Opinion

IMF folly – Imputed Rental Income Tax

By Dr Sirimewan Dharmaratne,

Former Senior Analyst, HM Revenue

and Customs, UK.

While one can only imagine the atmosphere at the discussions with the IMF, what transpires from these meetings, one can presume that there was no resistance or contention to whatever the IMF proposes. The IMF appears to be pretty much dictating the fiscal policies for Sri Lanka to follow. The proposed Imputed Rental Income Tax (IRIT) is a good example how helpless or defenceless Sri Lanka has become to get a bit of money that some oligarchs spend on their yachts. The gravity of this tax is only just gradually sinking in Sri Lanka. Even those in the government, or those wannabes, are clueless as to what this policy is. It is utter stupidity to make statements such as “90% of the property owners won’t be affected” when the policy is not yet even formulated. Without the Sale Price and Rent Register (SPRR), which will be the basis for valuation, it has not been even started, but is required to be completed within a few months. Tax rate has not been determined either. Therefore, it is disingenuous and misleading to say that only 10% of the households will be affected. Further because of the word ‘rental’, some politicians still believe this is a tax on rented properties or on those with ‘commercial value,” whatever that is. But potentially it could be far more sinister!

What is Imputed Rental Income Tax?

This is a highly controversial and nonsensical tax that is imposed in only five countries, namely Iceland, Luxembourg, the Netherlands, Slovenia and Switzerland. None of these are developing countries and even in Switzerland, there is an ongoing debate on its abolition. The tax is imposed on the ‘imputed’ rental income of your own home after deducting mortgage or loan payments. The imputation is based on the rent that you would have to pay to rent a similar property in that location. Once this is determined, there may be some provision for the homeowner to negotiate the imputed value, based on several other factors. In countries where this is imposed, imputed value is negotiated down to be less than half of the potential rental value.

Proposed SPRR

The IMF has suggested implementing this tax by March 2025, once the SPRR is completed within a few months of this year. This will be a monumental task in the informal and disparate property market that exists in Lanka. Except for some properties in high-rise apartment complexes and a few other high-end properties, mainly in Colombo, most rentals and property transactions occur through personal advertisements on newspapers and online. Their rental rates and selling prices are personal information and are unlikely to be recorded anywhere. Further, each property is unique and no two properties, in the same neighbourhood, are the same. This adds to the complexity of determining overarching rental rates, or sale prices, even for a small confined neighbourhood. Also, rents are negotiated, based on personal acquaintances, actual or perceived ability to pay rent and several other factors that cannot be quantified. Often one finds palatial homes in not so desirable neighbourhoods surrounded by very basic abodes. This will make it extremely challenging for authorities to come up with any credible imputed rent register for a myriad of heterogeneous properties strewn all over the island.

This is very much different to developed countries, where there are whole neighbourhoods with pretty much identical properties. Variation is sale prices and rents are very minor within a neighbourhood. Transaction information on only a few properties is enough to impute the sale or rental value of similar properties. In the UK, for example, there are several online property sites that individuals use as guides to advertise properties for sale and rent. Also, since most homes are mortgaged owned, banks have a record of sale prices and mortgages extended to each property. The government and tax authorities have access to all this information almost in real time.

Is this tax realistic in Sri Lanka?

Despite the ill-conceived optimism of the IMF, this tax is highly impractical in Sri Lanka due to aforementioned reasons and certainly not within the suggested time frame. This is an excellent manifestation of what happens when international organisations run out of ideas and are devoid of any sense of reality of the environment that they are working on. In a highly fractured and heterogenous property market, each property will have to be considered individually to calculate the imputed rent as each property is a unique entity. Further, the rental demand for high-end properties in Colombo and its purlieu are by embassies, international organisations and other foreign establishments that can pay high rents, which are out of reach of many ordinary Sri Lankans. While those who are lucky enough to get such clients may demand high rents, to use them to impute rental value of the adjoining property is not possible. For properties of this nature there is an esoteric and limited client base. For the rest of the country, there is a ‘rent ceiling’ that any property could demand, regardless of how grand it is.

Therefore, any kind of rent register has to be either very individualised or fairly prosaic, mostly based on highly conservative estimates in a very parsimonious information environment. Either way, putting together a useful and credible SPRR would be highly contentious and those with means and connections could influence how much their imputed rent would be. This opens up another avenue for widespread corruption, where valuation offices could easily be the new elite surpassing custom offices.

Is this tax fair?

One of the main arguments against IRIT is that it goes against the very principle of taxation. A tax is imposed on a transaction or when an income is generated. This tax is imposed on a non-income generating asset. As such, it is biased against those individuals who are asset rich but cash poor. Sri Lankan house ownership is unique. Most people strive throughout their working years to build a house that eventually becomes their family home. When they retire and income is drastically reduced, it not only becomes their permanent refuge, but also serves as a launching pad for grown up children until they become independent. Few lucky ones acquire homes through bequeath or marriage. For these individuals’ this tax may not be as unfair as for those who have spent their hard-earned money building or acquiring a property. However, the morality of the tax is still questionable. This tax is penalising people for their enterprise. It is in effect disincentivizing people from investing in their future and the welfare of their children. While tax implications can be taken into account in making a decision about going for a higher paying job, or purchasing an item, no one would know what the future tax is when they start to build their own home. It is completely at the mercy of an imperfect and capricious valuation process. Therefore, if applied regressively, this tax would be unfair on the owners of the existing stock of property and could peril the livelihood of those who are living at the margins, but fortunate enough to have their own comfortable home in a desirable location. Those who are planning to get on the property ladder would be no better off either as they would have to consider some random tax that will be imposed once the property is built or acquired.

Why in this predicament?

The reason that Sri Lanka is in this quandary and has to propitiate IMF is due to years of neglect to implement sensible tax policies. Ridiculously low historic personal income taxes and their ad hoc implementation has given a false sense of prosperity that accustomed the populace to a lifestyle that otherwise would not have been possible. If the taxes have been allowed to increase marginally over the years to reflect the true cost of providing public services, the pain would have been much less. To cover the gap that could not be covered by taxes, all elected governments have been borrowing heavily, primarily to support consumption. Even when borrowed for income generation, gratuitous corruption and egregious decisions have rendered most investments liabilities. All the while the debt has been piling up unabated, and passed on from one administration to another. Economic mismanagement and the maintenance of a bloated, inefficient and corrupt public service have finally nailed the coffin in. While decreasing government expenditure through restructuring and privatisation is facing fierce opposition, agreeing to raise taxes and find new sources for taxation appears to be the only way to convince creditors to lend more. But is it?

Tax Gap – Finding tax leakages

One of the main accusations against pervasive taxation is the inability or unwillingness to clamp down on widespread tax evasion. Different groups point out sources where substantial haemorrhage of tax occurs. However, quantifying leakages of tax revenue has hampered putting forward a compelling case against imposing more debilitating taxes. To realise how extra tax can be collected without imposing new taxes, the government needs to know how much tax is lost and then formulate a comprehensive plan to collect. The method to estimate lost tax is by calculating the tax gap. Tax gap calculates the overall deficit in the tax that is due under full compliance and what is actually collected. It can be broken down by sector, such as tax lost through income tax, corporate tax, excise tax. The concept is fairly straightforward although computationally data driven. Rather than agreeing to every outlandish suggestion that the IMF makes, the government should be able to suggest alternative methods to raise taxes without further burdening the long-suffering public. The way to achieve this is by having people who could hold a conversation at their level. Obsequiousness is seen as a sign of weakness that organisations like the IMF have come to expect in developing countries. Unless the government gets its act together and shows that they could put forward fact-based strong arguments, it won’t be able to defend the public from the wrath of the IMF. Without the knowledge of how much tax is lost and a comprehensive plan to collect it, it is not surprising that only one party dominates these discussions.

Repercussions of Excessive Taxation

Studies done in the UK and other countries have shown that excessive tax burden promotes evasion and evasion is self-feeding. When people see others evade taxes, they are also compelled to do so, especially if they see no action is taken. Since taxes don’t give any direct benefits, individuals are more likely to comply if everyone else does. People neither feel good when they pay taxes or feel bad when they evade. Because they feel ‘everyone’ is doing it. All this means that there will be a huge cost making individuals comply with various taxes and associated regulations that are popping up like mushrooms. This will in turn increase government expenditure, negating most or some of the revenue from increased taxation. A complicated tax like IRIT will face significant difficulties and costs through its implementation. Identifying the ownership, imputed rent valuation, adjusting it for various mitigating factors, negotiations, endless legal challenges and distortions to the property market will render this tax unworkable in Sri Lanka. The IMF really should stay away from prescribing specific tax policies that are not suitable for Sri Lanka while the government should be much more erudite in holding their ground and fighting their corner.

Opinion

Open letter to PUCSL on proposed electricity tariff revision

Although the Public Utilities Commission of Sri Lanka (PUCSL) has appropriately invited public consultation on the proposed electricity tariff revision from 27 February to 18 March, the online submission portal appears to contain a non-functioning submission tab. If this technical issue persists, it risks undermining the integrity and effectiveness of the entire consultation process. Consequently, I have chosen to present this letter openly for public consideration, including by the PUCSL.

Current geopolitical tensions in the Middle East underscore the urgent need for Sri Lanka to minimise its dependence on imported fossil fuels and prioritise the development of domestic renewable energy resources, including solar, hydro, and wind power. Such a transition is essential to securing a stable and independent energy supply. Regrettably, the Ceylon Electricity Board (CEB) appears to be moving in the opposite direction.

Promoting solar-powered electric vehicles supported by home-based renewable charging systems would strengthen national energy security and reduce pressure on imported fuel supplies. The fuel queues witnessed during periods of crisis, most notably in 2022, serve as a stark reminder of the risks associated with excessive dependence on external energy sources and the national anarchy that can follow.

As a small nation operating within a volatile global economy, Sri Lanka must remain as non-aligned and self-reliant as possible. Strengthening self-sufficiency in strategic sectors is critical to avoiding collateral damage amid escalating geopolitical rivalries among major powers. India has made steady progress along this path; Sri Lanka would be well-advised to do the same.

Raising electricity tariffs — a measure repeatedly adopted over the past decades to offset the high cost of fossil-fuel-based power generation — places an unfair burden on debt-ridden households and struggling businesses. Resorting once again to tariff increases, rather than addressing structural inefficiencies and fuel dependency, reflects a failure of long-term planning. The nation must instead pursue sustainable energy solutions that reduce costs over time.

As a debt-burdened country, Sri Lanka urgently requires pragmatic, forward-looking strategies that ease the pressure on citizens while strengthening resilience in times of geopolitical instability. Energy pricing is not a peripheral issue; it is a central pillar of economic stability and national security, demanding serious and immediate attention.

Established on 1 November 1969, the CEB was entrusted with the responsibility of generating and distributing electricity across the island while promoting social and economic development through the optimal use of national resources.

Recent developments suggest that the Ceylon Electricity Board has fallen short of these foundational objectives. Over the past two decades, electricity tariffs have been increased repeatedly under various justifications yet supply reliability has not consistently improved. The current proposed revision appears to perpetuate the same pattern: continued dependence on imported fossil fuels, directly contradicting the principle of optimally utilising national resources. This trajectory risks returning the country to recurring crises, including the prolonged fuel shortages and power cuts experienced in recent years.

Energy is not an ordinary commodity confined to a single sector; it affects every dimension of national life. High energy costs increase the cost of living by inflating expenses related to food production, transportation, manufacturing, and consumer goods. Ultimately, these costs are borne by citizens.

Moreover, elevated energy prices undermine national competitiveness by discouraging foreign investment and constraining local entrepreneurship, technological advancement, industrial expansion, and job creation. High-cost energy impedes national development.

Low-cost energy should therefore be formally adopted as a national policy objective. The CEB must adhere to its original mandate of optimising national resources for cost-effective electricity generation. Any deviation from this principle must be fully transparent and supported by clear, evidence-based justification.

Even in the sphere of renewable energy, concerns arise about the apparent preference for large-scale solar and battery storage projects that require substantial public funding. Previous claims of “grid instability” attributed to household rooftop solar generation were used to justify policy shifts. If electricity generated by rooftop solar during daylight hours was considered problematic, how would significantly larger solar installations differ in principle? Without systematic and transparent grid modernisation, such projects risk becoming costly stopgap measures rather than sustainable long-term solutions.

Poorly planned initiatives could once again expose the country to high delivery costs, reflected in elevated tariffs. They may also increase the risk of power disruptions due to battery limitations, spare-part shortages, infrastructure weaknesses, or maintenance failures. Sri Lanka has previously endured six- to ten-hour power outages, with severe economic and social consequences. The nation cannot afford a return to such instability.

It must also be recognised that rooftop solar installations, financed by homeowners — often through personal loans — have provided a crucial safety net for many families. By purchasing surplus energy from these “prosumers,” the system has functioned in a mutually beneficial manner for both households and the nation. Rather than discouraging decentralised generation, Sri Lanka should modernise its grid and meaningfully integrate citizen-led energy production. Short- and medium-term grid improvements could be facilitated through structured private-sector participation, including by prosumers themselves.

Globally, affordable energy underpins economic growth. Countries such as China, the United States, Norway, Brazil, and Canada have leveraged domestic energy resources to produce cost-effective power and accelerate development.

Sri Lanka must adopt a clear national policy centred on low-cost energy, fully utilising its natural endowments — solar, hydro, wind, and emerging technologies. Proposals prioritising imported fuels should be considered secondary and strictly transitional.

A nation that endures long queues for essential energy supplies cannot reasonably expect its citizens and businesses to remain productive and resilient. These realities are fundamentally incompatible.

Encouraging decentralised energy production would:

* Reduce the cost of living

* Improve national resilience

* Attract foreign investment

* Create employment

* Enhance export competitiveness

The people have entrusted the government with this responsibility. The time has come for a decisive, transparent, and forward-looking policy shift.

Chula Goonasekera

(cgoonase@sltnet.lk)

A concerned citizen

Opinion

Need for well-designed contracts and their implementation

The purchase of substandard coal using a faulty tendering process has become news lately. This enormous financial loss to the country indicates the urgent need for the Government to pass stronger contract laws and have their proper implementation in Sri Lanka by professionals. It is recommended that “Model” contracts need to be drawn up as typical examples and these made available to governmental departments who may need to enter into similar contracts. Do not ask a busy manager to design a contract, a legal document from scratch! Perhaps a whole department should be set up to monitor (police?) government and local government administration of contracts under English Contract Law and contracts under the United Nations Convention for International Sale of Goods (CISG). Perhaps now, it seems that anyone in government can draw up a contract and design it to suit his own whims and fancies!

I suggest here models of typical contracts, useable for different cases are made available for anyone or any department required to enter into a contract to enable them, or at least assist them to first formulate, and draw up an effective contract which must have certain important clauses. Contract administrators and supervisors need to be well trained, motivated and independent in order to administer Government contracts as the law of Sri Lanka should demand.

Contract Management

In the West, mutually agreed contracts are considered legal agreements enforceable by law under a given jurisdiction. There is the initiator of the contract named the Owner and a Main Contractor who agrees to implement the work for a price consideration, and who may delegate part, or all of the work to sub-contractors.

Contracts must provide all the information required by a contractor to complete the work. Contract clauses must incorporate all foreseeable eventualities. For example, the acceptance, as agreed and signed between the contacting parties by the supplier or lead contractor, needs to have clauses that allow for design changes (change orders), additional time and the formulation of related costs and profit accordingly. Such ‘in progress’ changes have procedures which are given in clauses dealing with ‘change orders’ which require assessing the cost of the change order implementation. Change order management may best be done by a firm of Quantity Surveyors.

The main contractor agrees with the owner to supply labour, materials and specialist equipment to fulfil the terms of the agreement or contract for a price. Special tax concessions, customs clearances and other legal requirements can fall on the shoulders of the Owner, or as negotiated from the outset. All these matters need to be clarified from the outset of any contract.

Time is of the essence. The time value of money is always at the forefront of the contract manager’s mind. The work is usually expected to be carried out to a time frame set by the owner. Therefore, the implementation of an agreement should be set in an agreed time frame with easily defined milestones marking progress and marking when appropriate payments become due.

Of course, contract administrators must make payments only when the work is verified as satisfactorily completed at each of previously agreed stages of the contract. Usually, there are time limitations, with penalties for time overruns. Owners want their goods delivered on time and to meet all contractual specifications on quality and performance. There should be clauses stipulating quality and quantity guarantees and guarantees of remedial repairs, continuing service agreements to be settled before an official handover and signing on completion of a contract. Final payment should be withheld until the guarantee period has expired. Preparing for these events needs computers, foresight and experience.

Small contracts are usually managed by the owner, but large, multimillion dollar contracts may be administered by an independent organisation. A contract is enforceable by law, with stated financial penalties for failures to abide by the terms of the contract, but all is subject to “Force Majeure.” This is when progress of the work is seriously impeded or impossible due to events totally outside the control of the Subcontractor.

Contract implementation is a large area, well catered for by laws in the English language. This letter can only raise questions about the quality of contract administration in Sri Lanka. Unfortunately, so few legislators have sufficient knowledge of English, resulting in loopholes allowing manipulation which may result in Sri Lankan public having to pay through the nose, pay dearly for incompetent practice.

I can suggest these improvements, but my actual experience is that all my letters, in English, to officialdom go unanswered and ignored.

Roger. O. Smith

Opinion

Sri Lanka Cricket needs a bitter pill

A systemic diagnosis of a fading legacy

The outcome of the 2026 T20 World Cup, coupled with the trajectory of the sport in recent years, provides harrowing evidence that Sri Lankan cricket is suffering from a terminal malignancy.The Doomsday clock for Sri Lankan cricket has not just started ticking—it has reached its final hour.

Therefore this note is written to call the attention of the cricketing elite who love the sport.

The current state of affairs suggests a pathology so deep-seated that conventional remedies—be it revolving-door coaching changes or fleeting, opportunistic victories—can no longer arrest its spread.

What we are witnessing is not a mere slump in form or a temporary lapse in rhythm; it is a profound systemic collapse that threatens the very foundation of our national pastime.

The Illusion of Recovery: The “Sanath Factor” as Palliative Care:

Since late 2024, the appointment of Sanath Jayasuriya as Head Coach injected a much-needed surge of adrenaline into the national side.

Statistically, the highlights were historic: a first ODI series win against India in 27 years, a Test victory at The Oval after a decade, and a clinical 2-0 whitewash of New Zealand.

However, a data-driven autopsy reveals that these will be “palliative” successes rather than a cure.

Under Jayasuriya’s tenure, the team maintained a win rate of approximately 50 percent (29 wins in 60 matches).

While analysts optimistically labeled this a “transitional phase,” the recent T20 series against England and Pakistan exposed the raw truth: in high-pressure “crunch” moments, the team’s performance metrics—specifically Strike Rate (SR) and Fielding Efficiency—regress to amateur levels.

We are not transitioning; we are stagnating in a professional abyss.

The Scientific Gap:

Why India and Australia Lead

The disparity between Sri Lanka and global giants such as the BCCI and Cricket Australia (CA) is now rooted in High-Performance Science and Algorithmic Management.

Predictive Analytics & Biometrics

In Australia, fast bowlers utilise wearable sensors to monitor workload and biomechanical stress.

AI models analyse this data to predict stress fractures before they occur.

Sri Lanka, conversely, continues to cycle through injured pacemen with no predictive oversight.

Virtual Reality (VR) Training

While Australian batters use VR to simulate the trajectories of elite global bowlers, Sri Lankan players remain tethered to traditional net sessions on deteriorating domestic tracks.

Data-Driven Talent Identification:

India’s “transmission system” utilises automated data analysis across thousands of domestic matches to identify players who thrive under specific pressure indices.

In Sri Lanka, 85 percent of national talent still originates from just four districts—a statistical failure in talent scouting and geographic expansion.

Infrastructure vs. Intellect:

A Misallocation of Capital

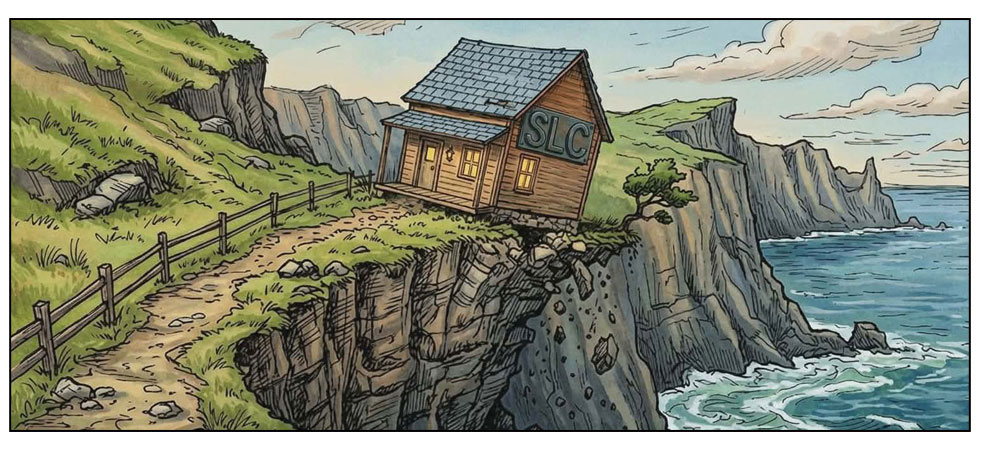

Sri Lanka Cricket (SLC) boasts massive reserves, yet its investment strategy is fundamentally flawed.

Capital is funneled into “bricks and mortar”—grand stadiums and administrative buildings—rather than the human capital of the sport.

We build colosseums but fail to train the gladiators.

The domestic structure remains a “spin trap.”

By producing “rank turners” to suit club politics, we have effectively de-skilled our batters against elite pace and rendered our spinners ineffective on the flat, true wickets required for international success.

The Leadership Deficit:

A Failure of Succession Planning

The crisis of leadership post-Sangakkara and Mahela is a byproduct of poor “Succession Science.”

Australia maintains a “Culture of Continuity,” backing leadership even through lean periods to ensure stability.

India employs a rigid “Succession Roadmap,” ensuring the next generation is integrated into the system long before the veterans depart.

In contrast, SLC operates on a “carousel of convenience,” changing captains and coaches to distract from administrative failures.

This lack of imaginative management stems from a low literacy in modern Sports Governance.

From a philosophical perspective, our established cricketing traditions have failed to absorb the antithesis of the modern, hyper-professionalized global game.

As a result, a truly modern Sri Lankan brand of cricket has failed to materialise.

Instead, we are trapped in what is called a “Static Synthesis,” where the administration clings to the glories of 1996 and 2014 as a shield against the necessity of change.

This is not a transition; it is a refusal to evolve

We are witnessing the alienation of the sport from its people, where the “Master” (the administration) has become detached from the “Slave” (the grassroots talent and the fans).

The Verdict:

A National Emergency

The “cancer” in Sri Lankan cricket is a trifecta of political interference, irrational management, and a refusal to embrace the Fourth Industrial Revolution (AI, VR, and Big Data).

As someone who contributed to the formation of the Sri Lankan Professional Cricketers’ Association, I see the current trajectory as a betrayal of the players’ potential and the nation’s heritage.

Sri Lanka Cricket does not need another “review committee” or a new coach to act as a human shield for the board.

It needs a “Bitter Pill”—an aggressive, independent restructuring that prioritises scientific professionalisation over cronyism.

Without this, our cricket will remain at the bottom of the well, looking up at a world that has moved light-years ahead.

Shiral Lakthilaka

LLB, LLM/MA

Attorney-at-Law

Former Advisor to H.E. the President of Sri Lanka

Former Member of the Western Provincial Council

Executive Committee member of the Asian Social Democratic Political Parities

-

Opinion6 days ago

Opinion6 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features3 days ago

Features3 days agoBrilliant Navy officer no more

-

Features6 days ago

Features6 days agoAn innocent bystander or a passive onlooker?

-

Features7 days ago

Features7 days agoRatmalana Airport: The Truth, The Whole Truth, And Nothing But The Truth

-

Opinion3 days ago

Opinion3 days agoSri Lanka – world’s worst facilities for cricket fans

-

Business7 days ago

Business7 days agoIRCSL transforms Sri Lanka’s insurance industry with first-ever Centralized Insurance Data Repository

-

Business6 days ago

Business6 days agoAn efficacious strategy to boost exports of Sri Lanka in medium term

-

Features4 days ago

Features4 days agoOverseas visits to drum up foreign assistance for Sri Lanka