Features

Idiot’s guide to global and domestic debt

Immortal invisible god only wise

by Kumar David

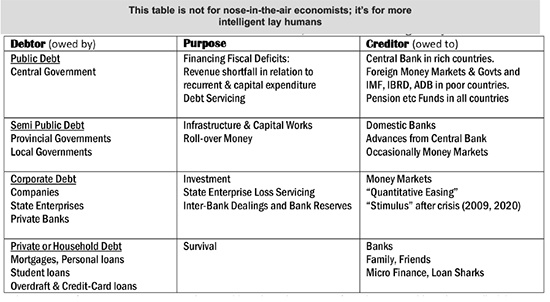

“In light inaccessible hid from our eyes”, is a line from an 1867 hymn set to the tune of a Welsh ballad: it is not a quip about the mystery of global debt but it could well be. Economists don’t enlighten you on the nature and ubiquity of debt because they are muddled themselves. The eclectic hither and thither is recounted in The Economist’s ‘A new era of economics’ – 25 July 2020. There is no shared paradigm, laymen have to cogitate and pick up as best they can. Scientists, finicky about cause and effect cannot suppress the need to frame things in intelligible terms; see if you can pick up anything useful from this idiot’s guide to the ubiquity and explosion of global and domestic public and private indebtedness. Public or national refers to central and local governments. Private is corporate, non-central-bank, bank and household borrowing; the last includes mortgages, personal overdrafts and credit-card indebtedness.

There have been four stages in economic theology since the 1930s. The Keynesian gambit, the neoliberal (Friedman-monetarist) nightmare and the two post-2009 phases. Yes, two phases, the first till about 2018 and the second thereafter which accelerated with Covid-19. I say little on Keynesian macroeconomics or neo-liberalism; the former reigned from the Great Depression till the 1970s when it was invalidated by stagflation, and the latter, that is the neo-liberalism of Pinochet-Regan-Thatcher-IMF, gripped the world by the throat till the 1990s. The last nail in the coffin of dying neo-liberalism was the Great Recession (GR) of 2009-10; the last captain of that sinking ship, Tony Blair, earning himself the epithet Blatcherist. GR proved that unchecked free-market capitalism contained the germs of its destruction in its own DNA, collapsing under its own rationale.

The ratios vary from country to country. In the US Public Debt is about 100% of GDP but semi-Public Debt is small while Corporate and Private Debt are roughly 50% and 70% of GDP. In China Public Debt is not large (48% oh GDP) but Provincial Governments have run wild with infrastructure and waste, which summing up with household debt to over 200% of GDP. In Japan government, debt is 230% of GDP but corporate debt is below 10% and household debt is minimal. For Sri Lanka the big item is Public Debt; nearly 90% of GDP. It doesn’t sound bad, comparatively, but we don’t have the resources to service it.

A feature of the global economy since the 1990s is mounting debt, now astronomical public plus corporate debt, and in the run up to GR acute household mortgages. Strangely, no one asks: “If-all the world is in debt, who is the creditor? Who owns the loot? What the source?” Leaving aside the printing press, a substantive topic of this essay, there are two tangible sources; the enormous wealth accumulated in the hands of the ultra-rich (the “One-Percent”) and public savings in provident funds, social-security coffers and in Japan Post Office Savings accounts. The former is the surplus created by social labour appropriated by capital or siphoned into institutions called private equity, mutual and hedge funds and into mighty investment banks. Maybe half Lanka’s foreign debt is owned to these money-market funds, the other portion to multi-lateral agencies IMF, ADB and World Bank and foreign governments, mainly China and its state banking arms. The point I am driving is that the people of the poor half of the world are deeply in hock to the moguls of international finance capital, including the mighty One-Percent.

The first period of the post-GR phase which lasted for a little less than a decade was characterised in metropolitan centres by measures intended to revive economic growth. Credit was created by central banks (US Fed, EU’s ECB, Japan’s BoJ and limping along, the Bank of England) by the shipload and pumped out to Treasuries, or by purchases of corporate bonds, or shoved into bank vaults. The hope was that there would be investment, growth and employment. It fell flat on its face. Though employment did pick up a bit for reasons too long to detail here, production-capital did not take the ball and run. Instead finance took the money and put it into shares (equities), commercial property and Treasury Bonds, creating an asset bubble.

Central bank money did not go into economic activity; it was siphoned through the ultra-rich into the asset bubble, that is the rich got richer. For this reason, demand for goods and services did not grow (how many bottles of Premier Cru can a millionaire imbibe?). Sans demand, economic growth did not take off in the US, Europe or Japan, hence inflation was stuck below 2% and the economy did not fire up (if inflation escalates, the economy exudes full employment and output is near capacity-output they call it “heating up”). Economic misery in the lower orders created anger and populism (Occupy Movements and radical fundamentalisms). Outrage at the rich getting richer and everyone else getting poorer also triggered the Trump Base, the grip of Marine Le Penn, the popularity of Nigel French, Brexit, near fascists Hungary’s Victor Oban and Poland’s Andrzej Duda, and Hindutva’s Muslim-hating Amit Shah and Narendra Modi. In sum the first phase of post-GR intervention was neither an economic success nor was it politically soothing, it was a failure.

Enter the second post-GR stage starting in 2018 but fouled up and drowned by covid-19. The world’s ruling powers had to take note that growth was not picking up, political resentment was swelling, inflation doggedly low and interest rates peering into the moat of negativity. Then corona hit! It summoned gigantic “stimulus” packages; in the domain of economic theory four schools of were jostling for space.

MMT (Modern Monetary Theory)

MMT is really odd in the eyes of regular economists; I too find it difficult to digest. Were I to exaggerate but only a bit, the theory says print money, print as much as you like, it won’t and it can’t do harm. Governments should not break their heads about deficits, central banks should not let inflation fears hold them back, they should create stimulus money by the bathtub and pour it into investment markets; household should party late into the night. The argument is that by turbo charging the economy with cash, productive activity will take off and rising output will defeat the demon of galloping inflation. The more serious-minded supporters of this school want to keep it going only till inflation and growth pick up and unemployment falls sufficiently, then slacken. But I am not persuaded. When inflation hits it hits fast and hard. Governments and the unwary, soaked in debt, will be overwhelmed by rapidly rising interest rates which will drive them to bankruptcy. Going in search of a free lunch is never unproblematic.

Fiscal splurge driven strategies (FS)

The more conventional last-ditch efforts are Fiscal Splurge (FS) and Monetary Control (MC). The former is the de facto method employed, whether consciously named FS or not, in broke, crisis driven, debt wracked or plain basket economies. While these pejoratives do not all apply to Lanka, some do. The bottom line is that in poor countries with high populist expectations, or enjoying electoral democracy that can oust politicians, governments if they wish to survive, have no option but to resort to fiscal deficits. That is spend more than their revenues to keep the masses stoned, an alternative opiate to religion. In a debt-intoxicated country this means monetary policy and fiscal policy have to merge, the former becomes a service provider to the latter; Prof Laxman transmutes into front office receptionist for President and PM.

In the long-term fiscal profligacy has disastrous consequences that are so well-known that I don’t need to dwell on the it here.

Monetary control and manipulation (MC)

This is typical of the EU; the US is a mix of FS and MC. With MC power rests in the hands of the central bank not government, finance ministry or treasury – FS is the other way round. The prime example of MC is the European Central Bank, I dare say with the Bundesbank breathing down its neck, which drives a chariot whose lowly drays are individual EU governments. BoJ too is not a sub-contractor of the Japanese government. The Reserve Bank of India tried to talk big in the era of Raghuram Rajan but Governors and the Bank have since been cut down to size. Central banks in dominance use interest rates and money supply to manage inflation with an eye on the side turned towards employment and growth.

Restructuring (social concern or state-led)

This is an outlier in a discussion of how capitalist economies (including Scandinavian version) are struggling to cope with explosive debt, income and wealth gaps, and retain social instability. The two key concepts in understanding this fourth option are restructuring and involvement of the state. State-led, but market sensitive and capitalism-accommodative, one party China seems an obvious prototype but it is not an exemplar because this essay is focussed on capitalist (the majority) nations of the world. An imagined President Bernie Sanders Administration in the US is a hypothetical example of this option. I don’t need to explain how this will be different from the US we know, but the point of this essay is that US national debt is large and will be larger in the hypothetical case. At the moment in the debate about coping with a belly-up economy, staggering stimulus packages are on Congress’ table – the Republicans want to cap it at $2 trillion, Democrats to push it up to $3 trillion. Hypothetical Bernie and his Squad will make it larger.

Whatever the version, stimulus money will be part channelled to government (Treasury Bond purchase) and a comparable sum will be siphoned into corporate bonds and private assets. Soaring debt will undermine faith in America’s ability to measure up to its commitments and will damage faith in the dollar as the world’s reserve currency. Debt has come to stay in every corner, an unwelcome guest determined to hang on till there is a global transformation. Sri Lanka is a footnote to the story.

Features

People set example for politicians to follow

Some opposition political parties have striven hard to turn the disaster of Cyclone Ditwah to their advantage. A calamity of such unanticipated proportions ought to have enabled all political parties to come together to deal with this tragedy. Failure to do so would indicate both political and moral bankruptcy. The main issue they have forcefully brought up is the government’s failure to take early action on the Meteorological Department’s warnings. The Opposition even convened a meeting of their own with former President Ranil Wickremesinghe and other senior politicians who shared their experience of dealing with natural and man-made disasters of the past, and the present government’s failures to match them.

The difficulty to anticipate the havoc caused by the cyclone was compounded by the neglect of the disaster management system, which includes previous governments that failed to utilise the allocated funds in an open, transparent and corruption free manner. Land designated as “Red Zones” by the National Building Research Organisation (NBRO), a government research and development institute, were built upon by people and ignored by successive governments, civil society and the media alike. NBRO was established in 1984. According to NBRO records, the decision to launch a formal “Landslide Hazard Zonation Mapping Project (LHMP)” dates from 1986. The institutional process of identifying landslide-prone slopes, classifying zones (including what we today call “Red Zones”), and producing hazard maps, started roughly 35 to 40 years ago.

Indonesia, Thailand and the Philippines which were lashed by cyclones at around the same time as Sri Lanka experienced Cyclone Ditwah were also unprepared and also suffered enormously. The devastation caused by cyclones in the larger southeast Asian region is due to global climate change. During Cyclone Ditwah some parts of the central highlands received more than 500 mm of rainfall. Official climatological data cite the average annual rainfall for Sri Lanka as roughly 1850 mm though this varies widely by region: from around 900 mm in the dry zones up to 5,000 mm in wet zones. The torrential rains triggered by Ditwah were so heavy that for some communities they represented a rainfall surge comparable to a major part of their typical annual rainfall.

Inclusive Approach

Climate change now joins the pantheon of Sri Lanka’s challenges that are beyond the ability of a single political party or government to resolve. It is like the economic bankruptcy, ethnic conflict and corruption in governance that requires an inclusive approach in which the Opposition, civil society, religious society and the business community need to join rather than merely criticise the government. It will be in their self-interest to do so. A younger generation (Gen Z), with more energy and familiarity with digital technologies filled, the gaps that the government was unable to fill and, in a sense, made both the Opposition and traditional civil society redundant.

Within hours of news coming in that floods and landslides were causing havoc to hundreds of thousands of people, a people’s movement for relief measures was underway. There was no one organiser or leader. There were hundreds who catalysed volunteers to mobilise to collect resources and to cook meals for the victims in community kitchens they set up. These community kitchens sprang up in schools, temples, mosques, garages and even roadside stalls. Volunteers used social media to crowdsource supplies, match donors with delivery vehicles, and coordinate routes that had become impassable due to fallen trees or mudslides. It was a level of commitment and coordination rarely achieved by formal institutions.

The spontaneous outpouring of support was not only a youth phenomenon. The larger population, too, contributed to the relief effort. The Galle District Secretariat sent 23 tons of rice to the cyclone affected areas from donations brought by the people. The Matara District Secretariat made arrangements to send teams of volunteers to the worst affected areas. Just as in the Aragalaya protest movement of 2022, those who joined the relief effort were from all ethnic and religious communities. They gave their assistance to anyone in need, regardless of community. This showed that in times of crisis, Sri Lankans treat others without discrimination as human beings, not as members of specific communities.

Turning Point

The challenge to the government will be to ensure that the unity among the people that the cyclone disaster has brought will outlive the immediate relief phase and continue into the longer term task of national reconstruction. There will be a need to rethink the course of economic development to ensure human security. President Anura Kumara Dissanayake has spoken about the need to resettle all people who live above 5000 feet and to reforest those areas. This will require finding land for resettlement elsewhere. The resettlement of people in the hill country will require that the government address the issue of land rights for the Malaiyaha Tamils.

Since independence the Malaiyaha Tamils have been collectively denied ownership to land due first to citizenship issues and now due to poverty and unwillingness of plantation managements to deal with these issues in a just and humanitarian manner beneficial to the workers. Their resettlement raises complex social, economic and political questions. It demands careful planning to avoid repeating past mistakes where displaced communities were moved to areas lacking water, infrastructure or livelihoods. It also requires political consensus, as land is one of the most contentious issues in Sri Lanka, tied closely to identity, ethnicity and historical grievances. Any sustainable solution must go beyond temporary relocation and confront the historical exclusion of the Malaiyaha Tamil community, whose labour sustains the plantation economy but who remain among the poorest groups in the country.

Cyclone Ditwah has thus become a turning point. It has highlighted the need to strengthen governance and disaster preparedness, but it has also revealed a different possibility for Sri Lanka, one in which the people lead with humanity and aspire for the wellbeing of all, and the political leadership emulates their example. The people have shown through their collective response to Cyclone Ditwah that unity and compassion remain strong, which a sincere, moral and hardworking government can tap into. The challenge to the government will be to ensure that the unity among the people that the cyclone disaster has brought will outlive the immediate relief phase and continue into the longer term task of national reconstruction with political reconciliation.

by Jehan Perera

Features

An awakening: Revisiting education policy after Cyclone Ditwah

In the short span of two or three days, Cyclone Ditwah, has caused a disaster of unprecedented proportions in our midst. Lashing away at almost the entirety of the country, it has broken through the ramparts of centuries old structures and eroded into areas, once considered safe and secure.

In the short span of two or three days, Cyclone Ditwah, has caused a disaster of unprecedented proportions in our midst. Lashing away at almost the entirety of the country, it has broken through the ramparts of centuries old structures and eroded into areas, once considered safe and secure.

The rains may have passed us by. The waters will recede, shops will reopen, water will be in our taps, and we can resume the daily grind of life. But it will not be the same anymore; it should not be. It should not be business as usual for any of us, nor for the government. Within the past few years, Sri Lankan communities have found themselves in the middle of a crisis after crisis, both natural and man-made, but always made acute by the myopic policies of successive governments, and fuelled by the deeply hierarchical, gendered and ethnicised divides that exist within our societies. The need of the hour for the government today is to reassess its policies and rethink the directions the country, as a whole, has been pushed into.

Neoliberal disaster

In the aftermath of the devastation caused by the natural disaster, fundamental questions have been raised about our existence. Our disaster is, in whole or in part, the result of a badly and cruelly managed environment of the planet. Questions have been raised about the nature of our economy. We need to rethink the way land is used. Livelihoods may have to be built anew, promoting people’s welfare, and by deveoloping a policy on climate change. Mega construction projects is a major culprit as commentators have noted. Landslides in the upcountry are not merely a result of Ditwah lashing at our shores and hills, but are far more structural and points to centuries of mismanagement of land. (https://island.lk/weather-disasters-sri-lanka-flooded-by-policy-blunders-weak-enforcement-and-environmental-crime-climate-expert/). It is also about the way people have been shunted into lands, voluntarily or involuntarily, that are precarious, in their pursuit of a viable livelihood, within the limited opportunities available to them.

Neo liberal policies that demand unfettered land appropriation and built on the premise of economic growth at any expense, leading to growing rural-urban divides, need to be scrutinised for their short and long term consequences. And it is not that any of these economic drives have brought any measure of relief and rejuvenation of the economy. We have been under the tyrannical hold of the IMF, camouflaged as aid and recovery, but sinking us deeper into the debt trap. In October 2025, Ahilan Kadirgamar writes, that the IMF programme by the end of 2027, “will set up Sri Lanka for the next crisis.” He also lambasts the Central Bank and the government’s fiscal policy for their punishing interest rates in the context of disinflation and rising poverty levels. We have had to devalue the rupee last month, and continue to rely on the workforce of domestic workers in West Asia as the major source of foreign exchange. The government’s negotiations with the IMF have focused largely on relief and infrastructure rebuilding, despite calls from civil society, demanding debt justice.

The government has unabashedly repledged its support for the big business class. The cruelest cut of them all is the appointment of a set of high level corporate personalities to the post-disaster recovery committee, with the grand name, “Rebuilding Sri Lanka.” The message is loud and clear, and is clearly a slap in the face of the working people of the country, whose needs run counter to the excessive greed of extractive corporate freeloaders. Economic growth has to be understood in terms that are radically different from what we have been forced to think of it as, till now. For instance, instead of investment for high profits, and the business of buy and sell in the market, rechannel investment and labour into overall welfare. Even catch phrases like sustainable development have missed their mark. We need to think of the economy more holistically and see it as the sustainability of life, livelihood and the wellbeing of the planet.

The disaster has brought on an urgency for rethinking our policies. One of the areas where this is critical is education. There are two fundamental challenges facing education: Budget allocation and priorities. In an address at a gathering of the Chamber of Commerce, on 02 December, speaking on rebuilding efforts, the Prime Minister and Minister of Education Dr. Harini Amarasuriya restated her commitment to the budget that has been passed, a budget that has a meagre 2.4% of the GDP allocated for education. This allocation for education comes in a year that educational reforms are being rolled out, when heavy expenses will likely be incurred. In the aftermath of the disaster, this has become more urgent than ever.

Reforms in Education

The Government has announced a set of amendments to educational policy and implementation, with little warning and almost no consultation with the public, found in the document, Transforming General Education in Sri Lanka 2025 published by the Ministry of Education. Though hailed as transformative by the Prime Minister (https://www.news.lk/current-affairs/in-the-prevailing-situation-it-is-necessary-to-act-strategically-while-creating-the-proper-investments-ensuring-that-actions-are-discharged-on-proper-policies-pm), the policy is no more than a regurgitation of what is already there, made worse. There are a few welcome moves, like the importance placed on vocational training. Here, I want to raise three points relating to vital areas of the curriculum that are of concern: 1) streamlining at an early age; relatedly 2) prioritising and privileging what is seen as STEM education; and 3) introducing a credit-based modular education.

1. A study of the policy document will demonstrate very clearly that streamlining begins with Junior Secondary Education via a career interest test, that encourages students to pursue a particular stream in higher studies. Further Learning Modules at both “Junior Secondary Education” and “Senior Secondary Education Phase I,” entrench this tendency. Psychometric testing, that furthers this goal, as already written about in our column (https://kuppicollective.lk/psychometrics-and-the-curriculum-for-general-education/) points to the bizarre.

2. The kernel of the curriculum of the qualifying examination of Senior Secondary Education Phase I, has five mandatory subjects, including First Language, Math, and Science. There is no mandatory social science or humanities related subject. One can choose two subjects from a set of electives that has history and geography as separate subjects, but a Humanities/Social Science subject is not in the list of mandatory subjects. .

3. A credit-based, modular education: Even in universities, at the level of an advanced study of a discipline, many of us are struggling with module-based education. The credit system promotes a fragmented learning process, where, depth is sacrificed for quick learning, evaluated numerically, in credit values.

Units of learning, assessed, piece meal, are emphasised over fundamentals and the detailing of fundamentals. Introducing a module based curriculum in secondary education can have an adverse impact on developing the capacity of a student to learn a subject in a sustained manner at deeper levels.

Education wise, and pedagogically, we need to be concerned about rigidly compartmentalising science oriented, including technological subjects, separately from Humanities and Social Studies. This cleavage is what has led to the idea of calling science related subjects, STEM, automatically devaluing humanities and social sciences. Ironically, universities, today, have attempted, in some instances, to mix both streams in their curriculums, but with little success; for the overall paradigm of education has been less about educational goals and pedagogical imperatives, than about technocratic priorities, namely, compartmentalisation, fragmentation, and piecemeal consumerism. A holistic response to development needs to rethink such priorities, categorisations and specialisations. A social and sociological approach has to be built into all our educational and development programmes.

National Disasters and Rebuilding Community

In the aftermath of the disaster, the role of education has to be rethought radically. We need a curriculum that is not trapped in the dichotomy of STEM and Humanities, and be overly streamlined and fragmented. The introduction of climate change as a discipline, or attention to environmental destruction cannot be a STEM subject, a Social Science/Humanities subject or even a blend of the two. It is about the vision of an economic-cum-educational policy that sees the environment and the economy as a function of the welfare of the people. Educational reforms must be built on those fundamentals and not on real or imagined short term goals, promoted at the economic end by neo liberal policies and the profiteering capitalist class.

As I write this, the sky brightens with its first streaks of light, after days of incessant rain and gloom, bringing hope into our hearts, and some cheer into the hearts of those hundreds of thousands of massively affected people, anxiously waiting for a change in the weather every second of their lives. The sense of hope that allows us to forge ahead is collective and social. The response by Lankan communities, to the disaster, has been tremendously heartwarming, infusing hope into what still is a situation without hope for many. This spirit of collective endeavour holds the promise for what should be the foundation for recovery. People’s demands and needs should shape the re-envisioning of policy, particularly in the vital areas of education and economy.

(Sivamohan Sumathy was formerly attached to the Department of English, University of Peradeniya)

Kuppi is a politics and pedagogy happening on the margins of the lecture hall that parodies, subverts, and simultaneously reaffirms social hierarchies.

By Sivamohan Sumathy

Features

ABBA scene in Doha … Ishini in the spotlight

The group ABBA, from Sweden, officially disbanded in 1982, and that made room for several ABBA imitators to come into the scene.

The group ABBA, from Sweden, officially disbanded in 1982, and that made room for several ABBA imitators to come into the scene.

What’s more, ABBA tribute concerts are also turning out to be popular with music lovers who still appreciate, and enjoy, the music of ABBA.

With this in mind, Treffen House Hotel, in Doha, decided to put together a series of ABBA Tribute Concerts which were held, in the hotel itself, on 27th, 28th and 29th November, 2025.

To do the needful, on stage, they selected our very own Ishini Fonseka and her participation certainly did highlight the global appeal of ABBA’s music and the talent of Sri Lankan artistes.

The tribute shows brought the magic of ABBA’s hits to the audience,

On stage belting out the ABBA hits

Backed by a Sri Lankan band, the Vibes, based in Qatar, Ishini was in the spotlight for one hour, each night, belting out the hits of ABBA.

She also obliged the audience, from various nationalities, with a few hit songs in Hindi, Tamil and Sinhala.

Her repertoire included the best of ABBA hits, such as ‘Mamma Mia’, ‘Dancing Queen’, ‘Chiquitita’ and many more.

Being a multi-instrumentalist, she also played the piano, and guitar, as well, while singing some of the beautiful ABBA songs.

The three-day concert was a part of a Sri Lankan food festival, held at the hotel, in which several unique Sri Lankan cuisines were promoted internationally.

The event’s main sponsor was Prime Lands, and the event focused on the importance of investing on Real Estate, especially since the foreign currency sent to Sri Lanka benefits the country’s economy vastly.

Kumudu Fonseka, the General Manager of Treffen House Hotel, the main man behind the spectacular three-day Sri Lankan Food Festival, I’m told, is very keen to highlight the uniqueness of Sri Lanka.

He also has plans to put together a charity concert to raise funds for the people in Sri Lanka, affected by Cyclone Ditwah.

The Chief Guest, on the second day, was the Ambassador of Sri Lanka, who personally appreciated and admired Ishini Fonseka for bringing back her childhood memories of ABBA.

Ishini was involved in three other events, at the hotel, as a guest star, before returning home.

Her next foreign assignment is to the Maldives, on 22nd December, with her band Ishini & The Branch.

She will be doing the Christmas and New Year’s Eve scene in the Maldives and will be back, in Sri Lanka, on 02nd January 2026.

-

News6 days ago

Lunuwila tragedy not caused by those videoing Bell 212: SLAF

-

News1 day ago

News1 day agoOver 35,000 drug offenders nabbed in 36 days

-

News5 days ago

News5 days agoLevel III landslide early warning continue to be in force in the districts of Kandy, Kegalle, Kurunegala and Matale

-

Business3 days ago

Business3 days agoLOLC Finance Factoring powers business growth

-

News3 days ago

News3 days agoCPC delegation meets JVP for talks on disaster response

-

News3 days ago

News3 days agoA 6th Year Accolade: The Eternal Opulence of My Fair Lady

-

News1 day ago

News1 day agoRising water level in Malwathu Oya triggers alert in Thanthirimale

-

Midweek Review6 days ago

Midweek Review6 days agoHouse erupts over Met Chief’s 12 Nov unheeded warning about cyclone Ditwah