Business

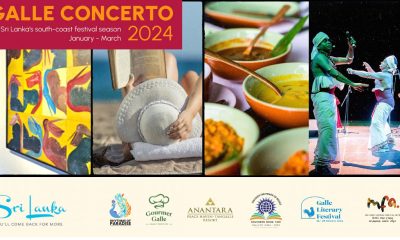

‘Galle Concerto 2024’ to put Sri Lanka back on world stage; four years on from crises exit

By Sanath Nanayakkare

The Presidential Secretariat, the Sri Lanka Tourism Promotion Bureau and the Sri Lanka Tourism Development Authority together with sponsors announced the launch of Galle Concerto 2024 at the Kingsbury Hotel Colombo on Wednesday.

They emphasized that the series of events of the programme would convey to the world that Sri Lanka is not only recovering but re-emerging as a strategically managed top tourist destination, consistent with its social, environmental and macroeconomic goals.

The Concerto, which comprises six segments, held its inaugurating ‘Rhythms of Paradise’ drum festival in Koggala from 12th – 14th January. The ‘Gourmet Galle Food Festival’ is taking place from 12th January – 30th March. The Classical Music Event will take place in Tangalle through 19th-21st January. Meanwhile, the Southern Book Fair will be held in Galle from 19th – 28th January, while the Galle Literary Festival will take place from January 25-28, followed by the Matara Festival from February 1-4.

“It will be the largest promotion of Sri Lanka’s music, culture, art and food ever undertaken, reaching out to a global audience, marketed throughout South Asia and the world. Galle Concerto will help make the southern belt of Sri Lanka to become one of the most visited destination in the world with the right audience”, Chalaka Gajabahu – chairman, Sri Lanka Tourism Promotion Bureau said.

The handbook launched along with the official announcement is set against the backdrop of the rich heritage of the country’s tourism ecosystem and vibrant coastal charm in the Southern Province.

Notably, the event will bring together a diverse array of writers, poets, intellectuals, literary enthusiasts, musicians, artists and celebrity chefs from around the world, who have the power to influence more travellers to visit Sri Lanka.

The Galle Concerto 2024 is launched under the auspices of President Ranil Wickremesinghe with the support of the office of the Presidential Envoy, Niranjan Deva Aditya.

Delivering the keynote speech at the event, Niranjan Deva Aditya said,” Four years ago, this country was shut down due to Covid 19 travel restrictions and people were forced to stay home unable to interact face-to-face for meaningful work like this. And two years ago, we had Aragalaya, riots, power-cuts and various shortages. I don’t need to remind you of the trials and tribulations the country of my birth endured over the past four years.

However, in the two ensuing years, we have all come together to work in unison to create an extraordinary celebration of Sri Lanka’s ancient history, culture, music, food, art and so on which are unique in the world with the objective of putting Sri Lanka back on the world tourism map in a much more dynamic way. I personally know the uniqueness of Sri Lanka. I have legislated for a number of countries over the past 20 years, and therefore, I can tell you Sri Lanka is the best.”

“Having gone through the two crises, we have been able to resurrect and revive our global identity and stand within a short span of two years and showcase our cultural diversity to the world. Today we are working together under the auspices of a man who inspired us for progressive possibilities. Nine months ago, he said we should call the largest event Sri Lanka ever had to show that we are back on the world stage.

Everybody right around him bought into his vision and many unsung heroes have worked thousands of hours to put together this extraordinary event without being paid, without any salaries because they believe in the great potential of this country. If we continue to nurture this progressive and collaborative attitude, I can assure you that Sri Lanka will have a great and secure future,” he said.

Tracy Holisnger -Galle Literary Festival- Gourmet Galle said,” Gourmet Galle will be a 12 week-long gourmet festival up and down the southern coast of Sri Lanka. A partner to the incredibly successful Galle Literary Festival, Gourmet Galle will feature dinners, afternoon tea and master classes with thirteen amazing celebrity and world-renowned chefs along the southern coast of Sri Lanka. The dinners will take place in exquisite homes and the finest boutique hotels, carefully curated to make each weekend its own unique and incredible event.”

Edward Robinson – Southern Book Fair, Chanchala Gunewardena – Matara Festival for the Arts, Nilupul Gunawardena – Rhythms of Paradise, Champika De Silva – Opera at the Anantara , and Damitha Nikapota – Gourmet Galle, spoke of their respective segments.

The literary sessions will be held at the Martin Wickramasinghe Folk Museum. The flagship event will conclude with a concert by internationally acclaimed Sri Lankan artistes.

Sri Lanka’s Tourism earnings for 2023 exceeded $ 2 billion mark with 1.48 million tourist arrivals. The following are some official statistics on tourist arrivals to Sri Lanka in 2023 in alphabetical order.

Armenia 2,490, Australia 67,436, Austria 10,594, Bangladesh 17,846, Belarus 10,969, Belgium 10,667, Canada 43,944, China 68,789, Czech Republic 12,056, Denmark 10,346, France 56,251, Germany 102,539, India 302,844, Israel 19,517, Italy 22,242, Japan 19,583, Malaysia 10,940, Maldives 37,328,Netherlands 29,056,Pakistan 10,744, Poland 17,946, Russia 197,498, Spain 23,905, Switzerland 23,556, U.K. 130,088, U.S.A 46,344.

Business

A Historic First: Sri Lanka’s capital market leaders bring investor forum to Saudi Arabia

The Securities and Exchange Commission of Sri Lanka (SEC) and the Colombo Stock Exchange (CSE), in association with the Embassy of Sri Lanka to the Kingdom of Saudi Arabia, successfully convened an investor forum on Saturday 24th January 2026 at the Radisson Blu Hotel, Riyadh Convention & Exhibition Center. Alongside the forum, the SEC and CSE facilitated a meeting with the Public Investment Fund (PIF) which is Saudi Arabia’s main sovereign wealth fund.

The forum was organized to engage directly with the vibrant Sri Lankan expatriate community in the Kingdom and international investors, highlighting compelling opportunities within Sri Lanka’s capital market following the country’s successful exit from sovereign default and restoration of macroeconomic stability.

The forum was marked by the presence of several senior level policy officials, market leaders and market regulators including; Dr. P. Nandalal Weerasinghe, Governor of the Central Bank of Sri Lanka (CBSL); Chathuranga Abeysinghe, Deputy Minister of Industry and Entrepreneurship Development; Ameer Ajwad Ambassador of Sri Lanka to the Kingdom of Saudi Arabia.; Senior Prof D.B.P.H. Dissabandara, Chairman of the SEC; Ray Abeywardena, Director of CSE; and Dr. Naveen Gunawardane, Co-Founder and Managing Director of Lynear Wealth Management.

In his welcome address, Ameer Ajwad stated, that a significant opportunity remains in broadening public participation in the capital market of Sri Lanka. As financial literacy and investment awareness among potential investors are limited, the investor forum would serve to bridge the knowledge gap. The forum offered an excellent opportunity for first-time investors, overseas investors, and those seeking to enhance their knowledge, to learn how to invest prudently, manage risk, and build wealth with discipline and confidence. Ambassador invited participants to make full use of the presence of high-level authorities from Sri Lanka’s key financial institutions, such as the Central Bank of Sri Lanka, the SEC, and the CSE, and to explore investment opportunities in Sri Lanka’s capital market, not only as a pathway to financial growth but also as a meaningful contribution to Sri Lanka’s resilience and long-term prosperity.

Business

CIC Holdings’ 9MFY26 revenue reaches Rs.70 bn

Agriculture-rich diversified conglomerate CIC Holdings PLC (CSE: CIC) recorded a consolidated revenue of Rs. 70.28 billion for the nine months ended 31 December 2025 (9MFY26), reflecting an increase of 8.69% YoY compared to the corresponding period of the previous year.

The Group’s gross profit increased by 10.11% to Rs. 18.42 billion, with the gross profit margin for the period under review improving to approximately 26%, supported by disciplined pricing and product mix optimisation. Profit after tax (PAT) increased to Rs. 5.97 billion from Rs. 5.70 billion in the corresponding period of the previous year, despite losses incurred in parts of the Group’s agri operations following the impact of Cyclone Ditwah, which disrupted cultivation activity during the Maha season.

The Group’s Crop Solutions sector remained the largest contributor to consolidated revenue, accounting for approximately 44.7% of total revenue, followed by Livestock Solutions at 21% and Health & Personal Care at 20.18%. The remaining sectors, Industrial Solutions and Agri Produce, contributed 8.6% and 6.4% to Group turnover respectively. Health and Personal Care , particularly export-driven product lines, recorded improved performance during the period, alongside continued growth in feeds, poultry, and veterinary care solutions, which supported the Group’s overall operating results.

Despite cyclone-related disruption to cultivation cycles, the Group delivered a strong operating performance, with EBITDA and operating profit (EBIT) both recording year-on-year growth. Operating profit (EBIT) closed at Rs. 9.67 billion, compared to Rs. 8.62 billion in the corresponding period of the previous year, reflecting the strength of the Group’s diversified portfolio and disciplined cost management.

During the period in review, key Group businesses across the five industry sectors, namely Crop Solutions, Agri Produce, Livestock Solutions, Industrial Solutions, and Health & Personal Care, continued to perform resiliently. Crop Solutions revenue increased from Rs. 28.06 billion to Rs. 32.32 billion, while Livestock Solutions revenue grew from Rs. 13.35 billion to Rs. 14.60 billion. Health & Personal Care revenue improved from Rs. 14.29 billion to Rs. 14.46 billion, supported by herbal health product exports and steady domestic demand. Revenue from Agri Produce increased from Rs. 4.35 billion to Rs. 4.64 billion, while Industrial Solutions revenue rose from Rs. 6.07 billion to Rs. 6.28 billion.

Commenting on the performance, CIC Holdings Group CEO Aroshan Seresinhe said, “Despite the disruption caused by Cyclone Ditwah to agricultural activity during the Maha season, the Group remained focused on supporting farming communities through well clean-up operations, field renovation, and the restoration of cultivation activity.

Business

CSE regains some of its bullish verve as turnover hits Rs.11 billion

CSE trading reflected a bullish trend yesterday due to positive quarterly corporate earnings coupled with lower Treasury Bill yields, market analysts said.

Further, institutional participation contributed more than 50 percent to the day’s turnover.

Amid those developments both indices moved upwards. The All Share Price Index went up by 63.67 points, while the S and P SL20 rose by 12.58 points.

Turnover stood at Rs 11.1 billion with10 crossings. The top seven crossings were: JKH 189.5 million shares crossed to the tune of Rs 4.2 billion; its shares traded at Rs 22.70, HNB 3.5 million shares crossed for Rs 1.48 billion; its shares traded at Rs 422, Hemas Holdings 11 million shares crossed for Rs 376.2 million; its shares traded at Rs 34 20, Commercial Bank 1.5 million shares crossed for Rs 336.8 million; its shares traded at Rs 224.50, Sampath Bank 600,000 shares crossed for Rs 93.6 million; its shares sold at Rs 156, Laugfs Gas 868,000 shares crossed for Rs 51.6 million; its shares sold at Rs 71 and Sierra Cables 1 million shares crossed for Rs 36.7 million; its shares sold at Rs 36.70.

In the retail market top seven companies that mainly contributed to the turnover were; Ceylon Land Equity Rs 385 million (20 million shares traded), Commercial Bank Rs 373.9 million (1.7 million shares traded), Luminex Rs 247.2 million (26.7 million shares traded), Colombo Dockyard Rs 152 million (one million shares traded), TJ Lanka Rs 152 million (four million shares traded), Easter Merchants Rs 142 million (8.7 million shares traded) and RIL Properties Rs 116.9 million. During the day 441.3 million share volumes changed hands in 44406 transactions.

It is said that manufacturing sector counters, especially JKH, led the market while the banking sector also performed well, especially HNB and Sampath Bank. Further, the capital goods sector too performed well.Yesterday the Central Bank’s US dollar buying rate was Rs 305.78 and selling rate Rs 313.32.

By Hiran H Senewiratne

-

Business6 days ago

Business6 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business3 days ago

Business3 days agoSLIM-Kantar People’s Awards 2026 to recognise Sri Lanka’s most trusted brands and personalities

-

Business6 days ago

Business6 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business6 days ago

Business6 days agoArpico NextGen Mattress gains recognition for innovation

-

Business5 days ago

Business5 days agoAltair issues over 100+ title deeds post ownership change

-

Editorial6 days ago

Editorial6 days agoGovt. provoking TUs

-

Business5 days ago

Business5 days agoSri Lanka opens first country pavilion at London exhibition

-

Business4 days ago

Business4 days agoAll set for Global Synergy Awards 2026 at Waters Edge