News

Ex-CB Governor calls for disciplined fiscal policy, hopeful of agreement with external commercial lenders soon

By Shamindra Ferdinando

Former Central Bank Governor Dr. Indrajith Coomaraswamy has warned that the period ahead required the continued commitment to disciplined fiscal policy, a data dependent and forward-looking monetary policy, as well as a flexible exchange rate procedure.

Dr. Coomaraswamy stressed that the above mentioned strategy should be strongly backed by a laser-like focus on constructing an outward-looking competitive economy that drives sustained growth and higher value employment generation, primarily through export transformation.

The former head of the Monetary Board said so when The Island asked him what the government should do (whoever is in power) to bring the debt restructuring to a successful conclusion. Dr. Coomaraswamy appreciated the simultaneous finalization of Memorandum of Understanding (MoU) between the government and Sri Lanka’s Official Creditor Committee (OCC) and another MoU with China’s Exim Bank on Wednesday.

The Presidential election is scheduled for Sept/Oct this year.

Dr. Coomaraswamy, who had served the Central Bank for 15 years, was invited to rejoin as Governor in July 2016 in the wake of the Treasury bond scams that were perpetrated in Feb 2015 and March 2016. Having succeeded Singaporean Arjuna Mahendran, who had been implicated in the Treasury bond scams, Dr. Coomaraswamy was replaced soon after Gotabaya Rajapaksa’s election as the President in Nov 2019.

Dr. Coomaraswamy said that those who represented Sri Lanka had done extremely well to secure the IMF Executive Board approval for the EFF (Extended Fund Facility) second review. “Performance has exceeded targets on a number of key macroeconomic indicators. On debt restructuring, they have completed the DDR (Domestic Debt Restructuring) some months ago and have done very well to sign agreements with the OCC and Exim Bank China,” Dr. Coomaraswamy said.

Having said so, Dr. Coomaraswamy pointed out the pivotal importance of finalizing an agreement on, what he called, a comparable basis with the commercial external creditors, particularly the ISB holders and the China Development Bank (CDB). The former outspoken official underscored the need to bring negotiations between commercial external creditors to a successful conclusion as soon as possible.

Dr. Coomaraswamy said: “The IMF Executive Directors would not have approved the payment of the third tranche unless they were confident that the negotiations were progressing well in good faith. One can, therefore, be hopeful that these negotiations will be completed soon with the terms of restructuring being aligned with Sri Lanka achieving debt sustainability. This would constitute a major landmark in stabilizing the Sri Lankan economy. Completing the debt restructuring is a sine qua non for creating a platform that creates the space for achieving sustained recovery.

The period ahead requires the continued commitment to disciplined fiscal policy, a data dependent and forward-looking monetary policy and a flexible exchange rate policy. This needs to be complemented by a laser-like focus on constructing an outward-looking competitive economy that drives sustained growth and higher value employment generation, primarily through export transformation.”

So, we could be quite hopeful that these negotiations would be completed soon with the terms of the restructuring being aligned with Sri Lanka achieving debt sustainability. Asked to explain, Dr. Coomaraswamy said that he was very confident that the anticipated deal with the private creditors could be reached quickly though at this point it is too early to tell whether debt sustainability can be achieved with just one restructuring.

Dr. Coomaraswamy said: “This is crucial to address the sharp reversals that have taken place in poverty and multidimensional vulnerability.”

The Island

also sought Dr. Coomaraswamy’s opinion on anti-corruption measures. Asked how anti-corruption measures fit into our overall strategy, the former Governor said that at a minimum the government must implement the time-bound programme it has agreed with the IMF to give effect to the 15 recommendations of its Governance Diagnostic. Dr. Coomaraswamy emphasized that this should apply for any government that took office.

Top Opposition spokesman Prof. G. L. Peiris, MP, recently pointed out that the external debt had increased to USD 100 bn from USD 82 bn since July 2022 therefore efforts on the part of the government to portray a much better or improved performance under Ranil Wickremesinghe’s watch is nothing but propaganda. The former External Affairs Minister said that the borrowings from commercial external creditors were included in the USD 100 bn debt.

Latest News

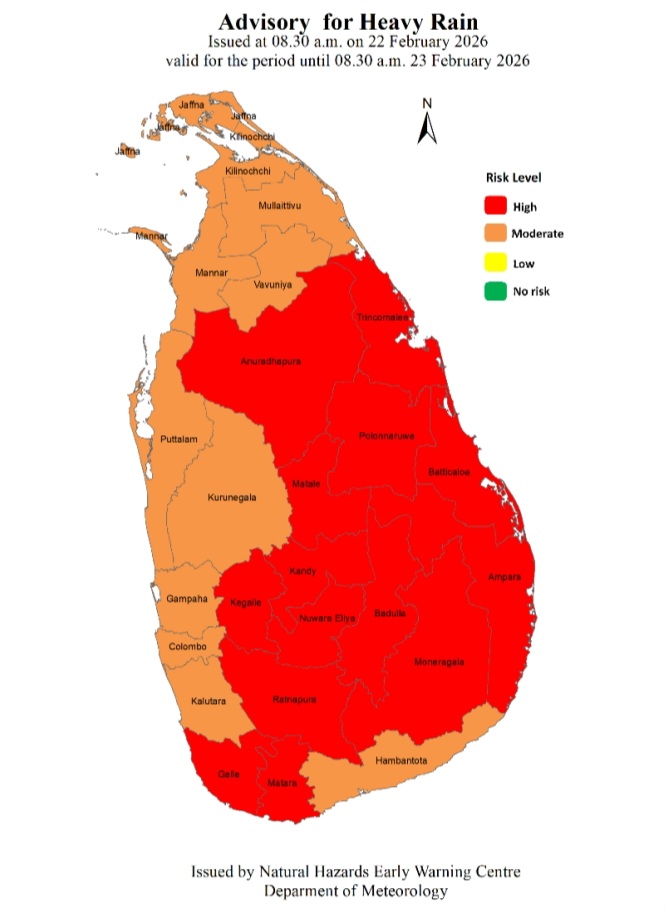

Advisory for Heavy Rain issued for the Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts

Advisory for Heavy Rain Issued by the Natural Hazards Early Warning Centre at 08.30 a.m. on 22 February 2026 valid for the period until 08.30 a.m. 23 February 2026

Due to the influence of the low level atmospheric disturbance in the vicinity of Sri Lanka, Heavy showers above 100 mm are likely at some places in Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts.

Therefore, general public is advised to take adequate precautions to minimize damages caused by heavy rain, strong winds and lightning during thundershowers

News

Matara Festival for the Arts’ inaugurated by the Prime Minister

The inaugural ceremony of the Matara Festival for the Arts, featuring a wide range of creations by local and international artists, was held on February 19 at the Old High Court premises of the Matara Fort, under the patronage of Prime Minister Dr. Harini Amarasuriya.

The festival, centred around the Old High Court premises in Matara and the auditorium of the Matara District Secretariat, will be open to the public from 20 to 23 of February. The festival will be featured by visual art exhibitions, short film screenings, Kala Pola, and a series of workshops conducted by experts.

The inaugural event was attended by the Minister of Women and Child Affairs, Ms. Saroja Paulraj, along with artists, guests, and a large number of schoolchildren.

(Prime Minister’s Media Division)

News

Only single MP refuses salary as Parliament details pays and allowances

Only one Member of Parliament has chosen not to receive the salaries and allowances entitled to MPs, Prime Minister Dr. Harini Amarasuriya revealed in Parliament last Thursday, shedding light on the financial perks enjoyed by members of the Tenth Parliament.

Speaking on Thursday (Feb. 19) in response to a question from SJB Badulla District MP Chaminda Wijesiri, the Prime Minister outlined the full range of pay and allowances provided to parliamentarians.

According to Dr. Amarasuriya, MPs receive a monthly allowance of Rs. 54,285, an entertainment allowance of Rs. 1,000, and a driver’s allowance of Rs. 3,500—though MPs provided with a driver through the Ministry of Public Security and Parliamentary Affairs are not eligible for the driver’s allowance.

Additional benefits include a telephone allowance of Rs. 50,000, a transport allowance of Rs. 15,000, and an office allowance of Rs. 100,000. MPs are also paid a daily sitting allowance of Rs. 2,500 for attending parliamentary sessions, with an additional Rs. 2,500 per day for participation in parliamentary sittings and Rs. 2,500 per day as a committee allowance.

Committee meetings held on non-parliament sitting days also attract Rs. 2,500 per day.

Fuel allowances are provided based on the distance between an MP’s electoral district and Parliament. National List MPs are entitled to a monthly allocation equivalent to 419.76 litres of diesel at the market price on the first day of each month.

Despite the comprehensive benefits, only SJB Badulla District MP Nayana Wasalathilaka has opted not to draw a salary or allowances. Dr. Amarasuriya said that in accordance with a written notification submitted by MP Wasalathilaka on August 20, 2025, payments have been suspended since that date.

The Prime Minister also confirmed that she, along with the Speaker, Deputy Speaker, committee chairs, ministers, deputy ministers, the Opposition Leader, and senior opposition whips, have all informed the Secretary-General of Parliament in writing that they will not claim the fuel allowance.

Challenging the ruling party’s voluntary pledge to forgo salaries, MP Wijesiri pointed out that all MPs except Wasalathilaka continue to receive their salaries and allowances. “On one hand you speak about the people’s mandate, which is good. But the mandate also included people who said they would voluntarily serve in this Parliament without salaries. Today we have been able to prove, Hon. Speaker, that except for one SJB MP, the other 224 Members are drawing parliamentary salaries,” he said.

The Prime Minister responded by defending the political culture and practice of allocating portions of MPs’ salaries to party funds. Referring to previous practices by the JVP and NPP, she said: “It is no secret to the country that the JVP has for a long time not personally taken MPs’ salaries or any allowances. I think the entire country knows that these go to a party fund. That is not new, nor is it something special to mention. The NPP operates in the same way. That too is not new; it is the culture of our political movement.”

When MP Wijesiri posed a supplementary question asking whether diverting salaries to party funds was an indirect method of taking care of MPs, Dr. Amarasuriya said: “There is no issue there. No question was raised; the Member made a statement. What we have seen throughout this week is an inability to understand our political culture and practice, and a clash with decisions taken by political movements that misused public funds. What is coming out is a certain mindset. That is why there is such an effort to find fault with the 159. None of these facts are new to people. He did not ask a question, so I have nothing to answer.”

The disclosures come days after the Government moved to abolish the parliamentary pension, a measure that has sparked renewed debate over MP compensation and the transparency of funds allocation.

-

Features19 hours ago

Features19 hours agoWhy does the state threaten Its people with yet another anti-terror law?

-

Business7 days ago

Business7 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features19 hours ago

Features19 hours agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features19 hours ago

Features19 hours agoReconciliation, Mood of the Nation and the NPP Government

-

Latest News2 days ago

Latest News2 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Features19 hours ago

Features19 hours agoVictor, the Friend of the Foreign Press

-

Latest News2 days ago

Latest News2 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News2 days ago

Latest News2 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction