national budget integrates non-financial policy objectives such as welfare, security, and the provision of public goods, while also reflecting political trade-offs and long-term commitments like pensions and public debt.

Why the budget matters:

= Macroeconomic stability: The budget shapes fiscal deficits, public debt paths, and influences inflation and interest rates. Sound fiscal management builds confidence among investors, international partners, and citizens alike.

= Resource allocation: Through its expenditure framework, the budget determines how resources are distributed among key sectors such as health, education, and infrastructure, directly affecting service delivery and development outcomes.

= Redistribution: Taxation and social transfer mechanisms embedded within the budget play a key role in determining income distribution and social equity.

= Signalling and governance: The budget serves as a policy signal to both markets and the public. A transparent and accountable budget process enhances trust, governance quality, and institutional credibility.

The Importance of the Government Budget

A national budget is more than a financial plan — it is the government’s main tool for turning policy goals into economic action. Its impact extends across all sectors of society, shaping stability, confidence, and development.

= For the Economy:

A credible budget anchors macroeconomic expectations, manages fiscal deficits, and supports investment by ensuring stability and predictability.

= For Investors:

It signals policy direction on taxation, spending, and fiscal priorities. Transparent and consistent budgeting reduces risk and builds investor confidence.

= For Households:

Budgets fund essential services such as health, education, and social protection, helping safeguard vulnerable groups and promote inclusive growth.

= For Public Institutions:

They guide operational priorities of ministries while ensuring transparency and accountability through parliamentary and civic oversight.

= For Creditors and Partners:

Budgets demonstrate fiscal discipline and reform commitment, strengthening credibility with international lenders and development agencies.

Characteristics of a “Best Practice” Government Budget

= Macroeconomic Consistency: Based on realistic, transparent assumptions for GDP, inflation, and interest rates, aligned with monetary policy.

= Fiscal Sustainability: Maintains credible deficit and debt targets within a medium-term fiscal framework.

= Strategic Focus: Links annual spending to medium-term policy goals and development priorities.

= Prioritization & Efficiency: Directs funds to high-impact investments and social protection while reducing wasteful spending.

= Transparency: Ensures public access to budget data, fostering accountability and investor trust.

= Realistic Revenue & Tax Design: Uses conservative revenue estimates and broad, fair, growth-friendly taxation.

= Strong Public Financial Management: Strengthens controls, procurement, and cash management to reduce leakages.

= Countercyclical Flexibility: Allows fiscal adjustment to respond effectively to economic shocks.

= Inclusivity: Protects vulnerable groups through funding for welfare, education, and healthcare.

= Monitoring & Evaluation: Uses measurable indicators and reviews to enhance performance and accountability.

Special Features of Sri Lanka’s 2026 Budget

Sri Lanka’s 2026 Budget marks a shift from crisis recovery to sustainable growth while staying aligned with IMF-supported fiscal frameworks. It emphasizes fiscal discipline, revenue mobilization, and investment-led growth.

Key Highlights:

= IMF Alignment: The budget follows IMF fiscal targets on deficit reduction, revenue growth, and achieving a primary surplus to restore debt sustainability.

· Revenue Mobilization: Focus on expanding the tax base, improving administration, and digitalizing systems to raise revenue-to-GDP ratios sustainably.

= Debt Management: Debt restructuring eased pressures but requires transparent reporting and credible medium-term plans to maintain stability.

= Capital Expenditure Push: Increased capital spending to close infrastructure gaps and stimulate private investment and productivity.

= Subsidy and Expenditure Reform: Rationalizing subsidies and recurrent costs while protecting key social sectors like health, education, and welfare.

= Transparency and PFM Reforms: Ongoing improvements in treasury operations, cash-flow forecasting, and procurement to enhance accountability.

Fiscal and Monetary Policy Coordination

Fiscal policy (spending and taxation) and monetary policy (interest rates and liquidity) must work together for stability.

= Debt & Interest Rates: Large deficits can raise interest rates and crowd out private credit; external borrowing raises currency risks.

= Inflation Control: Expansionary budgets can fuel inflation, prompting tighter monetary policy and higher borrowing costs.

= Policy Coordination: Fiscal discipline supports central bank independence and price stability.

Sri Lanka’s Central Bank has maintained a cautious stance ahead of the 2026 Budget — balancing growth support with inflation control.

Singapore – Fiscal Prudence & Institutional Strength

= Focuses on long-term stability, protected reserves, and efficient use of surpluses.

= Invests in competitiveness, human capital, and innovation.

= Strong institutions and transparent fiscal management ensure sustainable growth.

= Lesson: Strengthen PFM systems, build fiscal buffers, and focus on high-return investments.

India – Scale & Infrastructure-Led Growth

= Uses large infrastructure spending and social programs to drive employment and consumption.

= Leverages PPPs and incentives to attract private investment.

= Balances higher deficits with strong growth potential.

= Lesson: Invest in infrastructure, expand PPPs, and manage fiscal risks carefully.

Sri Lanka must balance Singapore’s fiscal discipline with India’s growth-driven investment — building a resilient, inclusive, and forward-looking fiscal framework aligned with its Vision 2048 goals.

Sri Lanka’s Appropriation Bill 2026

Sri Lanka’s Appropriation Bill 2026, which projects total government expenditure at Rs. 4,434.36 billion for the period from January 1 to December 31, 2026, marks a critical point in the nation’s post-crisis recovery path.

After several years of fiscal strain, mounting external debt obligations, and persistent inflationary pressures, the 2026 budget seeks to strike a delicate balance among three key objectives: macroeconomic stabilization, social welfare protection, and structural economic transformation. However, achieving this balance remains a significant challenge.

Expenditure Overview:

= Total Government Expenditure: Rs. 4,434.36 billion

=Recurrent Expenditure: Rs. 3,028.75 billion (68% of total)

= Capital Expenditure: Rs. 1,405.60 billion (32% of total)

This composition reflects Sri Lanka’s enduring fiscal structure, where recurrent spending—driven by public sector salaries, pensions, interest obligations, and subsidies—continues to dominate.

From an economic perspective, this 68:32 ratio highlights the country’s limited fiscal flexibility. For a more sustainable and growth-oriented fiscal path, economists often advocate for a 60:40 ratio, ensuring that a greater share of government expenditure supports capital formation, infrastructure development, and innovation-driven growth.

Fiscal Interpretation

= The recurrent-heavy composition signals fiscal rigidity — the inability of the government to reallocate spending efficiently due to structural commitments.

= Capital expenditure, though improved in nominal terms, still constrains the government’s ability to finance long-term infrastructure, technology, and competitiveness improvements.

= The dominance of consumption-oriented expenditure over investment spending implies that fiscal policy is still more focused on stability and social continuity than on transformation and growth. (See Figure 1)

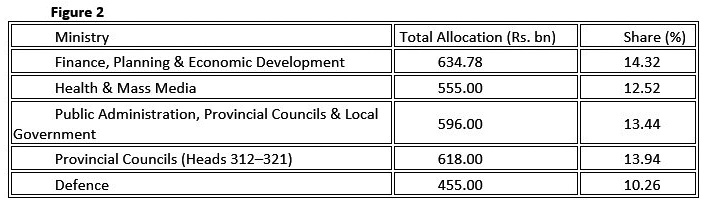

High-Expenditure Ministries

These five ministries alone account for nearly 65% of the total national expenditure, reflecting the government’s concentration on administration, debt service, and essential social services.

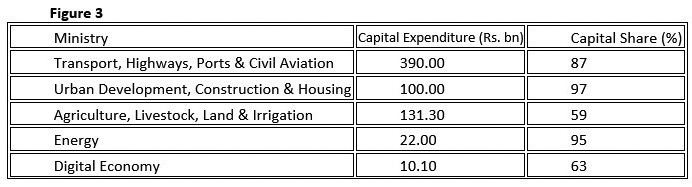

Capital-Intensive Ministries

Some ministries stand out for their high proportion of capital investment, signaling their developmental role:

These allocations emphasize infrastructure development, urban expansion, and irrigation improvement — key pillars of physical and economic connectivity. However, the digital and renewable sectors, though strategically vital, still receive relatively modest allocations compared to traditional infrastructure.

Low-Allocation and Emerging Sectors

Several ministries receive less than 1% of total spending — including Environment (0.41%), Digital Economy (0.36%), Youth and Sports (0.30%), and Science and Technology (0.14%).

From an economist’s perspective, this signals a policy gap between stated national goals (e.g., digital transformation, climate resilience, innovation) and actual fiscal commitment. For a modern economy aspiring to transition toward a knowledge- and technology-driven model, such underfunding represents a missed opportunity.

Key Economic Insights and Structural Issues

The Weight of Recurrent Commitments

Public sector salaries, pensions, and debt servicing consume the majority of recurrent expenditure. This pattern leaves limited fiscal space for productivity-enhancing spending. In 2026, the Ministry of Finance alone accounts for Rs. 634.78 billion, largely reflecting interest and debt repayments, which absorb a significant share of GDP.

Economists caution that such fiscal patterns can lead to a “crowding out effect”, where public debt obligations limit the government’s capacity to invest in education, research, and entrepreneurship — areas critical for long-term economic competitiveness.

Defence and Administrative Overheads

Despite the absence of internal conflict, defence expenditure (Rs. 455 billion) remains over 10% of total expenditure, surpassing allocations for education, agriculture, or digital development. While national security is indispensable, reallocating even a small portion of defence spending toward research, innovation, and human capital could yield higher socio-economic returns.

Social Sector Balance

= Health (Rs. 555 billion) maintains a robust 12.5% share — a positive sign of post-pandemic resilience and continued investment in public healthcare.

= Education (Rs. 301 billion) receives only 6.8%, lower than the global average of 4–6% of GDP recommended by UNESCO for developing nations.

= The Women and Child Affairs (Rs. 16.4 billion) and Social Empowerment (Rs. 38.6 billion) ministries, though small in absolute terms, play crucial roles in human capital and inclusion, yet remain underfunded.

Capital Development and Growth Drivers

Infrastructure-related ministries — particularly Transport, Urban Development, and Agriculture — exhibit a more development-oriented focus. The Rs. 390 billion capital investment in transport aligns with the government’s ambition to modernize logistics, reduce bottlenecks, and attract investment in ports and civil aviation.

However, without parallel reforms in energy, industry, and entrepreneurship, the long-term multiplier effects of these capital projects may remain limited.

Comparative Economic Context

a) India and Singapore as Contrasts

= India’s Union Budget 2025–26 allocates around 37% for capital expenditure, emphasizing infrastructure, manufacturing, and renewable energy.

= Singapore, though smaller, channels over 45% of its annual spending into development projects, digital economy infrastructure, and R&D.

In comparison, Sri Lanka’s 32% capital ratio indicates a more conservative fiscal structure, constrained by debt obligations and revenue limitations.

b) Regional Benchmarking

Countries like Bangladesh and Vietnam have prioritized industrial policy and export competitiveness, leading to GDP growth rates exceeding 6%. Sri Lanka’s fiscal design, heavily skewed toward recurrent expenditure, risks prolonging stagnant productivity unless structural adjustments are made.

Fiscal Policy Implications

a) Fiscal Discipline vs. Growth Ambition

The 2026 Appropriation Bill shows clear signs of fiscal consolidation under IMF guidance — maintaining expenditure discipline while avoiding excessive borrowing. However, fiscal consolidation must be paired with growth-oriented fiscal policy, ensuring that expenditure quality improves, not just expenditure control.

b) Revenue and Deficit Management

= Tax administration efficiency and digital compliance systems.

= Widening of the tax base, especially through formalizing the informal economy.

= Reduction of tax exemptions that erode fiscal capacity.

Without improved revenue mobilization, dependence on domestic and external borrowing could perpetuate debt vulnerability and currency instability.

Monetary and Macro Linkages

Sri Lanka’s fiscal stance directly influences monetary stability. With recurrent expenditure at 68%, the government must rely on short-term borrowing and domestic credit expansion, which can pressure interest rates and exchange rates.

A prudent coordination between the Central Bank’s monetary tightening and the Treasury’s fiscal strategy is essential to prevent inflationary resurgence and maintain external credibility.

Investment Climate and Private Sector Response

From an investor’s perspective, the 2026 budget sends mixed signals.

= On one hand, infrastructure allocations (transport, urban development, irrigation) enhance long-term investment attractiveness and logistics efficiency.

= On the other, persistent fiscal rigidity, high administrative expenditure, and low innovation investment limit the country’s competitiveness in attracting FDI and technology ventures.

To strengthen investor confidence, future budgets must:

= Provide predictable fiscal policy.

= Enhance public-private partnership (PPP) frameworks.

= Support digital transformation, start-up ecosystems, and green industries.

Social and Human Development Dimensions

Economic recovery must be inclusive. With poverty and inequality still elevated post-crisis, social spending quality becomes crucial. The allocations to education, health, women, and youth are essential, yet insufficient to drive structural transformation.

A more effective approach would involve targeted social protection, skills development, and employment-linked welfare programs, particularly for rural and marginalized communities.

Recommendations

= Rebalancing Recurrent vs. Capital Spending

Shift gradually from 68:32 to 60:40, prioritizing productive investment in technology, transport, and renewable energy.

= Performance-Based Budgeting

· Introduce outcome-oriented metrics for ministries — measuring not only spending but impact (e.g., literacy, employment, exports).

= Fiscal Decentralization

· Strengthen provincial councils’ fiscal autonomy while ensuring transparent reporting and auditing.

= Innovation and R&D Investment

· Allocate at least 1% of GDP for science, research, and innovation — critical for productivity growth.

= Public Sector Reform

· Rationalize administrative structures and adopt digital systems to reduce recurrent overhead.

= Green and Digital Transformation

· Scale up investment in renewable energy, climate adaptation, and digital infrastructure, positioning Sri Lanka within the global sustainability agenda.

Conclusion

The Sri Lankan Appropriation Bill 2026 represents a budget of stabilization and continuity, rather than bold transformation. While it ensures essential services, administrative continuity, and gradual infrastructure recovery, it still reflects the weight of historical fiscal constraints.

The economic direction is cautiously positive — signaling discipline under IMF guidance and a slow shift toward investment-led growth. However, to truly unlock its economic potential, Sri Lanka must redefine its spending priorities — from consumption to creation, from protection to production.

A resilient and prosperous Sri Lankan economy will require not only balanced books but balanced vision — one that aligns fiscal responsibility with innovation, inclusivity, and sustainable growth.

Visvalingam Muralithas

is a researcher in the legislative sector, specializing in policy analysis and economic research. He is currently pursuing a PhD in Economics at the University of Colombo, with a research focus on governance, development, and sustainable growth.

He holds a Bachelor of Arts in Economics (Honours) from the University of Jaffna and a Master’s degree in Economics from the University of Colombo. His academic background is further strengthened by postgraduate diplomas in Education from the Open University of Sri Lanka and in Monitoring and Evaluation from the University of Sri Jayewardenepura.

In addition to his research work, Muralithas has contributed to academia by teaching economics at the University of Colombo and the Institute of Bankers of Sri Lanka (IBSL), and has also gained industry experience as an investment advisor at a stock brokerage firm affiliated with the Colombo Stock Exchange. Views are personal. He can be contacted at muralithas.v@gmail.com

by Visvalingam Muralithas

Features

Indian Ocean Security: Strategies for Sri Lanka

During a recent panel discussion titled “Security Environment in the Indo-Pacific and Sri Lankan Diplomacy”, organised by the Embassy of Japan in collaboration with Dr. George I. H. Cooke, Senior Lecturer and initiator of the Awarelogue Initiative, the keynote address was delivered by Prof Ken Jimbo of Kelo University, Japan (Ceylon Today, February 15, 2026).

The report on the above states: “Prof. Jimbo discussed the evolving role of the Indo-Pacific and the emergence of its latest strategic outlook among shifting dynamics. He highlighted how changing geopolitical realities are reshaping the region’s security architecture and influencing diplomatic priorities”.

“He also addressed Sri Lanka’s position within this evolving framework, emphasising that non-alignment today does not mean isolation, but rather, diversified engagement. Such an approach, he noted, requires the careful and strategic management of dependencies to preserve national autonomy while maintaining strategic international partnerships” (Ibid).

Despite the fact that Non-Alignment and Neutrality, which incidentally is Sri Lanka’s current Foreign Policy, are often used interchangeably, both do not mean isolation. Instead, as the report states, it means multi-engagement. Therefore, as Prof. Jimbo states, it is imperative that Sri Lanka manages its relationships strategically if it is to retain its strategic autonomy and preserve its security. In this regard the Policy of Neutrality offers Rule Based obligations for Sri Lanka to observe, and protection from the Community of Nations to respect the territorial integrity of Sri Lanka, unlike Non-Alignment. The Policy of Neutrality served Sri Lanka well, when it declared to stay Neutral on the recent security breakdown between India and Pakistan.

Also participating in the panel discussion was Prof. Terney Pradeep Kumara – Director General of Coast Conservation and Coastal Resources Management, Ministry of Environment and Professor of Oceanography in the University of Ruhuna.

He stated: “In Sri Lanka’s case before speaking of superpower dynamics in the Indo-Pacific, the country must first establish its own identity within the Indian Ocean region given its strategically significant location”.

“He underlined the importance of developing the ‘Sea of Lanka concept’ which extends from the country’s coastline to its 200nauticalmile Exclusive Economic Zone (EEZ). Without firmly establishing this concept, it would be difficult to meaningfully engage with the broader Indian Ocean region”.

“He further stated that the Indian Ocean should be regarded as a zone of peace. From a defence perspective, Sri Lanka must remain neutral. However, from a scientific and resource perspective, the country must remain active given its location and the resources available in its maritime domain” (Ibid).

Perhaps influenced by his academic background, he goes on to state:” In that context Sri Lanka can work with countries in the Indian Ocean region and globally, including India, China, Australia and South Africa. The country must remain open to such cooperation” (Ibid).

Such a recommendation reflects a poor assessment of reality relating to current major power rivalry. This rivalry was addressed by me in an article titled “US – CHINA Rivalry: Maintaining Sri Lanka’s autonomy” ( 12.19. 2025) which stated: “However, there is a strong possibility for the US–China Rivalry to manifest itself engulfing India as well regarding resources in Sri Lanka’s Exclusive Economic Zone. While China has already made attempts to conduct research activities in and around Sri Lanka, objections raised by India have caused Sri Lanka to adopt measures to curtail Chinese activities presumably for the present. The report that the US and India are interested in conducting hydrographic surveys is bound to revive Chinese interests. In the light of such developments it is best that Sri Lanka conveys well in advance that its Policy of Neutrality requires Sri Lanka to prevent Exploration or Exploitation within its Exclusive Economic Zone under the principle of the Inviolability of territory by any country” ( https://island.lk/us- china-rivalry-maintaining-sri-lankas-autonomy/). Unless such measures are adopted, Sri Lanka’s Exclusive Economic Zone would end up becoming the theater for major power rivalry, with negative consequences outweighing possible economic gains.

The most startling feature in the recommendation is the exclusion of the USA from the list of countries with which to cooperate, notwithstanding the Independence Day message by the US Secretary of State which stated: “… our countries have developed a strong and mutually beneficial partnership built on the cornerstone of our people-to-people ties and shared democratic values. In the year ahead, we look forward to increasing trade and investment between our countries and strengthening our security cooperation to advance stability and prosperity throughout the Indo-Pacific region (NEWS, U.S. & Sri Lanka)

Such exclusions would inevitably result in the US imposing drastic tariffs to cripple Sri Lanka’s economy. Furthermore, the inclusion of India and China in the list of countries with whom Sri Lanka is to cooperate, ignores the objections raised by India about the presence of Chinese research vessels in Sri Lankan waters to the point that Sri Lanka was compelled to impose a moratorium on all such vessels.

CONCLUSION

During a panel discussion titled “Security Environment in the Indo-Pacific and Sri Lankan Diplomacy” supported by the Embassy of Japan, Prof. Ken Jimbo of Keio University, Japan emphasized that “… non-alignment today does not mean isolation”. Such an approach, he noted, requires the careful and strategic management of dependencies to preserve national autonomy while maintaining strategic international partnerships”. Perhaps Prof. Jimbo was not aware or made aware that Sri Lanka’s Foreign Policy is Neutral; a fact declared by successive Governments since 2019 and practiced by the current Government in the position taken in respect of the recent hostilities between India and Pakistan.

Although both Non-Alignment and Neutrality are often mistakenly used interchangeably, they both do NOT mean isolation. The difference is that Non-Alignment is NOT a Policy but only a Strategy, similar to Balancing, adopted by decolonized countries in the context of a by-polar world, while Neutrality is an Internationally recognised Rule Based Policy, with obligations to be observed by Neutral States and by the Community of Nations. However, Neutrality in today’s context of geopolitical rivalries resulting from the fluidity of changing dynamics offers greater protection in respect of security because it is Rule Based and strengthened by “the UN adoption of the Indian Ocean as a Zone of peace”, with the freedom to exercise its autonomy and engage with States in pursuit of its National Interests.

Apart from the positive comments “that the Indian Ocean should be regarded as a Zone of Peace” and that “from a defence perspective, Sri Lanka must remain neutral”, the second panelist, Professor of Oceanography at the University of Ruhuna, Terney Pradeep Kumara, also advocated that “from a Scientific and resource perspective (in the Exclusive Economic Zone) the country must remain active, given its location and the resources available in its maritime domain”. He went further and identified that Sri Lanka can work with countries such as India, China, Australia and South Africa.

For Sri Lanka to work together with India and China who already are geopolitical rivals made evident by the fact that India has already objected to the presence of China in the “Sea of Lanka”, questions the practicality of the suggestion. Furthermore, the fact that Prof. Kumara has excluded the US, notwithstanding the US Secretary of State’s expectations cited above, reflects unawareness of the geopolitical landscape in which the US, India and China are all actively known to search for minerals. In such a context, Sri Lanka should accept its limitations in respect of its lack of Diplomatic sophistication to “work with” such superpower rivals who are known to adopt unprecedented measures such as tariffs, if Sri Lanka is to avoid the fate of Milos during the Peloponnesian Wars.

Under the circumstances, it is in Sri Lanka’s best interest to lay aside its economic gains for security, and live by its proclaimed principles and policies of Neutrality and the concept of the Indian Ocean as a Zone of Peace by not permitting its EEC to be Explored and/or Exploited by anyone in its “maritime domain”. Since Sri Lanka is already blessed with minerals on land that is awaiting exploitation, participating in the extraction of minerals at the expense of security is not only imprudent but also an environmental contribution given the fact that the Sea and its resources is the Planet’s Last Frontier.

by Neville Ladduwahetty

Features

Protecting the ocean before it’s too late: What Sri Lankans think about deep seabed mining

Far beneath the waters surrounding Sri Lanka lies a largely unseen frontier, a deep seabed that may contain cobalt, nickel and rare earth elements essential to modern technologies, from smartphones to electric vehicles. Around the world, governments and corporations are accelerating efforts to tap these minerals, presenting deep-sea mining as the next chapter of the global “blue economy.”

For an island nation whose ocean territory far exceeds its landmass, the question is no longer abstract. Sri Lanka has already demonstrated its commitment to ocean governance by ratifying the United Nations High Seas Treaty (BBNJ Agreement) in September 2025, becoming one of the early countries to help trigger its entry into force. The treaty strengthens biodiversity conservation beyond national jurisdiction and promotes fair access to marine genetic resources.

Yet as interest grows in seabed minerals, a critical debate is emerging: Can Sri Lanka pursue deep-sea mining ambitions without compromising marine ecosystems, fisheries and long-term sustainability?

Speaking to The Island, Prof. Lahiru Udayanga, Dr. Menuka Udugama and Ms. Nethini Ganepola of the Department of Agribusiness Management, Faculty of Agriculture & Plantation Management, together with Sudarsha De Silva, Co-founder of EarthLanka Youth Network and Sri Lanka Hub Leader for the Sustainable Ocean Alliance, shared findings from their newly published research examining how Sri Lankans perceive deep-sea mineral extraction.

The study, published in the journal Sustainability and presented at the International Symposium on Disaster Resilience and Sustainable Development in Thailand, offers rare empirical insight into public attitudes toward deep-sea mining in Sri Lanka.

Limited Public Inclusion

“Our study shows that public inclusion in decision-making around deep-sea mining remains quite limited,” Ms. Nethini Ganepola told The Island. “Nearly three-quarters of respondents said the issue is rarely covered in the media or discussed in public forums. Many feel that decisions about marine resources are made mainly at higher political or institutional levels without adequate consultation.”

The nationwide survey, conducted across ten districts, used structured questionnaires combined with a Discrete Choice Experiment — a method widely applied in environmental economics to measure how people value trade-offs between development and conservation.

Ganepola noted that awareness of seabed mining remains low. However, once respondents were informed about potential impacts — including habitat destruction, sediment plumes, declining fish stocks and biodiversity loss — concern rose sharply.

“This suggests the problem is not a lack of public interest,” she told The Island. “It is a lack of accessible information and meaningful opportunities for participation.”

Ecology Before Extraction

Dr. Menuka Udugama said the research was inspired by Sri Lanka’s growing attention to seabed resources within the wider blue economy discourse — and by concern that extraction could carry long-lasting ecological and livelihood risks if safeguards are weak.

“Deep-sea mining is often presented as an economic opportunity because of global demand for critical minerals,” Dr. Udugama told The Island. “But scientific evidence on cumulative impacts and ecosystem recovery remains limited, especially for deep habitats that regenerate very slowly. For an island nation, this uncertainty matters.”

She stressed that marine ecosystems underpin fisheries, tourism and coastal well-being, meaning decisions taken about the seabed can have far-reaching consequences beyond the mining site itself.

Prof. Lahiru Udayanga echoed this concern.

“People tended to view deep-sea mining primarily through an environmental-risk lens rather than as a neutral industrial activity,” Prof. Udayanga told The Island. “Biodiversity loss was the most frequently identified concern, followed by physical damage to the seabed and long-term resource depletion.”

About two-thirds of respondents identified biodiversity loss as their greatest fear — a striking finding for an issue that many had only recently learned about.

A Measurable Value for Conservation

Perhaps the most significant finding was the public’s willingness to pay for protection.

“On average, households indicated a willingness to pay around LKR 3,532 per year to protect seabed ecosystems,” Prof. Udayanga told The Island. “From an economic perspective, that represents the social value people attach to marine conservation.”

The study’s advanced statistical analysis — using Conditional Logit and Random Parameter Logit models — confirmed strong and consistent support for policy options that reduce mineral extraction, limit environmental damage and strengthen monitoring and regulation.

The research also revealed demographic variations. Younger and more educated respondents expressed stronger pro-conservation preferences, while higher-income households were willing to contribute more financially.

At the same time, many respondents expressed concern that government agencies and the media have not done enough to raise awareness or enforce safeguards — indicating a trust gap that policymakers must address.

“Regulations and monitoring systems require social acceptance to be workable over time,” Dr. Udugama told The Island. “Understanding public perception strengthens accountability and clarifies the conditions under which deep-sea mining proposals would be evaluated.”

Youth and Community Engagement

Ganepola emphasised that engagement must begin with transparency and early consultation.

“Decisions about deep-sea mining should not remain limited to technical experts,” she told The Island. “Coastal communities — especially fishers — must be consulted from the beginning, as they are directly affected. Youth engagement is equally important because young people will inherit the long-term consequences of today’s decisions.”

She called for stronger media communication, public hearings, stakeholder workshops and greater integration of marine conservation into school and university curricula.

“Inclusive and transparent engagement will build trust and reduce conflict,” she said.

A Regional Milestone

Sudarsha De Silva described the study as a milestone for Sri Lanka and the wider Asian region.

“When you consider research publications on this topic in Asia, they are extremely limited,” De Silva told The Island. “This is one of the first comprehensive studies in Sri Lanka examining public perception of deep-sea mining. Organizations like the Sustainable Ocean Alliance stepping forward to collaborate with Sri Lankan academics is a great achievement.”

He also acknowledged the contribution of youth research assistants from EarthLanka — Malsha Keshani, Fathima Shamla and Sachini Wijebandara — for their support in executing the study.

A Defining Choice

As Sri Lanka charts its blue economy future, the message from citizens appears unmistakable.

Development is not rejected. But it must not come at the cost of irreversible ecological damage.

The ocean’s true wealth, respondents suggest, lies not merely in minerals beneath the seabed, but in the living systems above it — systems that sustain fisheries, tourism and coastal communities.

For policymakers weighing the promise of mineral wealth against ecological risk, the findings shared with The Island offer a clear signal: sustainable governance and biodiversity protection align more closely with public expectations than unchecked extraction.

In the end, protecting the ocean may prove to be not only an environmental responsibility — but the most prudent long-term investment Sri Lanka can make.

By Ifham Nizam

Features

How Black Civil Rights leaders strengthen democracy in the US

On being elected US President in 2008, Barack Obama famously stated: ‘Change has come to America’. Considering the questions continuing to grow out of the status of minority rights in particular in the US, this declaration by the former US President could come to be seen as somewhat premature by some. However, there could be no doubt that the election of Barack Obama to the US presidency proved that democracy in the US is to a considerable degree inclusive and accommodating.

On being elected US President in 2008, Barack Obama famously stated: ‘Change has come to America’. Considering the questions continuing to grow out of the status of minority rights in particular in the US, this declaration by the former US President could come to be seen as somewhat premature by some. However, there could be no doubt that the election of Barack Obama to the US presidency proved that democracy in the US is to a considerable degree inclusive and accommodating.

If this were not so, Barack Obama, an Afro-American politician, would never have been elected President of the US. Obama was exceptionally capable, charismatic and eloquent but these qualities alone could not have paved the way for his victory. On careful reflection it could be said that the solid groundwork laid by indefatigable Black Civil Rights activists in the US of the likes of Martin Luther King (Jnr) and Jesse Jackson, who passed away just recently, went a great distance to enable Obama to come to power and that too for two terms. Obama is on record as owning to the profound influence these Civil Rights leaders had on his career.

The fact is that these Civil Rights activists and Obama himself spoke to the hearts and minds of most Americans and convinced them of the need for democratic inclusion in the US. They, in other words, made a convincing case for Black rights. Above all, their struggles were largely peaceful.

Their reasoning resonated well with the thinking sections of the US who saw them as subscribers to the Universal Declaration of Human Rights, for instance, which made a lucid case for mankind’s equal dignity. That is, ‘all human beings are equal in dignity.’

It may be recalled that Martin Luther King (Jnr.) famously declared: ‘I have a dream that one day this nation will rise up, live out the true meaning of its creed….We hold these truths to be self-evident, that all men are created equal.’

Jesse Jackson vied unsuccessfully to be a Democratic Party presidential candidate twice but his energetic campaigns helped to raise public awareness about the injustices and material hardships suffered by the black community in particular. Obama, we now know, worked hard at grass roots level in the run-up to his election. This experience proved invaluable in his efforts to sensitize the public to the harsh realities of the depressed sections of US society.

Cynics are bound to retort on reading the foregoing that all the good work done by the political personalities in question has come to nought in the US; currently administered by Republican hard line President Donald Trump. Needless to say, minority communities are now no longer welcome in the US and migrants are coming to be seen as virtual outcasts who need to be ‘shown the door’ . All this seems to be happening in so short a while since the Democrats were voted out of office at the last presidential election.

However, the last US presidential election was not free of controversy and the lesson is far too easily forgotten that democratic development is a process that needs to be persisted with. In a vital sense it is ‘a journey’ that encounters huge ups and downs. More so why it must be judiciously steered and in the absence of such foresighted managing the democratic process could very well run aground and this misfortune is overtaking the US to a notable extent.

The onus is on the Democratic Party and other sections supportive of democracy to halt the US’ steady slide into authoritarianism and white supremacist rule. They would need to demonstrate the foresight, dexterity and resourcefulness of the Black leaders in focus. In the absence of such dynamic political activism, the steady decline of the US as a major democracy cannot be prevented.

From the foregoing some important foreign policy issues crop-up for the global South in particular. The US’ prowess as the ‘world’s mightiest democracy’ could be called in question at present but none could doubt the flexibility of its governance system. The system’s inclusivity and accommodative nature remains and the possibility could not be ruled out of the system throwing up another leader of the stature of Barack Obama who could to a great extent rally the US public behind him in the direction of democratic development. In the event of the latter happening, the US could come to experience a democratic rejuvenation.

The latter possibilities need to be borne in mind by politicians of the South in particular. The latter have come to inherit a legacy of Non-alignment and this will stand them in good stead; particularly if their countries are bankrupt and helpless, as is Sri Lanka’s lot currently. They cannot afford to take sides rigorously in the foreign relations sphere but Non-alignment should not come to mean for them an unreserved alliance with the major powers of the South, such as China. Nor could they come under the dictates of Russia. For, both these major powers that have been deferentially treated by the South over the decades are essentially authoritarian in nature and a blind tie-up with them would not be in the best interests of the South, going forward.

However, while the South should not ruffle its ties with the big powers of the South it would need to ensure that its ties with the democracies of the West in particular remain intact in a flourishing condition. This is what Non-alignment, correctly understood, advises.

Accordingly, considering the US’ democratic resilience and its intrinsic strengths, the South would do well to be on cordial terms with the US as well. A Black presidency in the US has after all proved that the US is not predestined, so to speak, to be a country for only the jingoistic whites. It could genuinely be an all-inclusive, accommodative democracy and by virtue of these characteristics could be an inspiration for the South.

However, political leaders of the South would need to consider their development options very judiciously. The ‘neo-liberal’ ideology of the West need not necessarily be adopted but central planning and equity could be brought to the forefront of their talks with Western financial institutions. Dexterity in diplomacy would prove vital.

-

Life style6 days ago

Life style6 days agoMarriot new GM Suranga

-

Business5 days ago

Business5 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features6 days ago

Features6 days agoMonks’ march, in America and Sri Lanka

-

Features6 days ago

Features6 days agoThe Rise of Takaichi

-

Features6 days ago

Features6 days agoWetlands of Sri Lanka:

-

News6 days ago

News6 days agoThailand to recruit 10,000 Lankans under new labour pact

-

News6 days ago

News6 days agoMassive Sangha confab to address alleged injustices against monks

-

Sports2 days ago

Sports2 days agoOld and new at the SSC, just like Pakistan