Opinion

Turning Trade Disruptions into Opportunities

The silver lining of US tariffs for emerging economies:

In a world that thrives on interconnectedness, the imposition of U.S. tariffs has been widely discussed through the lens of negativity—trade wars, disrupted supply chains, and market turbulence. However, this narrow view fails to account for the opportunities that arise from such disruptions. While it’s easy to focus on the immediate challenges—rising costs, retaliatory measures, and financial volatility—emerging economies, especially those in Asia and South Asia, are beginning to see a silver lining.

In a world that thrives on interconnectedness, the imposition of U.S. tariffs has been widely discussed through the lens of negativity—trade wars, disrupted supply chains, and market turbulence. However, this narrow view fails to account for the opportunities that arise from such disruptions. While it’s easy to focus on the immediate challenges—rising costs, retaliatory measures, and financial volatility—emerging economies, especially those in Asia and South Asia, are beginning to see a silver lining.

The very disruptions caused by U.S. tariffs can open up pathways for growth, innovation, and strategic realignment. Rather than being passive victims of global trade tensions, countries like Sri Lanka can leverage these moments of upheaval as catalysts for economic renewal, stronger international partnerships, and greater resilience in the face of future global shifts. The silver lining of U.S. tariffs, therefore, lies in how emerging economies can transform these challenges into lasting opportunities for economic development and regional integration.

Traditionally seen as a blunt economic tool, tariffs have made a comeback, especially during and after the Trump administration. While much attention has focused on the negative impacts of tariffs—such as trade slowdowns, retaliatory tariffs, and market volatility—this view overlooks some of the potential positive outcomes, especially in the longer term. This article will explore the opportunities created by U.S. tariffs, particularly for emerging economies like Sri Lanka.

What Are Tariffs and Why Are They Imposed?

Tariffs are taxes placed on imported goods, making them more expensive for consumers. The United States has used tariffs as a way to address trade imbalances, protect domestic industries, and assert its influence on the global stage. For example, tariffs on steel and aluminum were meant to safeguard American manufacturing jobs, while tariffs on Chinese goods were part of broader efforts to correct trade deficits with China and challenge unfair trade practices.

The Immediate Consequences

of U.S. Tariffs

When tariffs are imposed, the immediate effects are usually negative for global trade. Countries that rely on exporting to the U.S. face reduced demand for their goods, which can lead to financial losses. Markets may experience increased volatility, stock prices may drop, and inflation could rise, especially in countries dependent on global supply chains.

For instance, countries like China have retaliated with their own tariffs, leading to a “trade war” that has disrupted global supply chains. As a result, businesses face higher costs and reduced profits, which can also affect consumers who pay more for goods.

The Longer-Term Effects: Economic Reshaping

Although tariffs create challenges, they also lead to changes that could benefit certain economies in the long run. For example, trade wars often force countries to rethink their supply chains. In response to U.S. tariffs, many multinational companies started seeking alternatives to China for manufacturing. This shift, known as the “China +1” strategy, has led to countries like Sri Lanka, Vietnam, and India seeing a rise in foreign investment and a growing role in the global supply chain.

Sri Lanka, with its strategic location and competitive labor costs, has become an attractive destination for businesses looking to diversify their production outside of China. Sri Lanka’s exports, such as tea and apparel, have seen increased demand as companies move their operations to places less affected by tariffs. This shift creates opportunities for countries like Sri Lanka to boost their industrial sectors, attract foreign capital, and integrate into regional trade networks.

The Role of Financial Volatility

One of the immediate reactions to tariffs is financial volatility, as global markets try to adjust to the uncertainty caused by trade conflicts. While this often results in market instability, financial volatility can also serve as a catalyst for broader economic reforms. In times of crisis, countries may be forced to improve their fiscal policies, strengthen their institutions, and diversify their economies.

For example, countries in the emerging world may use the pressure from tariffs to undertake structural reforms that make their economies more resilient. They may improve fiscal governance, attract more investment, and create a more diversified and stable economy. Over time, this can reduce their dependence on any single trading partner and help them weather future economic shocks.

Opportunities for Emerging Economies

Although U.S. tariffs present challenges for emerging economies, especially those that depend on exports to the U.S., they also provide opportunities for strategic realignment. With companies looking for alternatives to China, emerging economies can reposition themselves as attractive investment destinations.

Sri Lanka, for instance, has benefited from this shift in the global supply chain. As businesses look for stable alternatives to Chinese manufacturing, Sri Lanka has seen an increase in demand for its exports, such as textiles and tea. Additionally, foreign direct investment (FDI) in Sri Lanka has been growing, with companies looking to set up production facilities in countries that are less affected by tariff measures.

This shift is not just about attracting investment but also about repositioning a country within regional supply chains. Sri Lanka has the potential to become a key player in the Indian Ocean region, connecting Asia with Europe and Africa. By improving infrastructure, such as ports and digital networks, Sri Lanka can better integrate into global value chains and increase its export capacity.

Sri Lanka’s Response

to Global Shifts

For Sri Lanka, the global effects of U.S. tariffs present both a challenge and an opportunity. The country is currently dealing with debt restructuring, fiscal deficits, and economic instability. However, these global disruptions can be leveraged as a platform for domestic renewal.

Sri Lanka’s response to these shifts includes diversifying its export markets. By increasing trade with other regions, such as Southeast Asia, India, and the EU, Sri Lanka can reduce its reliance on any one country or market. Regional trade agreements like the South Asian Free Trade Area (SAFTA) can help strengthen Sri Lanka’s position in the global market and protect it from the volatility of global trade wars.

Additionally, Sri Lanka has used these global shifts as an opportunity to undertake important fiscal reforms. These reforms, including improving fiscal governance and enhancing investor confidence, can help the country become more resilient in the long term. By addressing internal structural issues, Sri Lanka can better navigate global economic shifts and position itself for sustainable growth.

The Role of Technology and Digitalisation

Technology plays an essential role in Sri Lanka’s strategy to capitalise on global economic changes. The digital transformation of industries, driven in part by U.S. tariffs and trade disruptions, opens new avenues for economic development. For example, Sri Lanka’s growing IT sector, combined with advancements in e-commerce and digital infrastructure, allows the country to offer a variety of services to global markets, including financial services, software development, and education.

By investing in digital infrastructure and embracing new technologies like artificial intelligence and automation, Sri Lanka can position itself as a leader in the regional digital economy. This technological upgrade can help Sri Lanka integrate more deeply into global value chains, boosting exports and creating new economic opportunities. Possible benefits from US tariffs include,

Short-Term Benefits

* Diversified Exports: Emerging economies gain market share by offering alternatives to Chinese products.

* Increased Demand: Tariffs on China boost demand for products from other regions.

* Boost in FDI: Countries attract more foreign investments as supply chains shift.

* Lower Competition: Protectionist measures reduce competition for domestic industries.

Medium-Term Benefits

* Industrial Upgrading: Local industries modernise, innovate, and become more productive.

* Policy Reforms: Financial instability prompts improvements in governance and policies.

* Supply Chain Integration: Economies join more resilient and diversified global supply chains.

* Regional Trade: Strengthened trade partnerships with neighbouring countries and regional organisations.

Long-Term Benefits

* Structural Growth: Policy changes create a more resilient and diversified economy.

* Technological Advancements: Focus on innovation positions economies as leaders in new industries.

* Geopolitical Influence: Adaptation to global changes boosts regional and international influence.

* Better Positioning in Global Value Chains: Emerging economies align with evolving global demands, securing a stronger role in global trade.

A Turning Point for Emerging Economies

While U.S. tariffs initially cause economic disruption, they can also serve as a wake-up call for emerging economies like Sri Lanka. By diversifying trade relationships, investing in technology, and undertaking necessary structural reforms, countries can turn these challenges into long-term growth opportunities. The global shifts triggered by U.S. tariffs provide a unique opportunity for countries like Sri Lanka to reinvent their economic models, enhance their resilience, and position themselves as key players in the evolving global economy.

In this era of trade wars and economic realignments, smaller nations no longer need to simply weather the storm. With the right policies, proactive strategies, and a focus on innovation, countries like Sri Lanka can not only survive the disruptions caused by U.S. tariffs but thrive in the new economic landscape.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)

Opinion

Lakshman Balasuriya – Not just my boss but a father and a brother

It is with profound sadness that we received the shocking news of untimely passing of our dear leader Lakshman Balasuriya.

I first met Lakshman Balasuriya in 1988 while working at John Keells, which had been awarded an IT contract to computerise Senkadagala Finance. Thereafter, in 1992, I joined the E. W. Balasuriya Group of Companies and Senkadagala Finance when the organisation decided to bring its computerisation in-house.

Lakshman Balasuriya obtained his BSc from the University of London and his MSc from the University of Lancaster. He was not only intellectually brilliant, but also a highly practical and pragmatic individual, often sitting beside me to share instructions and ideas, which I would then translate directly into the software through code.

My first major assignment was to computerise the printing press. At the time, the systems in place were outdated, and modernisation was a challenging task. However, with the guidance, strong support, and decisive leadership of our boss, we were able to successfully transform the printing press into a modern, state-of-the-art operation.

He was a farsighted visionary who understood the value and impact of information technology well ahead of his time. He possessed a deep knowledge of the subject, which was rare during those early years. For instance, in the 1990s, Balasuriya engaged a Canadian consultant to conduct a cybersecurity audit—an extraordinary initiative at a time when cybersecurity was scarcely spoken of and far from mainstream.

During that period, Senkadagala Finance’s head office was based in Kandy, with no branch network. When the decision was made to open the first branch in Colombo, our IT team faced the challenge of adapting the software to support branch operations. It was him who proposed the innovative idea of creating logical branches—a concept well ahead of its time in IT thinking. This simple yet powerful idea enabled the company to expand rapidly, allowing branches to be added seamlessly to the system. Today, after many upgrades and continuous modernisation, Senkadagala Finance operates over 400 locations across the country with real-time online connectivity—a testament to his original vision.

In September 2013, we faced a critical challenge with a key system that required the development of an entirely new solution. A proof of concept was prepared and reviewed by Lakshman Balasuriya, who gave the green light to proceed. During the development phase, he remained deeply involved, offering ideas, insights, and constructive feedback. Within just four months, the system was successfully developed and went live—another example of his hands-on leadership and unwavering support for innovation.

These are only a few examples among many of the IT initiatives that were encouraged, supported, and championed by him. Information technology has played a pivotal role in the growth and success of the E. W. Balasuriya Group of Companies, including Senkadagala Finance PLC, and much of that credit goes to his foresight, trust, and leadership.

On a deeply personal note, I was not only a witness to, but also a recipient of, the kindness, humility, and humanity of Lakshman Balasuriya. There were occasions when I lost my temper and made unreasonable demands, yet he always responded with firmness tempered by gentleness. He never lost his own composure, nor did he ever harbour grudges. He had the rare ability to recognise people’s shortcomings and genuinely tried to guide them toward self-improvement.

He was not merely our boss. To many of us, he was like a father and a brother.

I will miss him immensely. His passing has left a void that can never be filled. Of all the people I have known in my life, Mr. Lakshman Balasuriya stands apart as one of the finest human beings.

He leaves behind his beloved wife, Janine, his children Amanthi and Keshav, and the four grandchildren.

May he rest in eternal peace!

Timothy De Silva

(Information Systems Officer at Senkadagala Finance.)

Opinion

The science of love

A remarkable increase in marriage proposals in newspapers and the thriving matchmaking outfits in major cities indicate the difficulty in finding the perfect partners. Academics have done much research in interpersonal attraction or love. There was an era when young people were heavily influenced by romantic fiction. They learned how opposites attract and absence makes the heart grow fonder. There was, of course, an old adage: Out of sight out of mind.

Some people find it difficult to fall in love or they simply do not believe in love. They usually go for arranged marriages. Some of them think that love begins after marriage. There is an on-going debate whether love marriages are better than arranged marriages or vice versa. However, modern psychologists have shed some light on the science of love. By understanding it you might be able to find the ideal life partner.

To start with, do not believe that opposites attract. It is purely a myth. If you wish to fall in love, look for someone like you. You may not find them 100 per cent similar to you, but chances are that you will meet someone who is somewhat similar to you. We usually prefer partners who have similar backgrounds, interests, values and beliefs because they validate our own.

Common trait

It is a common trait that we gravitate towards those who are like us physically. The resemblance of spouses has been studied by scientists more than 100 years ago. According to them, physical resemblance is a key factor in falling in love. For instance, if you are a tall person, you are unlikely to fall in love with a short person. Similarly, overweight young people are attracted to similar types. As in everything in life, there may be exceptions. You may have seen some tall men in love with short women.

If you are interested in someone, declare your love in words or gestures. Some people have strong feelings about others but they never make them known. If you fancy someone, make it known. If you remain silent you will miss a great opportunity forever. In fact if someone loves you, you will feel good about yourself. Such feelings will strengthen love. If someone flatters you, be nice to them. It may be the beginning of a great love affair.

Some people like Romeo and Juliet fall in love at first sight. It has been scientifically confirmed that the longer a pair of prospective partners lock eyes upon their first meeting they are very likely to remain lovers. They say eyes have it. If you cannot stay without seeing your partner, you are in love! Whenever you meet your lover, look at their eyes with dilated pupils. Enlarged pupils signal intense arousal.

Body language

If you wish to fall in love, learn something about body language. There are many books written on the subject. The knowledge of body language will help you to understand non-verbal communication easily. It is quite obvious that lovers do not express their love in so many words. Women usually will not say ‘I love you’ except in films. They express their love tacitly with a shy smile or preening their hair in the presence of their lovers.

Allan Pease, author of The Definitive Guide to Body Language says, “What really turn men on are female submission gestures which include exposing vulnerable areas such as the wrists or neck.” Leg twine was something Princess Diana was good at. It involves crossing the legs hooking the upper leg’s foot behind the lower leg’s ankle. She was an expert in the art of love. Men have their own ways. In order to look more dominant than their partners they engage in crotch display with their thumbs hooked in pockets. Michael Jackson always did it.

If you are looking for a partner, be a good-looking guy. Dress well and behave sensibly. If your dress is unclean or crumpled, nobody will take any notice of you. According to sociologists, men usually prefer women with long hair and proper hip measurements. Similarly, women prefer taller and older men because they look nice and can be trusted to raise a family.

Proximity rule

You do not have to travel long distances to find your ideal partner. He or she may be living in your neighbourhood or working at the same office. The proximity rule ensures repeated exposure. Lovers should meet regularly in order to enrich their love. On most occasions we marry a girl or boy living next door. Never compare your partner with your favourite film star. Beauty lies in the eyes of the beholder. Therefore be content with your partner’s physical appearance. Each individual is unique. Never look for another Cleopatra or Romeo. Sometimes you may find that your neighbour’s wife is more beautiful than yours. On such occasions turn to the Bible which says, “Thou shalt not covet thy neighbour’s wife.”

There are many plain Janes and penniless men in society. How are they going to find their partners? If they are warm people, sociable, wise and popular, they too can find partners easily. Partners in a marriage need not be highly educated, but they must be intelligent enough to face life’s problems. Osho compared love to a river always flowing. The very movement is the life of the river. Once it stops it becomes stagnant. Then it is no longer a river. The very word river shows a process, the very sound of it gives you the feeling of movement.

Although we view love as a science today, it has been treated as an art in the past. In fact Erich Fromm wrote The Art of Loving. Science or art, love is a terrific feeling.

karunaratners@gmail.com

By R.S. Karunaratne

Opinion

Are we reading the sky wrong?

Rethinking climate prediction, disasters, and plantation economics in Sri Lanka

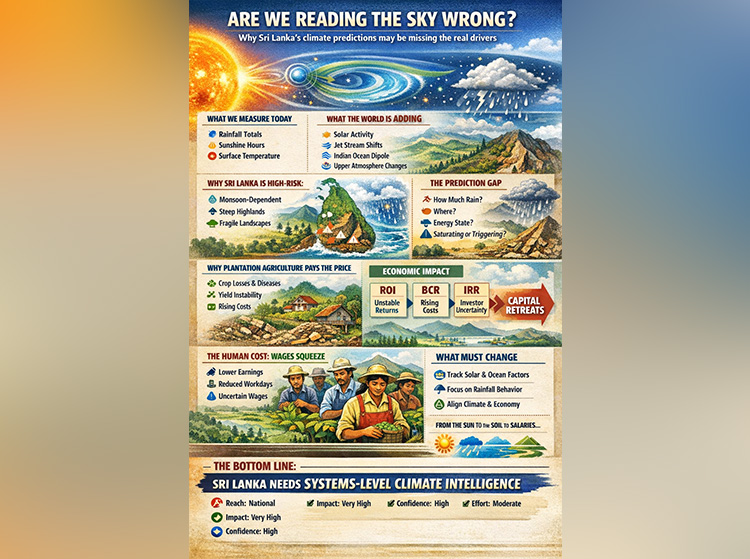

For decades, Sri Lanka has interpreted climate through a narrow lens. Rainfall totals, sunshine hours, and surface temperatures dominate forecasts, policy briefings, and disaster warnings. These indicators once served an agrarian island reasonably well. But in an era of intensifying extremes—flash floods, sudden landslides, prolonged dry spells within “normal” monsoons—the question can no longer be avoided: are we measuring the climate correctly, or merely measuring what is easiest to observe?

Across the world, climate science has quietly moved beyond a purely local view of weather. Researchers increasingly recognise that Earth’s climate system is not sealed off from the rest of the universe. Solar activity, upper-atmospheric dynamics, ocean–atmosphere coupling, and geomagnetic disturbances all influence how energy moves through the climate system. These forces do not create rain or drought by themselves, but they shape how weather behaves—its timing, intensity, and spatial concentration.

Sri Lanka’s forecasting framework, however, remains largely grounded in twentieth-century assumptions. It asks how much rain will fall, where it will fall, and over how many days. What it rarely asks is whether the rainfall will arrive as steady saturation or violent cloudbursts; whether soils are already at failure thresholds; or whether larger atmospheric energy patterns are priming the region for extremes. As a result, disasters are repeatedly described as “unexpected,” even when the conditions that produced them were slowly assembling.

This blind spot matters because Sri Lanka is unusually sensitive to climate volatility. The island sits at a crossroads of monsoon systems, bordered by the Indian Ocean and shaped by steep central highlands resting on deeply weathered soils. Its landscapes—especially in plantation regions—have been altered over centuries, reducing natural buffers against hydrological shock. In such a setting, small shifts in atmospheric behaviour can trigger outsized consequences. A few hours of intense rain can undo what months of average rainfall statistics suggest is “normal.”

Nowhere are these consequences more visible than in commercial perennial plantation agriculture. Tea, rubber, coconut, and spice crops are not annual ventures; they are long-term biological investments. A tea bush destroyed by a landslide cannot be replaced in a season. A rubber stand weakened by prolonged waterlogging or drought stress may take years to recover, if it recovers at all. Climate shocks therefore ripple through plantation economics long after floodwaters recede or drought declarations end.

From an investment perspective, this volatility directly undermines key financial metrics. Return on Investment (ROI) becomes unstable as yields fluctuate and recovery costs rise. Benefit–Cost Ratios (BCR) deteriorate when expenditures on drainage, replanting, disease control, and labour increase faster than output. Most critically, Internal Rates of Return (IRR) decline as cash flows become irregular and back-loaded, discouraging long-term capital and raising the cost of financing. Plantation agriculture begins to look less like a stable productive sector and more like a high-risk gamble.

The economic consequences do not stop at balance sheets. Plantation systems are labour-intensive by nature, and when financial margins tighten, wage pressure is the first stress point. Living wage commitments become framed as “unaffordable,” workdays are lost during climate disruptions, and productivity-linked wage models collapse under erratic output. In effect, climate misprediction translates into wage instability, quietly eroding livelihoods without ever appearing in meteorological reports.

This is not an argument for abandoning traditional climate indicators. Rainfall and sunshine still matter. But they are no longer sufficient on their own. Climate today is a system, not a statistic. It is shaped by interactions between the Sun, the atmosphere, the oceans, the land, and the ways humans have modified all three. Ignoring these interactions does not make them disappear; it simply shifts their costs onto farmers, workers, investors, and the public purse.

Sri Lanka’s repeated cycle of surprise disasters, post-event compensation, and stalled reform suggests a deeper problem than bad luck. It points to an outdated model of climate intelligence. Until forecasting frameworks expand beyond local rainfall totals to incorporate broader atmospheric and oceanic drivers—and until those insights are translated into agricultural and economic planning—plantation regions will remain exposed, and wage debates will remain disconnected from their true root causes.

The future of Sri Lanka’s plantations, and the dignity of the workforce that sustains them, depends on a simple shift in perspective: from measuring weather, to understanding systems. Climate is no longer just what falls from the sky. It is what moves through the universe, settles into soils, shapes returns on investment, and ultimately determines whether growth is shared or fragile.

The Way Forward

Sustaining plantation agriculture under today’s climate volatility demands an urgent policy reset. The government must mandate real-world investment appraisals—NPV, IRR, and BCR—through crop research institutes, replacing outdated historical assumptions with current climate, cost, and risk realities. Satellite-based, farm-specific real-time weather stations should be rapidly deployed across plantation regions and integrated with a central server at the Department of Meteorology, enabling precision forecasting, early warnings, and estate-level decision support. Globally proven-to-fail monocropping systems must be phased out through a time-bound transition, replacing them with diversified, mixed-root systems that combine deep-rooted and shallow-rooted species, improving soil structure, water buffering, slope stability, and resilience against prolonged droughts and extreme rainfall.

In parallel, a national plantation insurance framework, linked to green and climate-finance institutions and regulated by the Insurance Regulatory Commission, is essential to protect small and medium perennial growers from systemic climate risk. A Virtual Plantation Bank must be operationalized without delay to finance climate-resilient plantation designs, agroforestry transitions, and productivity gains aligned with national yield targets. The state should set minimum yield and profit benchmarks per hectare, formally recognize 10–50 acre growers as Proprietary Planters, and enable scale through long-term (up to 99-year) leases where state lands are sub-leased to proven operators. Finally, achieving a 4% GDP contribution from plantations requires making modern HRM practices mandatory across the sector, replacing outdated labour systems with people-centric, productivity-linked models that attract, retain, and fairly reward a skilled workforce—because sustainable competitive advantage begins with the right people.

by Dammike Kobbekaduwe

(www.vivonta.lk & www.planters.lk ✍️

-

News5 days ago

News5 days agoBritish MP calls on Foreign Secretary to expand sanction package against ‘Sri Lankan war criminals’

-

Sports5 days ago

Sports5 days agoChief selector’s remarks disappointing says Mickey Arthur

-

News4 days ago

News4 days agoStreet vendors banned from Kandy City

-

News6 days ago

News6 days agoSri Lanka’s coastline faces unfolding catastrophe: Expert

-

Opinion5 days ago

Opinion5 days agoDisasters do not destroy nations; the refusal to change does

-

News4 days ago

News4 days agoLankan aircrew fly daring UN Medevac in hostile conditions in Africa

-

Midweek Review6 days ago

Midweek Review6 days agoYear ends with the NPP govt. on the back foot

-

Sports6 days ago

Sports6 days agoLife after the armband for Asalanka