Business

UN-recognized pioneer leads Hayley’s Fabric’s greening thrust

Leonie Vaas, a chemical engineer who’s the Manager of Sustainability and Innovation at Hayley’s Fabrics made history last June when she was selected from thousands across the globe to be designated as one of just 10 Sustainable Development Goal (SDG) Pioneers by the United Nations (UN) Global Compact for 2021.

With an extensive range of experience in green house gas (GHG) reduction and ensuring carbon neutrality, life cycle perspective of products, plant and process improvements with sustainable technologies and textile chemical management, Leonie has paved the path for local sustainability champions to be recognized on a global platform, a news release from Hayley’s Fabrics said.

She primarily focuses on five key areas at Hayleys Fabric, including driving efforts in reducing GHG emissions, water preservation, improving efficiency with sustainable solutions for effluent treatment plants, building and training sustainability teams, as well as developing and applying new processes for ‘better and greener’ products, the release said.

Sustainable business starts with a sustainable culture

Sustainable business starts with a sustainable culture

“I’ve always had a passion for the environment, and so from the start, I gravitated towards work in sustainability. Once I joined Hayleys Fabric, I was challenged and supported to link sustainability with innovation properly. Here, the opportunity to have a continuous learning experience, to be at the very forefront of sustainable innovation and part of shaping a greener future – is tremendous.

“We have a strong leadership commitment that all employees evenly match, and ultimately, that culture and enthusiasm to take the lead on sustainability are what drives our success. Sustainability at its core is driven by the higher management and we were able to come this far with the support and guidance of our CEO and Managing Director Rohan Goonetilleke. Because of this unique dynamic, we were able to rapidly commercialise our sustainable innovations, which gave me a chance to showcase what Hayleys and Sri Lanka have to offer the world. When you build the right culture, everything else flows from there,” Vaas said.

A team committed to sustainable innovation

True sustainability is about more than a single innovation. Leonie cites a host of extraordinary initiatives implemented by the Hayleys Fabric team collectively aimed at securing global leadership in sustainable textile manufacturing.

“We treat 100% of the water used for production to maintain strict compliance with certified and audited commitments on Zero Discharge of Hazardous Chemicals. This standard is recognised globally, beyond Sri Lanka’s strict national regulations,” Leonie noted.

As a signatory to the Science-Based Targets initiative (SBTi) to reduce greenhouse gas emissions and limit global warming at 1.5°C, Hayleys Fabric has already cut its carbon footprint by 15%. This was achieved by installing the largest private sector rooftop solar power system in Sri Lanka at the company’s state-of-the-art manufacturing facility in Horana. With 9,000 solar panels installed across 18,000 square metres, the system has contributed 4.5 Mw to the National Grid since June 2021.

Leonie finds the company’s future focus on re-engineering its value chain truly inspirational. “Our team is looking at substituting production supplies with recycled polyester, organic cotton, and other bio-degradable materials as well as augmenting production capabilities to create textiles from yarn comprised of recycled plastic.”

The innovation team recently launched an app to enable end-to-end traceability for its recycled PET fabrics, mostly supplied locally to Sri Lanka’s largest apparel manufacturers. This will allow local producers and global retailers to tag individual pieces of clothing with a QR code, which customers can scan to learn exactly how many discarded PET bottles were used to create the item and exactly which part of Sri Lanka, the bottles were collected from.

Hayleys Fabric also connects employees with key sustainability issues through culture building, webinars, and training and awareness building workshops.

“Keeping key issues like waste segregation, pollution, and energy efficiency top of mind, ensures that the entire workforce stays engaged with the company’s quest to become a global leader in sustainable textile production. As local leaders, we must always continue to find ways to become global pioneers.”

Business

SriLankan Airlines Resumes Flights to Riyadh and Dubai

09 March 2026; Colombo – SriLankan Airlines would like to inform passengers that it is resuming daily services to Riyadh tonight and Dubai tomorrow, while continuing to closely monitor the situation in the Middle East and prioritising the safety and wellbeing of its passengers and crew.

The following flights are scheduled to operate:

For more information please contact: 1979 (within Sri Lanka); +94 11 777 1979 (international); WhatsApp +94 74 444 1979 (chat only); your travel agent; visit www.srilankan.com; or follow us on social media.

Business

Oil prices jump above $100 for first time in four years

Global oil prices have jumped above $100 (£75.11) a barrel for the first time since 2022 as the escalating US-Israeli war with Iran has fuelled fears of prolonged disruption to shipments through the Strait of Hormuz.

Iran on Sunday named Mojtaba Khamenei to succeed his father Ali Khamenei as Supreme Leader, signalling that a week into the conflict hardliners remain in charge of the country.

The US and Israel launched fresh waves of airstrikes across Iran over the weekend, hitting multiple targets including oil depots.

Major disruption to energy supplies from the region threatens to push up prices for consumers and businesses around the world.

Early on Monday in Asia, Brent crude was around 15.5% higher at $107.16, while Nymex light sweet was up by more than 17% at $106.77.

Stock markets in the Asia-Pacific region fell sharply in early trading on Monday, with Japan’s Nikkei 225 index down by more than 5% and the ASX 200 in Australia more than 3.5% lower.

Many in the markets predicted that oil would hit the $100 a barrel mark this week.

In the event it took about a minute to jump 10%, and then another 15 minutes to rise a further 10% in early Asian trading.

Last week the markets had been relatively relaxed about the seeming nightmare scenario for millions of barrels of crude and liquefied natural gas trapped in the Gulf, unable or unwilling to transit the Strait of Hormuz.

But the escalations over the weekend, alongside scenes of destruction of energy infrastructure both in Iran and across the Gulf, saw the markets take rapid fright.

The question now is where does this go? Some analysts argue that if the shutdown in the strait lasts until the end of March, we could see record oil prices above $150 a barrel.

The existing rise is likely to further increase petrol prices, and those of important derivative products such as jet fuel and vital precursors for fertilisers.

The physical supplies from the Gulf are mainly consumed in Asia.

Already however there are signs that Asian consumers are bidding up prices for US gas, with some tankers originally heading for Europe turning around in the mid-Atlantic.

US President Donald Trump responded to the jump in prices by saying that short term rises were a “small price to pay” for removing Iran’s nuclear threat.

His energy secretary told US broadcasters on Sunday that Israel, not the US, was targeting Iran’s energy infrastructure, amid some concern about rising domestic pump prices caused by the war.

(BBC)

Business

CMTA warns buyers of long-term costs hidden in reconditioned vehicle imports

The Ceylon Motor Traders’ Association (CMTA) has issued a stark cautionary note to prospective vehicle buyers, warning that the initial price advantage of reconditioned imports often masks significant long-term financial risks.

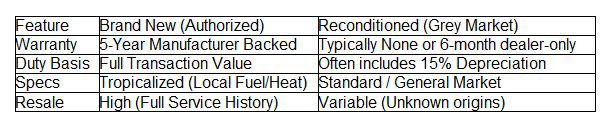

By highlighting a “structural imbalance” in the current duty valuation system – which allows near-identical vehicles to be imported under a 15% automatic depreciation bracket – the CMTA argues that the lack of manufacturer-backed warranties and tropicalised specifications in the grey market could lead to a “reconditioned trap” for unsuspecting consumers. For the savvy buyer, the association suggests that the true cost of ownership is increasingly tilting the scales in favour of brand-new vehicles from authorised agents.

If two identical 2026 models are sitting on different lots, and one is significantly cheaper because it was technically “registered and de-registered” abroad, the frugal buyer’s instinct is to take the discount. But the CMTA argues that this 15% depreciation benefit – intended for genuine used cars – is being leveraged as a loophole for zero-mileage vehicles.

For the savvy buyer, this raises a fundamental question of transparency. If the entry price of a vehicle is built on a “procedural” technicality rather than actual wear and tear, where else is the transparency lacking? Does the lower price reflect a genuine saving passed to the consumer, or does it mask a lack of manufacturer-backed after-sales support?

When a buyer chooses an authorised agent, they are essentially purchasing an insurance policy against the unknown. With a five-year manufacturer warranty, the financial burden of a faulty transmission or a software glitch stays with the global giant that built the car, not the local owner. In an era where vehicles are increasingly “computers on wheels,” the technical specialised tools and genuine parts held by authorised agents are no longer a luxury – they are a necessity for longevity.

The CMTA’s perspective also invites the buyer to look at the “Big Picture.” Every time a vehicle is imported under an under-declared value or an artificial depreciation bracket, it isn’t just a loss for the Treasury; it is a blow to the country’s foreign exchange discipline.

“A savvy buyer today is more informed than ever. They realize that a “cheap” import with no service history and no tropicalised specifications may eventually become a “minus” on the balance sheet. Frequent repairs and lower resale value can quickly evaporate the initial few lakhs saved at the point of purchase. Ultimately, the choice between brand new and used is a choice between certainty and speculation,” the Association says.

The CMTA is advocating for a level playing field where duty is based on true transaction value. Until that day comes, the burden of due diligence rests on the consumer. To be a “savvy buyer” in 2026 means looking past the showroom shine and asking: Who stands behind this car if something goes wrong tomorrow?

In conclusion, CMTA says,” For those seeking long-term peace of mind, the “brand new” path – supported by a transparent duty structure and a solid warranty – remains the gold standard for steering Sri Lanka’s complex automotive landscape.”

Before signing the papers on a reconditioned vehicle, the CMTA suggests buyers evaluate the four “minus” factors against a “brand new” purchase:

By Sanath Nanayakkare

-

News4 days ago

News4 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

News5 days ago

News5 days agoLegal experts decry move to demolish STC dining hall

-

News4 days ago

News4 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

News3 days ago

News3 days agoPeradeniya Uni issues alert over leopards in its premises

-

Business5 days ago

Business5 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News4 days ago

News4 days agoLibrary crisis hits Pera university

-

News3 days ago

News3 days agoWife raises alarm over Sallay’s detention under PTA

-

Business6 days ago

Business6 days agoWar in Middle East sends shockwaves through Sri Lanka’s export sector