Business

ComBank appoints new Chairman and Deputy Chairman

Top investment banker Sharhan Muhseen and financial services professional Raja Senanayake to lead the Board of country’s largest private sector bank

Commercial Bank of Ceylon PLC has announced the appointment of top international investment banker Mr Sharhan Muhseen as Chairman, and financial services professional Mr Raja Senanayake as Deputy Chairman, effective Monday, April 22, 2024.

Muhseen, previously Deputy Chairman of the Bank, succeeds Prof. Ananda Jayawardane as Chairman upon the latter’s retirement, and Senanayake, a non-executive director, fills the vacancy created by Muhseen’s elevation to the position of Chairman of the Bank.

Sharhan Muhseen is a senior Investment Banker with extensive experience in the areas of Mergers and Acquisitions, Corporate Finance and Capital Markets. He has served in senior capacities working with company boards and senior leadership teams of financial institutions across Asia to help drive their Strategic Corporate Agendas and Roadmaps. He previously worked in best-in-class global investment banks, Credit Suisse, Bank of America Merrill Lynch and JPMorgan in leading regional coverage roles. He was also an Associate Director of Deloitte.

His most immediate previous role was as Managing Director, Head of South East Asia Financial Institutions Group (FIG) and Head of Asia Insurance at Credit Suisse based in Singapore. In his Investment Banking career spanning over 20 years, Muhseen has completed landmark mergers and capital raising transactions in excess of USD 100 billion. The Asia FIG sectors team at Merrill Lynch and Credit Suisse has won the “FIG Asia House of the Year” awards from the Asset magazine for several years under his leadership. Multiple transactions he led have been awarded as best country deals and best financial sector capital raise transactions.

Mr Muhseen is credited with several leading research reports including reports on Banking sector efficiency, currency depreciation and budget deficit in his role as Head of Sri Lanka Banking Sector Research Coverage and Lead Economist at Jardine Flemming. He has also worked at Standard Chartered Bank in the Corporate Banking Division, where he started out as a Management Trainee and at Rodman and Renshaw Stock and Commodities Broker based in Chicago. He has also acted as senior advisor for TPG and BNP Paribas.

He has experience at the policy level, working as a Team Leader at the National Council for Economic Development (NCED) under the Ministry of Finance as well as a Director at the Task Force to Rebuild the Nation (TAFREN), the Presidential Task Force for rebuilding the economy after the 2004 Tsunami.

He holds a Masters in Economics from the University of Colombo and a Bachelor of Business Administration (Hons) from Western Michigan University. He has completed the Corporate Finance training program with JPMorgan in New York and board leadership training from the Singapore Management University.

An independent non-executive director of Commercial Bank since September 2020, Mr Raja Senanayake is a Fellow Member of CA Sri Lanka with over 30 years of post-qualifying experience and holds a B.Com (Special) degree from the University of Sri Jayewardenepura and a Postgraduate Diploma in Business Management from the PIM of the University of Sri Jayewardenepura. He has also undergone training on banking and finance with Euromoney and on general management with the National University of Singapore.

Having completed his articles at Ernst & Young and qualifying as a Chartered Accountant, Mr Senanayake joined Singer Industries (Ceylon) PLC in 1991 as the Financial Accountant and moved on to Commercial Bank as the Senior Manager Finance in 1994. In January 2004, he assumed the role of Assistant General Manager (Finance & Planning) of the Bank and held this position until February 2007. He joined Nations Trust Bank PLC in March 2007 as its Chief Financial Officer. He was also a non-executive director of CBC Finance Ltd., a fully owned subsidiary of Commercial Bank.

Senanayake currently serves as the Chairman of Senkadagala Finance PLC, where he has been an independent/non-executive Director since April 2017. He is a Director of Virtual Capital Technologies (Pvt) Ltd., a software development company that caters to the New Zealand and the Australian markets, since August 2017. He is also an Advisor to Unicorn Hatch Limited, a SaaS AI-powered applications builder incorporated in New Zealand, with effect from March 2024. Presently he works at Smart Media – The Annual Report Company, and currently heads the Smart Academy, an IFRS Accredited Training Partner.

Senanayake is passionate about and possesses extensive domain knowledge on the financial services industry, financial management and corporate reporting in particular, including aspects such as risk management, capital management, corporate governance, compliance, sustainability and integrated reporting.

Business

CEB urged to revise Draft Long Term Generation Expansion Plan, in view of renewable energy needs

By Ifham Nizam

The Public Utilities Commission of Sri Lanka (PUCSL) has instructed the Ceylon Electricity Board (CEB) to revise its Draft Long-Term Generation Expansion Plan (LTGEP) 2025-2044, incorporating more robust projections for renewable energy and battery storage, while also reassessing LNG infrastructure and procurement strategies.

The Island Financial Review reliably learns PUCSL Director General Damitha Kumarasinghe emphasized the need for “more robust and realistic cost assumptions for Renewable Technologies and Battery Energy Storage Systems (BESS).”

The Commission stressed that BESS should be valued not just as a renewable integration tool but also for its potential to mitigate power shortages.

The directive also calls for revisions in LNG infrastructure planning, including “a comprehensive analysis covering LNG fuel cost calculation, infrastructure development, procurement contracting options, and risks associated with supply and procurement.” PUCSL has specifically highlighted the importance of evaluating the financial and economic feasibility of a natural gas pipeline from Kerawalapitiya to Kelanitissa.

Kanchana Siriwardena, Deputy Director General – Industry Services, reinforced the Commission’s stance on renewable energy, stating that “further reductions in renewable energy curtailment should be explored by incorporating more BESS.”

The PUCSL’s instructions also mandate incorporating clauses from the Memorandum of Understanding (MoU) with Petronet India, which includes a temporary LNG supply for the Sobadhanavi Plant. The revised LTGEP must also factor in infrastructure costs related to the Floating Storage Regasification Unit (FSRU) and pipeline networks as part of the overall LNG cost calculation.

The CEB is expected to resubmit the revised plan for PUCSL’s approval, ensuring alignment with Sri Lanka’s long-term energy security and sustainability goals.

The PUCSL directive also calls for a comprehensive evaluation of various LNG procurement options and associated risks. These include:

LNG infrastructure development and expansion

Contracting options for LNG procurement

Risks related to LNG supply and procurement stability

Robustness of natural gas demand calculations

Economic feasibility of the proposed natural gas pipeline from Kerawalapitiya to Kelanitissa, given the low plant factors of power stations at Kelanitissa.

Business

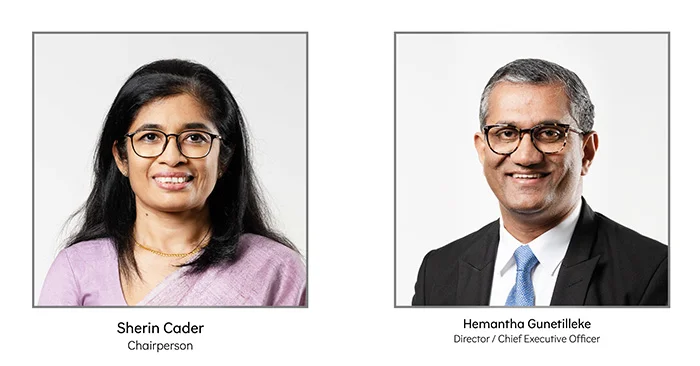

Nations Trust Bank ends 2024 with strong performance, achieving 24% ROE

Nations Trust Bank PLC reported strong financial results for the twelve months ending 31st December 2024, achieving a Profit After Tax (PAT) of LKR 17 Bn, up 46% YoY.

Nations Trust Bank, Director & Chief Executive Officer, Hemantha Gunetilleke, stated, “The Bank’s performance for the twelve months ending 31st December 2024 showcases our continued growth and expansion across diverse customer segments. Our solid capital position, strong liquidity buffers, effective risk management frameworks, and steadfast commitment to service excellence and digital empowerment remain the key drivers of our success.”

Improvements in the macro-economic environment and successful management of the Bank’s credit portfolio resulted in total impairment charges decreasing by 69% and the Net Stage 3 ratio reducing to 1.6%.

The Bank’s financial performance is supported by its strong capital buffers, with Tier I Capital at 21.47% and a Total Capital Adequacy Ratio of 22.66%, well above the regulatory requirements of 8.5% and 12.5%, respectively.

A strong liquidity buffer was maintained with a Liquidity Coverage Ratio of 320.56% against the regulatory requirement of 100%.

The Bank reported a Return on Equity (ROE) of 24.22%, while its Earnings Per Share for the twelve months ending 31st December 2024 increased to LKR 50.82, against LKR 34.70 recorded during the same period last year.

Nations Trust Bank PLC serves a diverse range of customers across Consumer, Commercial and Corporate segments through multi-channel customer touch points spanning both physical and digital. The Bank is focused on digital empowerment through cutting-edge digital banking technologies, and pioneered FriMi, Sri Lanka’s leading digital banking experience. Nations Trust Bank PLC is an issuer and sole acquirer of American Express Cards in Sri Lanka with market leadership in the premium segments.

Business

Modern Challenges and Opportunities for the Apparel Industry: JAAF drives industry dialogue

The Joint Apparel Association Forum (JAAF), in collaboration with Monash Business School and the Postgraduate Institute of Management (PIM) successfully hosted the International Conference on the Apparel Industry 2025 recently in Colombo. This was the second time the event was held, following its inaugural edition in 2018, as part of JAAF’s commitment to fostering dialogue and collaboration within the global apparel sector.

Themed “Modern Challenges and Opportunities for the Apparel Industry”, the three-day event brought together industry leaders, academics, and sustainability experts to discuss pressing issues such as ESG (Environmental, Social, and Governance) compliance, circular economy strategies, technological advancements, and workforce transformation.

A key highlight of the event was the panel discussion on “Current Actions and Their Impact on ESG-Related Outcomes in the Apparel Industry,” featuring:

Felix A. Fernando – CEO, Omega Line Ltd.

Nemanthie Kooragamage – Director Group Sustainable Business, MAS Holdings

Gayan Ranasinghe – Control Union,

Chamindry Saparamadu – Director General/CEO, Sustainable Development Council

Pyumi Sumanasekara – Principal Partner, KPMG Sri Lanka

Discussions emphasized how Sri Lanka’s apparel industry is adapting to global ESG standards, incorporating sustainable production methods, and aligning with evolving regulatory frameworks.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

Sports7 days ago

Sports7 days agoSri Lanka face Australia in Masters World Cup semi-final today

-

News7 days ago

News7 days agoCourtroom shooting: Police admit serious security lapses

-

News7 days ago

News7 days agoUnderworld figure ‘Middeniye Kajja’ and daughter shot dead in contract killing

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

Features4 days agoThe Murder of a Journalist