Business

Cracking the Code: Why women’s innovations are lagging behind in Sri Lanka

By Dilani Hirimuthugodage

By Dilani Hirimuthugodage

“I do not intend to get a patent right for my invention as I do not want to disclose my research findings and methodologies to the public domain”, stated a female researcher who has discovered a solution for dengue fever.

Like her, many female innovators are unwilling to obtain Intellectual Property (IP) protection and commercialise their innovations for various reasons. One of the significant issues is the insufficient understanding of Intellectual Property Rights (IPRs) and their application. Given that this year’s World IP Day, observed on April 26, focuses on “Women and IP: Accelerating Innovation and Creativity”, it is timely to explore the state of women’s innovations in Sri Lanka and consider possible strategies to promote better IP protection for women’s creativity and innovations.

Women in Innovations

The number of patent applications issued to women is a crucial and commonly used indicator to determine their involvement in innovation. However, Sri Lanka does not have gender-specific patent application data. Based on approximate calculations, the number of individual female patent applications fluctuated between 2010 and 2022, averaging nearly 25 patent applications per year in the last five years (Infographic 1). This represents only 8% of the total patent applications during that period.

Globally, women’s patent applications are less than men’s; in 2020, nearly 16.5% of international patent applications were filed by women. Sri Lankan women appear to do poorly, especially compared to their Asian counterparts, where women’s applications represent 17.7% of total applications, with China and India leading the way.

Infographic 1:

Gender Disparity in Sri Lanka’s Patent Applications (2010-2022)

Why are Women’s Innovations Low in Sri Lanka?

Women’s involvement in research and development (R&D) activities, one of the key components of innovations, is at a satisfactory level in Sri Lanka. According to the National R&D survey conducted by the National Science Foundation (NSF) in 2020, nearly 50% of researchers in the country are females. This figure is the highest percentage when compared with other South Asian countries. However, in total, the output indicators of R&D, such as the number of patents, journal publications, commercialisation, etc., are low in Sri Lanka. Further, the low number of female patents reveals that most women are involved in less patent-intensive fields, such as natural sciences, social sciences and humanities. Moreover, female researchers are uninterested in commercialising their inventions or using them for commercial purposes. There could be several reasons for this, such as a lack of awareness of IPRs and their importance, lack of incentives and institutional support for research commercialisation, and lack of targeted programmes to promote women’s innovations.

Science, technology, engineering, and mathematics (STEM) are the core fields of innovation. Female STEM education in Sri Lanka is relatively good. According to the University Grant Commission (UGC) statistics, in 2017, women comprised 49% of undergraduate enrolments in STEM subjects in local universities. Yet very few women work or lead in STEM-related fields. This could be attributed to negative stereotypes surrounding girls’ competencies in subjects like mathematics, engineering, and information technology, as well as social, cultural, and gender norms.

Moreover, women’s participation in Sri Lanka’s creative industry sector is nearly 36%, with significant contributions in the product, graphic and fashion design and craft sectors. Nonetheless, the Creative and Cultural Industries in Sri Lanka report reveals that women’s awareness of IPRs, even within the creative industry sector, is very minimal.

What Needs to be Done?

IPRs play a major role in encouraging innovation and creativity as they help to turn an idea/solution into a commercial opportunity. In Sri Lanka, there is clearly a need to encourage more female participation in patent-intensive R&D fields (such as medical sciences, engineering and technologies) and commercialisation. ‘Technology Transfer and Commercialization Units’ in universities and research institutes should collaborate effectively with key stakeholder organisations such as the National Intellectual Property Office (NIPO), World Intellectual Property Office (WIPO), and the National Innovation Agency (NIA) to create awareness amongst women innovators and to support them in managing IP related commercial activities. Furthermore, Sri Lanka can promote gender-inclusive innovation policies by introducing special programmes encouraging women’s participation in R&D activities and commercialisation, including national awards and incentive schemes in universities and research institutes.

Women’s participation in STEM fields and careers should be promoted by providing scholarships and introducing mentoring and development-oriented programmes. Furthermore, the importance of IPRs should be taught in secondary school and university curricula. This fact was highlighted by a young female inventor with more than 60 patent rights in Sri Lanka. She noted that “an inquisitive mind and a thirst for knowledge from school age have encouraged me to innovate. Creativity should be encouraged at the school level”.

It is of utmost importance to raise awareness and strengthen knowledge on access to IPRs amongst women innovators in Sri Lanka. This could be done by establishing women-focused support networking systems, collaborations, learnings through selected role models, mentorship and funding programmes. Countries such as India (Women Scientists Scheme (WOS) by the Department of Science and Technology (DST)), Singapore (Women in Science (SgWIS) organisation), China, and South Korea have programmes and organisations tailored explicitly for women innovators.

Lastly, it is crucial to maintain an accurate and current database of women’s patent applications at individual and group levels at the national database system of NIPO. Simple modifications to patent applications could facilitate this process. In addition, having such a database would be valuable in developing policies specific to women’s innovations.

Link to the full Talking Economics blog: https://www.ips.lk/talkingeconomics/2023/04/26/cracking-the-code-why-womens-innovations-are-lagging-behind-in-sri-lanka/

Dilani Hirimuthugodage is a Research Economist at IPS with research interests in Agriculture and Agribusiness Development, Environment, Natural Resources and Climate Change, and Intellectual Property. She holds a BA in Economics with a Second Class (Upper) and Masters in Economics (Distinction Pass) from the University of Colombo. In addition, she is a part-qualified candidate of CIMA-UK. (Talk with Dilani: dilani@ips.lk).

Business

Cheaper credit expected to drive Sri Lanka’s business landscape in 2026

The opening weeks of 2026 are offering a glimmer of cautious hope for the business community weary from years of economic turbulence and steep financing costs. The Central Bank’s latest weekly economic indicators signal more than just macroeconomic stability. They point to early signs of a long-awaited trend; a measurable dip in borrowing costs.

“If sustained, this shift could transform steady growth into a robust, investment-led expansion,” a senior economist told The Island Financial Review.

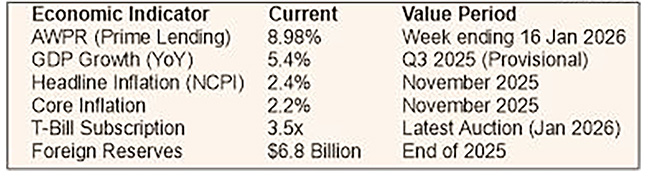

The benchmark Average Weighted Prime Lending Rate (AWPR) declined by 21 basis points to 8.98% for the week ending 16 January, according to the Central Bank.

“For entrepreneurs and CEOs, this is not just another statistic. It could mean the difference between postponing an expansion and hiring new staff. Across boardrooms, the hope is that this marks the start of a sustained downward trend that holds through 2026,” he said.

When asked about the instances where Treasury Bills are not fully subscribed by the investors, he replied,” Treasury Bill yields remained broadly stable, with only minimal movement across 91-day, 182-day, and 364-day tenors. Strong demand was clear, with the latest T-Bill auction oversubscribed by about 3.5 times. This sovereign-level stability creates room for the gradual easing of commercial lending rates, allowing the Central Bank to nurture a more growth-supportive monetary policy.”

Replying to a question on how he views the inflation numbers in this context, he said, “The year-on-year increase in the National Consumer Price Index stood at a manageable 2.4% in November, with core inflation at 2.2%. Such an environment should allow interest rates to fall without sparking a price spiral. For businesses, it means the real cost of borrowing adjusted for inflation, and it is becoming more favourable for them. While consumers still face weekly price shifts in vegetables and fish, the broader disinflation trend gives policymakers leeway to keep credit affordable.”

Referring to the growth trajectory, he mentioned, “With GDP growth provisionally at 5.4% in the third quarter of 2025 and Purchasing Managers’ Indices signalling expansion in both manufacturing and services, the economy is in a growth phase. However, to accelerate this momentum businesses need capital at lower cost to modernise machinery, boost export capacity, and spur innovation. Affordable credit is, therefore, not merely helpful, it is essential to shift growth into a higher gear.”

In conclusion , he said,” The coming months will be watched closely, because for Sri Lankan businesses, a sustained decline in borrowing costs isn’t just an indicator; it’s the foundation for growth. There’s hope that this easing in the cost of money will prevail through most of the year.”

By Sanath Nanayakkare ✍️

Business

Mercantile Investments expands to 90 branches, backed by strong growth

Mercantile Investments & Finance PLC has expanded its national footprint to 90 branches with a new opening in Tangalle, reinforcing its commitment to community accessibility. The trusted non-bank financial institution, with over 60 years of service, now supports diverse communities across Sri Lanka with leasing, deposits, gold loans, and tailored lending.

This physical expansion aligns with significant financial growth. The company recently surpassed an LKR 100 billion asset base, with its lending portfolio doubling to Rs. 75 billion and deposits growing to Rs. 51 billion, reflecting strong customer trust. It maintains a low NPL ratio of 4.65%.

Chief Operating Officer Laksanda Gunawardena stated the branch network is vital for building trust, complemented by ongoing digital investments. Managing Director Gerard Ondaatjie linked the growth to six decades of safeguarding depositor interests.

With strategic plans extending to 2027, Mercantile Investments aims to convert its scale into sustained competitive advantage, supporting both customers and Sri Lanka’s economic progress.

Business

AFASL says policy gap creates ‘uneven playing field,’ undercuts local Aluminium industry

A glaring omission in the Board of Investment’s (BOI) Negative List is allowing duty-free imports of fully fabricated aluminium products, severely undercutting Sri Lanka’s domestic manufacturers, according to a leading industry association.

The Aluminium Fabricators Association of Sri Lanka (AFASL) warns that this policy failure is threatening tens of thousands of jobs, draining foreign exchange, and stifling local industrial capacity.

“This has created an uneven playing field,” the AFASL said, adding that BOI-approved developers gain cost advantages over local fabricators, while government revenue and foreign exchange are lost through imports of products already made in Sri Lanka.

The core of the issue lies in a critical policy gap. While raw aluminium extrusions are protected on the BOI’s Negative List – which restricts duty-free imports – finished products like doors, windows, and façade systems are not. Furthermore, the list’s lack of specific Harmonised System (HS) codes allows these finished items to be imported under varying descriptions, slipping through duty-free.

This loophole, the AFASL argues, disadvantages a robust local industry that employs over 30,000 people directly and indirectly. Supported by five local extrusion manufacturers, a skilled NVQ-certified workforce, and a well-established glass-processing sector, the industry has been operational since the 1980s.

The association highlights that the damage extends beyond fabrication. The imported systems often include glass, hinges, locks, and accessories, all of which are produced locally, thereby cutting off demand across the entire domestic value chain. Small and medium-sized enterprises (SMEs), a segment government policy aims to support, are feeling the impact most acutely.

Since May 2025, the AFASL has been engaged in talks with the BOI, Finance Ministry, and Industries Ministry. Their key demand is to include specific HS codes on the Negative List and to list fabricated aluminium doors, windows, and curtain wall systems under HS Code 7610 to close the loophole.

While welcoming supportive recommendations from the Industries Ministry to add these products to an updated Negative List, the AFASL sounded a note of caution. It warned that proposed reductions in the CESS levy could further incentivise imports, undermining the sector’s recovery from the economic crisis.

The association also pointed to an inequity in the current framework. With most subsidies withdrawn, BOI-registered property developers continue to benefit from duty-free imports, while locally made products remain subject to heavy taxes for the general population.

The AFASL is urging policymakers to align investment incentives with national industrial policy, protect domestic manufacturing, and ensure fair competition across the construction supply chain to safeguard an industry vital to Sri Lanka’s economy.

By Sanath Nanayakkare ✍️

-

Editorial1 day ago

Editorial1 day agoIllusory rule of law

-

News2 days ago

News2 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business4 days ago

Business4 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial2 days ago

Editorial2 days agoCrime and cops

-

Features1 day ago

Features1 day agoDaydreams on a winter’s day

-

Editorial3 days ago

Editorial3 days agoThe Chakka Clash

-

Features1 day ago

Features1 day agoSurprise move of both the Minister and myself from Agriculture to Education

-

Business4 days ago

Business4 days agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App