Business

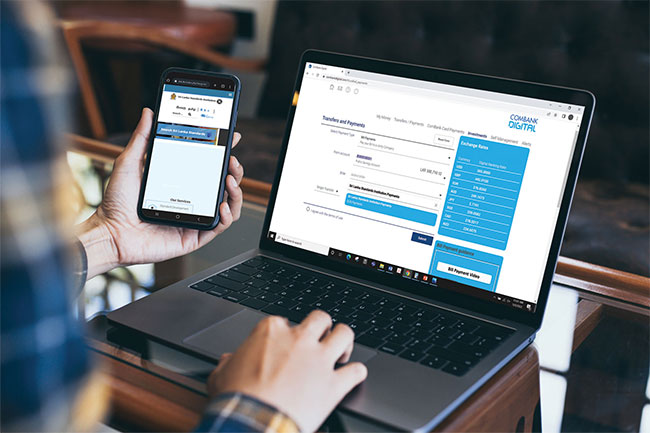

ComBank Digital enables real-time online payments to SLSI in another first

The Commercial Bank of Ceylon has become the first bank in Sri Lanka to enable online payments to the Sri Lanka Standards Institution (SLSI) by linking the institution to ‘ComBank Digital,’ making it possible for customers to pay their fees to SLSI from anywhere and at any time.

The Bank has enabled real-time online payments to the SLSI for both its retail and business customers who can access www.combankdigital.com and its iOS, Android or Huawei mobile applications for this purpose.

The platform is secured with industry-level security standards to provide a swift and safe digital banking experience to customers. As this is a paperless process that does not require customers to visit a bank branch or the SLSI office, it further contributes to the ‘green’ initiatives of the Bank and also enables customers to be more environment-friendly, the Bank said.

To use this online payment option, customers simply have to visit the ‘Billers’ section on the platform, select the desired biller and make the payment. Once the payment has been successfully completed, the customer can download a cyber receipt as payment confirmation.

Commenting on this collaboration with SLSI, Commercial Bank’s Group Chief Marketing Officer Mr Hasrath Munasinghe said: “The SLSI is the latest government institution to be connected to ComBank Digital. The Bank has been exploring every possibility offered by technology and consistently enhancing its digital banking capabilities to facilitate convenience and encourage its customers to manage their day-to-day banking activities in a timely and hassle-free manner from their personal devices.”

ComBank Digital already enables payments to government authorities such as the Import and Export Control Department (IECD), the Inland Revenue Department (IRD), Sri Lanka Ports Authority (SLPA) for cargo, vessel, and entry permit payments, Sri Lanka Customs, Employees Provident Fund (EPF), Employees Trust Fund (ETF), and the Board of Investment of Sri Lanka (BOI). These payments are routed through the LankaPay Online Payment Platform (LPPOP).

One of the top five financial apps in use in Sri Lanka, ‘ComBank Digital’ was launched in 2020, has since undergone enhancements, and is now enabled for the Bank’s business clientele too. Positioned as the Bank’s single omni-channel digital banking platform, it is powered by Fiserv, the US-based global provider of financial services technology.

Sri Lanka’s first 100% carbon neutral bank, the first Sri Lankan bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 11 years consecutively, Commercial Bank operates a network of 268 branches and 938 automated machines in Sri Lanka. Commercial Bank is the largest lender to Sri Lanka’s SME sector and is a leader in digital innovation in the country’s Banking sector. The Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.

Business

Sri Lanka’s economy at a crossroads: Fiscal improvement amid trade and demand woes

Sri Lanka’s fiscal health showed signs of improvement in early 2025, with the budget deficit narrowing to Rs. 86.6 billion in the first two months of the year, down from Rs. 129.3 billion in the same period last year. This was supported by a rise in government revenue and a decline in domestic borrowing, signaling cautious optimism in the country’s economic recovery.

Net domestic financing dropped to Rs. 96.8 billion, a significant reduction from Rs. 144.8 billion in early 2024, while foreign debt repayments continued, albeit at a slower pace. The Treasury bill and bond markets remained stable, with strong investor interest auctions were oversubscribed by 2 to 3 times. Foreign holdings of government securities also saw a slight uptick, reflecting cautious confidence in Sri Lanka’s debt instruments.

Meanwhile, lending rates edged lower, with the Weekly Average Weighted Prime Lending Rate (AWPR) dipping to 8.36%, supporting hopes of easier credit conditions. The stock market also saw modest gains, with the All Share Price Index (ASPI) rising 0.7% by early May.

Deflation persisted but softened in April 2025, with prices declining by 2.0% year-on-year – a slight improvement from previous months.

Food prices rose by 1.3%, while non-food categories continued to see deflation (-3.6%). Core inflation, which excludes volatile items, remained low at 0.8%, suggesting weak underlying demand.

Global oil prices fell amid concerns over slowing growth, particularly due to US trade policies, with Brent crude dropping by over $4 per barrel. However, Sri Lanka’s import costs for crude oil in March 2025 were slightly higher than the previous year, posing a challenge for energy-dependent sectors.

Export earnings grew by 5.3% in the first quarter of 2025, driven by strong performances in textiles, spices, and tea. However, import expenditure surged by 11.1%, led by machinery, oils, and dairy products, widening the trade deficit to $1.54 billion.

The Sri Lankan rupee depreciated by 2.3% against the US dollar this year, though the Central Bank bolstered reserves with 160.8 million in net foreign exchange purchases in April.

Gross official reserves stood at 6.53 billion by end-March, including funds from the PBOC swap arrangement.

While fiscal consolidation and stable debt markets provide some relief, Sri Lanka’s economy faces headwinds from global uncertainties and domestic demand weakness. The easing deflation trend and lower interest rates may support recovery but managing the trade deficit and sustaining export growth remain key challenges. In a broader context, the Central Bank figures depict neither a recession nor a boom. These figures suggest instead an economy grappling with persistent challenges and lacking clear momentum in either direction,” a source told The Island on condition of anonymity.

Reported using data from Central Bank.

By Sanath Nanayakkare

Business

Sri Lanka’s scenic South Coast emerging as a hotspot for digital nomads

WORX Co-Working leading the charge

As remote work continues to reshape global work culture, Sri Lanka’s scenic South Coast is emerging as a hotspot for digital nomads and WORX Co-Working is leading the charge. The country’s largest co-working network has just launched its fifth location, this time in the surfers’ paradise of Midigama, in partnership with Lime & Co Hostel.

Midigama, famed for its world-class reef breaks and laid-back vibe, is attracting a growing wave of long-term travellers and remote professionals.

Recognising this shift, WORX’s latest space blends productivity and leisure, offering high-speed Wi-Fi, 25 workstations, and an on-site Zippi café serving artisanal coffee, all just two minutes from the beach.

“Sri Lanka’s work-travel scene is evolving,” says Azahn Munas, Managing Director of WORX. “By partnering with Lime & Co, we’re creating spaces where professionals can work efficiently while enjoying the surf-and-sunshine lifestyle.”

The Lime & Co-Working space isn’t just about desks; it’s a community hub for workshops, networking, and pop-ups, catering to the booming digital nomad scene in the South. With Mirissa, Weligama, and Ahangama also seeing rising demand, WORX’s expansion signals a broader trend: Sri Lanka is becoming a top destination for location-independent workers.

Business

Belluna Lanka: A silent force behind Sri Lanka’s growth story

For over a decade, Belluna Lanka—the Sri Lankan arm of Japan’s Belluna Co. Ltd. (a Tokyo Stock Exchange-listed giant with 50+ years of global expertise) has been a quiet yet powerful driver of investment in the island nation. With over USD 200 million pumped into the region and the biggest share of it into Sri Lanka, this Japanese-backed firm has shaped luxury hospitality, high-end real estate, and sustainable development, all while staying true to a philosophy of long-term commitment over short-term gains.

Unlike fly-by-night investors, Belluna chose Sri Lanka as its South Asian hub—not just for its natural beauty, but for its untapped potential. Every investment has been self-financed from Japan, avoiding reliance on local debt, a testament to Belluna’s financial strength and faith in Sri Lanka’s future. Belluna’s Signature Projects in Sri lanka are : Granbell Colombo & Le Grand Galle – Luxury hotels blending Japanese precision with Sri Lankan soul., The Westin Maldives (2018) – Proof of Belluna’s regional ambition, managed by Marriott., 447 Luna Tower, Cinnamon Gardens – A haven of unassuming elegance in Colombo’s heart., Prime Colombo 3 Land (Dr. Wijewardene Mawatha) – A future landmark in the making.

“We don’t just build properties—we build legacies,” says Hiroshi Yasuno, Director of Belluna Co. Ltd. “Our projects fuse Japanese sustainability with Sri Lankan warmth, ensuring growth that lasts.”

“As Sri Lanka rebounds, Belluna Lanka remains all in backing the country’s revival with more jobs, smarter infrastructure, and sustainable tourism. This isn’t just business; it’s a partnership for progress”. Yasuno said.

-

News6 days ago

News6 days agoJapan-funded anti-corruption project launched again

-

Sports5 days ago

Sports5 days agoOTRFU Beach Tag Rugby Carnival on 24th May at Port City Colombo

-

News6 days ago

News6 days agoSethmi Premadasa youngest Sri Lankan to perform at world-renowned Musikverein in Vienna

-

News3 days ago

News3 days agoRanil’s Chief Security Officer transferred to KKS

-

Business6 days ago

Business6 days agoNational Savings Bank appoints Ajith Akmeemana,Chief Financial Officer

-

Features4 days ago

Features4 days agoThe Broken Promise of the Lankan Cinema: Asoka & Swarna’s Thrilling-Melodrama – Part IV

-

Opinion1 day ago

Opinion1 day agoRemembering Dr. Samuel Mathew: A Heart that Healed Countless Lives

-

Features5 days ago

Features5 days agoTrump tariffs and their effect on world trade and economy with particular