Features

Plants glowing in the dark

By Prof. Kirthi Tennakone

Email: ktenna@yahoo.co.uk

When Rama’s brother Lakshmana fell unconscious, hit by an arrow from Indrajit, the son of Ravana, Hanuman appealed to Sushena, the genius Sri Lankan physician, for intervention. Vaidya Sushena said, “Rush to Dronagiri Parvat in the Himalayas and fetch the herb, Sanjeevani. I will resuscitate the wounded instantly. As the plant emanates light all the time and glows in the dark! You will make no mistake in identification.” (Ramayana).

In 2016, the Ministry of Alternative Medicine, State of Uttarakhand, India proposed spending 250 million rupees to search for the herb. An ayurvedic adviser claimed the herb had been seen growing in the slopes of Dronagiri endowed with a unique fragrance and lights up in the night.

Expeditions to the Himalayas have returned accompanying samples claimed to be Sanjeevani, but none glowed in the dark.

Although animals and fungi glowing in the dark exist, plants exhibiting the same quality are not found in nature. Nature may forbid the appearance of such plants in the wilderness for some unknown reason. Or perhaps an inadvertently long overdue. Yet if the laws of nature do not rule out their existence, man will someday invent them, somehow?

Starting in the early days of genetic engineering, attempts were made to modify plants to glow in the dark with little success. In 2017, the Russian chemist Zinaida Kazakova described the situation as: It can be done but may be as challenging as going to Mars. Things happen sooner than expected. The first plant to glow in the dark was engineered in 2020.

If a plant glowing evolved naturally, the trait would undoubtedly be a tremendous advantage for the species, because man certainly jumps to propagate. Presumably, the task that took a few decades for human intelligence to achieve, nature’s method of random mutations needs eons.

Recently a live herb emitting light constantly and blooming flowers luminescent at night was created artificially, making Valmiki’s imagination a reality.

A synthetic biology startup Light Bio in the United States engineered a novel variety of flowering plants. And named it Firefly Petunia, because at night, the irradiance of flower buds resembles fireflies. After clearance from the United States Department of Agriculture, the transgenic ornamental was released for propagation (only in the United States) this year.

The phenomenon of light emission by living things is referred to as bioluminescence. Bioluminescent organisms live on land and more abundantly in the ocean. The familiar light sources, sun and fire are extremely hot. In the days before the advent of LEDs, people pondered how tender living objects emit light without getting burnt.

The flashing lights of fireflies, familiar to us, fascinate the curious. For those reasons, all cultures have folklore and myths connected to fireflies. Later firefly curiosity inspired research revealing the science behind the mystery. Applications followed, notably around advanced medical research.

The seas around the Islands of Maldives frequently glitters at night owing to the bioluminescence of algae. In the olden days, the islanders revered and feared, considering the happening as an omen. Today the sight attracts tourists.

A species of jellyfish displays brilliant green bioluminescence. In 1961, the biochemist Osamu Shimomura found that when he extracted the active components, the luminescence appeared blue. Continuing experiments, Shimomura concluded a protein in the jellyfish, absorbs blue light and re-emits as green. Finding enabled devising a way of monitoring in real time, how cancer and virus diseases progress in living animals at the cellular level.

Equally mysterious are the bioluminescent mushrooms and fungi. In 1840 the English botanist George Gardner visiting Brazil was startled to see a group of boys playing with a luminous object. He identified it to be a mushroom growing at the base of coconut trees, subsequently named Neonothopanus Gardeneri to honor the discoverer. The same species occurs in Sri Lanka, growing on decaying exposed roots of coconut trees. We too as children played with it and read newspapers at night holding the mushroom.

One day, seven decades ago, the people of my ancestral village were agitated after seeing an avatar. Something as lengthy as a tall man in a thicket beside a footpath glowed at night, scaring passersby. Those days, it was normal for a man to walk along a footpath at night in the neighborhood, without a light source in hand. My father, who didn’t believe in ghosts, found the avatar to be a rotting bamboo pole. A mold (microscopic fungus) breeding on the pole caused luminance.

The phenomenon of bioluminescence intrigued humans since time immemorial is now understood as a sustained chemical reaction liberating energy, as light. Bioluminescent organisms carry two chemical substances: luciferin and luciferase. The former reacts with oxygen emitting light and the latter fastens the rate of the reaction without undergoing any change. Light emission sustains itself replenishing luciferin by biochemical synthesis. A remarkable way of converting the metabolic energy of an organism into light, generating very little heat and consuming oxygen.

Perhaps bioluminescence evolved more than 300 million years ago as a response of organisms to the danger posed by the increased oxygen in the atmosphere. In the carboniferous period, plants grew vigorously on land, releasing excessive amounts of oxygen. Bioluminescence afforded a way of eliminating oxygen without generating too much heat. Later organisms found other advantages of the process; to deter predators, communicate with their mates, and in the case of mushrooms attract insects and disperse spores.

Firefly petunia was designed by incorporating four genes from a Neonothopanus species mushroom and one gene from a fungus to the common, white-flowered petunia DNA. A strategy more involved than conventional genetic engineering, but a more advanced version termed synthetic biology.

Science examines nature – seeking explanations, correlations and generalizations and foresees innovations. Engineering turns innovative ideas derived from science into practicalities. During the past five decades, molecular biology and genetics have advanced tremendously. Synthetic biology aims to utilise knowledge gained to modify existing life forms or design new organisms, beneficial to the world, with the help of advanced instrumentation and computational facilities. Firefly petunia stands out as a step in this direction readily appreciated by laymen.

It is a realization of an imagination written down in one of the greatest epics of all time. And of particular interest to Sri Lankans. In the East, we mix up myth and imagination and fool ourselves. Whereas in the West, imagination inspires innovation.

In the future, you will walk on streets lit by trees. These engineered trees emit carbon dioxide at night and capture it during the daytime harvesting sunlight .Net zero carbon emissions!The author was motivated to write this essay after taking care of a Firefly Petunia plant and seeing how it glows at night.

Features

US’ drastic aid cut to UN poses moral challenge to world

‘Adapt, shrink or die’ – thus runs the warning issued by the Trump administration to UN humanitarian agencies with brute insensitivity in the wake of its recent decision to drastically reduce to $2bn its humanitarian aid to the UN system. This is a substantial climb down from the $17bn the US usually provided to the UN for its humanitarian operations.

‘Adapt, shrink or die’ – thus runs the warning issued by the Trump administration to UN humanitarian agencies with brute insensitivity in the wake of its recent decision to drastically reduce to $2bn its humanitarian aid to the UN system. This is a substantial climb down from the $17bn the US usually provided to the UN for its humanitarian operations.

Considering that the US has hitherto been the UN’s biggest aid provider, it need hardly be said that the US decision would pose a daunting challenge to the UN’s humanitarian operations around the world. This would indeed mean that, among other things, people living in poverty and stifling material hardships, in particularly the Southern hemisphere, could dramatically increase. Coming on top of the US decision to bring to an end USAID operations, the poor of the world could be said to have been left to their devices as a consequence of these morally insensitive policy rethinks of the Trump administration.

Earlier, the UN had warned that it would be compelled to reduce its aid programs in the face of ‘the deepest funding cuts ever.’ In fact the UN is on record as requesting the world for $23bn for its 2026 aid operations.

If this UN appeal happens to go unheeded, the possibilities are that the UN would not be in a position to uphold the status it has hitherto held as the world’s foremost humanitarian aid provider. It would not be incorrect to state that a substantial part of the rationale for the UN’s existence could come in for questioning if its humanitarian identity is thus eroded.

Inherent in these developments is a challenge for those sections of the international community that wish to stand up and be counted as humanists and the ‘Conscience of the World.’ A responsibility is cast on them to not only keep the UN system going but to also ensure its increased efficiency as a humanitarian aid provider to particularly the poorest of the poor.

It is unfortunate that the US is increasingly opting for a position of international isolation. Such a policy position was adopted by it in the decades leading to World War Two and the consequences for the world as a result for this policy posture were most disquieting. For instance, it opened the door to the flourishing of dictatorial regimes in the West, such as that led by Adolph Hitler in Germany, which nearly paved the way for the subjugation of a good part of Europe by the Nazis.

If the US had not intervened militarily in the war on the side of the Allies, the West would have faced the distressing prospect of coming under the sway of the Nazis and as a result earned indefinite political and military repression. By entering World War Two the US helped to ward off these bleak outcomes and indeed helped the major democracies of Western Europe to hold their own and thrive against fascism and dictatorial rule.

Republican administrations in the US in particular have not proved the greatest defenders of democratic rule the world over, but by helping to keep the international power balance in favour of democracy and fundamental human rights they could keep under a tight leash fascism and linked anti-democratic forces even in contemporary times. Russia’s invasion and continued occupation of parts of Ukraine reminds us starkly that the democracy versus fascism battle is far from over.

Right now, the US needs to remain on the side of the rest of the West very firmly, lest fascism enjoys another unfettered lease of life through the absence of countervailing and substantial military and political power.

However, by reducing its financial support for the UN and backing away from sustaining its humanitarian programs the world over the US could be laying the ground work for an aggravation of poverty in the South in particular and its accompaniments, such as, political repression, runaway social discontent and anarchy.

What should not go unnoticed by the US is the fact that peace and social stability in the South and the flourishing of the same conditions in the global North are symbiotically linked, although not so apparent at first blush. For instance, if illegal migration from the South to the US is a major problem for the US today, it is because poor countries are not receiving development assistance from the UN system to the required degree. Such deprivation on the part of the South leads to aggravating social discontent in the latter and consequences such as illegal migratory movements from South to North.

Accordingly, it will be in the North’s best interests to ensure that the South is not deprived of sustained development assistance since the latter is an essential condition for social contentment and stable governance, which factors in turn would guard against the emergence of phenomena such as illegal migration.

Meanwhile, democratic sections of the rest of the world in particular need to consider it a matter of conscience to ensure the sustenance and flourishing of the UN system. To be sure, the UN system is considerably flawed but at present it could be called the most equitable and fair among international development organizations and the most far-flung one. Without it world poverty would have proved unmanageable along with the ills that come along with it.

Dehumanizing poverty is an indictment on humanity. It stands to reason that the world community should rally round the UN and ensure its survival lest the abomination which is poverty flourishes. In this undertaking the world needs to stand united. Ambiguities on this score could be self-defeating for the world community.

For example, all groupings of countries that could demonstrate economic muscle need to figure prominently in this initiative. One such grouping is BRICS. Inasmuch as the US and the West should shrug aside Realpolitik considerations in this enterprise, the same goes for organizations such as BRICS.

The arrival at the above international consensus would be greatly facilitated by stepped up dialogue among states on the continued importance of the UN system. Fresh efforts to speed-up UN reform would prove major catalysts in bringing about these positive changes as well. Also requiring to be shunned is the blind pursuit of narrow national interests.

Features

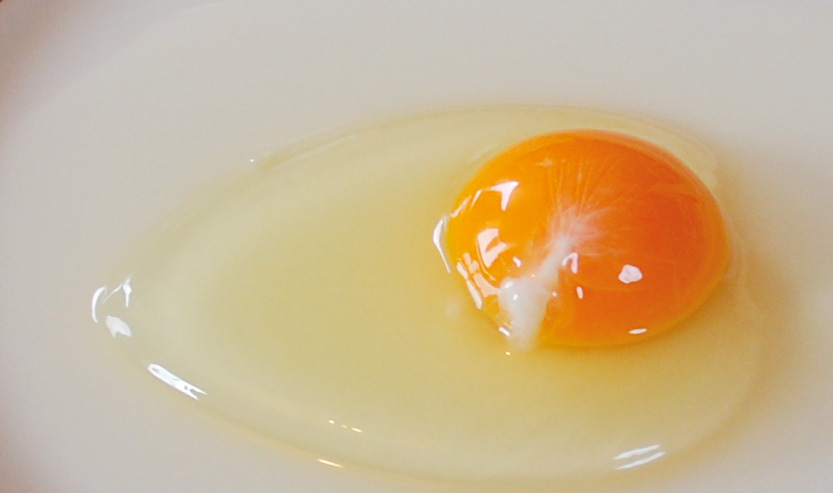

Egg white scene …

Hi! Great to be back after my Christmas break.

Hi! Great to be back after my Christmas break.

Thought of starting this week with egg white.

Yes, eggs are brimming with nutrients beneficial for your overall health and wellness, but did you know that eggs, especially the whites, are excellent for your complexion?

OK, if you have no idea about how to use egg whites for your face, read on.

Egg White, Lemon, Honey:

Separate the yolk from the egg white and add about a teaspoon of freshly squeezed lemon juice and about one and a half teaspoons of organic honey. Whisk all the ingredients together until they are mixed well.

Apply this mixture to your face and allow it to rest for about 15 minutes before cleansing your face with a gentle face wash.

Don’t forget to apply your favourite moisturiser, after using this face mask, to help seal in all the goodness.

Egg White, Avocado:

In a clean mixing bowl, start by mashing the avocado, until it turns into a soft, lump-free paste, and then add the whites of one egg, a teaspoon of yoghurt and mix everything together until it looks like a creamy paste.

Apply this mixture all over your face and neck area, and leave it on for about 20 to 30 minutes before washing it off with cold water and a gentle face wash.

Egg White, Cucumber, Yoghurt:

In a bowl, add one egg white, one teaspoon each of yoghurt, fresh cucumber juice and organic honey. Mix all the ingredients together until it forms a thick paste.

Apply this paste all over your face and neck area and leave it on for at least 20 minutes and then gently rinse off this face mask with lukewarm water and immediately follow it up with a gentle and nourishing moisturiser.

Egg White, Aloe Vera, Castor Oil:

To the egg white, add about a teaspoon each of aloe vera gel and castor oil and then mix all the ingredients together and apply it all over your face and neck area in a thin, even layer.

Leave it on for about 20 minutes and wash it off with a gentle face wash and some cold water. Follow it up with your favourite moisturiser.

Features

Confusion cropping up with Ne-Yo in the spotlight

Superlatives galore were used, especially on social media, to highlight R&B singer Ne-Yo’s trip to Sri Lanka: Global superstar Ne-Yo to perform live in Colombo this December; Ne-Yo concert puts Sri Lanka back on the global entertainment map; A global music sensation is coming to Sri Lanka … and there were lots more!

Superlatives galore were used, especially on social media, to highlight R&B singer Ne-Yo’s trip to Sri Lanka: Global superstar Ne-Yo to perform live in Colombo this December; Ne-Yo concert puts Sri Lanka back on the global entertainment map; A global music sensation is coming to Sri Lanka … and there were lots more!

At an official press conference, held at a five-star venue, in Colombo, it was indicated that the gathering marked a defining moment for Sri Lanka’s entertainment industry as international R&B powerhouse and three-time Grammy Award winner Ne-Yo prepares to take the stage in Colombo this December.

What’s more, the occasion was graced by the presence of Sunil Kumara Gamage, Minister of Sports & Youth Affairs of Sri Lanka, and Professor Ruwan Ranasinghe, Deputy Minister of Tourism, alongside distinguished dignitaries, sponsors, and members of the media.

According to reports, the concert had received the official endorsement of the Sri Lanka Tourism Promotion Bureau, recognising it as a flagship initiative in developing the country’s concert economy by attracting fans, and media, from all over South Asia.

However, I had that strange feeling that this concert would not become a reality, keeping in mind what happened to Nick Carter’s Colombo concert – cancelled at the very last moment.

Carter issued a video message announcing he had to return to the USA due to “unforeseen circumstances” and a “family emergency”.

Though “unforeseen circumstances” was the official reason provided by Carter and the local organisers, there was speculation that low ticket sales may also have been a factor in the cancellation.

Well, “Unforeseen Circumstances” has cropped up again!

In a brief statement, via social media, the organisers of the Ne-Yo concert said the decision was taken due to “unforeseen circumstances and factors beyond their control.”

Ne-Yo, too, subsequently made an announcement, citing “Unforeseen circumstances.”

The public has a right to know what these “unforeseen circumstances” are, and who is to be blamed – the organisers or Ne-Yo!

Ne-Yo’s management certainly need to come out with the truth.

However, those who are aware of some of the happenings in the setup here put it down to poor ticket sales, mentioning that the tickets for the concert, and a meet-and-greet event, were exorbitantly high, considering that Ne-Yo is not a current mega star.

We also had a cancellation coming our way from Shah Rukh Khan, who was scheduled to visit Sri Lanka for the City of Dreams resort launch, and then this was received: “Unfortunately due to unforeseen personal reasons beyond his control, Mr. Khan is no longer able to attend.”

Referring to this kind of mess up, a leading showbiz personality said that it will only make people reluctant to buy their tickets, online.

“Tickets will go mostly at the gate and it will be very bad for the industry,” he added.

-

News7 days ago

News7 days agoStreet vendors banned from Kandy City

-

Sports4 days ago

Sports4 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne

-

News7 days ago

News7 days agoLankan aircrew fly daring UN Medevac in hostile conditions in Africa

-

News2 days ago

News2 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Sports5 days ago

Sports5 days agoTime to close the Dickwella chapter

-

Features3 days ago

Features3 days agoIt’s all over for Maxi Rozairo

-

Features7 days ago

Features7 days agoRethinking post-disaster urban planning: Lessons from Peradeniya

-

Opinion7 days ago

Opinion7 days agoAre we reading the sky wrong?