Business

Notable dip in blue-chip counters as macro and micro uncertainties weigh on bourse

By Hiran H.Senewiratne

The CSE surrendered its early gains to close marginally lower yesterday as looming macro and micro economic uncertainties weighed on investor sentiment amid a significant drop in blue-chip counters, stock market analysts said.

Despite global tensions with regard to the Russian- Ukraine issue easing out, since Russia is reportedly looking for a diplomatic intervention, the local micro economic front did not seem to facilitate profitable stock market operations, which factor dragged the bourse to negative territory, stock market analysts added. Moreover, an increase in world crude oil prices to the higher level of US $ 94 per barrel from US $ 72, put more pressure on the Sri Lankan economy due to the ongoing currency crisis, market analysts pointed out.

Against this backdrop, the stock market started on a positive note but later turned negative, especially with regard to blue-chip counters. Both indices moved downward. The All- Share Price Index went down by 106 points and S and P SL20 declined by 16.8 points.

Turnover stood at Rs 3.2 billion with a single crossing. The crossing was recorded from Melstacorp, which crossed 390,000 shares to the tune of Rs 26.6 million, its shares traded at Rs 56.

In the retail market, top seven companies that were mainly contributed to the turnover were; Commercial Leasing and Finance Rs 756 million (16.9 million shares traded), LOLC Finance Rs 460 million (17.2 million shares traded), Browns Investments Rs 229 million (16.2 million shares traded), Expolanka Rs 163 million (503,000 shares traded), Sinhaputhra Finance Rs 142 million (4.2 million shares traded), Softlogic Life Insurance Rs 102.6 million (738,000 shares traded) and Softlogic Holdings Rs 68.8 million (953,000 shares traded). During the day 108 million share volumes changed hands in 36000 share transactions.

The index pared early gains thereupon and slipped into negative territory as investors realized quick profits, capitalizing on recent sharp price increases in select heavyweight counters. However, activity continued at moderate levels with daily turnover coming in at a four-month low. The breadth of the market ended negative with 78 price gainers and 121 decliners, market watchers said.

It is said that foreigners recorded a net outflow of Rs. 42 million, while their participation increased marginally to 2.7 per cent of turnover (previous day 2.3 percent). Reportedly, high net worth and institutional investor participation was noted in Royal Ceramics, Softlogic Life Insurance and LOLC Holdings.

Mixed interest was observed in Expolanka Holdings, Vallibel Finance and Sunshine Holdings, while retail interest was noted in SMB Leasing non-voting, Dialog Axiata and Browns Investments. The share price of Vallibel Finance gained Rs. 3.50 to close at Rs. 55.

The Capital Goods sector was the second highest contributor to the market turnover (due to Royal Ceramics), while the sector index increased by 0.06 per cent. The share price of Royal Ceramics recorded a gain of 60 cents to close at Rs. 71.90. Further First Capital Holdings and First Capital Treasuries announced subdivision of shares from one existing share into four new shares.

Yesterday, the US dollar was quoted at Rs 202.52, which was the controlled price of the Central Bank. The Central Bank has imposed a ceiling of Rs 203 per US dollar. However, market sources said that the actual price would be more than Rs 250.

Business

“We Are Building a Stable, Transparent and Resilient Sri Lanka Ready for Sustainable Investment Partnerships” – PM

Prime Minister Dr. Harini Amarasuriya addressed members of the Chief Executives Organization (CEO) during a session held on Thursday [3 February 2026] at the Shangri-La Hotel, Colombo, as part of CEO’s Pearl of the Indian Ocean: Sri Lanka programme.

The Chief Executives Organization is a global network of business leaders representing diverse industries across more than 60 countries. The visiting delegation comprised leading entrepreneurs and executives exploring Sri Lanka’s economic prospects, investment climate, and development trajectory.

Addressing the gathering, the Prime Minister emphasized that Sri Lanka’s reform agenda is anchored in structural transformation, transparency, and inclusive growth.

“We are committed not only to ensuring equitable access to education, but equitable access to quality education. Our reforms are designed to create flexible pathways for young people beyond general education and to build a skilled and adaptable workforce for the future.”

She highlighted that the Government is undertaking a fundamental pedagogical shift towards a more student-focused, less examination-driven system as part of a broader national transformation.

Reflecting on Sri Lanka’s recent political transition, the Prime Minister stated:

“The people gave us a mandate to restore accountability, strengthen democratic governance, and ensure that opportunity is not determined by patronage or privilege, but by fairness and merit. Sri Lanka is stabilizing. We have recorded positive growth, restored confidence in key sectors, and are committed to sustaining this momentum. But our objective is not short-term recovery it is long-term resilience.”

Addressing governance reforms aimed at improving the investment climate, she said:

“We are aligning our legislative and regulatory frameworks with international standards to provide predictability, investor protection, and institutional transparency. Sustainable investment requires trust, and trust requires reform.”

Turning to the recent impact of Cyclone Ditwa, which affected all 25 districts of the country, the Prime Minister underscored the urgency of climate resilience.

“Climate change is not a distant threat. It is a lived reality for our people. We are rebuilding not simply to recover, but to build resilience, strengthen disaster mitigation systems, and protect vulnerable communities.”

Inviting CEO members to consider Sri Lanka as a strategic partner in the Indo-Pacific region, she highlighted opportunities in value-added mineral exports, logistics and shipping, agro-processing, renewable energy, pharmaceuticals, and innovation-driven sectors.

“We are not looking for speculative gains. We are seeking long-term partners who share our commitment to transparency, sustainability, and inclusive development.”

She further emphasized collaboration in education, research, vocational training, and innovation as essential pillars for sustained economic growth.

Concluding her address, the Prime Minister expressed appreciation to the Chief Executives Organization for selecting Sri Lanka as part of its 2026 programme and reaffirmed the Government’s readiness to engage constructively with responsible global investors.

The event was attended by the Governor of the Western Province, Hanif Yusoof, and other distinguished guests.

[Prime Minister’s Media Division]

Business

High Commissioner in Pakistan urges high level business visit to Colombo

The High Commissioner of Sri Lanka to Pakistan, Rear Admiral Fred Senevirathne, met Dr. Zeelaf Munir, Chairperson of the Pakistan Business Council (PBC), in Karachi on Feb. 6 and urged a high level visit of Pakistani business people to Sri Lanka, a news release from the High Commission said.

Dr. Munir, who also serves as the Managing Director and Chief Executive Officer of English Biscuit Manufacturers (EBM), leads Pakistan’s premier business policy advocacy body, which plays a key role in promoting a conducive business environment, export growth, and industrial development.

The High Commissioner who was warmly received by Dr. Munir at her office briefed her on the current economic and political landscape in Sri Lanka, highlighting the country’s improving economic outlook, enhanced political stability, and a favourable environment for foreign investment, the release said.

He also outlined the policy priorities of the new Government, with particular emphasis on ongoing economic reforms, investment-friendly initiatives, and opportunities to further strengthen bilateral economic and trade cooperation between Sri Lanka and Pakistan, it said.

He invited Dr. Munir to consider leading a delegation of prominent business leaders and investors to Sri Lanka, with a view to engaging with Sri Lankan counterparts and exploring potential investment opportunities and avenues for collaboration across key sectors.

The meeting was facilitated by. Honorary Consul of Sri Lanka in Hyderabad, Mehmood Mandviwalla, who was also present. Minister and Head of Chancery of the Sri Lanka High Commission in Islamabad, Christy Ruban, and Consul General of Sri Lanka in Karachi, Sanjeewa Pattiwila also participated at the meeting.

Business

IRONMAN 70.3 Colombo Returns, Kicks Off #ActiveColombo City Transformation

Officials from the Western Provincial Council, Colombo Municipal Council, and event organisers marked the official launch of IRONMAN 70.3 Colombo – Presented by Port City Colombo today at Shangri-La Colombo, the Host Hotel, signalling the return of Sri Lanka’s premier endurance event and the start of the long-term #ActiveColombo initiative.

Scheduled from 19–22 February 2026, the world-class triathlon will anchor #ActiveColombo Week, combining international competition with a city-wide celebration of sport, health, and urban vitality. Highlights include the KAYA Colombo – Active Lifestyle & International Expo (19–21 Feb), the family-focused IRONKIDS Colombo (21 Feb), and the IRONMAN 70.3 Colombo triathlon (22 Feb), featuring swim, bike, and run events at Port City Colombo, the Official Venue Partner.

The event is set to welcome nearly 1,000 athletes from over 49 countries, many visiting Sri Lanka for the first time, bringing international media attention and significant economic impact across hospitality, aviation, retail, and transport. As part of the globally recognised IRONMAN® circuit, Colombo now joins iconic host cities such as Sydney, Nice, and Muscat, reinforcing its position as South Asia’s emerging endurance sports hub.

“IRONMAN 70.3 Colombo embodies the spirit of resilience and excellence,” said Rajan Thananayagam, Director of Serendib Multisport (Pvt) Ltd. “This event puts Sri Lanka on the world stage and showcases Colombo as a vibrant, welcoming destination for athletes and their families.”

The launch also introduced #ActiveColombo, a long-term initiative aimed at transforming Colombo into South Asia’s leading Active City. The programme focuses on activating everyday urban spaces through parks, waterfronts, beaches, clean streets, shaded corridors, and safe environments that encourage walking, cycling, yoga, and other outdoor activities.

“Through #ActiveColombo, we aim to inspire a more active generation while strengthening Colombo’s appeal as a globally competitive capital,” said Hanif Yusoof, Governor of the Western Province. Mayor Vraîe Cally Balthazaar added that the initiative symbolises inclusive growth, promoting healthier streets, greener corridors, and vibrant public spaces for residents and visitors alike.

With signature policies such as the “Every Active Street is a Shaded Street” Shade the Road initiative, Colombo aims to combine urban health, economic growth, and international sports tourism. Experts say cities that invest in active lifestyles see 10–20% reductions in long-term healthcare costs, safer streets, and higher visitor spending.

By linking IRONMAN 70.3 Colombo with #ActiveColombo, organisers hope to position the city as a healthier home for citizens, a premier destination for high-value tourists, and a credible host for global sporting and lifestyle events, cementing Colombo’s reputation as South Asia’s Active Capital.

-

Business4 days ago

Business4 days agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Midweek Review4 days ago

Midweek Review4 days agoA question of national pride

-

Opinion3 days ago

Opinion3 days agoWill computers ever be intelligent?

-

Midweek Review4 days ago

Midweek Review4 days agoTheatre and Anthropocentrism in the age of Climate Emergency

-

Editorial6 days ago

Editorial6 days agoThe JRJ syndrome

-

Opinion4 days ago

Opinion4 days agoThe Walk for Peace in America a Sri Lankan initiative: A startling truth hidden by govt.

-

Foreign News6 days ago

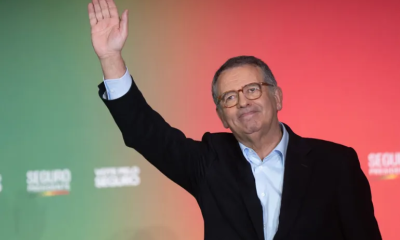

Foreign News6 days agoPortugal elects Socialist Party’s Seguro as president in landslide

-

Foreign News7 days ago

Foreign News7 days agoWashington Post chief executive steps down after mass lay-offs