Features

Sri Lanka’s 2026 Budget: Fiscal balance meets economic progress

The government budget is the nation’s key economic policy document — the primary instrument through which a state translates its political priorities into concrete economic action. Sri Lanka’s 2026 Budget comes at a crucial juncture, following the severe macroeconomic crisis of 2022, the implementation of an IMF-supported stabilization programme, and the ongoing debt restructuring process. As the country enters a phase of gradual recovery, the government faces the delicate task of balancing fiscal discipline, social protection, and growth-oriented investment.

A government budget functions both as a financial plan and a policy document. It outlines projected revenues and planned expenditures for a fiscal year, sets tax and spending priorities, and articulates the government’s broader macroeconomic objectives — economic growth, price stability, social equity, and debt sustainability. Unlike a corporate budget focused purely on profits and losses, a national budget integrates non-financial policy objectives such as welfare, security, and the provision of public goods, while also reflecting political trade-offs and long-term commitments like pensions and public debt.

Why the budget matters:

= Macroeconomic stability: The budget shapes fiscal deficits, public debt paths, and influences inflation and interest rates. Sound fiscal management builds confidence among investors, international partners, and citizens alike.

= Resource allocation: Through its expenditure framework, the budget determines how resources are distributed among key sectors such as health, education, and infrastructure, directly affecting service delivery and development outcomes.

= Redistribution: Taxation and social transfer mechanisms embedded within the budget play a key role in determining income distribution and social equity.

= Signalling and governance: The budget serves as a policy signal to both markets and the public. A transparent and accountable budget process enhances trust, governance quality, and institutional credibility.

The Importance of the Government Budget

A national budget is more than a financial plan — it is the government’s main tool for turning policy goals into economic action. Its impact extends across all sectors of society, shaping stability, confidence, and development.

= For the Economy:

A credible budget anchors macroeconomic expectations, manages fiscal deficits, and supports investment by ensuring stability and predictability.

= For Investors:

It signals policy direction on taxation, spending, and fiscal priorities. Transparent and consistent budgeting reduces risk and builds investor confidence.

= For Households:

Budgets fund essential services such as health, education, and social protection, helping safeguard vulnerable groups and promote inclusive growth.

= For Public Institutions:

They guide operational priorities of ministries while ensuring transparency and accountability through parliamentary and civic oversight.

= For Creditors and Partners:

Budgets demonstrate fiscal discipline and reform commitment, strengthening credibility with international lenders and development agencies.

Characteristics of a “Best Practice” Government Budget

= Macroeconomic Consistency: Based on realistic, transparent assumptions for GDP, inflation, and interest rates, aligned with monetary policy.

= Fiscal Sustainability: Maintains credible deficit and debt targets within a medium-term fiscal framework.

= Strategic Focus: Links annual spending to medium-term policy goals and development priorities.

= Prioritization & Efficiency: Directs funds to high-impact investments and social protection while reducing wasteful spending.

= Transparency: Ensures public access to budget data, fostering accountability and investor trust.

= Realistic Revenue & Tax Design: Uses conservative revenue estimates and broad, fair, growth-friendly taxation.

= Strong Public Financial Management: Strengthens controls, procurement, and cash management to reduce leakages.

= Countercyclical Flexibility: Allows fiscal adjustment to respond effectively to economic shocks.

= Inclusivity: Protects vulnerable groups through funding for welfare, education, and healthcare.

= Monitoring & Evaluation: Uses measurable indicators and reviews to enhance performance and accountability.

Special Features of Sri Lanka’s 2026 Budget

Sri Lanka’s 2026 Budget marks a shift from crisis recovery to sustainable growth while staying aligned with IMF-supported fiscal frameworks. It emphasizes fiscal discipline, revenue mobilization, and investment-led growth.

Key Highlights:

= IMF Alignment: The budget follows IMF fiscal targets on deficit reduction, revenue growth, and achieving a primary surplus to restore debt sustainability.

· Revenue Mobilization: Focus on expanding the tax base, improving administration, and digitalizing systems to raise revenue-to-GDP ratios sustainably.

= Debt Management: Debt restructuring eased pressures but requires transparent reporting and credible medium-term plans to maintain stability.

= Capital Expenditure Push: Increased capital spending to close infrastructure gaps and stimulate private investment and productivity.

= Subsidy and Expenditure Reform: Rationalizing subsidies and recurrent costs while protecting key social sectors like health, education, and welfare.

= Transparency and PFM Reforms: Ongoing improvements in treasury operations, cash-flow forecasting, and procurement to enhance accountability.

Fiscal and Monetary Policy Coordination

Fiscal policy (spending and taxation) and monetary policy (interest rates and liquidity) must work together for stability.

= Debt & Interest Rates: Large deficits can raise interest rates and crowd out private credit; external borrowing raises currency risks.

= Inflation Control: Expansionary budgets can fuel inflation, prompting tighter monetary policy and higher borrowing costs.

= Policy Coordination: Fiscal discipline supports central bank independence and price stability.

Sri Lanka’s Central Bank has maintained a cautious stance ahead of the 2026 Budget — balancing growth support with inflation control.

Singapore – Fiscal Prudence & Institutional Strength

= Focuses on long-term stability, protected reserves, and efficient use of surpluses.

= Invests in competitiveness, human capital, and innovation.

= Strong institutions and transparent fiscal management ensure sustainable growth.

= Lesson: Strengthen PFM systems, build fiscal buffers, and focus on high-return investments.

India – Scale & Infrastructure-Led Growth

= Uses large infrastructure spending and social programs to drive employment and consumption.

= Leverages PPPs and incentives to attract private investment.

= Balances higher deficits with strong growth potential.

= Lesson: Invest in infrastructure, expand PPPs, and manage fiscal risks carefully.

Sri Lanka must balance Singapore’s fiscal discipline with India’s growth-driven investment — building a resilient, inclusive, and forward-looking fiscal framework aligned with its Vision 2048 goals.

Sri Lanka’s Appropriation Bill 2026

Sri Lanka’s Appropriation Bill 2026, which projects total government expenditure at Rs. 4,434.36 billion for the period from January 1 to December 31, 2026, marks a critical point in the nation’s post-crisis recovery path.

After several years of fiscal strain, mounting external debt obligations, and persistent inflationary pressures, the 2026 budget seeks to strike a delicate balance among three key objectives: macroeconomic stabilization, social welfare protection, and structural economic transformation. However, achieving this balance remains a significant challenge.

Expenditure Overview:

= Total Government Expenditure: Rs. 4,434.36 billion

=Recurrent Expenditure: Rs. 3,028.75 billion (68% of total)

= Capital Expenditure: Rs. 1,405.60 billion (32% of total)

This composition reflects Sri Lanka’s enduring fiscal structure, where recurrent spending—driven by public sector salaries, pensions, interest obligations, and subsidies—continues to dominate.

From an economic perspective, this 68:32 ratio highlights the country’s limited fiscal flexibility. For a more sustainable and growth-oriented fiscal path, economists often advocate for a 60:40 ratio, ensuring that a greater share of government expenditure supports capital formation, infrastructure development, and innovation-driven growth.

Fiscal Interpretation

= The recurrent-heavy composition signals fiscal rigidity — the inability of the government to reallocate spending efficiently due to structural commitments.

= Capital expenditure, though improved in nominal terms, still constrains the government’s ability to finance long-term infrastructure, technology, and competitiveness improvements.

= The dominance of consumption-oriented expenditure over investment spending implies that fiscal policy is still more focused on stability and social continuity than on transformation and growth. (See Figure 1)

High-Expenditure Ministries

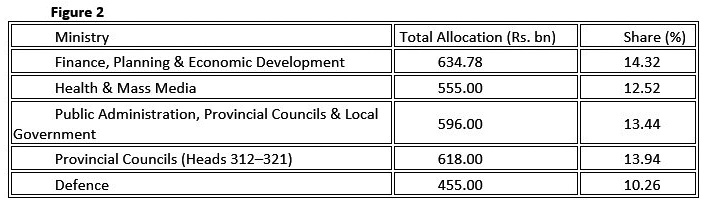

These five ministries alone account for nearly 65% of the total national expenditure, reflecting the government’s concentration on administration, debt service, and essential social services.

Capital-Intensive Ministries

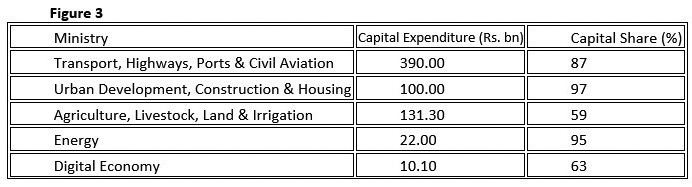

Some ministries stand out for their high proportion of capital investment, signaling their developmental role:

These allocations emphasize infrastructure development, urban expansion, and irrigation improvement — key pillars of physical and economic connectivity. However, the digital and renewable sectors, though strategically vital, still receive relatively modest allocations compared to traditional infrastructure.

Low-Allocation and Emerging Sectors

Several ministries receive less than 1% of total spending — including Environment (0.41%), Digital Economy (0.36%), Youth and Sports (0.30%), and Science and Technology (0.14%).

From an economist’s perspective, this signals a policy gap between stated national goals (e.g., digital transformation, climate resilience, innovation) and actual fiscal commitment. For a modern economy aspiring to transition toward a knowledge- and technology-driven model, such underfunding represents a missed opportunity.

Key Economic Insights and Structural Issues

The Weight of Recurrent Commitments

Public sector salaries, pensions, and debt servicing consume the majority of recurrent expenditure. This pattern leaves limited fiscal space for productivity-enhancing spending. In 2026, the Ministry of Finance alone accounts for Rs. 634.78 billion, largely reflecting interest and debt repayments, which absorb a significant share of GDP.

Economists caution that such fiscal patterns can lead to a “crowding out effect”, where public debt obligations limit the government’s capacity to invest in education, research, and entrepreneurship — areas critical for long-term economic competitiveness.

Defence and Administrative Overheads

Despite the absence of internal conflict, defence expenditure (Rs. 455 billion) remains over 10% of total expenditure, surpassing allocations for education, agriculture, or digital development. While national security is indispensable, reallocating even a small portion of defence spending toward research, innovation, and human capital could yield higher socio-economic returns.

Social Sector Balance

= Health (Rs. 555 billion) maintains a robust 12.5% share — a positive sign of post-pandemic resilience and continued investment in public healthcare.

= Education (Rs. 301 billion) receives only 6.8%, lower than the global average of 4–6% of GDP recommended by UNESCO for developing nations.

= The Women and Child Affairs (Rs. 16.4 billion) and Social Empowerment (Rs. 38.6 billion) ministries, though small in absolute terms, play crucial roles in human capital and inclusion, yet remain underfunded.

Capital Development and Growth Drivers

Infrastructure-related ministries — particularly Transport, Urban Development, and Agriculture — exhibit a more development-oriented focus. The Rs. 390 billion capital investment in transport aligns with the government’s ambition to modernize logistics, reduce bottlenecks, and attract investment in ports and civil aviation.

However, without parallel reforms in energy, industry, and entrepreneurship, the long-term multiplier effects of these capital projects may remain limited.

Comparative Economic Context

a) India and Singapore as Contrasts

= India’s Union Budget 2025–26 allocates around 37% for capital expenditure, emphasizing infrastructure, manufacturing, and renewable energy.

= Singapore, though smaller, channels over 45% of its annual spending into development projects, digital economy infrastructure, and R&D.

In comparison, Sri Lanka’s 32% capital ratio indicates a more conservative fiscal structure, constrained by debt obligations and revenue limitations.

b) Regional Benchmarking

Countries like Bangladesh and Vietnam have prioritized industrial policy and export competitiveness, leading to GDP growth rates exceeding 6%. Sri Lanka’s fiscal design, heavily skewed toward recurrent expenditure, risks prolonging stagnant productivity unless structural adjustments are made.

Fiscal Policy Implications

a) Fiscal Discipline vs. Growth Ambition

The 2026 Appropriation Bill shows clear signs of fiscal consolidation under IMF guidance — maintaining expenditure discipline while avoiding excessive borrowing. However, fiscal consolidation must be paired with growth-oriented fiscal policy, ensuring that expenditure quality improves, not just expenditure control.

b) Revenue and Deficit Management

= Tax administration efficiency and digital compliance systems.

= Widening of the tax base, especially through formalizing the informal economy.

= Reduction of tax exemptions that erode fiscal capacity.

Without improved revenue mobilization, dependence on domestic and external borrowing could perpetuate debt vulnerability and currency instability.

Monetary and Macro Linkages

Sri Lanka’s fiscal stance directly influences monetary stability. With recurrent expenditure at 68%, the government must rely on short-term borrowing and domestic credit expansion, which can pressure interest rates and exchange rates.

A prudent coordination between the Central Bank’s monetary tightening and the Treasury’s fiscal strategy is essential to prevent inflationary resurgence and maintain external credibility.

Investment Climate and Private Sector Response

From an investor’s perspective, the 2026 budget sends mixed signals.

= On one hand, infrastructure allocations (transport, urban development, irrigation) enhance long-term investment attractiveness and logistics efficiency.

= On the other, persistent fiscal rigidity, high administrative expenditure, and low innovation investment limit the country’s competitiveness in attracting FDI and technology ventures.

To strengthen investor confidence, future budgets must:

= Provide predictable fiscal policy.

= Enhance public-private partnership (PPP) frameworks.

= Support digital transformation, start-up ecosystems, and green industries.

Social and Human Development Dimensions

Economic recovery must be inclusive. With poverty and inequality still elevated post-crisis, social spending quality becomes crucial. The allocations to education, health, women, and youth are essential, yet insufficient to drive structural transformation.

A more effective approach would involve targeted social protection, skills development, and employment-linked welfare programs, particularly for rural and marginalized communities.

Recommendations

= Rebalancing Recurrent vs. Capital Spending

Shift gradually from 68:32 to 60:40, prioritizing productive investment in technology, transport, and renewable energy.

= Performance-Based Budgeting

· Introduce outcome-oriented metrics for ministries — measuring not only spending but impact (e.g., literacy, employment, exports).

= Fiscal Decentralization

· Strengthen provincial councils’ fiscal autonomy while ensuring transparent reporting and auditing.

= Innovation and R&D Investment

· Allocate at least 1% of GDP for science, research, and innovation — critical for productivity growth.

= Public Sector Reform

· Rationalize administrative structures and adopt digital systems to reduce recurrent overhead.

= Green and Digital Transformation

· Scale up investment in renewable energy, climate adaptation, and digital infrastructure, positioning Sri Lanka within the global sustainability agenda.

Conclusion

The Sri Lankan Appropriation Bill 2026 represents a budget of stabilization and continuity, rather than bold transformation. While it ensures essential services, administrative continuity, and gradual infrastructure recovery, it still reflects the weight of historical fiscal constraints.

The economic direction is cautiously positive — signaling discipline under IMF guidance and a slow shift toward investment-led growth. However, to truly unlock its economic potential, Sri Lanka must redefine its spending priorities — from consumption to creation, from protection to production.

A resilient and prosperous Sri Lankan economy will require not only balanced books but balanced vision — one that aligns fiscal responsibility with innovation, inclusivity, and sustainable growth.

Visvalingam Muralithas

is a researcher in the legislative sector, specializing in policy analysis and economic research. He is currently pursuing a PhD in Economics at the University of Colombo, with a research focus on governance, development, and sustainable growth.

He holds a Bachelor of Arts in Economics (Honours) from the University of Jaffna and a Master’s degree in Economics from the University of Colombo. His academic background is further strengthened by postgraduate diplomas in Education from the Open University of Sri Lanka and in Monitoring and Evaluation from the University of Sri Jayewardenepura.

In addition to his research work, Muralithas has contributed to academia by teaching economics at the University of Colombo and the Institute of Bankers of Sri Lanka (IBSL), and has also gained industry experience as an investment advisor at a stock brokerage firm affiliated with the Colombo Stock Exchange. Views are personal. He can be contacted at muralithas.v@gmail.com

by Visvalingam Muralithas

Features

Rethinking post-disaster urban planning: Lessons from Peradeniya

A recent discussion by former Environment Minister, Eng. Patali Champika Ranawaka on the Derana 360 programme has reignited an important national conversation on how Sri Lanka plans, builds and rebuilds in the face of recurring disasters.

His observations, delivered with characteristic clarity and logic, went beyond the immediate causes of recent calamities and focused sharply on long-term solutions—particularly the urgent need for smarter land use and vertical housing development.

Ranawaka’s proposal to introduce multistoried housing schemes in the Gannoruwa area, as a way of reducing pressure on environmentally sensitive and disaster-prone zones, resonated strongly with urban planners and environmentalists alike.

It also echoed ideas that have been quietly discussed within academic and conservation circles for years but rarely translated into policy.

One such voice is that of Professor Siril Wijesundara, Research Professor at the National Institute of Fundamental Studies (NIFS) and former Director General of the Royal Botanic Gardens, Peradeniya, who believes that disasters are often “less acts of nature and more outcomes of poor planning.”

“What we repeatedly see in Sri Lanka is not merely natural disasters, but planning failures,” Professor Wijesundara told The Island.

“Floods, landslides and environmental degradation are intensified because we continue to build horizontally, encroaching on wetlands, forest margins and river reservations, instead of thinking vertically and strategically.”

The former Director General notes that the University of Peradeniya itself offers a compelling case study of both the problem and the solution. The main campus, already densely built and ecologically sensitive, continues to absorb new faculties, hostels and administrative buildings, placing immense pressure on green spaces and drainage systems.

“The Peradeniya campus was designed with landscape harmony in mind,” he said. “But over time, ad-hoc construction has compromised that vision. If development continues in the same manner, the campus will lose not only its aesthetic value but also its ecological resilience.”

Professor Wijesundara supports the idea of reorganising the Rajawatte area—located away from the congested core of the university—as a future development zone. Rather than expanding inward and fragmenting remaining open spaces, he argues that Rajawatte can be planned as a well-designed extension, integrating academic, residential and service infrastructure in a controlled manner.

Crucially, he stresses that such reorganisation must go hand in hand with social responsibility, particularly towards minor staff currently living in the Rajawatte area.

“These workers are the backbone of the university. Any development plan must ensure their dignity and wellbeing,” he said. “Providing them with modern, safe and affordable multistoried housing—especially near the railway line close to the old USO premises—would be both humane and practical.”

According to Professor Wijesundara, housing complexes built near existing transport corridors would reduce daily commuting stress, minimise traffic within the campus, and free up valuable land for planned academic use.

More importantly, vertical housing would significantly reduce the university’s physical footprint.

Drawing parallels with Ranawaka’s Gannoruwa proposal, he emphasised that vertical development is no longer optional for Sri Lanka.

“We are a small island with a growing population and shrinking safe land,” he warned.

“If we continue to spread out instead of building up, disasters will become more frequent and more deadly. Vertical housing, when done properly, is environmentally sound, economically efficient and socially just.”

The veteran botanist also highlighted the often-ignored link between disaster vulnerability and the destruction of green buffers.

“Every time we clear a lowland, a wetland or a forest patch for construction, we remove nature’s shock absorbers,” he said.

“The Royal Botanic Gardens has survived floods for over a century precisely because surrounding landscapes once absorbed excess water. Urban planning must learn from such ecological wisdom.”

Professor Wijesundara believes that universities, as centres of knowledge, should lead by example.

“If an institution like Peradeniya cannot demonstrate sustainable planning, how can we expect cities to do so?” he asked. “This is an opportunity to show that development and conservation are not enemies, but partners.”

As climate-induced disasters intensify across the country, voices like his—and proposals such as those articulated by Patali Champika Ranawaka—underscore a simple but urgent truth: Sri Lanka’s future safety depends not only on disaster response, but on how and where we build today.

The challenge now lies with policymakers and planners to move beyond television studio discussions and academic warnings, and translate these ideas into concrete, people-centred action.

By Ifham Nizam ✍️

Features

Superstition – Major barrier to learning and social advancement

At the initial stage of my six-year involvement in uplifting society through skill-based initiatives, particularly by promoting handicraft work and teaching students to think creatively and independently, my efforts were partially jeopardized by deep-rooted superstition and resistance to rational learning.

Superstitions exerted a deeply adverse impact by encouraging unquestioned belief, fear, and blind conformity instead of reasoning and evidence-based understanding. In society, superstition often sustains harmful practices, social discrimination, exploitation by self-styled godmen, and resistance to scientific or social reforms, thereby weakening rational decision-making and slowing progress. When such beliefs penetrate the educational environment, students gradually lose the habit of asking “why” and “how,” accepting explanations based on fate, omens, or divine intervention rather than observation and logic.

Initially, learners became hesitant to challenge me despite my wrong interpretation of any law, less capable of evaluating information critically, and more vulnerable to misinformation and pseudoscience. As a result, genuine efforts towards social upliftment were obstructed, and the transformative power of education, which could empower individuals economically and intellectually, was weakened by fear-driven beliefs that stood in direct opposition to progress and rational thought. In many communities, illnesses are still attributed to evil spirits or curses rather than treated as medical conditions. I have witnessed educated people postponing important decisions, marriages, journeys, even hospital admissions, because an astrologer predicted an “inauspicious” time, showing how fear governs rational minds.

While teaching students science and mathematics, I have clearly observed how superstition acts as a hidden barrier to learning, critical thinking, and intellectual confidence. Many students come to the classroom already conditioned to believe that success or failure depends on luck, planetary positions, or divine favour rather than effort, practice, and understanding, which directly contradicts the scientific spirit. I have seen students hesitate to perform experiments or solve numerical problems on certain “inauspicious” days.

In mathematics, some students label themselves as “weak by birth”, which creates fear and anxiety even before attempting a problem, turning a subject of logic into a source of emotional stress. In science classes, explanations based on natural laws sometimes clash with supernatural beliefs, and students struggle to accept evidence because it challenges what they were taught at home or in society. This conflict confuses young minds and prevents them from fully trusting experimentation, data, and proof.

Worse still, superstition nurtures dependency; students wait for miracles instead of practising problem-solving, revision, and conceptual clarity. Over time, this mindset damages curiosity, reduces confidence, and limits innovation, making science and mathematics appear difficult, frightening, or irrelevant. Many science teachers themselves do not sufficiently emphasise the need to question or ignore such irrational beliefs and often remain limited to textbook facts and exam-oriented learning, leaving little space to challenge superstition directly. When teachers avoid discussing superstition, they unintentionally reinforce the idea that scientific reasoning and superstitious beliefs can coexist.

To overcome superstition and effectively impose critical thinking among students, I have inculcated the process to create a classroom culture where questioning was encouraged and fear of being “wrong” was removed. Students were taught how to think, not what to think, by consistently using the scientific method—observation, hypothesis, experimentation, evidence, and conclusion—in both science and mathematics lessons. I have deliberately challenged superstitious beliefs through simple demonstrations and hands-on experiments that allow students to see cause-and-effect relationships for themselves, helping them replace belief with proof.

Many so-called “tantrik shows” that appear supernatural can be clearly explained and exposed through basic scientific principles, making them powerful tools to fight superstition among students. For example, acts where a tantrik places a hand or tongue briefly in fire without injury rely on short contact time, moisture on the skin, or low heat transfer from alcohol-based flames rather than divine power.

“Miracles” like ash or oil repeatedly appearing from hands or idols involve concealment or simple physical and chemical tricks. When these tricks are demonstrated openly in classrooms or science programmes and followed by clear scientific explanations, students quickly realise how easily perception can be deceived and why evidence, experimentation, and critical questioning are far more reliable than blind belief.

Linking concepts to daily life, such as explaining probability to counter ideas of luck, or biology to explain illness instead of supernatural causes, makes rational explanations relatable and convincing.

Another unique example that I faced in my life is presented here. About 10 years ago, when I entered my new house but did not organise traditional rituals that many consider essential for peace and prosperity as my relatives believed that without them prosperity would be blocked. Later on, I could not utilise the entire space of my newly purchased house for earning money, largely because I chose not to perform certain rituals.

While this decision may have limited my financial gains to some extent, I do not consider it a failure in the true sense. I feel deeply satisfied that my son and daughter have received proper education and are now well settled in their employment, which, to me, is a far greater achievement than any ritual-driven expectation of wealth. My belief has always been that a house should not merely be a source of income or superstition-bound anxiety, but a space with social purpose.

Instead of rituals, I strongly feel that the unused portion of my house should be devoted to running tutorials for poor and underprivileged students, where knowledge, critical thinking, and self-reliance can be nurtured. This conviction gives me inner peace and reinforces my faith that education and service to society are more meaningful measures of success than material profit alone.

Though I have succeeded to some extent, this success has not been complete due to the persistent influence of superstition.

by Dr Debapriya Mukherjee

Former Senior Scientist

Central Pollution Control Board, India ✍️

Features

Race hate and the need to re-visit the ‘Clash of Civilizations’

Australian Prime Minister Anthony Albanese has done very well to speak-up against and outlaw race hate in the immediate aftermath of the recent cold-blooded gunning down of several civilians on Australia’s Bondi Beach. The perpetrators of the violence are believed to be ardent practitioners of religious and race hate and it is commendable that the Australian authorities have lost no time in clearly and unambiguously stating their opposition to the dastardly crimes in question.

Australian Prime Minister Anthony Albanese has done very well to speak-up against and outlaw race hate in the immediate aftermath of the recent cold-blooded gunning down of several civilians on Australia’s Bondi Beach. The perpetrators of the violence are believed to be ardent practitioners of religious and race hate and it is commendable that the Australian authorities have lost no time in clearly and unambiguously stating their opposition to the dastardly crimes in question.

The Australian Prime Minister is on record as stating in this connection: ‘ New laws will target those who spread hate, division and radicalization. The Home Affairs Minister will also be given new powers to cancel or refuse visas for those who spread hate and a new taskforce will be set up to ensure the education system prevents, tackles and properly responds to antisemitism.’

It is this promptness and single-mindedness to defeat race hate and other forms of identity-based animosities that are expected of democratic governments in particular world wide. For example, is Sri Lanka’s NPP government willing to follow the Australian example? To put the record straight, no past governments of Sri Lanka initiated concrete measures to stamp out the evil of race hate as well but the present Sri Lankan government which has pledged to end ethnic animosities needs to think and act vastly differently. Democratic and progressive opinion in Sri Lanka is waiting expectantly for the NPP government’ s positive response; ideally based on the Australian precedent to end race hate.

Meanwhile, it is apt to remember that inasmuch as those forces of terrorism that target white communities world wide need to be put down their counterpart forces among extremist whites need to be defeated as well. There could be no double standards on this divisive question of quashing race and religious hate, among democratic governments.

The question is invariably bound up with the matter of expeditiously and swiftly advancing democratic development in divided societies. To the extent to which a body politic is genuinely democratized, to the same degree would identity based animosities be effectively managed and even resolved once and for all. To the extent to which a society is deprived of democratic governance, correctly understood, to the same extent would it experience unmanageable identity-bred violence.

This has been Sri Lanka’s situation and generally it could be stated that it is to the degree to which Sri Lankan citizens are genuinely constitutionally empowered that the issue of race hate in their midst would prove manageable. Accordingly, democratic development is the pressing need.

While the dramatic blood-letting on Bondi Beach ought to have driven home to observers and commentators of world politics that the international community is yet to make any concrete progress in the direction of laying the basis for an end to identity-based extremism, the event should also impress on all concerned quarters that continued failure to address the matters at hand could prove fatal. The fact of the matter is that identity-based extremism is very much alive and well and that it could strike devastatingly at a time and place of its choosing.

It is yet premature for the commentator to agree with US political scientist Samuel P. Huntingdon that a ‘Clash of Civilizations’ is upon the world but events such as the Bondi Beach terror and the continuing abduction of scores of school girls by IS-related outfits, for instance, in Northern Africa are concrete evidence of the continuing pervasive presence of identity-based extremism in the global South.

As a matter of great interest it needs mentioning that the crumbling of the Cold War in the West in the early nineties of the last century and the explosive emergence of identity-based violence world wide around that time essentially impelled Huntingdon to propound the hypothesis that the world was seeing the emergence of a ‘Clash of Civilizations’. Basically, the latter phrase implied that the Cold War was replaced by a West versus militant religious fundamentalism division or polarity world wide. Instead of the USSR and its satellites, the West, led by the US, had to now do battle with religion and race-based militant extremism, particularly ‘Islamic fundamentalist violence’ .

Things, of course, came to a head in this regard when the 9/11 calamity centred in New York occurred. The event seemed to be startling proof that the world was indeed faced with a ‘Clash of Civilizations’ that was not easily resolvable. It was a case of ‘Islamic militant fundamentalism’ facing the great bulwark, so to speak, of ‘ Western Civilization’ epitomized by the US and leaving it almost helpless.

However, it was too early to write off the US’ capability to respond, although it did not do so by the best means. Instead, it replied with military interventions, for example, in Iraq and Afghanistan, which moves have only earned for the religious fundamentalists more and more recruits.

Yet, it is too early to speak in terms of a ‘Clash of Civilizations’. Such a phenomenon could be spoken of if only the entirety of the Islamic world took up arms against the West. Clearly, this is not so because the majority of the adherents of Islam are peaceably inclined and want to coexist harmoniously with the rest of the world.

However, it is not too late for the US to stop religious fundamentalism in its tracks. It, for instance, could implement concrete measures to end the blood-letting in the Middle East. Of the first importance is to end the suffering of the Palestinians by keeping a tight leash on the Israeli Right and by making good its boast of rebuilding the Gaza swiftly.

Besides, the US needs to make it a priority aim to foster democratic development worldwide in collaboration with the rest of the West. Military expenditure and the arms race should be considered of secondary importance and the process of distributing development assistance in the South brought to the forefront of its global development agenda, if there is one.

If the fire-breathing religious demagogue’s influence is to be blunted worldwide, then, it is development, understood to mean equitable growth, that needs to be fostered and consolidated by the democratic world. In other words, the priority ought to be the empowerment of individuals and communities. Nothing short of the latter measures would help in ushering a more peaceful world.

-

News5 days ago

News5 days agoMembers of Lankan Community in Washington D.C. donates to ‘Rebuilding Sri Lanka’ Flood Relief Fund

-

News3 days ago

News3 days agoBritish MP calls on Foreign Secretary to expand sanction package against ‘Sri Lankan war criminals’

-

Business7 days ago

Business7 days agoBrowns Investments sells luxury Maldivian resort for USD 57.5 mn.

-

News6 days ago

News6 days agoAir quality deteriorating in Sri Lanka

-

News6 days ago

News6 days agoCardinal urges govt. not to weaken key socio-cultural institutions

-

Features7 days ago

Features7 days agoHatton Plantations and WNPS PLANT Launch 24 km Riparian Forest Corridor

-

Features7 days ago

Features7 days agoAnother Christmas, Another Disaster, Another Recovery Mountain to Climb

-

Features5 days ago

Features5 days agoGeneral education reforms: What about language and ethnicity?