Business

CSE set to introduce delivery vs payment mechanism to stock market

The Securities and Exchange Commission of Sri Lanka (SEC) and the Colombo Stock Exchange (CSE) announced the introduction of a Delivery vs Payment (DVP) system for stock market transactions. The Go Live is scheduled for 26th July 2021 subject to a final round of testing and industry wide mock runs.

The objective of introducing a DVP system for the stock market in Sri Lanka is to minimize the Asset commitment risk of sellers. Under the DVP system the physical custody of shares will be transferred to buyers only on settlement date.

Presently the delivery of shares occurs immediately upon the execution of the transaction while fund settlement takes place 3 market days after the transaction date (T+3), thus exposing the seller to a 3-day settlement risk. Although stringent measures had been introduced to reduce settlement risk and the CSE has never experienced a settlement failure, the globally accepted mechanism for minimizing settlement risk is through a DVP system where the securities and funds are exchanged simultaneously on the settlement date.

The implementation of DVP, a much needed market infrastructure enhancement, will increase the overall credibility and integrity of the Sri Lankan stock market. Furthermore, the adaptation of the DVP settlement mechanism by CSE will be an additional qualification in obtaining the emerging market classification on international market indices.

Chairman of the SEC Viraj Dayaratne, PC stated that the SEC is pleased that they were able to fast track the implementation of DVP through the facilitation of the regulatory framework. He added that DVP is a critical risk management mechanism and it will also complement the efforts in attracting more foreign investor participation in the stock market. He further added that the industry should now commence work on a Central Counterparty System (CCP).

Director General of SEC, Chinthaka Mendis, stated that he is pleased to note how the SEC was able to secure technical assistance from the World Bank and the Asian Development Bank to advise the SEC to facilitate the launch of the DVP, which is in fact the most significant milestone of the CSE since the implementation of the Automated Trading System (ATS) in 1997. He further stated that this would contribute towards upgrading the CSE status in risk assessments carried out by international bodies and will enable the Sri Lankan market to better position itself within the spectrum of foreign portfolio investments.

Chairman of the CSE, Dumith Fernando said that he is delighted to see the introduction of DVP which was a long felt need for the Sri Lankan Stock Market. He commented that this is a result of a three-year long project and is a landmark achievement for Sri Lanka’s capital market made possible by a substantial amount of planning, hard work and resource allocation on the part of all stakeholders – the CSE, SEC and the Stock Broking community. While thanking the SEC for its support in approving the DVP framework quickly, he further expressed confidence in the fact that all stakeholders, had collaborated to develop a robust DVP model which suits the local environment and will be able to mitigate the asset commitment risk

CEO of CSE, Rajeeva Bandaranaike remarked that the introduction of a DVP mechanism is a milestone development. He said that with DVP the CSE is aligning itself with global market practices and strengthening the overall credibility and integrity of the market. He further appreciated the support given by all stakeholders who have collectively contributed to enable the CSE to transition to a DVP environment.

Significant upgrades have been made to the Automated Trading System (ATS), the Central Depository System (CDS) including the development of a Risk Management and Margining System. The technology at all Stock Brokering Offices has been strengthened and upgraded to include risk management in Order Management Systems (OMS) and Broker Back Office systems (BBO).

The SEC has granted the necessary regulatory approvals for the amendments to the CDS Rules, ATS Rules, Listing Rules and Stockbroker Rules of the CSE to facilitate the implementation of the DVP Settlement Mechanism and enhanced margining model. Subsequent to the successful completion of the User Acceptance Testing (UAT) on the system changes, the CSE completed Market wide testing (Mock runs). The CSE will shortly commence the final round of Market wide testing which is due to be completed by 15th July 2021.

The Go Live of the DVP will mark a milestone in the history of share trading in Sri Lanka and pave the way to set up a Central Counter Party System (CCP), which has been a long-awaited necessity in the Sri Lankan capital market.

Business

Supporting the Increase in Withholding Tax: A Step Toward Strengthening Sri Lanka’s Tax System

By Sanjeewa Jayaweera

The government’s decision to increase the withholding tax (WHT) rate to 10%, effective 1 April 2025, deserves commendation. Too often, political leaders have avoided necessary but unpopular decisions, opting to appease the electorate. This has led to various issues, from economic stagnation to the erosion of minority and religious rights. The proposed tax increase, however, marks a significant step in addressing a pressing concern: Sri Lanka’s persistent tax evasion problem.

Tax evasion in Sri Lanka is alarmingly high. While some degree of evasion is common in many countries, effective tax compliance is largely achieved through a comprehensive tax policy and an efficient tax administration. Unfortunately, Sri Lanka has fallen short in both these areas. Since the early 1990s, successive governments have either reduced or eliminated key taxes, granted widespread exemptions, and failed to adequately develop the Inland Revenue Department (IRD) in terms of manpower and technology.

Rather than addressing these systemic issues, governments have relied on increasing indirect taxes. The contribution of direct taxes to overall revenue has fallen to a mere 20%. Indirect taxes, such as Value Added Tax (VAT), are largely hidden from the consumer, as the IRD has mandated that supplier invoices do not show VAT charged. This has created a society that is not accustomed to paying direct taxes. Additionally, the acceptance of corruption as a “necessary evil” has contributed to the perception that tax evasion is acceptable.

Consequently, the imposition of new taxes, rate increases, and threshold reductions often generates confusion and frustration among the public. Opposition parties frequently exploit these sentiments to mislead the electorate, complicating the government’s efforts. To counter this, the government must invest in educating the public about taxes, the need for tax revenue, and the civic duty of tax compliance. This is a long-term effort that, if successful, could lead to improved tax revenues and higher compliance rates.

Policymakers should consider insights from an OECD report published in 2021, which analyzed taxpayer education initiatives in 59 developed and developing countries. The report revealed that over 80% of such initiatives improved tax morale—the intrinsic motivation to pay taxes. The findings underscore the importance of tax literacy in shaping a culture where citizens understand how their tax contributions affect their daily lives.

The report suggests a step-by-step approach for designing and implementing taxpayer education initiatives customized to local contexts. Three key strategies for promoting tax compliance emerged:

· Teaching tax: Engaging all audiences, including youth, adults, and entrepreneurs, through long-term educational programs.

· Communicating tax

: Raising awareness through campaigns, tax fairs, TV shows, and behavioural economics-based messaging.

· Supporting compliance

: Providing practical assistance, particularly for vulnerable taxpayers, to navigate modern e-administration tools and fulfill reporting requirements.

Verité Research, an independent think tank, has long advocated increasing the WHT rate on interest income from 5% to 10%. Their estimate suggests that this increase could generate an additional Rs. 90 billion in revenue for the state. Despite this, the government of Ranil Wickremesinghe hesitated to act, even though it had already raised VAT to 18% and introduced progressive income tax rates as high as 36% and reduced the monthly tax-free threshold to Rs. 100,000.

Importantly, WHT on interest income is not an additional tax; it is a prepayment of taxes collected by the payer on behalf of the government, similar to the Pay As You Earn (PAYE) system used for salaried employees. The challenge, however, lies in the fact that individuals often earn interest from multiple banks, unlike salary income, which typically comes from a single employer. As a result, financial institutions cannot easily determine whether an individual’s total income surpasses the annual tax-free threshold of Rs. 1,200,000 (or Rs. 1,800,000 starting April 2025).

To address this, the IRD should implement a system allowing individuals over 18 to obtain a letter from the IRD confirming that WHT need not be deducted if their total annual income is below the threshold. While this will initially be challenging due to the lack of tax files for many individuals, it is a step that should be supported. Despite its complexities, the government’s decision to increase the WHT rate should be backed.

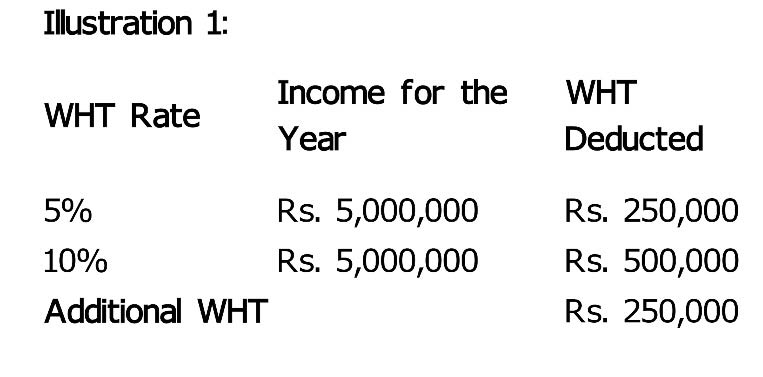

To illustrate the impact of this change, consider the following examples assuming the person’s total income is derived solely from interest:

Total Income Tax Due:

· Income: Rs. 5,000,000

· Single Person Allowance

: Rs. 1,200,000

· Taxable Income

: Rs. 3,800,000

· Income Tax at Progressive Rates

: Rs. 918,000

· Less WHT Collected at Source

: Rs. 250,000

· Tax Evaded

: Rs. 668,000

With the WHT Rate Increase:

· Income: Rs. 5,000,000

· Single Person Allowance

: Rs. 1,200,000

· Taxable Income

: Rs. 3,800,000

· Income Tax at Progressive Rates

: Rs. 918,000

· Less WHT Collected at Source

: Rs. 500,000

· Tax Evaded

: Rs. 418,000

As illustrated, raising the WHT rate to 10% would generate an additional Rs. 250,000 in tax revenue. I have assumed in my illustration that the recipient of interest income is not tax-compliant and is currently outside the tax net. This demonstrates how the rate increase could significantly reduce tax evasion. The IRD’s ultimate goal should be to recover the Rs. 418,000 currently evaded by taxpayers. By streamlining the reporting systems of financial institutions and integrating them with the RAMIS system, the IRD can take a significant step toward curbing tax evasion and boosting government revenue.

Business

Intrepid Travel Wins at Sri Lanka Tourism Awards 2024

Intrepid Travel, the world’s largest adventure travel company, has been recognized at the Sri Lanka Tourism Awards 2024, winning the Best Destination Loyal Partner award under the Travel & Tourism Operator category, said a release.

It said that the company was also shortlisted as a finalist for Best Sustainable Practices in Specified Tourist Services. These accolades highlight Intrepid’s commitment to promoting sustainable tourism and showcasing Sri Lanka’s cultural and natural assets. The awards were presented during a ceremony on 20 December at Cinnamon Life, acknowledging businesses that have revitalized Sri Lanka’s tourism sector amidst global challenges. Intrepid’s success reflects its longstanding partnership with Sri Lanka, bringing over 4,000 travelers to the island in 2024—a 209% increase from 2023.

Natalie Kidd, Managing Director – Asia for Intrepid Travel said: “This recognition is a testament to the incredible work of our team in Colombo and Globally. It highlights how Intrepid’s dedication to sustainable travel and meaningful connections with local communities continues to elevate Sri Lanka as a destination of choice.”

Poornaka Delpachitra, Intrepid’s Country General Manager for Sri Lanka, said: “This achievement reflects our ambition to continue growing Sri Lanka as a key destination in our source markets, driving more travelers to the island and ensuring that the benefits are shared with local communities, while prioritizing responsible and sustainable tourism practices.”

Business

Ranjan Lanka introduces Zero brand air conditioners

Ranjan Lanka Private Limited has entered the air conditioning market with the launch of Zero brand ACs, imported from Zero Technologies in China. These units are designed for small offices, houses, and apartments, available as non-inverter models (9,000 to 12,000 BTU) and inverter models (12,000 to 18,000 BTU). The initial launch took place in Gampaha, with plans for island-wide distribution.

Zero ACs feature durable copper tubes, energy-efficient compressors, and competitive pricing. They come with a one-year machine warranty, a five-year compressor warranty, and three free services in the first year. Spare parts availability is also guaranteed to ensure customer satisfaction.

-

News5 days ago

News5 days agoOffice of CDS likely to be scrapped; top defence changes on the cards

-

Features5 days ago

Features5 days agoAn Absurd play in Parliament: Qualifications versus education

-

Opinion6 days ago

Opinion6 days agoWhat AKD and NPP should bear in mind

-

Midweek Review4 days ago

Midweek Review4 days agoEx-SLN seniors focus on seabed mining and Sri Lanka’s claim for the delimitation of the Outer Continental Margin

-

Editorial6 days ago

Editorial6 days agoSeeyanomics, rhetoric and reality

-

Editorial4 days ago

Editorial4 days agoOf that half-open can of worms

-

Business6 days ago

Business6 days agoS&P Sri Lanka 20 Index undergoes recalibration

-

Opinion3 days ago

Opinion3 days agoGoing easy on Year 5 Scholarship trial