Opinion

Sri Lanka’s development dilemmas

by Uditha Devapriya

On May 18, the grace period for a USD 78 million coupon payment expired in Sri Lanka. For the first time in its post-independence history, the island nation defaulted on its foreign debt. The Governor of the Central Bank, Dr Nandalal Weerasinghe, then announced that it would take six months for it to start repaying its creditors. An agreement with the IMF is in the pipeline now, but such an agreement will take another month or two.From a global perspective, of course, there is nothing unique about Sri Lanka’s crisis. For the country’s 22 million plus population, however, its scale has been unprecedented. While horror stories of Sri Lanka turning into another Lebanon or Zimbabwe have been recycled relentlessly in the press, since 2020, in recent months such comparisons have been made more frequently. Inflation, which began peaking last year, hit 30 percent in April and 40 percent in May. While nowhere near Lebanon or Zimbabwe, estimates by certain observers and analysts put Sri Lanka at the top of global inflation indices.All this has given rise to certain perceptions about the country’s problems. Western and Indian media, in particular, ascribe the crisis to the convulsions of domestic politics. Very few commentators have noted that these problems have been decades in the making, that the government’s ineptitude is more a symptom than a cause, and that external factors have had a say in such issues. The President’s bungling has contributed to these problems, to be sure, but that only shows how complex they are in the first place.

Neoliberal prescriptions

Just how complex, though? To answer that, it is necessary to address the structural causes that neoliberal economists and commentators note as having led to the crisis. These groups underline four factors: the government’s indulgence of unorthodox economic theories, its drive towards organic agriculture, its refusal to go to the IMF, and its insistence on diverting foreign reserves to defending the currency and repaying bondholders.It must be noted that all these problems are linked to the structural weaknesses of the economy. While there is a consensus on those weaknesses, though, economists and political analysts are divided over what, or who, is to blame for them.

Sri Lanka’s economy has been paraded, even by some radical commentators, as “export-dependent.” Yet it has been running trade deficits for the last 50 years. Its exports include primary commodities like tea, textiles, and tourism. It also earns remittances from migrant workers, many of whom effectively subsidise West Asian economies.These sectors took a hit from the COVID-19 pandemic. While tourism was on its way up in February, most arrivals were from countries like Russia and Ukraine. Russia’s invasion of Ukraine thus, effectively, dealt a blow to hopes of a long-term revival.

Neoliberal economists, especially those linked to Colombo’s well-funded and well-oiled think-tanks, attribute the country’s problems to excessive money printing and government spending. They see the country’s public sector as bloated, politicised.To an extent, the latter view is correct. Sri Lanka’s bureaucracy has long been a preferred destination for unemployed graduates and the politically connected. While Gotabaya Rajapaksa came to power implying he would end such a culture, he reversed course two years later and hired 65,000 graduates to the state sector. Ironically enough, it is their peers who are occupying the frontlines of anti-government protests today.

The heterodox view: Industrialisation and local production

Heterodox economists see things differently. According to them, Sri Lanka’s problems have had to do with its failure to industrialise and shift to manufacture.One of Gotabaya Rajapaksa’s first decisions, after coming to power in 2019, was to appoint Dr W. D. Lakshman, a proponent of industrialisation, as the Governor of the Central Bank. Economic analyst Shiran Illanperuma describes Dr Lakshman’s appointment as having been “poorly received by comprador capitalists and economists.” Lakshman earned the wrath of this crowd heavily after he began enacting policies aimed, ostensibly, at stimulating growth, including a series of tax cuts which have now been reversed.

Another of the country’s biggest advocates of industrialisation is Dr Howard Nicholas. A Senior Lecturer in Economics at the International Institute of Social Studies at the Erasmus University of Rotterdam, the Netherlands, Dr Nicholas helped set up the Institute of Policy Studies (IPS), a think-tank that advocated industrialisation, in the late 1980s.In its first few years, the IPS promoted alternative development strategies. Its advocacy of these strategies was received positively by then president, Ranasinghe Premadasa; based on its recommendations, he spearheaded an ambitious Garment Factory Programme which provided jobs to the rural sector while stimulating growth. This was around the same time Vietnam embarked on export-led industrialisation via its apparel sector.

According to Dr Nicholas, Sri Lanka’s prospects were bright in the 1990s. It even had the potential to surpass Vietnam. Yet with the assassination of Premadasa and the election in 1994 of a regime that modelled itself on Clintonian Third Way Centrist lines, industrialisation was abandoned in favour of outright privatisation and deregulation.The new strategy filled the government coffers – for a while. But with the escalation of the civil war and, paradoxically, the elevation of the country to middle-income status in the 2000s, Sri Lanka found it hard to access traditional aid programmes. It was at that juncture that it started moving into international bond markets.

While Western media and think-tanks propagate Chinese debt trap narratives, it has been Sri Lanka’s reliance on bond markets, which constitute a greater proportion of its external debt than does China, that finally brought its economy to its knees.To be sure, over the years several groups have highlighted these concerns. Yet, they differ as to the strategies and tactics needed to chart a way out of the crisis.

Neoliberal commentators argue that the private sector should take the lead. But Sri Lanka’s private sector is dominated by rentiers. Moreover, the country’s exports are limited to commodities and tourism, along with sectors such as IT. These themselves are dependent heavily on imported raw materials and intermediate capital goods.According to Harvard University’s Atlas of Economic Complexity, Sri Lanka’s largest exports are in “moderate and low complexity products”, like textiles. This contrasts with Vietnam, where textiles are more highly complex. Sri Lanka is also seeing “a static pattern of export growth.” In other words, while in 1990 it could boast of much potential in garments, by the early 2000s the sector’s prospects had considerably reduced.

To resolve the economic crisis, heterodox economists and analysts thus contend that the government must oversee a radical, socialist strategy, centring on import-substitution and local production: a dreary, dismal prospect for Colombo’s neoliberal coterie.

Leaderless protests and lack of alternatives

Sadly, the protests themselves seem little concerned by these imperatives. As has been pointed out by Rathindra Kuruwita in The Diplomat, they remain leaderless and rudderless. This has exposed them considerably to the risk of manipulation.Thus, while the protesters have called for Rajapaksa’s resignation and coupled it with demands for the resignation of all parliamentarians, they have also claimed that the latter demand, which delegitimises the country’s legislature and empowers the Executive, was incorporated into the protests by government supporters. Moreover, many of them fault the government for not going to the IMF earlier, failing to realise that the IMF’s track record in the Global South, during the COVID-19 pandemic, has been questionable.

More seriously, none of the protesters seem aware of what led to the crisis in the first place. To quote Dr Asoka Bandarage of the California Institute of Integral Studies, they “have not been able to put forward an alternative leadership or a viable road map for the future” and seem “unaware of the global dynamics” of the crisis.

Gotagogama, the site of the protests at Galle Face Green, has played host to several radical activists and artists, many of them linked to Marxist, anarchist, and other anti-government parties and alliances. Yet even these groups have failed to call attention to the wider issues. Those that have, like workers’ collectives and leftist commentators, have been marginalised by neoliberal discourses and populist demands for resignations.

The failures of governance and the road ahead

On the other hand, unfortunate as it has been for advocates of alternative development, the government has failed to appreciate the importance of their recommendations. A combination of corruption, ineptitude, and an eagerness to capitulate has thus put alternative development, and industrialisation, on the backburner.Milco is a case in point. Sri Lanka’s state-owned milk manufacturer, Milco recorded profits after a while last year. Yet a year or so after this milestone in the island’s public sector, the government replaced its chairman rather inexplicably. Such actions, multiplied many times over, have only distanced capable individuals from the State.

At one level, all this fits in with South Asia’s legacy of dynastic politics. From India to Bangladesh, the subcontinent is hardly a stranger to family rule. The Rajapaksas are no exception there: despite the recent spurt in anti-government protests, members of the family continue to hold important positions in the country.However, at another level, the Rajapaksa family has gone well beyond the regional model. As the country’s leading political analyst Dr Dayan Jayatilleka has observed, “this is not the Asian phenomenon of familial succession in politics, which is serial and sequential. The contemporary Sri Lankan phenomenon and process is both sequential and simultaneous, vertical and horizontal.” In other words, while family rule in the rest of Asia has served to sustain the political system, in Sri Lanka it has led to its very dismantlement. This includes the Rajapaksas’ deployment of the military, and allegations of militarisation in the north and east of the country: regions which bore the brunt of a 30-year civil war.

Nevertheless, despite all this, it goes without saying that what protesters consider as the government’s failures have been symptoms, rather than causes, of the structural faults underpinning the economy. The government must share the blame for this: in particular, its tendency to surround itself with yes-men and henchmen.Yet beyond this narrative, there is a far more compelling problem: a failure to resolve pressing issues like the island’s dependence on imports and sovereign debt. That in itself is linked to the sprawling global debt crisis, which has extended to other countries. While not all protesters are oblivious to these priorities, many of them are yet to address them fully. So long as debates over the crisis remain dominated by narratives of corruption and political personalities, such problems will go unnoticed and unresolved.

(The writer is an international relations analyst, researcher, and columnist based in Sri Lanka who can be reached at udakdev1@gmail.com. A shorter version of this article appeared in Global South Development Magazine.)

Opinion

What BNP should keep in mind as it assumes power

BNP rightly deserves our congratulations for winning a decisive victory in the 13th parliamentary election. This outcome reflects an unequivocal mandate that is both politically and historically significant. Coming as it does at a critical point in Bangladesh’s democratic journey, this moment marks more than a change of government; it signals a renewed public resolve to restore democratic norms, accountability, and institutional integrity.

The election came after years of severe distrust in the electoral process, questions over legitimacy, and institutional strain, so the poll’s successful conduct has reinforced trust in the process as well as the principle that governments derive authority from the consent of the governed. For quite some time now, Bangladesh has faced deep polarisation, intolerance, and threats to its democratic foundations. Regressive and anti-democratic tendencies—whether institutional, ideological, or political—risked steering the country away from its foundational goals. BNP’s decisive victory can therefore be interpreted as a call to reverse this trajectory, and a public desire for accountable, forward-looking governance rooted in liberal democratic principles.

However, the road ahead is going to be bumpy, to put it mildly. A broad mandate alone cannot resolve deep-rooted structural problems. The BNP government will likely continue to face economic challenges and institutional constraints for the foreseeable future. This will test its capacity and sincerity not only to govern but also to transform the culture of governance in the country.

Economic reform imperatives

A key challenge will be stabilising the economy, which continues to face mounting pressures: growth has decelerated, inflation has eroded people’s purchasing power, foreign exchange reserves remain low, and public finances are tight. External debt has increased significantly in recent years, while the tax-to-GDP ratio has fallen to historically low levels. State-owned enterprises and the banking sector face persistent structural weaknesses, and confidence among both domestic and international investors remains fragile.

The new government should begin by restoring macroeconomic discipline. Containing inflation will need close coordination across ministries and agencies. Monetary policy must remain cautious and credible, free from political interference, while fiscal policy should prioritise stability rather than expand populist spending.

Tax reform is also unavoidable. The National Board of Revenue requires comprehensive modernisation, digitalisation, and total compliance. Broadening the tax base, especially by bringing all high-income groups and segments of the informal economy into the formal system, is crucial. Over time, reliance on indirect taxes such as value-added tax and import duties should be reduced, paving the way for a more progressive direct tax regime.

Banking sector reform is equally crucial. Proper asset quality reviews and regulatory oversight are necessary to rebuild confidence in the sector. Political patronage within the financial institutions must end. Without a resilient financial system, private investment cannot recover. As regards growth, the government should focus on diversifying exports beyond ready-made garments and deepening integration into regional value chains. Attracting foreign direct investment will depend on regulatory predictability and improvements in logistics and energy reliability. Ambitious growth targets must be matched by realistic implementation capacity.

Political Challenges

Distrust among political actors, partly fuelled by fears of retribution and violence, is a reality that may persist. BNP will face pressure from its supporters to act quickly in addressing perceived injustices, but good governance demands restraint. If the new government resorts to or tolerates exclusion or retaliation, it will risk perpetuating the very cycle it has condemned.

Managing internal party discipline will also be crucial, as a large parliamentary majority can sometimes lead to complacency or factional rivalry. Strong leadership will be required to maintain unity while allowing constructive internal debate. BNP must also rebuild trust with minority communities and vulnerable groups. Elections often heighten anxieties among minorities, so a credible commitment to equal citizenship is crucial. BNP’s political maturity will also be judged by how it treats or engages with its opponents. In this regard, Chairman Tarique Rahman’s visits to the residences of top opposition leaders on Sunday marked a positive gesture, one that many hope will withstand the inevitable pressures or conflicts over governance in the coming days.

Strengthening democratic institutions

A central promise of this election was to restore democracy, which must now translate into concrete institutional reforms. Judicial independence needs constant safeguarding. Which means that appointment, promotion, and case management processes should be insulated from political influence. Parliamentary oversight committees must also function effectively, and the opposition’s voice in parliament must be protected.

Electoral institutions also need reform, particularly along the lines of the July Charter. Continued credibility of the Election Commission will depend on transparency, professional management, and impartiality. Meanwhile, the civil service must be depoliticised. Appointments based on loyalty rather than merit have long undermined governance in the country. So the new administration must work on curtailing the influence of political networks to ensure a professional, impartial civil service. Media reform and digital rights also deserve careful attention. We must remember that democratic consolidation is built through institutional habits, and these habits must be established early.

Beyond winner-takes-all

Bangladesh’s politics has long been characterised by a winner-takes-all mentality. Electoral victories have often resulted in monopolisation of power, marginalising opposition voices and weakening checks and balances. If BNP is serious about democratic renewal, it must consciously break with this tradition. Inclusive policy consultations will be a good starting point. Major economic and constitutional reforms should be based on cross-party dialogue and consensus. Appointments to constitutional bodies should be transparent and consultative, and parliamentary debates should be done with the letter and spirit of the July Charter in mind.

Meeting public expectations

The scale of public expectations now is naturally immense. Citizens want economic relief, employment opportunities, necessary institutional reforms, and improved governance. Managing these expectations will be quite difficult. Many reforms will not yield immediate results, and some may impose short-term costs. So, it is imperative to ensure transparent communication about the associated timelines, trade-offs, and fiscal constraints.

Anti-corruption efforts must be credible and monitored at all times. Measures are needed to strengthen oversight institutions, improve transparency in public procurement, and expand digital service delivery to reduce opportunities for rent-seeking. Governance reform should be systematic, not selective or politically driven. Tangible improvements are urgently needed in public service delivery, particularly in health, education, social protection, and local government.

Finally, a word of caution: BNP’s decisive victory presents both opportunities and risks. It can enable bold reforms but it also carries the danger of overreach. The key deciding factor here is political judgment. The question is, can our leaders deliver based on the mandate voters have given them? (The Daily Star)

Dr Fahmida Khatun is an economist and executive director at the Centre for Policy Dialogue (CPD). Views expressed in the article are the author’s own.

Views expressed in this article are the author’s own.

by Fahmida Khatun

Opinion

Why religion should remain separate from state power in Sri Lanka: Lessons from political history

Religion has been an essential part of Sri Lankan society for more than two millennia, shaping culture, moral values, and social traditions. Buddhism in particular has played a foundational role in guiding ethical behaviour, promoting compassion, and encouraging social harmony. Yet Sri Lanka’s modern political history clearly shows that when religion becomes closely entangled with state power, both democracy and religion suffer. The politicisation of religion especially Buddhism has repeatedly contributed to ethnic division, weakened governance, and the erosion of moral authority. For these reasons, the separation of religion and the state is not only desirable but necessary for Sri Lanka’s long-term stability and democratic progress.

Sri Lanka’s post-independence political history provides early evidence of how religion became a political tool. The 1956 election, which brought S. W. R. D. Bandaranaike to power, is often remembered as a turning point where Sinhala-Buddhist nationalism was actively mobilised for political expedience. Buddhist monks played a visible role in political campaigning, framing political change as a religious and cultural revival. While this movement empowered the Sinhala-Buddhist majority, it also laid the foundation for ethnic exclusion, particularly through policies such as the “Sinhala Only Act.” Though framed as protecting national identity, these policies marginalised Tamil-speaking communities and contributed significantly to ethnic tensions that later escalated into civil conflict. This period demonstrates how religious symbolism, when fused with state power, can undermine social cohesion rather than strengthen it.

The increasing political involvement of Buddhist monks in later decades further illustrates the risks of this entanglement. In the early 2000s, the emergence of monk-led political parties such as the Jathika Hela Urumaya (JHU) marked a new phase in Sri Lankan politics. For the first time, monks entered Parliament as elected lawmakers, directly participating in legislation and governance. While their presence was justified as a moral corrective to corrupt politics, in practice it blurred the boundary between spiritual leadership and political power. Once monks became part of parliamentary debates, policy compromises, and political rivalries, they were no longer perceived as neutral moral guides. Instead, they became political actors subject to criticism, controversy, and public mistrust. This shift significantly weakened the traditional reverence associated with the Sangha.

Sri Lankan political history also shows how religion has been repeatedly used by political leaders to legitimise authority during times of crisis. Successive governments have sought the public endorsement of influential monks to strengthen their political image, particularly during elections or moments of instability. During the war, religious rhetoric was often used to frame the conflict in moral or civilisational terms, leaving little room for nuanced political solutions or reconciliation. This approach may have strengthened short-term political support, but it also deepened ethnic polarisation and made post-war reconciliation more difficult. The long-term consequences of this strategy are still visible in unresolved ethnic grievances and fragile national unity.

Another important historical example is the post-war period after 2009. Despite the conclusion of the war, Sri Lanka failed to achieve meaningful reconciliation or strong democratic reform. Instead, religious nationalism gained renewed political influence, often used to silence dissent and justify authoritarian governance. Smaller population groups such as Muslims and Christians in particular experienced growing insecurity as extremist groups operated with perceived political protection. The state’s failure to maintain religious neutrality during this period weakened public trust and damaged Sri Lanka’s international reputation. These developments show that privileging one religion in state power does not lead to stability or moral governance; rather, it creates fear, exclusion, and institutional decay.

The moral authority of religion itself has also suffered as a result of political entanglement. Traditionally, Buddhist monks were respected for their distance from worldly power, allowing them to speak truth to rulers without fear or favour. However, when monks publicly defend controversial political decisions, support corrupt leaders, or engage in aggressive nationalist rhetoric, they risk losing this moral independence. Sri Lankan political history demonstrates that once religious figures are seen as aligned with political power, public criticism of politicians easily extends to religion itself. This has contributed to growing disillusionment among younger generations, many of whom now view religious institutions as extensions of political authority rather than sources of ethical guidance.

The teachings of the Buddha offer a clear contrast to this historical trend. The Buddha advised rulers on ethical governance but never sought political authority or state power. His independence allowed him to critique injustice and moral failure without compromise. Sri Lanka’s political experience shows that abandoning this principle has harmed both religion and governance. When monks act as political agents, they lose the freedom to challenge power, and religion becomes vulnerable to political failure and public resentment.

Sri Lanka’s multi-religious social structure nurtures divisive, if not separatist, sentiments. While Buddhism holds a special historical place, the modern state governs citizens of many faiths. Political history shows that when the state appears aligned with one religion, minority communities feel excluded, regardless of constitutional guarantees. This sense of exclusion has repeatedly weakened national unity and contributed to long-term conflict. A secular state does not reject religion; rather, it protects all religions by maintaining neutrality and ensuring equal citizenship.

Sri Lankan political history clearly demonstrates that the fusion of religion and state power has not produced good governance, social harmony, or moral leadership. Instead, it has intensified ethnic divisions, weakened democratic institutions, and damaged the spiritual credibility of religion itself. Separating religion from the state is not an attack on Buddhism or Sri Lankan tradition. On the contrary, it is a necessary step to preserve the dignity of religion and strengthen democratic governance. By maintaining a clear boundary between spiritual authority and political power, Sri Lanka can move toward a more inclusive, stable, and just society one where religion remains a source of moral wisdom rather than a tool of political control.

In present-day Sri Lanka, the dangers of mixing religion with state power are more visible than ever. Despite decades of experience showing the negative consequences of politicised religion, religious authority continues to be invoked to justify political decisions, silence criticism, and legitimise those in power. During recent economic and political crises, political leaders have frequently appeared alongside prominent religious figures to project moral legitimacy, even when governance failures, corruption, and mismanagement were evident. This pattern reflects a continued reliance on religious symbolism to mask political weakness rather than a genuine commitment to ethical governance.

The 2022 economic collapse offers a powerful contemporary example. As ordinary citizens faced shortages of fuel, food, and medicine, public anger was directed toward political leadership and state institutions. However, instead of allowing religion to act as an independent moral force that could hold power accountable, sections of the religious establishment appeared closely aligned with political elites. This alignment weakened religion’s ability to speak truthfully on behalf of the suffering population. When religion stands too close to power, it loses its capacity to challenge injustice, corruption, and abuse precisely when society needs moral leadership the most.

At the same time, younger generations in Sri Lanka are increasingly questioning both political authority and religious institutions. Many young people perceive religious leaders as participants in political power structures rather than as independent ethical voices. This growing scepticism is not a rejection of spirituality, but a response to the visible politicisation of religion. If this trend continues, Sri Lanka risks long-term damage not only to democratic trust but also to religious life itself.

The present moment therefore demands a critical reassessment. A clear separation between religion and the state would allow religious institutions to reclaim moral independence and restore public confidence. It would also strengthen democracy by ensuring that policy decisions are guided by evidence, accountability, and inclusive dialogue rather than religious pressure or nationalist rhetoric. Sri Lanka’s recent history shows that political legitimacy cannot be built on religious symbolism alone. Only transparent governance, social justice, and equal citizenship can restore stability and public trust.

Ultimately, the future of Sri Lanka depends on learning from both its past and present. Protecting religion from political misuse is not a threat to national identity; it is a necessary condition for ethical leadership, democratic renewal, and social harmony in a deeply diverse society.

by Milinda Mayadunna

Opinion

NPP’s misguided policy

Judging by some recent events, starting with the injudicious pronouncement in Jaffna by President Anura Kumara Dissanayake and subsequent statements by some senior ministers, the government tends to appease minorities at the expense of the majority. Ill-treatment of some Buddhist monks by the police continues to arouse controversy, and it looks as if the government used the police to handle matters that are best left to the judiciary. Sangadasa Akurugoda concludes his well-reasoned opinion piece “Appeasement of separatists” (The island, 13 February) as follows:

“It is unfortunate that the President of a country considers ‘national pride and patriotism’, a trait that every citizen should have, as ‘racism’. Although the President is repeating it like a mantra that he will not tolerate ‘racism’ or ‘extremism’ we have never heard him saying that he will not tolerate ‘separatism or terrorism’.”

It is hard to disagree with Akurugoda. Perhaps, the President may be excused for his reluctance to refer to terrorism as he leads a movement that unleashed terror twice, but his reluctance to condemn separatism is puzzling. Although most political commentators consider the President’s comment that ‘Buddhist go to Jaffna to spread hate’ to be callous, the head of an NGO heaped praise on the President for saying so!

As I pointed out in a previous article, puppet-masters outside seem to be pulling the strings (A puppet show? The Island, 23 January) and the President’s reluctance to condemn separatism whilst accusing Buddhists of spreading hatred by going to Jaffna makes one wonder who these puppeteers are.

Another incident that raises serious concern was reported from a Buddhist Temple in Trincomalee. The police removed a Buddha statue and allegedly assaulted Buddhist priests. Mysteriously, the police brought back the statue the following day, giving an absurd excuse; they claimed they had removed it to ensure its safety. No inquiry into police action was instituted but several Bhikkhus and dayakayas were remanded for a long period.

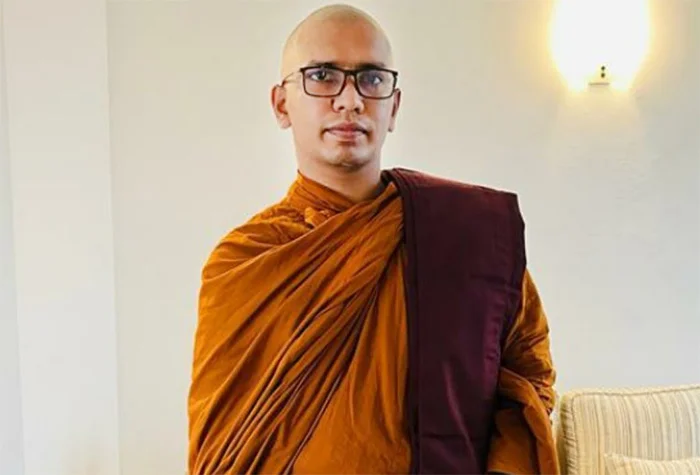

Having seen a front-page banner headline “Sivuru gelawenakam pahara dunna” (“We were beaten till the robes fell”) in the January 13th edition of the Sunday Divaina, I watched on YouTube the press briefing at the headquarters of the All-Ceylon Buddhist Association. I can well imagine the agony those who were remanded went through.

Ven. Balangoda Kassapa’s description of the way he and the others, held on remand, were treated raises many issues. Whether they committed a transgression should be decided by the judiciary. Given the well-known judicial dictum, ‘innocent until proven guilty’, the harassment they faced cannot be justified under any circumstances.

Ven. Kassapa exposed the high-handed actions of the police. This has come as no surprise as it is increasingly becoming apparent as they are no longer ‘Sri Lanka Police’; they have become the ‘NPP police’. This is an issue often editorially highlighted by The Island. How can one expect the police to be impartial when two key posts are held by officers brought out of retirement as a reward for canvassing for the NPP. It was surprising to learn that the suspects could not be granted bail due to objections raised by the police.

Ven. Kassapa said the head of the remand prison where he and others were held had threatened him.

However, there was a ray of hope. Those who cry out for reconciliation fail to recognise that reconciliation is a much-misused term, as some separatists masquerading as peacemakers campaign for reconciliation! They overlook the fact that it is already there as demonstrated by the behaviour of Tamil and Muslim inmates in the remand prison, where Ven. Kassapa and others were kept.

Non-Buddhist prisoners looked after the needs of the Bhikkhus though the prison chief refused even to provide meals according to Vinaya rules! In sharp contrast, during a case against a Sri Lankan Bhikkhu accused of child molestation in the UK, the presiding judge made sure the proceedings were paused for lunch at the proper time.

I have written against Bhikkhus taking to politics, but some of the issues raised by Ven. Kassapa must not be ignored. He alleges that the real reason behind the conflict was that the government was planning to allocate the land belonging to the Vihara to an Indian businessman for the construction of a hotel. This can be easily clarified by the government, provided there is no hidden agenda.

It is no secret that this government is controlled by India. Even ‘Tilvin Ayya’, who studied the module on ‘Indian Expansionism’ under Rohana Wijeweera, has mended fences with India. He led a JVP delegation to India recently. Several MoUs or pacts signed with India are kept under wraps.

Unfortunately, the government’s mishandling of this issue is being exploited by other interested parties, and this may turn out to be a far bigger problem.

It is high time the government stopped harassing the majority in the name of reconciliation, a term exploited by separatists to achieve their goals!

By Dr Upul Wijayawardhana

-

Life style6 days ago

Life style6 days agoMarriot new GM Suranga

-

Business5 days ago

Business5 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features6 days ago

Features6 days agoMonks’ march, in America and Sri Lanka

-

Features6 days ago

Features6 days agoThe Rise of Takaichi

-

Features6 days ago

Features6 days agoWetlands of Sri Lanka:

-

News6 days ago

News6 days agoThailand to recruit 10,000 Lankans under new labour pact

-

News6 days ago

News6 days agoMassive Sangha confab to address alleged injustices against monks

-

Sports2 days ago

Sports2 days agoOld and new at the SSC, just like Pakistan