Features

Politics and the Plantation Wage

by Anura Gunasekera

President Ranil Wickremesinghe chose the Ceylon Workers’ Congress May Day platform, in Kotagala, to announce the increase of the plantation workers’ daily wage to Rs 1,700.00. An unexpected presidential fiat, delivered just a few months before a possible election by a potential presidential candidate, was made public from the political platform of a major plantation trade union, generally seen as pro-government. The self-evident political implications do not merit either debate or elaboration.

Preamble

In a rational world, in any industry, the employer and the employee should arrive at a fair wage through a consultative process. The unsolicited intervention of a third force with an agenda unrelated to the interests of either party, is undesirable from all points of view. Still, there are precedents, when sitting presidents have mandated wage increases in the plantation sector, for patently political reasons, ignoring the possible toxic economic consequences.

Abrupt and illogically high increases are self-defeating, as sudden, unmanageable cost inflation force enterprises to withhold or diminish essential inputs, deny upgrades, abandon new investment and, in extreme cases, even close down. Unviable enterprises cannot discharge responsibilities to society, stakeholders, the economy and the environment. When operational costs suddenly exceed revenue the only relief is a magical increase in the selling price. Bur miracles do not happen in the real commercial world.

Products prices at public auctions are determined by unpredictable local and international market dynamics of supply and demand. Hence, the producer needs to be able to operate within a framework of reasonably priced inputs, especially the worker’s daily wage, which, prior to the above increase, constituted around 65% of the unit production cost; that could well be the largest labour cost component in the unit production cost of any factory produced item, in any industry, anywhere in the world.

Estimates are that the increase of the plantation wage to Rs 1,700.00 (with EPF/ETF- LKR 1.955.00 per day) will raise the above component to about 75% of the unit cost of production. The balance input proportion, representing fertilizer, energy, chemicals, other material requirements, machinery, vehicle and building maintenance, and welfare and contingencies, offers minimal margin for cost management. With that kind of lop-sided production cost distribution, no legitimate industry can remain viable.

Market Realities

Trade unionists who seek wage increases linked directly to auction price fluctuations, and politicians who support such proposals when it suits personal political aspirations, ignore the realities of international trends of supply and demand. Wage increases, whilst being of crucial importance, especially in periods of rapid cost-of-living inflation, still need to be sustainable in the context of the relevant industry .

An analysis of world market prices of Tea and Rubber in the last three decades, will demonstrate a consistent pattern of long troughs relieved by sudden, short-lived peaks. These trends are directly linked to weather, climate, production levels, changes in consumption patterns, resultant supply and demand, exchange rate movements , inflationary or recessive trends in consuming economies, and political climate and state-imposed trade policies and tariffs.

In the case of Rubber, in addition to all of the above, speculation in futures markets, crude oil prices, innovations in synthetic alternatives and fluctuating demand in high consumption industries, such as tyre and vehicle manufacture, are key determinants in demand and price. These factors contribute to a permanent state of commodity-market volatility. They also converge to fashion “Global Economic Health”, which determines the buying and selling price of all internationally traded commodities.

All of the above is to demonstrate that, whilst accepting the imperative of a living wage for the plantation worker, that it is unrealistic and imprudent to determine a wage increase, based on industry revenues during periods of peak prices.

Impact Distribution

The mandated increase will impact tea, rubber and oil palm plantations in the RPC sector, private “bought leaf factories”, mostly in the Southern and Sabaragamuwa provinces and, in particular, about 500,000 tea small-holders, again located mostly in the above provinces. The segment delivers 72% of the National Tea Production and 65% of the National Rubber Production, and represents a community of about 1.5 million citizens. That important vote-bank, primarily Sinhala speaking, is concentrated in the South, Sabaragamuwa and in a wide swathe in the mid-country, between Pussellawa and Matale. In a presidential election these people may not vote for the man who, with one irrational and cynical gesture, impoverished them.

Smallholder Segment

Contrary to popular belief that only a few “rich companies” will be affected by the wage increase, in actual fact, the smallholder will be the biggest loser.

Due to contribution to total national production, the smallholder is the most important segment in both Tea and Rubber. Individual holdings range from around 50 ha to half-hectare extents or less. This segment relies on external labour for harvesting (and for other work as well), generally on the payment of Rs 40 per kg of green leaf. Consequent to the mandated increase, harvesting one kg of green leaf will cost them around Rs 80, with no possibility of additional revenue. The green leaf is purchased by the manufacturing factory, based on the Tea Commissioner’s formula, linked to the Factory Net Sale Average, which is determined by auction prices. Any revision of the current green payment formula, designed to relieve the supplier, will bankrupt 427 private tea factories which, collectively, manufacture 70% of the national tea production.

A smallholder, confronted by suddenly increasing input costs and diminished revenues, may respond by harvesting less often, resulting in lower crops and a poor standard of green leaf. That will affect made tea quality, resulting in lower auction prices, a diminished net sale average for the manufacturing factory and, again, a proportionate diminution of the green leaf payment to the smallholder/supplier.

Poor quality tea coming in to the auction will affect demand, diminish the national net sale average and the competitiveness of Ceylon tea, with a corresponding impact on foreign exchange earnings. Exporters seeking quality Tea are likely to move to Kenya, India, Vietnam or Indonesia, and still buy reasonable quality at one USD per kilos less than in Colombo. The overall outcome will be massive hit on every aspect of the national industry, including value-added exports.

Alternately, the smallholder may reduce costs by withholding or minimizing inputs such as fertilizer and field cultural practices. Some may either abandon their holdings or convert to other crops. In combination all these will lead to the diminution of national crop outputs which, currently, are at a three-decade low.

Up to now the most efficient operational model of tea and rubber production was the smallholder segment. The mandated wage increase has thrown that in to total disarray.

Impact on Rubber Industry

The Rubber sector will face a similar fate. Our national production has declined from 152 mn kg in 2012, to 70 mn kg in 2022 ( RRI statistics). With 65% of the production coming from the small holder sector, the wage increase will have an impact as in Tea. The prospect of reduced revenue will inhibit future replanting of rubber, which has a gestation period of six years and a productive life of about 20 years. About 60% of the national rubber production is used locally whilst annual imports are around 60 mn kg a year. The outcome will be a further decline in national production and an increase in imports, if local manufacturers of rubber-based goods are to maintain current production levels. The result will be an increased outflow of foreign exchange.

Key Economic Factors and Paradoxes

Of all major tea growing countries, Sri Lanka has the highest cost of production, highest labour cost and the lowest productivity. The new Sri Lankan wage will be about double the Indian labour cost, four times that of Bangladesh, and about 30% more than Kenya, where national average field productivity is about double that of Sri Lanka.

This 70% increase will cost the Regional Planation Companies an additional LKR 28 billion a year and with high gearing being a common feature in the sector, will also affect banks and other financial institutions adversely. The total additional annual cost to the industry will be LKR 81 billion. The current auction tea average is LKR 1,250 per kg and, with the new wage increase, the national cost of production will increase to around LKR 1,450 per kg.

Prior to this increase, the Tea/Rubber wages board minimum determination was the second highest in the country. A demand for a proportionate increase by other local industries would lead to an economic disaster in the country. Another interesting feature is that a plantation worker clocking in for a minimum 25 days per month, working a four-five hour day, will now earn much more than a garment worker who works a minimum of eight hours per day, excluding meal breaks. In fact, both a graduate teacher and a fully qualified nurse, will earn less.

A common perception is that a higher wage will entice workers to stay on the plantation, rather than migrate to other employment. Nothing could be further from the truth. Since 1992 to-date, the basic daily wage has increased from LKR 66 to LKR 1,700, whilst, during the same period, the actual worker component in the RPC sector, has declined from 32% of the resident population to 17%.

The only method by which the plantation worker can be guaranteed a fair income, whilst maintaining the viability of the industry which sustains them, is to move to an output-based payment model. Proposals based on the smallholder model, offered by the RPC sector, guaranteeing the worker up to LKR 2,000/- per day, have been steadfastly resisted by the trade unions as such models would liberate the worker from the clutches of the unions. An independent worker, earning a decent wage and in control of his own destiny, renders the union irrelevant. That is a fearful outcome for politically-aligned unions which rely on monthly worker contributions for their existence.

Consequences of Political Intervention in Enterprise

In this country State intervention in the plantation industry has a dismal history. The nationalization in the 1970’s led to the dismantling of a management system of proven efficiency, and its replacement with a state apparatus, which, over the next couple of decades, led to the accumulation of vast liabilities. That, along with other inadequacies, compelled the re-privatization of the sector in 1992.

In 2016, then President , Maithripala Sirisena, on the advice of a Buddhist monk, overnight banned the use of Glyphosate, essential for weed control in the plantations. In 2021, then president Gotabhaya Rajapaksa, on the advice of an inner coterie with no experience in plantation management, similarly banned inorganic fertilizer and oil palm. The consequences were disastrous crop declines, freezing of both ongoing and planned investment, massive operational losses in all three sectors and the disruption of the Tea, Rubber and Oil Palm industries, from which they have not recovered yet.

For close upon 200 years, the local plantation industry has demonstrated incredible resilience in surviving a series of disasters, some natural and many man-made. This mandated wage, though, may be the last straw. Historians may one day record that the great industry birthed by a Scotsman named James Taylor, was strangled to death by a Sri Lankan named Ranil Wickremesinghe.

Anura Gunasekera

(The writer is a retired plantation specialist with over 50 years experience, covering the Agency House era, the State-management interlude and the Regional Plantation Company period.)

Features

The invisible crisis: How tour guide failures bleed value from every tourist

(Article 04 of the 04-part series on Sri Lanka’s tourism stagnation)

(Article 04 of the 04-part series on Sri Lanka’s tourism stagnation)

If you want to understand why Sri Lanka keeps leaking value even when arrivals hit “record” numbers, stop staring at SLTDA dashboards and start talking to the people who face tourists every day: the tour guides.

They are the “unofficial ambassadors” of Sri Lankan tourism, and they are the weakest, most neglected, most dysfunctional link in a value chain we pretend is functional. Nearly 60% of tourists use guides. Of those guides, 57% are unlicensed, untrained, and invisible to the very institutions claiming to regulate quality. This is not a marginal problem. It is a systemic failure to bleed value from every visitor.

The Invisible Workforce

The May 2024 “Comprehensive Study of the Sri Lankan Tour Guides” is the first serious attempt, in decades, to map this profession. Its findings should be front-page news. They are not, because acknowledging them would require admitting how fundamentally broken the system is. The official count (April 2024): SLTDA had 4,887 licensed guides in its books:

* 1,892 National Guides (39%)

* 1,552 Chauffeur Guides (32%)

* 1,339 Area Guides (27%)

* 104 Site Guides (2%)

The actual workforce: Survey data reveals these licensed categories represent only about 75% of people actually guiding tourists. About 23% identify as “other”; a polite euphemism for unlicensed operators: three-wheeler drivers, “surf boys,” informal city guides, and touts. Adjusted for informal operators, the true guide population is approximately 6,347; 32% National, 25% Chauffeur, 16% Area, 4% Site, and 23% unlicensed.

But even this understates reality. Industry practitioners interviewed in the study believe the informal universe is larger still, with unlicensed guides dominating certain tourist hotspots and price-sensitive segments. Using both top-down (tourist arrivals × share using guides) and bottom-up (guides × trips × party size) estimates, the study calculates that approximately 700,000 tourists used guides in 2023-24, roughly one-third of arrivals. Of those 700,000 tourists, 57% were handled by unlicensed guides.

Read that again. Most tourists interacting with guides are served by people with no formal training, no regulatory oversight, no quality standards, and no accountability. These are the “ambassadors” shaping visitor perceptions, driving purchasing decisions, and determining whether tourists extend stays, return, or recommend Sri Lanka. And they are invisible to SLTDA.

The Anatomy of Workforce Failure

The guide crisis is not accidental. It is the predictable outcome of decades of policy neglect, regulatory abdication, and institutional indifference.

1. Training Collapse and Barrier to Entry Failure

Becoming a licensed National Guide theoretically requires:

* Completion of formal training programmes

* Demonstrated language proficiency

* Knowledge of history, culture, geography

* Passing competency exams

In practice, these barriers have eroded. The study reveals:

* Training infrastructure is inadequate and geographically concentrated

* Language requirements are inconsistently enforced

* Knowledge assessments are outdated and poorly calibrated

* Continuous professional development is non-existent

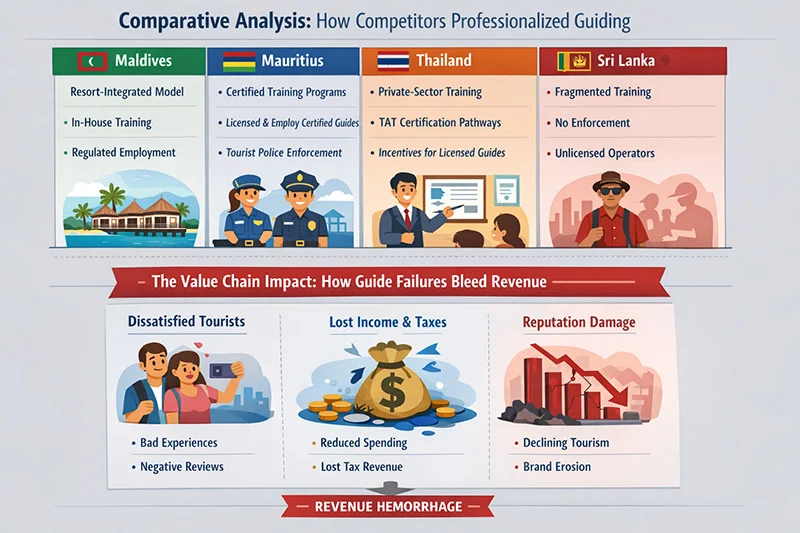

The result: even licensed guides often lack the depth of knowledge, language skills, or service standards that high-yield tourists expect. Unlicensed guides have no standards at all. Compare this to competitors. In Mauritius, tour guides undergo rigorous government-certified training with mandatory refresher courses. The Maldives’ resort model embeds guide functions within integrated hospitality operations with strict quality controls. Thailand has well-developed private-sector training ecosystems feeding into licensed guide pools.

2. Economic Precarity and Income Volatility

Tour guiding in Sri Lanka is economically unstable:

* Seasonal income volatility: High earnings in peak months (December-March), near-zero in low season (April-June, September)

* No fixed salaries: Most guides work freelance or commission-based

* Age and experience don’t guarantee income: 60% of guides are over 40, but earnings decline with age due to physical demands and market preference for younger, language-proficient guides

* Commission dependency: Guides often earn more from commissions on shopping, gem purchases, and restaurant referrals than from guiding fees

The commission-driven model pushes guides to prioritise high-commission shops over meaningful experiences, leaving tourists feeling manipulated. With low earnings and poor incentives, skilled guides exist in the profession while few new entrants join. The result is a shrinking pool of struggling licensed guides and rising numbers of opportunistic unlicensed operators.

3. Regulatory Abdication and Unlicensed Proliferation

Unlicensed guides thrive because enforcement is absent, economic incentives favour avoiding fees and taxes, and tourists cannot distinguish licensed professionals from informal operators. With SLTDA’s limited capacity reducing oversight, unregistered activity expands. Guiding becomes the frontline where regulatory failure most visibly harms tourist experience and sector revenues in Sri Lanka.

4. Male-Dominated, Ageing, Geographically Uneven Workforce

The guide workforce is:

* Heavily male-dominated: Fewer than 10% are women

* Ageing: 60% are over 40; many in their 50s and 60s

* Geographically concentrated: Clustered in Colombo, Galle, Kandy, Cultural Triangle—minimal presence in emerging destinations

This creates multiple problems:

* Gender imbalance: Limits appeal to female solo travellers and certain market segments (wellness tourism, family travel with mothers)

* Physical limitations: Older guides struggle with demanding itineraries (hiking, adventure tourism)

* Knowledge ossification: Ageing workforce with no continuous learning rehashes outdated narratives, lacks digital literacy, cannot engage younger tourist demographics

* Regional gaps: Emerging destinations (Eastern Province, Northern heritage sites) lack trained guide capacity

1. Experience Degradation Lower Spending

Unlicensed guides lack knowledge, language skills, and service training. Tourist experience degrades. When tourists feel they are being shuttled to commission shops rather than authentic experiences, they:

* Cut trips short

* Skip additional paid activities

* Leave negative reviews

* Do not return or recommend

The yield impact is direct: degraded experiences reduce spending, return rates, and word-of-mouth premium.

2. Commission Steering → Value Leakage

Guides earning more from commissions than guiding fees optimise for merchant revenue, not tourist satisfaction.

This creates leakage: tourism spending flows to merchants paying highest commissions (often with foreign ownership or imported inventory), not to highest-quality experiences.

The economic distortion is visible: gems, souvenirs, and low-quality restaurants generate guide commissions while high-quality cultural sites, local artisan cooperatives, and authentic restaurants do not. Spending flows to low-value, high-leakage channels.

3. Safety and Security Risks → Reputation Damage

Unlicensed guides have no insurance, no accountability, no emergency training. When tourists encounter problems, accidents, harassment, scams, there is no recourse. Incidents generate negative publicity, travel advisories, reputation damage. The 2024-2025 reports of tourists being attacked by wildlife at major sites (Sigiriya) with inadequate safety protocols are symptomatic. Trained, licensed guides would have emergency protocols. Unlicensed operators improvise.

4. Market Segmentation Failure → Yield Optimisation Impossible

High-yield tourists (luxury, cultural immersion, adventure) require specialised guide-deep knowledge, language proficiency, cultural sensitivity. Sri Lanka cannot reliably deliver these guides at scale because:

* Training does not produce specialists (wildlife experts, heritage scholars, wellness practitioners)

* Economic precarity drives talent out

* Unlicensed operators dominate price-sensitive segments, leaving limited licensed capacity for premium segments

We cannot move upmarket because we lack the workforce to serve premium segments. We are locked into volume-chasing low-yield markets because that is what our guide workforce can provide.

The way forward

Fixing Sri Lanka’s guide crisis demands structural reform, not symbolic gestures. A full workforce census and licensing audit must map the real guide population, identify gaps, and set an enforcement baseline. Licensing must be mandatory, timebound, and backed by inspections and penalties. Economic incentives should reward professionalism through fair wages, transparent fees, and verified registries. Training must expand nationwide with specialisations, language standards, and continuous development. Gender and age imbalances require targeted recruitment, mentorship, and diversified roles. Finally, guides must be integrated into the tourism value chain through mandatory verification, accountability measures, and performancelinked feedback.

The Uncomfortable Truth

Can Sri Lanka achieve high-value tourism with a low-quality, largely unlicensed guide workforce? The answer is NO. Unambiguously, definitively, NO. Sri Lanka’s guides shape tourist perceptions, spending, and satisfaction, yet the system treats them as expendable; poorly trained, economically insecure, and largely unregulated. With 57% of tourists relying on unlicensed guides, experience quality becomes unpredictable and revenue leaks into commission-driven channels.

High-yield markets avoid destinations with weak service standards, leaving Sri Lanka stuck in low-value, volume tourism. This is not a training problem but a structural failure requiring regulatory enforcement, viable career pathways, and a complete overhaul of incentives. Without professionalising guides, high-value tourism is unattainable. Fixing the guide crisis is the foundation for genuine sector transformation.

The choice is ours. The workforce is waiting.

This concludes the 04-part series on Sri Lanka’s tourism stagnation. The diagnosis is complete. The question now is whether policymakers have the courage to act.

For any concerns/comments contact the author at saliya.ca@gmail.com

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT, Malabe. The views and opinions expressed in this article are personal.)

Features

Recruiting academics to state universities – beset by archaic selection processes?

Time has, by and large, stood still in the business of academic staff recruitment to state universities. Qualifications have proliferated and evolved to be more interdisciplinary, but our selection processes and evaluation criteria are unchanged since at least the late 1990s. But before I delve into the problems, I will describe the existing processes and schemes of recruitment. The discussion is limited to UGC-governed state universities (and does not include recruitment to medical and engineering sectors) though the problems may be relevant to other higher education institutions (HEIs).

How recruitment happens currently in SL state universities

Academic ranks in Sri Lankan state universities can be divided into three tiers (subdivisions are not discussed).

* Lecturer (Probationary)

– recruited with a four-year undergraduate degree. A tiny step higher is the Lecturer (Unconfirmed), recruited with a postgraduate degree but no teaching experience.

* A Senior Lecturer can be recruited with certain postgraduate qualifications and some number of years of teaching and research.

* Above this is the professor (of four types), which can be left out of this discussion since only one of those (Chair Professor) is by application.

State universities cannot hire permanent academic staff as and when they wish. Prior to advertising a vacancy, approval to recruit is obtained through a mind-numbing and time-consuming process (months!) ending at the Department of Management Services. The call for applications must list all ranks up to Senior Lecturer. All eligible candidates for Probationary to Senior Lecturer are interviewed, e.g., if a Department wants someone with a doctoral degree, they must still advertise for and interview candidates for all ranks, not only candidates with a doctoral degree. In the evaluation criteria, the first degree is more important than the doctoral degree (more on this strange phenomenon later). All of this is only possible when universities are not under a ‘hiring freeze’, which governments declare regularly and generally lasts several years.

Problem type 1

– Archaic processes and evaluation criteria

Twenty-five years ago, as a probationary lecturer with a first degree, I was a typical hire. We would be recruited, work some years and obtain postgraduate degrees (ideally using the privilege of paid study leave to attend a reputed university in the first world). State universities are primarily undergraduate teaching spaces, and when doctoral degrees were scarce, hiring probationary lecturers may have been a practical solution. The path to a higher degree was through the academic job. Now, due to availability of candidates with postgraduate qualifications and the problems of retaining academics who find foreign postgraduate opportunities, preference for candidates applying with a postgraduate qualification is growing. The evaluation scheme, however, prioritises the first degree over the candidate’s postgraduate education. Were I to apply to a Faculty of Education, despite a PhD on language teaching and research in education, I may not even be interviewed since my undergraduate degree is not in education. The ‘first degree first’ phenomenon shows that universities essentially ignore the intellectual development of a person beyond their early twenties. It also ignores the breadth of disciplines and their overlap with other fields.

This can be helped (not solved) by a simple fix, which can also reduce brain drain: give precedence to the doctoral degree in the required field, regardless of the candidate’s first degree, effected by a UGC circular. The suggestion is not fool-proof. It is a first step, and offered with the understanding that any selection process, however well the evaluation criteria are articulated, will be beset by multiple issues, including that of bias. Like other Sri Lankan institutions, universities, too, have tribal tendencies, surfacing in the form of a preference for one’s own alumni. Nevertheless, there are other problems that are, arguably, more pressing as I discuss next. In relation to the evaluation criteria, a problem is the narrow interpretation of any regulation, e.g., deciding the degree’s suitability based on the title rather than considering courses in the transcript. Despite rhetoric promoting internationalising and inter-disciplinarity, decision-making administrative and academic bodies have very literal expectations of candidates’ qualifications, e.g., a candidate with knowledge of digital literacy should show this through the title of the degree!

Problem type 2 – The mess of badly regulated higher education

A direct consequence of the contemporary expansion of higher education is a large number of applicants with myriad qualifications. The diversity of degree programmes cited makes the responsibility of selecting a suitable candidate for the job a challenging but very important one. After all, the job is for life – it is very difficult to fire a permanent employer in the state sector.

Widely varying undergraduate degree programmes.

At present, Sri Lankan undergraduates bring qualifications (at times more than one) from multiple types of higher education institutions: a degree from a UGC-affiliated state university, a state university external to the UGC, a state institution that is not a university, a foreign university, or a private HEI aka ‘private university’. It could be a degree received by attending on-site, in Sri Lanka or abroad. It could be from a private HEI’s affiliated foreign university or an external degree from a state university or an online only degree from a private HEI that is ‘UGC-approved’ or ‘Ministry of Education approved’, i.e., never studied in a university setting. Needless to say, the diversity (and their differences in quality) are dizzying. Unfortunately, under the evaluation scheme all degrees ‘recognised’ by the UGC are assigned the same marks. The same goes for the candidates’ merits or distinctions, first classes, etc., regardless of how difficult or easy the degree programme may be and even when capabilities, exposure, input, etc are obviously different.

Similar issues are faced when we consider postgraduate qualifications, though to a lesser degree. In my discipline(s), at least, a postgraduate degree obtained on-site from a first-world university is preferable to one from a local university (which usually have weekend or evening classes similar to part-time study) or online from a foreign university. Elitist this may be, but even the best local postgraduate degrees cannot provide the experience and intellectual growth gained by being in a university that gives you access to six million books and teaching and supervision by internationally-recognised scholars. Unfortunately, in the evaluation schemes for recruitment, the worst postgraduate qualification you know of will receive the same marks as one from NUS, Harvard or Leiden.

The problem is clear but what about a solution?

Recruitment to state universities needs to change to meet contemporary needs. We need evaluation criteria that allows us to get rid of the dross as well as a more sophisticated institutional understanding of using them. Recruitment is key if we want our institutions (and our country) to progress. I reiterate here the recommendations proposed in ‘Considerations for Higher Education Reform’ circulated previously by Kuppi Collective:

* Change bond regulations to be more just, in order to retain better qualified academics.

* Update the schemes of recruitment to reflect present-day realities of inter-disciplinary and multi-disciplinary training in order to recruit suitably qualified candidates.

* Ensure recruitment processes are made transparent by university administrations.

Kaushalya Perera is a senior lecturer at the University of Colombo.

(Kuppi is a politics and pedagogy happening on the margins of the lecture hall that parodies, subverts, and simultaneously reaffirms social hierarchies.)

Features

Talento … oozing with talent

This week, too, the spotlight is on an outfit that has gained popularity, mainly through social media.

This week, too, the spotlight is on an outfit that has gained popularity, mainly through social media.

Last week we had MISTER Band in our scene, and on 10th February, Yellow Beatz – both social media favourites.

Talento is a seven-piece band that plays all types of music, from the ‘60s to the modern tracks of today.

The band has reached many heights, since its inception in 2012, and has gained recognition as a leading wedding and dance band in the scene here.

The members that makeup the outfit have a solid musical background, which comes through years of hard work and dedication

Their portfolio of music contains a mix of both western and eastern songs and are carefully selected, they say, to match the requirements of the intended audience, occasion, or event.

Although the baila is a specialty, which is inherent to this group, that originates from Moratuwa, their repertoire is made up of a vast collection of love, classic, oldies and modern-day hits.

The musicians, who make up Talento, are:

Prabuddha Geetharuchi:

(Vocalist/ Frontman). He is an avid music enthusiast and was mentored by a lot of famous musicians, and trainers, since he was a child. Growing up with them influenced him to take on western songs, as well as other music styles. A Peterite, he is the main man behind the band Talento and is a versatile singer/entertainer who never fails to get the crowd going.

Geilee Fonseka (Vocals):

A dynamic and charismatic vocalist whose vibrant stage presence, and powerful voice, bring a fresh spark to every performance. Young, energetic, and musically refined, she is an artiste who effortlessly blends passion with precision – captivating audiences from the very first note. Blessed with an immense vocal range, Geilee is a truly versatile singer, confidently delivering Western and Eastern music across multiple languages and genres.

Chandana Perera (Drummer):

His expertise and exceptional skills have earned him recognition as one of the finest acoustic drummers in Sri Lanka. With over 40 tours under his belt, Chandana has demonstrated his dedication and passion for music, embodying the essential role of a drummer as the heartbeat of any band.

Harsha Soysa:

(Bassist/Vocalist). He a chorister of the western choir of St. Sebastian’s College, Moratuwa, who began his musical education under famous voice trainers, as well as bass guitar trainers in Sri Lanka. He has also performed at events overseas. He acts as the second singer of the band

Udara Jayakody:

(Keyboardist). He is also a qualified pianist, adding technical flavour to Talento’s music. His singing and harmonising skills are an extra asset to the band. From his childhood he has been a part of a number of orchestras as a pianist. He has also previously performed with several famous western bands.

Aruna Madushanka:

(Saxophonist). His proficiciency in playing various instruments, including the saxophone, soprano saxophone, and western flute, showcases his versatility as a musician, and his musical repertoire is further enhanced by his remarkable singing ability.

Prashan Pramuditha:

(Lead guitar). He has the ability to play different styles, both oriental and western music, and he also creates unique tones and patterns with the guitar..

-

Features3 days ago

Features3 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features6 days ago

Features6 days agoAn innocent bystander or a passive onlooker?

-

Features7 days ago

Features7 days agoRatmalana Airport: The Truth, The Whole Truth, And Nothing But The Truth

-

Opinion3 days ago

Opinion3 days agoSri Lanka – world’s worst facilities for cricket fans

-

Business7 days ago

Business7 days agoIRCSL transforms Sri Lanka’s insurance industry with first-ever Centralized Insurance Data Repository

-

Business6 days ago

Business6 days agoAn efficacious strategy to boost exports of Sri Lanka in medium term

-

Features4 days ago

Features4 days agoOverseas visits to drum up foreign assistance for Sri Lanka