News

CB reduces interest rates by 100 basis points to tackle inflation and ease borrowing costs

The Monetary Policy Board of the Central Bank, at its meeting held on Thursday (23), decided to reduce the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 100 basis points (bps) to 9.00 percent and 10.00 percent, respectively, CB said in a press release.

It said: The Board arrived at this decision following a careful analysis of the current and expected developments in the domestic and global economy, with the aim of achieving and maintaining inflation at the targeted level of 5 percent over the medium term, while enabling the economy to reach and stabilise at the potential level.

The Board took note of possible upside risks to inflation projections in the near term due to supply-side factors stemming from the expected developments, domestically and globally. However, the Board viewed that such near term risks would not materially change the medium-term inflation outlook, as inflation expectations of the public remain anchored and economic activity is projected to remain below par in the near to medium term. Further, the Board viewed that with this reduction of policy interest rates, along with the monetary policy measures carried out since June 2023, sufficient monetary easing has been effected in order to stabilise inflation over the medium term.

Hence, the Monetary Policy Board underscored the need for a swift and full pass through of monetary easing measures to market interest rates, particularly lending rates, by the financial institutions, thereby accelerating the normalisation of market interest rates in the period ahead.

Headline inflation continues to remain low, reflecting subdued demand conditions. Headline inflation, as measured by the year-on-year change in the Colombo Consumer Price Index (CCPI, 2021=100), was recorded at 1.5 percent in October 2023 compared to 1.3 percent in September 2023.

Food inflation continued to be negative (year-on-year) for the fourth consecutive month in October 2023. The National Consumer Price Index (NCPI, 2021=100) based headline inflation (year-on-year) was recorded at 1.0 percent in October 2023, compared to 0.8 percent in September 2023.

Both CCPI and NCPI based core inflation (year-on-year), which reflects underlying demand pressures in the economy, moderated further in October 2023, reflecting the subdued demand pressures in the economy. A one-off upward movement in inflation is expected in the near term, driven mainly by the changes to the Value Added Tax (VAT) proposed by the Government effective January 2024. The spillover effects of tax measures and other developments are likely to be muted due to subdued underlying demand pressures; hence, this rise in inflation is expected to be transitory. Accordingly, headline inflation over the medium term is expected to converge towards the targeted level of 5 percent, supported by appropriate policy measures.

Market interest rates are expected to normalise in the period ahead. Market interest rates continued to adjust downwards, and most benchmark interest rates have declined significantly. Meanwhile, the yields on government securities are also adjusting downwards with falling risk premia. The reduction of policy interest rates by 100 bps in this monetary policy review is expected to create further space for market interest rates to adjust downward and normalise in the period ahead. Reflecting the transmission of the relaxed monetary policy stance, outstanding credit to the private sector by the banking sector expanded on a monthly basis in September as well as in October 2023 based on provisional data. With the moderation of market lending interest rates, credit to the private sector is expected to increase further in the period ahead, thereby supporting the envisaged rebound of domestic economic activity.

The Board anticipates a swift, sizeable and broad-based reduction in overall market lending interest rates in line with the monetary policy easing measures effected since June 2023. Such adjustment in interest rates is imperative to ease the domestic monetary conditions further. The Board stressed the need for all licensed banks to take swift measures to reduce market lending interest rates to ensure that the benefits of the series of monetary policy easing measures are adequately passed on to businesses and households.

Latest News

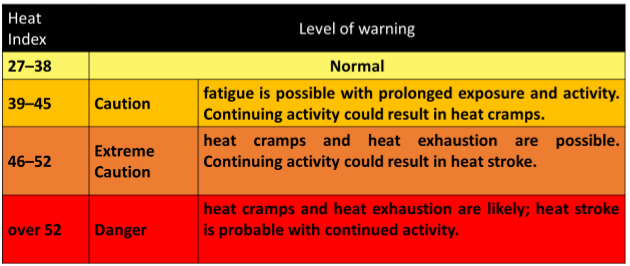

Heat index is likely to increase up to ‘Caution level’ at some places in Eastern, Northern and North-central provinces and in Monaragala and Kurunegala districts.

Warm Weather Advisory

Issued by the Natural Hazards Early Warning Centre of the Department of Meteorology at 3.30 p.m. 04 May 2025, valid for 05 May 2025.

The public are warned that the Heat index, the temperature felt on human body is likely to increase up to ‘Caution level’ at some places in Eastern, Northern and North-central provinces and in Monaragala and Kurunegala districts.

The Heat Index Forecast is calculated by using relative humidity and maximum temperature and this is the condition that is felt on your body. This is not the forecast of maximum temperature. It is generated by the Department of Meteorology for the next day period and prepared by using global numerical weather prediction model data.

Effect of the heat index on human body is mentioned in the above table and it is prepared on the advice of the Ministry of Health and Indigenous Medical Services.

ACTION REQUIRED

Job sites: Stay hydrated and takes breaks in the shade as often as possible.

Indoors: Check up on the elderly and the sick.

Vehicles: Never leave children unattended.

Outdoors: Limit strenuous outdoor activities, find shade and stay hydrated.

Dress: Wear lightweight and white or light-colored clothing.

Note:

In addition, please refer to advisories issued by the Disaster Preparedness & Response Division, Ministry of Health in this regard as well. For further clarifications please contact 011-7446491.

News

Fund issues may leave counting centres without back-up power tomorrow: GNs’ trade union

“Power failures on election day could occur due to natural causes or sabotage”

Funds allocated for hiring power generators for the counting centres were inadequate, and the Grama Niladaris (GNs) would not be able to ensure a back-up power supply to those places, President of the Sri Lanka United Grama Niladhari Association, Nandana Ranasinghe warned yesterday.

Addressing a press conference, Ranasinghe said: “Under these circumstances, it will not be possible to provide the counting centres with generators. Funds must also be allocated for hiring electric bulbs, cables and transporting generators as well.

“Unless funds are made available immediately, the GNs must not be held responsible if something goes wrong in the event of a power failure, either due to natural causes or sabotage. The GNs must not be asked to bear the cost of supplying back-up power to counting centres.

“In some areas, the District Returning Officers are pressuring the GNs to bear the cost of hiring power generators. The GNs must not be forced to spend their personal funds to provide facilities to counting centres.

“If a power outage occurs, it will definitely cause issues at counting centres. In the event of disruptions to the vote counting process, the results in the polling divisions under the centres may have to be annulled.”

News

LG polls: More than 65,000 cops and 8,500 military personnel deployed

More than 65,000 police officers would be deployed for the 06 May local government (LG) elections from today (05), Police Media Spokesman SSP Buddhika Manatunga told The Island, yesterday. The police personnel will include members of the Police Special Task Force, intelligence units, security divisions, and mobile patrol teams.

Army Media Spokesman Brigadier Varuna Gamage told The Island that 8,500 military personnel would be deployed on the roads across the country in view of the LG elections.

He said the Army would coordinate with the police, and that troops in all military camps had been placed on standby to face any situation.

By Norman Palihawadane and Chaminda Silva

-

News7 days ago

News7 days agoJapan-funded anti-corruption project launched again

-

News7 days ago

News7 days agoSethmi Premadasa youngest Sri Lankan to perform at world-renowned Musikverein in Vienna

-

Sports6 days ago

Sports6 days agoOTRFU Beach Tag Rugby Carnival on 24th May at Port City Colombo

-

News4 days ago

News4 days agoRanil’s Chief Security Officer transferred to KKS

-

Business7 days ago

Business7 days agoNational Savings Bank appoints Ajith Akmeemana,Chief Financial Officer

-

Opinion2 days ago

Opinion2 days agoRemembering Dr. Samuel Mathew: A Heart that Healed Countless Lives

-

Features5 days ago

Features5 days agoThe Broken Promise of the Lankan Cinema: Asoka & Swarna’s Thrilling-Melodrama – Part IV

-

Features6 days ago

Features6 days agoTrump tariffs and their effect on world trade and economy with particular