Business

VAT hike in Sri Lanka: Who really pays the price?

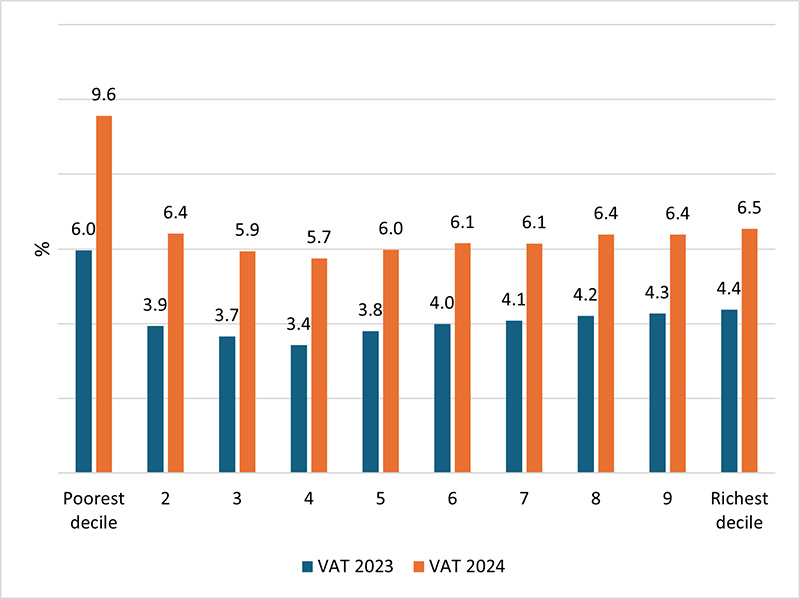

The recent VAT revisions have hit the poorest the hardest, whereas the bottom 10% of income group households now spend about 10% of their income on VAT.

The VAT burden has risen by approximately 50%, primarily due to theremoval of VAT exemptions on around 100 items. This blog offers potential solutions for easing the VAT burden in Sri Lanka.

Priyanka Jayawardena is a Research Economist at IPS with research interests in skills and education, demographics, health, and labour markets. Priyanka has around 15 years of research experience at IPS. She has worked as a consultant to international organisations including World Bank, ADB and UNICEF. She holds a BSc (Hons) specialised in Statistics and an MA in Economics, both from the University of Colombo. (Talk with Priyanka – priyanka@ips.lk)

By Priyanka Jayawardena

Earlier this year, Sri Lanka introduced major changes to the Value Added Tax (VAT) system. The VAT rate increased from 15% to 18%, and tax exemptions were removed for 97 items, including essential goods such as gas and stationery. While these revisions aimed to boost government revenue, they have also significantly increased the tax burden on low-income households, making life even more challenging for the most vulnerable during this ongoing crisis. This blog offers a comprehensive overview of the recent VAT revision and potential solutions for easing the VAT burden in Sri Lanka.

The Rise in VAT Burden

The VAT rate hike from 15% to 18% has translated into a 20% rise in VAT payments overall. A VAT simulation analysis based on Household Income and Expenditure Survey (HIES) 2019 data reveals that when combined with the removal of tax exemptions, the average VAT burden has increased by about 50%. However, this burden is not evenly distributed. The poorest 40% of households face an approximate 60% rise in VAT payments, while other income groups experience around a 50% increase.

Who Bears the Brunt of the VAT Revision?

The harshest impact of these VAT revisions has fallen on the lowest-income households. The bottom 10% of households now pay around 10% of their income as VAT, up from 6% under the previous VAT system (Figure 1). In comparison, other households spend about 6% of their income on VAT payments. This disproportionate impact is primarily due to the removal of tax exemptions on widely-use items, which are essential for all.

Indirect Taxes as a Share of Income

Source: Author’s calculations, based on HIES-2019 data from the DCS.

Removing VAT exemptions on 97 items out of the previously exempted 138 has made essential purchases more expensive. Low-income households typically allocate a greater portion of their budgets to essential items that were previously exempted from VAT but are now taxed. These include fuel, gas, telecommunication services, as well as various food products made from locally cultivated grains, locally produced coconut milk, and certain locally produced dairy products.

Comparing VAT with Other Indirect Taxes

VAT applies to a wide range of goods and services, affecting all consumers. However, its impact is regressive, taking a larger proportion of income from poorer households compared to richer ones (Figure 2). In contrast, excise taxes on products like alcohol and tobacco are less burdensome on lower-income groups. The top 20% of households contribute 43% of alcohol taxes and 44% of tobacco taxes, while the bottom 40% of households account for 19% of alcohol taxes and 14% of tobacco taxes. Additionally, VAT applies to basic commodities that everyone needs, whereas excise taxes apply to tobacco and alcohol, which are harmful products that contribute to non-communicable diseases (NCDs). In this sense, higher taxes on tobacco and alcohol act like an upfront investment in public health, helping to offset future healthcare costs.

What Can Be Done?

While the VAT hike was designed to stabilise Sri Lanka’s finances, it disproportionately affects vulnerable populations. This highlights the need for more balanced and fair fiscal policies. A more equitable approach would ensure that taxation doesn’t disproportionately affect those least able to afford it, preserving economic fairness during difficult times. Addressing the uneven impact of VAT requires exploring policy alternatives, such as reintroducing exemptions for essential goods if necessary. Increasing excise taxes on tobacco and alcohol is a favourable policy option. This could help create a more just system while reducing long-term healthcare expenses.

Business

Sri Lanka’s 2026 economic growth predicted to be around 4-5 percent

Sri Lanka’s economic growth for 2026 will be around 4-5 percent, Central Bank Governor Dr. Nandalal Weerasinghe said.

The Governor indicated the estimated economic growth while announcing the Central Bank’s policy agenda for this year, last Thursday.

‘The Central Bank’s 2026 growth estimation is higher than the growth prediction of the IMF and the World Bank and is achievable, the Governor told the media while announcing the Central Bank’s policy agenda for 2026.

Dr. Weerasinghe added: ‘The Central Bank will introduce a benchmark intra-day reference exchange rate this year to ensure transparency in the foreign exchange market.

‘The absence of a reference exchange rate has held back the expansion of the Sri Lankan forex market and discouraged the trading of rupee-denominated derivatives Governor said.

‘The Central Bank last year carried out the necessary preliminary work to implement the benchmark spot exchange rate.

‘The benchmark intra-day reference exchange rate will be introduced in 2026 to foster a transparent foreign exchange market.

‘This benchmark will guide market participants, help reduce volatility and promote more competitive pricing on a given date, thereby enabling the introduction of more innovative products in the foreign exchange market.

‘Sri Lanka’s foreign exchange market has limited derivatives like currency swaps and options aiming to deepen markets and attract inflows.

‘However, these instruments failed after a lack of reliable reference exchange rate amid concerns over excessive speculation, rupee over-appreciation risks and interventions distorting clean floating rates.’

Meanwhile, currency dealers welcomed the move and said it will help to deepen the market.

“This will expand the market with more products and promote rupee-denominated derivatives, a currency dealer from a local bank said.

“It is something the market wanted to fix in derivative prices. This is a pricing mechanism for the rupee, he added.

By Hiran H Senewiratne ✍️

Business

Sevalanka Foundation and The Coca-Cola Foundation support flood-affected communities in Biyagama, Sri Lanka

With funding support from The Coca-Cola Foundation (TCCF), the Sevalanka Foundation has launched a humanitarian relief programme to support flood-affected communities in Biyagama. The initiative focuses on restoring access to safe water, healthcare services, and essential public facilities during the critical recovery period following the Cyclone Ditwah.

Working closely with the Divisional Secretariat, the program prioritizes the cleaning and rehabilitation of contaminated dug and tube wells, helping address the urgent post-flood challenge of access to safe water. This intervention will also support the cleaning and reopening of essential public spaces, including schools, and Grama Niladhari (GN) offices, enabling authorities and communities to resume daily activities safely. The Sevalanka Foundation and TCCF, as part of the initial response, have also donated water pumps to the Divisional Secretariat to support immediate water extraction and clean-up efforts.

In addition, as the second main component of the project, and based on the guidance of the Medical Officer of Health (MOH), support is being provided to MOH-operated healthcare facilities to restore access to emergency and essential medical services. This support includes sanitization, debris removal, hazard stabilization, and the provision of emergency medical supplies such essential medicines and hygiene products. Medical camps staffed by doctors and senior nurses will be conducted through MOH offices to provide prioritized groups of persons with health, nutrition and hygiene related relief items.

Business

Bourse radiates optimism as UK grants tariff-free concession to local apparel exports

CSE activities were extremely bullish yesterday mainly due to the UK government’s announcement on tariff free access for local apparel sector exports into the UK coupled with Central Bank Governor Dr Nandalal Weerasinghe’s positive outlook on the economy this year.

Amid those developments the turnover level also improved and the All Share Price Index moved up to the 23500 mark during the trading day.

The All Share Price Index went up by 127.17 points, while the S and P SL20 rose by 56.75 points. Turnover stood at Rs 8.5 billion with 18 crossings.

Top seven crossings were: LOLC Holdings two million shares crossed to the tune of Rs 1.18 billion; its shares traded at Rs 575, Renuka Agri 45 million shares crossed to the tune of Rs 594 million; its share price was Rs 13.20, Sampath Bank 1.4 million shares crossed for Rs 215 million and its shares traded at Rs 154.35, Renuka Holdings 1.5 million shares crossed for Rs 75 million; its shares traded at Rs 50, Hayleys 200,000 shares crossed to the tune of Rs 41.3 million; its shares traded at Rs 207, Tokyo Cement (Non-Voting) 400,000 shares crossed for Rs 37.8 million; its shares sold at Rs 50 and NTB 100,000 shares crossed for Rs 326 million; its shares sold at Rs 326.

In the retail market top seven companies that contributed to the turnover were; LOLC Rs 340 million (591,000 shares traded), Sampath Bank Rs 310 million (two million shares traded), Renuka Agri Foods Rs 275 million (19.4 million shares traded), ACL Cables Rs 238 million (2.3 million shares traded), Overseas Realty Rs 215 million (4.9 million shares traded), CIC Holdings (Non Voting) Rs 180 million (6.3 million shares traded) and Wealth Trust Equity Rs 132 million (8.2 million shares traded). During the day 269.3 million share volumes changed hands in 47852 transactions.

It is said the banking and financial sectors performed well, especially Sampath Bank, while a top diversified company, LOLC Holdings, also performed well.

Yesterday, the rupee opened at Rs 309.15/30 to the US dollar in the spot market relatively flat from Rs 309.10/50 the previous day, having depreciated in recent weeks, dealers said, while bond yields opened higher.

The telegraphic transfer rates for the dollar were 305.8500 buying, 312.8500 selling; the British pound was 409.7568 buying, and 421.1186 selling, and the euro was 354.0809 buying, 365.4441 selling.

By Hiran H Senewiratne ✍️

-

News5 days ago

News5 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

News5 days ago

News5 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

Opinion2 days ago

Opinion2 days agoThe minstrel monk and Rafiki, the old mandrill in The Lion King – II

-

Features2 days ago

Features2 days agoThe Venezuela Model:The new ugly and dangerous world order

-

News4 days ago

News4 days agoPrez seeks Harsha’s help to address CC’s concerns over appointment of AG

-

News6 days ago

News6 days agoPrivate airline crew member nabbed with contraband gold

-

Latest News23 hours ago

Latest News23 hours agoRain washes out 2nd T20I in Dambulla

-

Business17 hours ago

Business17 hours agoSevalanka Foundation and The Coca-Cola Foundation support flood-affected communities in Biyagama, Sri Lanka