Features

Proposed wage-increase for tea plantation workers:

How it affects the small holders

by Dr Janaka Ratnasiri

The Cabinet of Ministers, at its meeting held on 26.01.2021, has decided to amend the Wages Board Regulations (WBR) by making it mandatory for tea plantation workers be paid a minimum of Rs. 1,000.00 a day. This is a follow up to the proposal made by the Finance Minister in his Budget Speech that “I also propose to increase the daily wage of plantation workers to Rs. 1,000 from January 2021”.

DEMAND BY THE PLANTATION WORKERS FOR A WAGE INCREASE

Since about 2016, tea plantation trade unions have been demanding that a daily wage of Rs. 1,000 be paid to their workers. However, the regional plantation companies (RPC) were resisting their demands, despite intervention by ministers from time to time. In order to ensure votes from the plantation workers, prior to the election, a pledge was given by those who are in office now, that the plantation worker salaries will be increased. The proposal in the budget speech, as well as the recent amendment to the WBR, were outcomes of this pledge.

Tea is grown in Sri Lanka by two groups, the large plantations managed by the Regional Plantation Companies including other public sector institutes, and the small holders of extent below 10 Acres each. According to the 2015 Annual Report of the Tea Small Holdings Development Authority (TSHDA), the small holders produced about 240 million kg of made tea in 2015, while the large estates produced 87 million kg, which are 73% and 27% of the total production, respectively. According to the TSHDA Report, the number of small holdings below 0.5 ha extent comprise 88% which are mostly managed by family members. The rest up to 10 Acres or 4 ha employ paid workers and they are subject to WBR.

The demand for wage increase came from plantation company workers where salaries paid to workers are decided by the collective agreement between the RPCs and worker trade unions negotiated once in two years. During the last agreement, RPCs have offered an increase of the basic to Rs. 600 a day and increases in some allowances making the total daily wage to Rs. 940.00 subject to good attendance (Daily FT, 26.10.2018). But this was not acceptable to the worker unions.

The RPCs have called for a new wage structure focusing on a revenue share model that could have sweeping productivity-focused reforms in the entire industry. An option favoured by the trade unions is the out-grower model where the workers are allocated small plots of land to grow their own tea to sell to the factories (Daily FT of 19.02.2019). In view of this deadlock, the COM decided to incorporate the LKR 1000 as minimum daily wage payable to tea industry workers which is applicable to both estate and small holding workers.

Despite this Cabinet decision, tea plantation workers across the up-country have launched a token strike demanding immediate payment of the agreed pay hike to them, as some RPCs were hesitant to implement the Government decision. With an annual export earning of LKR 240 billion in 2019, a single day production outage means a loss of over LKR 600 million a day to the country.

PRESENT EARNINGS OF PLANTATION WORKERS

Currently, WBR specifies that the tea plantation workers should be paid a minimum of LKR 680.00 a day, subject to satisfactory attendance during the month. In addition, they are paid EPF at 12% of basic salary of Rs. 545.00 and 3% for ETF, making the total wages Rs. 761.75. It should be remembered that plantation workers generally work only for about 6 hours from 0730 h to 1330 h including 30 min for a tea break. They have to stop plucking early so that the day’s collection could be handed over after weighing to the lorry which comes around 1400 h. A plucker works for a maximum of 22 days a month because it takes about a week for a new shoot to develop to be plucked again.

But, on an average, a plucker may work only for about 16-18 days and after deducting his own EFP contribution, may have a take-home pay of about Rs. 12,200 – 13,700 a month. If they pluck above the minimum quota, they may be paid extra at rates varying from employer to employer from Rs./kg 25 to 30, they can earn extra, provided the bushes in the worker’s lot have shoots. Both during dry months (no moisture) and wet months (no radiation), the shoot growth declines and the average yield drops and much extra revenue cannot be expected during these months.

Being daily paid workers, they are not entitled for any paid casual or sick leave unlike monthly paid workers elsewhere. No work means no pay. Unlike other workers in the mercantile sector, tea workers are not entitled for mercantile holidays, neither they have any annual leave. Whereas, in the case of all public sector and mercantile sector workers, the EPF contribution is computed based on the total salary received, in the case of plantation workers, it is computed based on the basic salary only.

The writer believes that this is a violation of the EPF Act. Though workers employed by RPCs may get free housing and free medical facilities, such benefits are not available to the large number of workers employed in the small-holder sector. Hence, there is a need to increase the wages paid to these workers to compensate for the loss of all these benefits.

In announcing the proposed wage hike for plantation workers, both the Government and the RPCs are deceiving them by adding the employers’ contribution to EPF and ETF as a part of the daily wage of Rs. 1,000. This is not done anywhere else either in the public or in the mercantile sector. When they announce a salary scale, only the basic salary along with allowances are shown, but not the EPF and ETF contributions. The workers themselves may not have understood the difference, but their unions should have seen the unfairness of this computation.

IMPACT OF THE WAGE INCREASE ON THE SMALL HOLDER SECTOR

Small holders get paid for the green leaf supplied to factories at a rate determined by the auction price paid to factories the previous month. Currently, the rate is about Rs. 90 per kilo after deducting for transport and sack weight. In the writer’s experience, a small holding of four acres with an average yield of 1,500 kg of green leaf a month, brings a monthly revenue of Rs. 135,000. The salary bill for four pluckers and a Kankanama will come to an average of Rs. 80,000 a month. This comprises Rs. 30,000 paid to the Kankanama and LKR 12,500 paid to each plucker on an average, including their EPF and ETF contributions. This works out to Rs. 781 a month per plucker, a little over Rs. 762, the minimum specified in the WBR.

The cost of weeding which is done manually, maintenance of drains and retaining walls on an average comes to about Rs. 25,000 a month. The cost of fertilizers and dolomite and their application costs another Rs. 6,000 a month on an average. In addition, there are other costs of infilling, pruning and replanting of unproductive sections which works out to about Rs. 14,000 a month. This leaves only Rs. 10,000 a month as income from the small holding, which is even less than what a worker earnes a month.

Once the WBR is amended to increase the daily wages to Rs. 1000, the Labour Officers will spare no time in visiting the small holdings and insisting the new wages be implemented. If this is done, it will be an added financial burden of Rs. 15,360 a month. This exceeds the amount left in hand after attending to its management properly. Since the small holdings depend entirely on the money paid by the factories, the obvious solution is to increase this amount at least by Rs. 20 a kilo which leaves behind a decent balance in hand. It is obvious that the COM was not concerned about the small holdings when it decided to amend the WBR, but had only the concerns about the RPC workers in mind.

INCREASING THE PAYMENT TO SMALL HOLDINGS BY FACTORIES

Tea samples offered at the auctions are purchased mostly by exporters for supplying to overseas buyers. About 3% is purchased for sale locally. According to the Tea Board Directory, there are about 325 exporters. Originally, only the dedicated companies exported tea but lately the factories as well as RPCs have got involved in export of tea considering the high profit margin. According to the Central Bank 2019 Annual Report, the average auction price of tea was Rs./kg 546.67, while the average export price was LKR/kg 822.25, leaving a margin of Rs./kg 275.58. The total tea (made tea) production in 2019 was 300.13 Mkg, while the quantity exported was 292.65 Mkg. Thus, the exporters had made a gross profit of Rs. 80.65 Billion in 2019.

Export of tea is subject to a CESS levied at Rs./kg 10, which works out to LKR. 2.9 Billion. Further, Rs.one billion is collected as Tea Promotion Levy by SLTB from the exporters. Another 1% or Rs. 2.4 Billion has to be paid to Brokers for conducting the auctions and carrying out quality control checks and certifying on samples received. These brokers comprising 8 companies deserve it because they ensure that quality tea is exported. After paying these taxes, the exporters are still left with a profit margin of about Rs. 65 Billion annually after paying Rs. 10 billion as income tax (assumed).

The export companies presently enjoy the benefit of this revenue shared among its staff. Assuming each company has 50 staff members, the total staff strength is about 16,250, and each of them could earn a salary of about Rs. 400,000 monthly. This is while a plucker earns below 1/25 th of this amount after trudging up and down the hills carrying kilos of leaf on their back in sun and rain. It would be in the interest of the exporters to share their profits among the plantation workers also, because if the industry collapses, there is nothing for them to export.

SHARING OF EXPORT PROFITS AMONG WORKERS

The number of workers employed in tea plantations are estimated to be about 174,000 in 2017 (ILO Publication on Tea Small Holdings, 2018). If each of them is to be paid an additional Rs. 238 monthly for raising the daily rate from Rs. 762 to LKR 1,000, the annual burden will be Rs. 414 Million. The total production in the small holdings in 2019 was 240 Mkg of made tea according to TSHDA, which is equivalent to 960 Mkg of Greenleaf. If the small holder is to be paid Rs./kg 20 more for Greenleaf, the added burden will be Rs. 19.2 Billion.

Thus, for increasing the daily wage to workers in both the estates and small holdings, the total added financial burden will be about Rs. 20 Billion annually. If the tea exporters could part this amount from their profits of Rs. 65 billion, the problem could be solved. The Government may do away with the CESS levy on tea exports to assist this process. Concurrently, an effort should be made by the tea industry to increase the revenue from tea exports.

INCREASING THE REVENUE FROM

TEA EXPORTS

The writer published an article in The Island of 11th and 13th of November, 2015 describing the strategies to be adopted to increase the export revenue, and also to increase the wage increase. Though it was written more than five years ago and the data little outdated, the reasonings are still valid. The article which appeared in two parts may be accessed via the following links:

http://archive.island.lk/index.php?page_cat=article-details&page=article-details&code_title=135105

http://archive.island.lk/index.php?page_cat=article-details&page=article-details&code_title=135203

One strategy is to move away from the manufacture of traditional orthodox tea to CTC (Crush-Tear-Curl) tea which is in high demand in the western countries like the USA and the UK. Both Kenya and India have overtaken Sri Lanka as major exporters because they supply CTC tea while Sri Lanka sticks to orthodox tea. According to Tea Exporters Association data, Sri Lanka has produced in 2019, out of a total of 300 kt of tea, 274 kt (91.3%) of orthodox tea, 23.6 kt (7.9%) of CTC tea and 2.6 kt (0.8%) of green tea. According to World Exporters Site http://www.worldstopexports.com/tea-imports-by-country/, Sri Lanka in 2019 has occupied only 10% of the tea market in the USA while only 4.1% in the UK. The major importers were Kenya, India and China. Today, most Western countries consume tea in the form of tea bags for which CTC tea is necessary. But to cater to these markets, Sri Lanka will have to increase the CTC output.

World’s highest tea importer is Pakistan, but most of the teas consumed in Pakistan are imported from Kenya, India, Uganda, Rwanda and Tanzania. Currently Sri Lanka’s market share in Pakistan is only 2-3% of total tea imports. A publication by Sri Lanka’s Consulate General of Sri Lanka in Karachi released in December, 2016 has recommended that “While capitalizing on the taste factor, Sri Lankan tea companies should produce quality strong black CTC teas comparable to East African countries focusing on leaf and liquor in large quantities and offer straight lines such as Garden Originals. Pakistan consumers are very particular about the appearance of tea and prefer to drink thick gold color tea”, if Sri Lanka wishes to increase its market share in Pakistan.

The other strategy is to move into producing more high value tea such as green tea and instant tea. According to Central Bank 2019 Annual Report, Sri Lanka has exported 285 Mkg of black tea at an average price of Rs./kg 797.00, 4.75 kt of green tea at an average price of Rs./kg 1,987.00 and 3.07 kt of instant tea at a price of Rs./kg 1.357.00. Hence, the logical step to increase the export revenue from tea is to offer high value tea instead of traditional black tea. But, instead of doing that the Sri Lanka Tea Board was spending billions of rupees on promoting black tea in existing markets. In 2014, the COM approved a budget of LKR 2.3 billion for promotional activities but the Tea Board could not finalize the project for several years because of disputes it ran into in selecting a suitable advertising company.

IMPLICATIONS OF WAGE INCREASE IN THE SMALL HOLDING SECTOR

If the proposed wage increase applies to the small tea holdings without any corresponding increase in the payments made for green leaf supplied to factories, the only option available to the small holder is to give up the tea plantation and consider other options. Among these are shifting to another crop such as cinnamon or pepper along with gliricidea or partition the land into several segments and hand over them to existing workers or others to manage them on their own with no liability to pay any wages to the workers by the land owner.

Gliricidea stems are in demand as a biofuel for use as a source of thermal energy in industries. With the Government giving high priority for renewable energy, industries will have to turn to biofuels as a substitute for oil or gas to generate thermal energy. One barrier they face is the lack of a proper supply chain ensuring continuous supply of biofuels. Already a project supported by UNDP and FAO is assisting the Government to set up fuelwood collecting centres across the country as part of the supply chain improvement. Hence, converting the tea plantation into a gliricidea plantation will help in this venture and provide a source of revenue possibly higher than what the tea plantation provides without any WBR controls.

CONCLUSION

In order to meet the demand made by tea plantation workers, the Government has decided to incorporate the proposed increase to the WBR rather than limiting it to the Collective Agreement between RPCs and Trade Unions. This affects the small holders as well who depend on payments made by factories for green leaf supplied to them. Unless there is a corresponding increase in this payment rate, the small holders have no option other than to give up planting tea.

It is also proposed that the Government should intervene to get the enormous profits earned by exporters to share their profits with the workers enabling the RPCs and small holders to implement the proposed wage rise. Concurrently, the factories should endeavour to produce high-value tea products to increase the export revenue.

Features

Hanoi’s most popular street could kill you

Train Street started life as a razor-thin alley with a train rushing through it. Now, it’s swarmed with Instagrammable cafes and tourists who can’t stay away, despite the risks.

A train chugs through Hanoi, approaching a narrow passageway festooned with Chinese-style lanterns. Just as it screams into the station, a tourist jumps onto the tracks, attempting her most social-media friendly pose. Moments before the train strikes, its horn blaring into the humid air, she recoils to safety. Click, post.

It’s just an ordinary day on Hanoi’s Train Street, a 400m stretch of railway flanked by cafes where tourists nurse beers and watch, mesmerised, as trains roar past them at dangerously close proximity: sometimes crashing into tables and chairs.

Fun? Evidently – in a few short years, Train Street has entered Vietnam’s pantheon of “must-see” attractions, along with Ha Long Bay and the Cu Chi Tunnels. But the Vietnamese government is less impressed; since the site went viral in 2017, it has attempted various shutdowns, first in 2019, then 2022 and most recently further investigations and crackdowns in 2025 after an incident where a selfie-snapping tourist was nearly dragged under an oncoming train’s wheels. Police barricades go up between train arrivals; edicts are issued to tour operators and bar owners.

The tourists come anyway.

How did an ordinary street become one of Vietnam’s hottest tourist attractions? It started innocently enough.

The North-South Railway was built by colonialist French forces in 1902, connecting Hanoi to Ho Chi Minh City. Fifty-four years later, the General Department of Railway erected a series of squat buildings straddling a stretch in central Hanoi to house employees. By the 1970s, the area was considered a slum; residents regularly roused out of their sleep by trains rumbling through, their houses quaking.

“It was just an ordinary street with train tracks running through it,” said Minh Anh, a lifelong Hanoi local who works at local whisky distillery,

Alamy The Vietnamese government has attempted numerous shutdowns of the area (Credit: Alamy)Alamy

The Vietnamese government has attempted numerous shutdowns of the area (Credit: Alamy)

From ordinary to unmissable

How did an ordinary street become one of Vietnam’s hottest tourist attractions? It started innocently enough.

The North-South Railway was built by colonialist French forces in 1902, connecting Hanoi to Ho Chi Minh City. Fifty-four years later, the General Department of Railway erected a series of squat buildings straddling a stretch in central Hanoi to house employees. By the 1970s, the area was considered a slum; residents regularly roused out of their sleep by trains rumbling through, their houses quaking.

“It was just an ordinary street with train tracks running through it,” said Minh Anh, a lifelong Hanoi local who works at local whisky distillery, Về Để Đi’. “When it started popping up all over social media, I was honestly surprised.”

Nhi Nguyn, a tour guide for A Taste of Hanoi, used to walk tourists through, just before it exploded in popularity. “People were still living ordinary lives there back then and there weren’t so many cafes next to the tracks,” she said. “It had a much more authentic feel: scooters were locked up just meters from the tracks, laundered clothes hung outside, and people were cooking outside on small gas stoves.”

. “When it started popping up all over social media, I was honestly surprised.”

Nhi Nguyn, a tour guide for

Alamy The Vietnamese government has attempted numerous shutdowns of the area (Credit: Alamy)Alamy

The Vietnamese government has attempted numerous shutdowns of the area (Credit: Alamy)

From ordinary to unmissable

How did an ordinary street become one of Vietnam’s hottest tourist attractions? It started innocently enough.

The North-South Railway was built by colonialist French forces in 1902, connecting Hanoi to Ho Chi Minh City. Fifty-four years later, the General Department of Railway erected a series of squat buildings straddling a stretch in central Hanoi to house employees. By the 1970s, the area was considered a slum; residents regularly roused out of their sleep by trains rumbling through, their houses quaking.

“It was just an ordinary street with train tracks running through it,” said Minh Anh, a lifelong Hanoi local who works at local whisky distillery, Về Để Đi’. “When it started popping up all over social media, I was honestly surprised.”

Nhi Nguyn, a tour guide for A Taste of Hanoi, used to walk tourists through, just before it exploded in popularity. “People were still living ordinary lives there back then and there weren’t so many cafes next to the tracks,” she said. “It had a much more authentic feel: scooters were locked up just meters from the tracks, laundered clothes hung outside, and people were cooking outside on small gas stoves.”

, used to walk tourists through, just before it exploded in popularity. “People were still living ordinary lives there back then and there weren’t so many cafes next to the tracks,” she said. “It had a much more authentic feel: scooters were locked up just meters from the tracks, laundered clothes hung outside, and people were cooking outside on small gas stoves.”

In early 2013, Colm Pierce and Alex Sheal, co-founders of Hanoi-based photography tours Vietnam in Focus, launched a Hanoi on the Tracks tour to show visitors how local residents had adopted to the locomotive-sized challenge of living on railway tracks. Serendipitously, in June 2013, Instagram launched its new video-sharing feature. A year later, the Travel Channel show “Tough Trains” featured Pierce walking down Train Street with a camera crew, further enticing travellers.

In 2017, an enterprising resident started selling beer and coffee, inviting curious tourists to stay to watch the train go by. Neighbours noticed the economic opportunity and cafes and bars rapidly spread. Soon, the formerly derelict alley, now dubbed Phố Đường Tàu (literally: “Train Street”) became bedecked with colourful lanterns and Christmas lights. Visitors learned to time their arrival for 30 minutes before a scheduled train and the “classic” Train Street experience was cemented: upon entering the tracks, tourists were shepherded into rail-side bars by local merchants and plied with beers and coffee, until the train shrieked through, rattling plates and causing hearts to pound.

Julia Husum, a university student from Norway, visited Train Street in February 2026, and “loved” the experience. “We put our beer caps on the railway, and the train flattened it, creating souvenirs for us,” she said. “I’d go back again.”

Without the advent of social media, would Train Street have become popular? As a travel writer, I’ve witnessed dozens of would-be influencers’ death-defying acts, like scaling down a rocky cliff above Dubrovnik and standing atop the side wall of 14th-Century Charles Bridge in Prague; wistfully looking off into the distance as the camera flashes. I’ve come to conclude that Train Street is no different; here, too, visitors risk their own safety for a picture-perfect opportunity.

“Essentially social media has fuelled Train Street into what it is today, [where] tourists flock in droves to the area to feel the adrenaline of the passing train while sipping local coffee,” echoed Michael Stanbury, the creative director for Vietnam in Focus. “Even without the train, the Instagrammable decorated street holds a very Hanoian charm.”

Local debate; the government proposes halting passenger trains for good. And each attempted shutdown, tourists climb past the barricades. There are, to date, more than 100,000 posts tagging Train Street on Instagram. Men’s grooming blogger Adam Hurly visited because a friend had hyped it. “It felt more like an Instagram attraction rather than a neighbourhood street,” he admitted, noting that once the crowds arrive, it becomes congested and less enjoyable, “Especially if you’re just standing on the main sidewalk trying to get a picture.”

He added: “It’s one of those places that looks better in photos than it feels in reality.”

But Matthew Tran, an artisanal footwear designer who visits Hanoi regularly, loves the pull of Train Street.

“The coffees were absurdly overpriced, yet I paid for them every time because I couldn’t stop marvelling at how the place worked; how an entire economy could thrive in such an improbable space,” he said. “These vendors built something real out of something most people would call chaos – that, to me, is worth coming back for.”

He offers advice for future visitors: “It’s a unique experience you won’t get anywhere else. Although I wish more visitors would stop for a moment and remember that while it’s a tourist attraction to them, living beside those train tracks is someone else’s daily reality.”

Under more superficial reasons, visiting Train Street is similar to the appeal of visiting the Eiffel Tower during someone’s first visit to Paris, said Charlotte Russell, founder of The Travel Psychologist.

“Humans are a social species and if we perceive that other people are enjoying an experience, it is natural for us to want to do it too,” she said. “This goes back to our evolution, when we lived in small groups and it would be advantageous for us to emulate other people in this way. So the sense of fear of missing out that we experience when seeing other people visiting places like Train Street is part of being human.”

Bearix Stewart-Frommer, an American pre-med student, validates Russell’s theory: “I found out about Train Street from my mum,” she said. “I didn’t have some deep motivation to see it, but I was curious because it’s one of those quirky, very photogenic spots that people talk about on social media.”

But there may be a more deep-seated reason why we’re lured to such places, Russell notes: “With Train Street specifically, the risk element is part of what makes it so novel, especially those of us from countries like the UK… We are used to regulation and precaution, railings, barriers and painted lines that we must stand behind. In contrast, Train Street can feel unbelievable to see and experience… [it helps] us reflect on our own norms and realise that other perspectives do exist.”

Local tour guide Phuong Loan Ngo offers one such alternative perspective: “The economic boost is undeniable, giving families who live along Train Street financial opportunities,” she said. “On the other hand, there are cultural challenges too. When an area becomes a ‘spotlight’ for social media, a place’s historical and cultural heritage can get lost. Instead of learning about how this railway has functioned since the colonial era, people often leave with only a photo, missing the true soul of the neighbourhood.”

The irony is that Vietnam in Focus has now moved their photography tours to another, far-less trammelled part of the railway, so they can show visitors that old, track-side way of life.

“As with all good things, the popularity of Train Street and the crowds it attracts are spreading,” said Sheal. “Thankfully, we have scoured Hanoi and found a fantastic local market that runs along the Hanoian railway further out in the suburbs – a new attraction.”

That is, until the social-media-obsessed travel masses find out about it. For better or worse, the unbearable lightness of Train Street is a permanent, but moveable feast.

[BBC]

Features

An innocent bystander or a passive onlooker?

After nearly two decades of on-and-off negotiations that began in 2007, India and the European Union formally finally concluded a comprehensive free trade agreement on 27 January 2026. This agreement, the India–European Union Free Trade Agreement (IEUFTA), was hailed by political leaders from both sides as the “mother of all deals,” because it would create a massive economic partnership and greatly increase the current bilateral trade, which was over US$ 136 billion in 2024. The agreement still requires ratification by the European Parliament, approval by EU member states, and completion of domestic approval processes in India. Therefore, it is only likely to come into force by early 2027.

An Innocent Bystander

When negotiations for a Free Trade Agreement between India and the European Union were formally launched in June 2007, anticipating far-reaching consequences of such an agreement on other developing countries, the Commonwealth Secretariat, in London, requested the Centre for Analysis of Regional Integration at the University of Sussex to undertake a study on a possible implication of such an agreement on other low-income developing countries. Thus, a group of academics, led by Professor Alan Winters, undertook a study, and it was published by the Commonwealth Secretariat in 2009 (“Innocent Bystanders—Implications of the EU-India Free Trade Agreement for Excluded Countries”). The authors of the study had considered the impact of an EU–India Free Trade Agreement for the trade of excluded countries and had underlined, “The SAARC countries are, by a long way, the most vulnerable to negative impacts from the FTA. Their exports are more similar to India’s…. Bangladesh is most exposed in the EU market, followed by Pakistan and Sri Lanka.”

Trade Preferences and Export Growth

Normally, reduction of price through preferential market access leads to export growth and trade diversification. During the last 19-year period (2015–2024), SAARC countries enjoyed varying degrees of preferences, under the EU’s Generalised Scheme of Preferences (GSP). But, the level of preferential access extended to India, through the GSP (general) arrangement, only provided a limited amount of duty reduction as against other SAARC countries, which were eligible for duty-free access into the EU market for most of their exports, via their LDC status or GSP+ route.

However, having preferential market access to the EU is worthless if those preferences cannot be utilised. Sri Lanka’s preference utilisation rate, which specifies the ratio of eligible to preferential imports, is significantly below the average for the EU GSP receiving countries. It was only 59% in 2023 and 69% in 2024. Comparative percentages in 2024 were, for Bangladesh, 96%; Pakistan, 95%; and India, 88%.

As illustrated in the table above, between 2015 and 2024, the EU’s imports from SAARC countries had increased twofold, from US$ 63 billion in 2015 to US$ 129 billion by 2024. Most of this growth had come from India. The imports from Pakistan and Bangladesh also increased significantly. The increase of imports from Sri Lanka, when compared to other South Asian countries, was limited. Exports from other SAARC countries—Afghanistan, Bhutan, Nepal, and the Maldives—are very small and, therefore, not included in this analysis.

Why the EU – India FTA?

With the best export performance in the region, why does India need an FTA with the EU?

Because even with very impressive overall export growth, in certain areas, India has performed very poorly in the EU market due to tariff disadvantages. In addition to that, from January 2026, the EU has withdrawn GSP benefits from most of India’s industrial exports. The FTA clearly addresses these challenges, and India will improve her competitiveness significantly once the FTA becomes operational.

Then the question is, what will be its impact on those “innocent bystanders” in South Asia and, more particularly, on Sri Lanka?

To provide a reasonable answer to this question, one has to undertake an in-depth product-by-product analysis of all major exports. Due to time and resource constraints, for the purpose of this article, I took a brief look at Sri Lanka’s two largest exports to the EU, viz., the apparels and rubber-based products.

Fortunately, Sri Lanka’s exports of rubber products will be only nominally impacted by the FTA due to the low MFN duty rate. For example, solid tyres and rubber gloves are charged very low (around 3%) MFN duty and the exports of these products from Sri Lanka and India are eligible for 0% GSP duty at present. With an equal market access, Sri Lanka has done much better than India in the EU market. Sri Lanka is the largest exporter of solid tyres to the EU and during 2024 our exports were valued at US$180 million.

On the other hand, Tariffs MFN tariffs on Apparel at 12% are relatively high and play a big role in apparel sourcing. Even a small difference in landed cost can shift entire sourcing to another supplier country. Indian apparel exports to the EU faced relatively high duties (8.5% – 12%), while competitors, such as Bangladesh, Pakistan, and Sri Lanka, are eligible for preferential access. In addition to that, Bangladesh enjoys highly favourable Rules of Origin in the EU market. The impact of these different trade rules, on the EU’s imports, is clearly visible in the trade data.

During the last 10 years (2015-2024), the EU’s apparel imports from Bangladesh nearly doubled, from US$15.1 billion, in 2015, to US$29.1 billion by 2024, and apparel imports from Pakistan more than doubled, from US$2.3 billion to US$5.5 billion. However, apparel imports from Sri Lanka increased only from US$1.3 billion in 2015 to US$2.2 billion by 2024. The impressive export growth from Pakistan and Bangladesh is mostly related to GSP preferences, while the lackluster growth of Sri Lankan exports was largely due to low preference utilisation. Nearly half of Sri Lanka’s apparel exports faced a 12% tariff due to strict Rules of Origin requirements to qualify for GSP.

During the same period, the EU’s apparel imports from India only showed very modest growth, from US$ 5.3 billion, in 2015, to US$ 6.3 billion in 2024. The main reason for this was the very significant tariff disadvantage India faced in the EU market. However, once the FTA eliminates this gap, apparel imports from India are expected to grow rapidly.

According to available information, Indian industry bodies expect US$ 5-7 billion growth of textiles and apparel exports during the first three years of the FTA. This will create a significant trade diversion, resulting in a decline in exports from China and other countries that do not enjoy preferential market access. As almost half of Sri Lanka’s apparel exports are not eligible for GSP, the impact on our exports will also be fierce. Even in the areas where Sri Lanka receives preferential duty-free access, the arrival of another large player will change the market dynamics greatly.

A Passive Onlooker?

Since the commencement of the negotiations on the EU–India FTA, Bangladesh and Pakistan have significantly enhanced the level of market access through proactive diplomatic interventions. As a result, they have substantially increased competitiveness and the market share within the EU. This would help them to minimize the adverse implications of the India–EU FTA on their exports. Sri Lanka’s exports to the EU market have not performed that well. The challenges in that market will intensify after 2027.

As we can clearly anticipate a significant adverse impact from the EU-India FTA, we should start to engage immediately with the European Commission on these issues without being passive onlookers. For example, the impact of the EU-India FTA should have been a main agenda item in the recently concluded joint commission meeting between the European Commission and Sri Lanka in Colombo.

Need of the Hour – Proactive Commercial Diplomacy

In the area of international trade, it is a time of turbulence. After the US Supreme Court judgement on President Trump’s “reciprocal tariffs,” the only prediction we can make about the market in the United States market is its continued unpredictability. India concluded an FTA with the UK last May and now the EU-India FTA. These are Sri Lanka’s largest markets. Now to navigate through these volatile, complex, and rapidly changing markets, we need to move away from reactive crisis management mode to anticipatory action. Hence, proactive commercial diplomacy is the need of the hour.

(The writer can be reached at senadhiragomi@gmail.com)

By Gomi Senadhira

Features

Educational reforms: A perspective

Dr. B.J.C. Perera (Dr. BJCP) in his article ‘The Education cross roads: Liberating Sri Lankan classroom and moving ahead’ asks the critical question that should be the bedrock of any attempt at education reform – ‘Do we truly and clearly understand how a human being learns? (The Island, 16.02.2026)

Dr. BJCP describes the foundation of a cognitive architecture taking place with over a million neural connections occurring in a second. This in fact is the result of language learning and not the process. How do we ‘actually’ learn and communicate with one another? Is a question that was originally asked by Galileo Galilei (1564 -1642) to which scientists have still not found a definitive answer. Naom Chomsky (1928-) one of the foremost intellectuals of our time, known as the father of modern linguistics; when once asked in an interview, if there was any ‘burning question’ in his life that he would have liked to find an answer for; commented that this was one of the questions to which he would have liked to find the answer. Apart from knowing that this communication takes place through language, little else is known about the subject. In this process of learning we learn in our mother tongue and it is estimated that almost 80% of our learning is completed by the time we are 5 years old. It is critical to grasp that this is the actual process of learning and not ‘knowledge’ which tends to get confused as ‘learning’. i.e. what have you learnt?

The term mother tongue is used here as many of us later on in life do learn other languages. However, there is a fundamental difference between these languages and one’s mother tongue; in that one learns the mother tongue- and how that happens is the ‘burning question’ as opposed to a second language which is taught. The fact that the mother tongue is also formally taught later on, does not distract from this thesis.

Almost all of us take the learning of a mother tongue for granted, as much as one would take standing and walking for granted. However, learning the mother tongue is a much more complex process. Every infant learns to stand and walk the same way, but every infant depending on where they are born (and brought up) will learn a different mother tongue. The words that are learnt are concepts that would be influenced by the prevalent culture, religion, beliefs, etc. in that environment of the child. Take for example the term father. In our culture (Sinhala/Buddhist) the father is an entity that belongs to himself as well as to us -the rest of the family. We refer to him as ape thaththa. In the English speaking (Judaeo-Christian) culture he is ‘my father’. ‘Our father’ is a very different concept. ‘Our father who art in heaven….

All over the world education is done in one’s mother tongue. The only exception to this, as far as I know, are the countries that have been colonised by the British. There is a vast amount of research that re-validates education /learning in the mother tongue. And more to the point, when it comes to the comparability of learning in one’s own mother tongue as opposed to learning in English, English fails miserably.

Education /learning is best done in one’s mother tongue.

This is a fact. not an opinion. Elegantly stated in the words of Prof. Tove Skutnabb-Kangas-“Mother tongue medium education is controversial, but ‘only’ politically. Research evidence about it is not controversial.”

The tragedy is that we are discussing this fundamental principle that is taken for granted in the rest of the world. It would not be not even considered worthy of a school debate in any other country. The irony of course is, that it is being done in English!

At school we learnt all of our subjects in Sinhala (or Tamil) right up to University entrance. Across the three streams of Maths, Bio and Commerce, be it applied or pure mathematics, physics, chemistry, zoology, botany economics, business, etc. Everything from the simplest to the most complicated concept was learnt in our mother tongue. An uninterrupted process of learning that started from infancy.

All of this changed at university. We had to learn something new that had a greater depth and width than anything we had encountered before in a language -except for a very select minority – we were not at all familiar with. There were students in my university intake that had put aside reading and writing, not even spoken English outside a classroom context. This I have been reliably informed is the prevalent situation in most of the SAARC countries.

The SAARC nations that comprise eight countries (Sri Lanka, Maldives, India, Pakistan Afghanistan, Bangladesh, Nepal and Bhutan) have 21% of the world population confined to just 3% of the earth’s land mass making it probably one of the most densely populated areas in the world. One would assume that this degree of ‘clinical density’ would lead to a plethora of research publications. However, the reality is that for 25 years from 1996 to 2021 the contribution by the SAARC nations to peer reviewed research in the field of Orthopaedics and Sports medicine- my profession – was only 1.45%! Regardless of each country having different mother tongues and vastly differing socio-economic structures, the common denominator to all these countries is that medical education in each country is done in a foreign language (English).

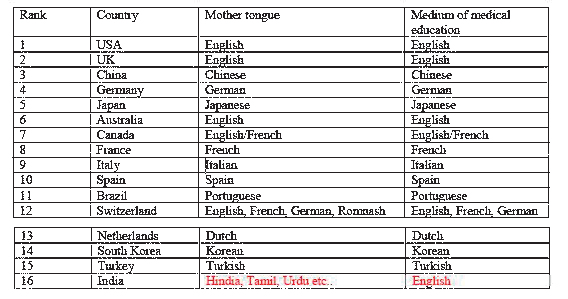

The impact of not learning in one’s mother tongue can be illustrated at a global level. This can be easily seen when observing the research output of different countries. For example, if one looks at orthopaedics and sports medicine (once again my given profession for simplicity); Table 1. shows the cumulative research that has been published in peer review journals. Despite now having the highest population in the world, India comes in at number 16! It has been outranked by countries that have a population less than one of their states. Pundits might argue giving various reasons for this phenomenon. But the inconvertible fact remains that all other countries, other than India, learn medicine in their mother tongue.

(See Table 1) Mother tongue, medium of education in country rank order according to the volume of publications of orthopaedics and sports medicine in peer reviewed journals 1996 to 2024. Source: Scimago SCImago journal (https://www.scimagojr.com/) has collated peer review journal publications of the world. The publications are categorized into 27 categories. According to the available data from 1996 to 2024, China is ranked the second across all categories with India at the 6th position. China is first in chemical engineering, chemistry, computer science, decision sciences, energy, engineering, environmental science, material sciences, mathematics, physics and astronomy. There is no subject category that India is the first in the world. China ranks higher than India in all categories except dentistry.

The reason for this difference is obvious when one looks at how learning is done in China and India.

The Chinese learn in their mother tongue. From primary to undergraduate and postgraduate levels, it is all done in Chinese. Therefore, they have an enormous capacity to understand their subject matter just not itself, but also as to how it relates to all other subjects/ themes that surround it. It is a continuous process of learning that evolves from infancy onwards, that seamlessly passes through, primary, secondary, undergraduate and post graduate education, research, innovation, application etc. Their social language is their official language. The language they use at home is the language they use at their workplaces, clubs, research facilities and so on.

In India higher education/learning is done in a foreign language. Each state of India has its own mother tongue. Be it Hindi, Tamil, Urdu, Telagu, etc. Infancy, childhood and school education to varying degrees is carried out in each state according to their mother tongue. Then, when it comes to university education and especially the ‘science subjects’ it takes place in a foreign tongue- (English). English remains only as their ‘research’ language. All other social interactions are done in their mother tongue.

India and China have been used as examples to illustrate the point between learning in the mother tongue and a foreign tongue, as they are in population terms comparable countries. The unpalatable truth is that – though individuals might have a different grasp of English- as countries, the ability of SAARC countries to learn and understand a subject in a foreign language is inferior to the rest of the world that is learning the same subject in its mother tongue. Imagine the disadvantage we face at a global level, when our entire learning process across almost all disciplines has been in a foreign tongue with comparison to the rest of the world that has learnt all these disciplines in their mother tongue. And one by-product of this is the subsequent research, innovation that flows from this learning will also be inferior to the rest of the world.

All this only confirms what we already know. Learning is best done in one’s mother tongue! .

What needs to be realised is that there is a critical difference between ‘learning English’ and ‘learning in English’. The primary-or some may argue secondary- purpose of a university education is to learn a particular discipline, be it medicine, engineering, etc. The students- have been learning everything up to that point in Sinhala or Tamil. Learning their discipline in their mother tongue will be the easiest thing for them. The solution to this is to teach in Sinhala or Tamil, so it can be learnt in the most efficient manner. Not to lament that the university entrant’s English is poor and therefore we need to start teaching English earlier on.

We are surviving because at least up to the university level we are learning in the best possible way i.e. in our mother tongue. Can our methods be changed to be more efficient? definitely. If, however, one thinks that the answer to this efficient change in the learning process is to substitute English for the mother tongue, it will defeat the very purpose it is trying to overcome. According to Dr. BJCP as he states in his article; the current reforms of 2026 for the learning process for the primary years, centre on the ‘ABCDE’ framework: Attendance, Belongingness, Cleanliness, Discipline and English. Very briefly, as can be seen from the above discussion, if this is the framework that is to be instituted, we should modify it to ABCDEF by adding a F for Failure, for completeness!

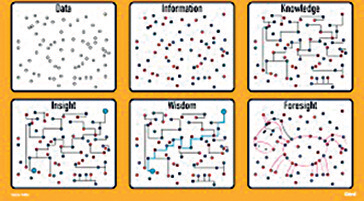

(See Figure 1) The components and evolution of learning: Data, information, knowledge, insight, wisdom, foresight As can be seen from figure 1. data and information remain as discrete points. They do not have interconnections between them. It is these subsequent interconnections that constitute learning. And these happen best through the mother tongue. Once again, this is a fact. Not an opinion. We -all countries- need to learn a second language (foreign tongue) in order to gather information and data from the rest of the world. However, once this data/ information is gathered, the learning needs to happen in our own mother tongue.

Without a doubt English is the most universally spoken language. It is estimated that almost a quarter of the world speaks English as its mother tongue or as a second language. I am not advocating to stop teaching English. Please, teach English as a second language to give a window to the rest of the world. Just do not use it as the mode of learning. Learn English but do not learn in English. All that we will be achieving by learning in English, is to create a nation of professionals that neither know English well nor their subject matter well.

If we are to have any worthwhile educational reforms this should be the starting pivotal point. An education that takes place in one’s mother tongue. Not instituting this and discussing theories of education and learning and proposing reforms, is akin to ‘rearranging the deck chairs on the Titanic’. Sadly, this is not some stupendous, revolutionary insight into education /learning. It is what the rest of the world has been doing and what we did till we came under British rule.

Those who were with me in the medical faculty may remember that I asked this question then: Why can’t we be taught in Sinhala? Today, with AI, this should be much easier than what it was 40 years ago.

The editorial of this newspaper has many a time criticised the present government for its lackadaisical attitude towards bringing in the promised ‘system change’. Do this––make mother tongue the medium of education /learning––and the entire system will change.

by Dr. Sumedha S. Amarasekara

-

Features6 days ago

Features6 days agoWhy does the state threaten Its people with yet another anti-terror law?

-

Features6 days ago

Features6 days agoReconciliation, Mood of the Nation and the NPP Government

-

Features6 days ago

Features6 days agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features5 days ago

Features5 days agoLOVEABLE BUT LETHAL: When four-legged stars remind us of a silent killer

-

Features6 days ago

Features6 days agoVictor, the Friend of the Foreign Press

-

Business5 days ago

Business5 days agoSeeing is believing – the silent scale behind SriLankan’s ground operation

-

Business5 days ago

Business5 days agoBathiya & Santhush make a strategic bet on Colombo

-

Features6 days ago

Features6 days agoBarking up the wrong tree