Features

There is no such person as ‘one- armed economist’

by Jayampathy Molligoda

The Sri Lankan government adopted a relaxed monetary policy coupled with lower taxes to stimulate economic growth since 2020 (beginning) till end of 2021. The objective was to provide relief to people and businesses in order to overcome negative effects due to COVID 19 and Easter Sunday attack in April 2019. However, whether the economy really produced goods and services to the extent that is required is questionable. It is true that during the year 2021 they have been able to convert the negative growth rate of 3.6% in 2020 into a positive growth rate of 3.7% in 2021. Commencing 2022, Central Bank (CBSL) has adopted a policy of tightening the monetary policy by increasing the interest rates and increase income tax and indirect taxes such as VAT and social security contribution levy in order to reduce inflation and inflationary expectations. One can argue that all these contrasting policy measures are in accordance with the accepted macro- economic theories put forward by eminent economists.

This year Nobel Price goes to Economist, Bernanke, Ex-Chief of Central bank, US:

Eminent economist, Ex-Fed reserve, Chief, US, Ben Bernanke, together with two other eminent economists, won the Economics Nobel price this October on the role of banks, particularly during financial crises and how to regulate financial markets. “In his role as Chief of the Central Bank, US, Bernanke was able to put knowledge from research into policy during the financial crisis of 2008-2009” the Nobel Committee said.

Bernanke has been previously credited and hailed for the Fed’s unorthodox response of slashing interest rates and flooding the financial system with liquidity and thus successfully handling the recovery after the 2008 recession, but at the same time, criticised for doing little to avert it, allowing investment bank Lehman Brothers to collapse. The award winners also showed how the financial institutions were vulnerable to so called bank runs. “If a large number of customers (savers) simultaneously run to the bank to withdraw their money, the rumour may become a self-fulfilling prophecy – a bank run occurs and the bank collapses” the Nobel Committee said. The Committee added this dangerous dynamic can be avoided by governments providing credit and giving banks a life-line by becoming a lender of last resort. “In a nutshell, the theory says that banks can be tremendously useful but they are only guaranteed to be stable if they are properly regulated,” Nobel committee chairman added.

Solutions to great depression in the 1930s:

This reminds me ‘Keynesian’ economics, which involves government expenditures while economics believe that government spending causes inflation and therefore need to control the supply of money that flows into the economy. In contrast, Keynesian economists believe that a troubled economy continues in a downward spiral unless a government intervention drives consumers to buy more goods and services. They believe in consumption, government expenditure and to change the state of the economy. In short, governments should balance out the cyclical movement of the economy by spending more in downturns and less in prosperous times (thereby preventing inflation). In fact, Keynes begins his general theory by attacking Say’s law, the view that ‘supply creates its own demand’. Keynes proceeded to turn Say’s law on his head, arguing that aggregate demand determines the supply of output and level of employment. (Post-Keynesian Economics (PKE) is a school of economic thought which builds upon John Maynard Keynes’s argument that effective demand is the key determinant of economic performance.) In the field of monetary theory, ‘post-Keynesian’ economists were among the first to emphasise that money supply responds to the demand for bank credit, so that Central Banks cannot control the quantity of money, but only manage the interest rate by managing the quantity of monetary reserves.

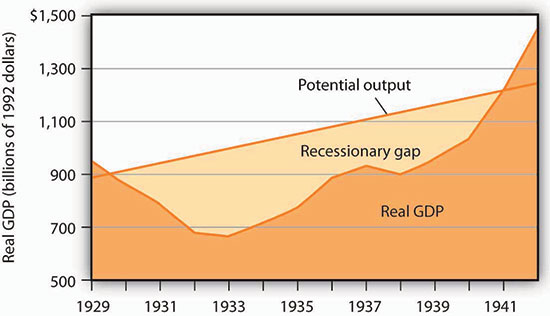

By the way, Bernanke previously received awards for his analysis, conducted in the early 1980s, of the ‘Great Depression’ in the 1930s, the worst economic crisis. For Keynesian economists, the experience of Great Depression provided impressive confirmation of Keynes’s idea which is consistent with Keynes’s argument. A sharp reduction in aggregate demand had gotten the trouble started. A reduction in aggregate demand took the economy from above its potential output to below its potential output, and, as we see in below the recessionary gap created by the change in aggregate demand had persisted for more than a decade, but expansionary fiscal policy had put an end to the worst macroeconomic nightmare.

The dark-shaded area shows real GDP from 1929 to 1942, the upper line shows potential output, and the light-shaded area shows the difference between the two—the recessionary gap. The gap nearly closed in 1941 The chart suggests that the recessionary gap remained very large throughout the 1930s.

Inflation, money printing and unemployment:

Under the Monetary Law Act 1949 as amended, the economic and price stability and financial system stability were made the core objectives of the CBSL. Therefore, it should focus on maintaining stable price levels, means containing inflation and inflationary expectations. In order to attain ‘price stability’, CBSL is required to keep liquidity and money supply of the country at appropriate levels so that the total demand for goods and services known as the ‘aggregate demand’ is more or less equal to the total supply of goods and services called ‘aggregate supply’.

In 1958, economist A W Phillips published an article in the British journal of economica that would make him famous covering a relationship between unemployment and inflation. Phillips curve showed negative correlation between rate of unemployment and the inflation. When inflation is high, the rate of unemployment is low and vice versa. Practically policy makers use this by altering monetary & fiscal policies in influencing ’aggregate demand’ in the short run and achieve trade -off between employment and rate of inflation. The ‘Nobel Price’ winner in 2001, Economist George Akerlof once said “probably the single most important macroeconomic relationship is the Phillips curve.

New Keynesian approach has emerged as the preferred approach:

Steeply rising prices is a bigger threat to businesses than high interest rates which will have to be maintained for a time until inflation start to ease, Central Bank Governor Dr. Nandalal Weerasinghe said recently. He was quoted by the local media as saying. “Sri Lanka was now experiencing the result of past money printing and if rates are cut now, runaway inflation could be the result. Higher interest rates are cost to business, but inflation drives up all costs,” Governor Weerasinghe explained addressing concerns of businesses on high interest rates and raising taxes. However, the Columbia University professor, author of “The Price of Inequality” and “Globalisation and Its Discontents,” Joseph Stiglitz argued that the overwhelming source of inflation is supply-side disruptions leading to higher prices in oil and food. “Will raising interest rates lead to more oil, lower prices of oil, more food, lower prices of food? Answer is clearly not”.

This is in response to recent announcements by Federal Reserve officials in the US indicating that interest rate hikes will continue in order to bring down rising prices — but this may intensify inflationary pressures, according to the Nobel Prize-winning economist. “The real worry in my mind is, will they increase interest rates too high, too fast, too far?” Joseph Stiglitz told CNBC recently at a Forum in Italy. In fact, the real risk is it will make it worse; Why? Because what we need to do is to make investments to relieve some of these supply-side bottlenecks that are causing such havoc on our economy. It’s going to make it more difficult.” Unquote. According to Joseph Stiglitz, raising interest rates in non-competitive markets may lead to even more inflation.

While there is less consensus on macroeconomic policy issues than on issues in the microeconomic and international areas, surveys of economists generally show that the new Keynesian approach has emerged as the preferred approach to macroeconomic analysis. The finding that about 80% of economists agree that governments’ expansionary fiscal measures can deal with recessionary gaps certainly suggests that most economists can be counted in the new Keynesian camp. Neither monetarist nor new classical analysis would support such measures. At the same time, there is considerable discomfort about actually using discretionary fiscal policy, as the same survey shows that about 70% of economists feel that discretionary fiscal policy should be avoided and that the business cycle should be managed by the Fed (Fuller & Geide-Stevenson, 2003). Just as the new Keynesian approach appears to have won support among most economists, it has become dominant in terms of macroeconomic policy.

Conflicting theories on macro-economic policies put in to practice:

As can be seen, Sri Lankan policy makers tend to adopt economic policies going into two extreme ends, namely; relaxed monetary policy, coupled with government expenditure through excessive money printing and lower taxes on the one hand, and tight monetary policies coupled with high Income Tax and indirect taxes on the other hand. When interest rates are raised, availability of bank credit reduces and consequently overall economic activities tend to slow down. If they continue to adopt tight monetary policy framework and fiscal (high taxation) policies, it’s likely the aggregate supply will contract and may lead to lower production, which in turn end up in ‘stagflation’ or it could even end up in a recession. The economy is expected to contract this year around 8-9 percent of gross domestic product (GDP) as investment and consumption falls. Nevertheless, at the IMF and World bank annual sessions in Washington this October, the State Finance Minister Shehan Semasinghe was quoted as saying; “Sri Lanka’s ongoing IMF-prescribed reforms to come out of an unprecedented economic crisis will not be reversed in future unlike in the past as there is somewhat consensus among the current lawmakers for such reforms”; Unquote. Already the micro and small and medium enterprises have serious issues, where they cannot afford to borrow any more or repay the debts already taken. As a result, household indebtedness may gradually increase to unprecedented levels. This may intern, increase the instability of the financial and banking system. How the present government is going to address those serious socio/ economic issues is yet to be seen.

We need to reiterate the fact that the Sri Lankan economy can only be re-built in the medium term by successfully addressing the structural weaknesses, increase exports as a % of GDP and thus eliminating the twin deficits, namely government budget deficit and balance of payments with rest of the world. Simultaneously, the above stated vulnerabilities; household indebtedness, banking system stability etc. must be arrested in order to make a sustainable economic recovery possible. However, the challenge is the time it can take for the economy to adjust to these changes and how to manage the cash flows and social unrest during the interim period. USA President Harry S. Truman (33rd President serving from 1945 to 1953) hated what he termed two-armed economists, those who would advise him first “on the one hand” and then “on the other hand.” Give me a one-armed economist, he demanded, an adviser who wouldn’t waffle.

Features

More state support needed for marginalised communities

Message from Malaiyaha Tamil community to govt:

Insights from SSA Cyclone Ditwah Survey

When climate disasters strike, they don’t affect everyone equally. Marginalised communities typically face worse outcomes, and Cyclone Ditwah is no exception. Especially in a context where normalcy is far from “normal”, the idea of returning to normalcy or restoring a life of normalcy makes very little sense.

The island-wide survey (https://ssalanka.org/reports/) conducted by the Social Scientists’ Association (SSA), between early to mid-January on Cyclone Ditwah shows stark regional disparities in how satisfied or dissatisfied people were with the government’s response. While national satisfaction levels were relatively high in most provinces, the Central Province tells a different story.

Only 35.2% of Central Province residents reported that they were satisfied with early warning and evacuation measures, compared to 52.2% nationally. The gap continues across every measure: just 52.9% were satisfied with immediate rescue and emergency response, compared with the national figure of 74.6%. Satisfaction with relief distribution in the Central Province is 51.9% while the national figure stands at 73.1%. The figures for restoration of water, electricity, and roads are at a low 45.9% in the central province compared to the 70.9% in national figures. Similarly, the satisfaction level for recovery and rebuilding support is 48.7% in the Central Province, while the national figure is 67.0%.

A deeper analysis of the SSA data on public perceptions reveals something important: these lower satisfaction rates came primarily from the Malaiyaha Tamil population. Their experience differed not just from other provinces, but also from other ethnic groups living in the Central Province itself.

The Malaiyaha Tamil community’s vulnerability didn’t start with the cyclone. Their vulnerability is a historically and structurally pre-determined process of exclusion and marginalisation. Brought to Sri Lanka during British rule to work for the empire’s plantation economies, they have faced long-term economic exploitation and have repeatedly been denied access to state support and social welfare systems. Most estate residents still live in ‘line rooms’ and have no rights to the land they cultivate and live on. The community continues to be governed by an outdated estate management system that acts as a barrier to accessing public and municipal services such as road repair, water, electricity and other basic infrastructures available to other citizens.

As far as access to improved water sources is concerned, the Sri Lanka Demographic Health Survey (2016) shows that 57% of estate sector households don’t have access to improved water sources, while more than 90% of households in urban and rural areas do. With regard to the level of poverty, as the Department of Census and Statistics (2019) data reveals, the estate sector where most Malaiyaha Tamils live had a poverty headcount index of 33.8%; more than double the national rate of 14.3%. These statistics highlight key indicators of the systemic discrimination faced by the Malaiyaha Tamil community.

Some crucial observations from the SSA data collectors who enumerated responses from estate residents in the survey reveal the specific challenges faced by the Malaiyaha Tamils, particularly in their efforts to seek state support for compensation and reconstruction.

First, the Central Province experienced not just flooding but also the highest number of landslides in the island. As a result, some residents in the region lost entire homes, access roadways, and other basic infrastructures. The loss of lives, livelihoods and land was at a higher intensity compared to the provinces not located in the hills. Most importantly, the Malaiyaha Tamil community’s pre-existing grievances made them even more vulnerable and the government’s job of reparation and restitution more complex.

Early warnings hadn’t reached many areas. Some data collectors said they themselves never heard any warnings in estate areas, while others mentioned that early warnings were issued but didn’t reach some segments of the community. According to the resident data collectors, the police announcements reached only as far as the sections where they were able to drive their vehicles to, and there were many estate roads that were not motorable. When warnings did filter through to remote locations, they often came by word of mouth and information was distorted along the way. Once the disaster hit, things got worse: roads were blocked, electricity went out, mobile networks failed and people were cut off completely.

Emergency response was slow. Blocked roads meant people could not get to hospitals when they needed urgent care, including pregnant mothers. The difficult terrain and poor road conditions meant rescue teams took much longer to reach affected areas than in other regions.

Relief supplies didn’t reach everyone. The Grama Niladhari divisions in these areas are huge and hard to navigate, making it difficult for Grama Niladharis to reach all places as urgently as needed. Relief workers distributed supplies where vehicles could go, which meant accessible areas got help while remote communities were left out.

Some people didn’t even try to go to safety centres or evacuation shelters set up in local schools because the facilities there were already so poor. The perceptions of people who did go to safety centres, as shown in the provincial data, reveal that satisfaction was low compared to other affected regions of the country. Less than half were satisfied with space and facilities (42.1%) or security and protection (45.0%). Satisfaction was even lower for assistance with lost or damaged documentation (17.9%) and information and support for compensation applications (28.2%). Only 22.5% were satisfied with medical care and health services below most other affected regions.

Restoring services proved nearly impossible in some areas. Road access was the biggest problem. The condition of the roads was already poor even before the cyclone, and some still haven’t been cleared. Recovery is especially difficult because there’s no decent baseline infrastructure to restore, hence you can’t bring roads and other public facilities back to a “good” condition when they were never good, even before the disaster.

Water systems faced their own complications. Many households get water from natural sources or small community projects, and not the centralised state system. These sources are often in the middle of the disaster zone and therefore got contaminated during the floods and landslides.

Long-term recovery remains stalled. Without basic infrastructure, areas that are still hard to reach keep struggling to get the support they need for rebuilding.

Taken together, what do these testaments mean? Disaster response can’t be the same for everyone. The Malaiyaha Tamil community has been double marginalised because they were already living with structural inequalities such as poor infrastructure, geographic isolation, and inadequate services which have been exacerbated by Cyclone Ditwah. An effective and fair disaster response needs to account for these underlying vulnerabilities. It requires interventions tailored to the historical, economic, and infrastructural realities that marginalized communities face every day. On top of that, it highlights the importance of dealing with climate disasters, given the fact that vulnerable communities could face more devastating impacts compared to others.

(Shashik Silva is a researcher with the Social Scientists’ Association of Sri Lanka)

by Shashik Silva ✍️

Features

Crucial test for religious and ethnic harmony in Bangladesh

Will the Bangladesh parliamentary election bring into being a government that will ensure ethnic and religious harmony in the country? This is the poser on the lips of peace-loving sections in Bangladesh and a principal concern of those outside who mean the country well.

Will the Bangladesh parliamentary election bring into being a government that will ensure ethnic and religious harmony in the country? This is the poser on the lips of peace-loving sections in Bangladesh and a principal concern of those outside who mean the country well.

The apprehensions are mainly on the part of religious and ethnic minorities. The parliamentary poll of February 12th is expected to bring into existence a government headed by the Bangladesh Nationalist Party (BNP) and the Islamist oriented Jamaat-e-Islami party and this is where the rub is. If these parties win, will it be a case of Bangladesh sliding in the direction of a theocracy or a state where majoritarian chauvinism thrives?

Chief of the Jamaat, Shafiqur Rahman, who was interviewed by sections of the international media recently said that there is no need for minority groups in Bangladesh to have the above fears. He assured, essentially, that the state that will come into being will be equable and inclusive. May it be so, is likely to be the wish of those who cherish a tension-free Bangladesh.

The party that could have posed a challenge to the above parties, the Awami League Party of former Prime Minister Hasina Wased, is out of the running on account of a suspension that was imposed on it by the authorities and the mentioned majoritarian-oriented parties are expected to have it easy at the polls.

A positive that has emerged against the backdrop of the poll is that most ordinary people in Bangladesh, be they Muslim or Hindu, are for communal and religious harmony and it is hoped that this sentiment will strongly prevail, going ahead. Interestingly, most of them were of the view, when interviewed, that it was the politicians who sowed the seeds of discord in the country and this viewpoint is widely shared by publics all over the region in respect of the politicians of their countries.

Some sections of the Jamaat party were of the view that matters with regard to the orientation of governance are best left to the incoming parliament to decide on but such opinions will be cold comfort for minority groups. If the parliamentary majority comes to consist of hard line Islamists, for instance, there is nothing to prevent the country from going in for theocratic governance. Consequently, minority group fears over their safety and protection cannot be prevented from spreading.

Therefore, we come back to the question of just and fair governance and whether Bangladesh’s future rulers could ensure these essential conditions of democratic rule. The latter, it is hoped, will be sufficiently perceptive to ascertain that a Bangladesh rife with religious and ethnic tensions, and therefore unstable, would not be in the interests of Bangladesh and those of the region’s countries.

Unfortunately, politicians region-wide fall for the lure of ethnic, religious and linguistic chauvinism. This happens even in the case of politicians who claim to be democratic in orientation. This fate even befell Bangladesh’s Awami League Party, which claims to be democratic and socialist in general outlook.

We have it on the authority of Taslima Nasrin in her ground-breaking novel, ‘Lajja’, that the Awami Party was not of any substantial help to Bangladesh’s Hindus, for example, when violence was unleashed on them by sections of the majority community. In fact some elements in the Awami Party were found to be siding with the Hindus’ murderous persecutors. Such are the temptations of hard line majoritarianism.

In Sri Lanka’s past numerous have been the occasions when even self-professed Leftists and their parties have conveniently fallen in line with Southern nationalist groups with self-interest in mind. The present NPP government in Sri Lanka has been waxing lyrical about fostering national reconciliation and harmony but it is yet to prove its worthiness on this score in practice. The NPP government remains untested material.

As a first step towards national reconciliation it is hoped that Sri Lanka’s present rulers would learn the Tamil language and address the people of the North and East of the country in Tamil and not Sinhala, which most Tamil-speaking people do not understand. We earnestly await official language reforms which afford to Tamil the dignity it deserves.

An acid test awaits Bangladesh as well on the nation-building front. Not only must all forms of chauvinism be shunned by the incoming rulers but a secular, truly democratic Bangladesh awaits being licked into shape. All identity barriers among people need to be abolished and it is this process that is referred to as nation-building.

On the foreign policy frontier, a task of foremost importance for Bangladesh is the need to build bridges of amity with India. If pragmatism is to rule the roost in foreign policy formulation, Bangladesh would place priority to the overcoming of this challenge. The repatriation to Bangladesh of ex-Prime Minister Hasina could emerge as a steep hurdle to bilateral accord but sagacious diplomacy must be used by Bangladesh to get over the problem.

A reply to N.A. de S. Amaratunga

A response has been penned by N.A. de S. Amaratunga (please see p5 of ‘The Island’ of February 6th) to a previous column by me on ‘ India shaping-up as a Swing State’, published in this newspaper on January 29th , but I remain firmly convinced that India remains a foremost democracy and a Swing State in the making.

If the countries of South Asia are to effectively manage ‘murderous terrorism’, particularly of the separatist kind, then they would do well to adopt to the best of their ability a system of government that provides for power decentralization from the centre to the provinces or periphery, as the case may be. This system has stood India in good stead and ought to prove effective in all other states that have fears of disintegration.

Moreover, power decentralization ensures that all communities within a country enjoy some self-governing rights within an overall unitary governance framework. Such power-sharing is a hallmark of democratic governance.

Features

Celebrating Valentine’s Day …

Valentine’s Day is all about celebrating love, romance, and affection, and this is how some of our well-known personalities plan to celebrate Valentine’s Day – 14th February:

Valentine’s Day is all about celebrating love, romance, and affection, and this is how some of our well-known personalities plan to celebrate Valentine’s Day – 14th February:

Merlina Fernando (Singer)

Yes, it’s a special day for lovers all over the world and it’s even more special to me because 14th February is the birthday of my husband Suresh, who’s the lead guitarist of my band Mission.

We have planned to celebrate Valentine’s Day and his Birthday together and it will be a wonderful night as always.

We will be having our fans and close friends, on that night, with their loved ones at Highso – City Max hotel Dubai, from 9.00 pm onwards.

Lorensz Francke (Elvis Tribute Artiste)

On Valentine’s Day I will be performing a live concert at a Wealthy Senior Home for Men and Women, and their families will be attending, as well.

I will be performing live with romantic, iconic love songs and my song list would include ‘Can’t Help falling in Love’, ‘Love Me Tender’, ‘Burning Love’, ‘Are You Lonesome Tonight’, ‘The Wonder of You’ and ‘’It’s Now or Never’ to name a few.

To make Valentine’s Day extra special I will give the Home folks red satin scarfs.

Emma Shanaya (Singer)

I plan on spending the day of love with my girls, especially my best friend. I don’t have a romantic Valentine this year but I am thrilled to spend it with the girl that loves me through and through. I’ll be in Colombo and look forward to go to a cute cafe and spend some quality time with my childhood best friend Zulha.

JAYASRI

Emma-and-Maneeka

This Valentine’s Day the band JAYASRI we will be really busy; in the morning we will be landing in Sri Lanka, after our Oman Tour; then in the afternoon we are invited as Chief Guests at our Maris Stella College Sports Meet, Negombo, and late night we will be with LineOne band live in Karandeniya Open Air Down South. Everywhere we will be sharing LOVE with the mass crowds.

Kay Jay (Singer)

I will stay at home and cook a lovely meal for lunch, watch some movies, together with Sanjaya, and, maybe we go out for dinner and have a lovely time. Come to think of it, every day is Valentine’s Day for me with Sanjaya Alles.

Maneka Liyanage (Beauty Tips)

On this special day, I celebrate love by spending meaningful time with the people I cherish. I prepare food with love and share meals together, because food made with love brings hearts closer. I enjoy my leisure time with them — talking, laughing, sharing stories, understanding each other, and creating beautiful memories. My wish for this Valentine’s Day is a world without fighting — a world where we love one another like our own beloved, where we do not hurt others, even through a single word or action. Let us choose kindness, patience, and understanding in everything we do.

Janaka Palapathwala (Singer)

Janaka

Valentine’s Day should not be the only day we speak about love.

From the moment we are born into this world, we seek love, first through the very drop of our mother’s milk, then through the boundless care of our Mother and Father, and the embrace of family.

Love is everywhere. All living beings, even plants, respond in affection when they are loved.

As we grow, we learn to love, and to be loved. One day, that love inspires us to build a new family of our own.

Love has no beginning and no end. It flows through every stage of life, timeless, endless, and eternal.

Natasha Rathnayake (Singer)

We don’t have any special plans for Valentine’s Day. When you’ve been in love with the same person for over 25 years, you realise that love isn’t a performance reserved for one calendar date. My husband and I have never been big on public displays, or grand gestures, on 14th February. Our love is expressed quietly and consistently, in ordinary, uncelebrated moments.

With time, you learn that love isn’t about proving anything to the world or buying into a commercialised idea of romance—flowers that wilt, sweets that spike blood sugar, and gifts that impress briefly but add little real value. In today’s society, marketing often pushes the idea that love is proven by how much money you spend, and that buying things is treated as a sign of commitment.

Real love doesn’t need reminders or price tags. It lives in showing up every day, choosing each other on unromantic days, and nurturing the relationship intentionally and without an audience.

This isn’t a judgment on those who enjoy celebrating Valentine’s Day. It’s simply a personal choice.

Melloney Dassanayake (Miss Universe Sri Lanka 2024)

I truly believe it’s beautiful to have a day specially dedicated to love. But, for me, Valentine’s Day goes far beyond romantic love alone. It celebrates every form of love we hold close to our hearts: the love for family, friends, and that one special person who makes life brighter. While 14th February gives us a moment to pause and celebrate, I always remind myself that love should never be limited to just one day. Every single day should feel like Valentine’s Day – constant reminder to the people we love that they are never alone, that they are valued, and that they matter.

I truly believe it’s beautiful to have a day specially dedicated to love. But, for me, Valentine’s Day goes far beyond romantic love alone. It celebrates every form of love we hold close to our hearts: the love for family, friends, and that one special person who makes life brighter. While 14th February gives us a moment to pause and celebrate, I always remind myself that love should never be limited to just one day. Every single day should feel like Valentine’s Day – constant reminder to the people we love that they are never alone, that they are valued, and that they matter.

I’m incredibly blessed because, for me, every day feels like Valentine’s Day. My special person makes sure of that through the smallest gestures, the quiet moments, and the simple reminders that love lives in the details. He shows me that it’s the little things that count, and that love doesn’t need grand stages to feel extraordinary. This Valentine’s Day, perfection would be something intimate and meaningful: a cozy picnic in our home garden, surrounded by nature, laughter, and warmth, followed by an abstract drawing session where we let our creativity flow freely. To me, that’s what love is – simple, soulful, expressive, and deeply personal. When love is real, every ordinary moment becomes magical.

Noshin De Silva (Actress)

Valentine’s Day is one of my favourite holidays! I love the décor, the hearts everywhere, the pinks and reds, heart-shaped chocolates, and roses all around. But honestly, I believe every day can be Valentine’s Day.

It doesn’t have to be just about romantic love. It’s a chance to celebrate love in all its forms with friends, family, or even by taking a little time for yourself.

Whether you’re spending the day with someone special or enjoying your own company, it’s a reminder to appreciate meaningful connections, show kindness, and lead with love every day.

And yes, I’m fully on theme this year with heart nail art and heart mehendi design!

Wishing everyone a very happy Valentine’s Day, but, remember, love yourself first, and don’t forget to treat yourself.

Sending my love to all of you.

-

Features5 days ago

Features5 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business6 days ago

Business6 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business5 days ago

Business5 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business5 days ago

Business5 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business5 days ago

Business5 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business2 days ago

Business2 days agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Business6 days ago

Business6 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Midweek Review2 days ago

Midweek Review2 days agoA question of national pride