Business

ComBank and Mastercard launch Sri Lanka’s first Dynamic Currency Conversion for online payments

As part of Commercial Bank of Ceylon’s sustained efforts to strengthen tourism-related businesses and improve convenience for foreign travellers, the Bank has partnered with Mastercard to introduce Sri Lanka’s first Dynamic Currency Conversion (DCC) capability for online payments, marking a significant milestone in the country’s digital payments landscape.

Enabled via the Mastercard Payment Gateway Services (MPGS) platform, the new DCC feature allows international cardholders making online purchases from Sri Lankan merchants and to pay in their home currency at checkout.

This first-of-its-kind capability for online payments in Sri Lanka is designed to help local merchants grow their business by making it easier for foreign travellers to book and pay online with confidence. By enabling Mastercard Payment Gateway Services (MPGS) with Dynamic Currency Conversion (DCC), Sri Lankan merchants, particularly in travel, hospitality and leisure can offer overseas customers a more transparent checkout experience when making reservations for flights, accommodation and related services.

DCC offers foreign cardholders the option to view and confirm the final transaction amount in their home currency before completing an online purchase, rather than being charged in Sri Lankan Rupees. The exchange rate and any associated fees are displayed upfront and processed in real time, removing uncertainty caused by fluctuating exchange rates or unexpected charges after the transaction is completed.

The solution is delivered in collaboration with global DCC provider FEXCO, with Euronet Worldwide providing the advanced switching and processing infrastructure that supports real-time currency conversion, transaction processing, clearing and settlement. Together, the partners enable a seamless, transparent and secure payment experience for cross-border online transactions, extending a capability that Commercial Bank has successfully offered for point-of-sale and in-store payments since 2019, into the fast-growing e-commerce space.

Commenting on this latest milestone, Sanath Manatunge, Managing Director/CEO of Commercial Bank said: “We have always been at the forefront of digital innovation, and introducing Sri Lanka’s first Dynamic Currency Conversion service for the Mastercard Payment Gateway is a testament to our commitment to merchants and the national economy. This collaboration with Mastercard enables us to offer our merchant base a competitive advantage, a new revenue stream, and a world-class payment experience that is transparent and convenient for every international shopper. This is a crucial step in supporting Sri Lanka’s drive to attract more digital foreign revenue and promote tourism.”

Sandun Hapugoda, Country Manager, Sri Lanka and Maldives at Mastercard, said: “Mastercard congratulates Commercial Bank of Ceylon for pioneering this milestone. The introduction of DCC brings global payment best practices to Sri Lanka, empowering international cardholders with choice and transparency when making payments. The bank has fully leveraged MPGS capabilities, including advanced features like Transaction Risk Management (TRM). MPGS serves as a versatile solution for merchants of all sizes, from small businesses to complex models such as payment aggregators and facilitators. This achievement is the result of seamless collaboration and technology integration with partners like FEXCO and Euronet, making this much-needed solution a reality for the market.”

The launch of DCC for online payments further reinforces Commercial Bank’s leadership in digital payments. The Bank was the first local bank to introduce MPGS in Sri Lanka in 2007 and today supports a large and diverse merchant base with the ability to accept online payments globally. Commercial Bank currently facilitates multi-currency transactions in more than 10 international currencies and provides built-in fraud monitoring within MPGS to ensure high standards of security and trust for merchants and customers alike.

By extending DCC to online payments, the Bank enables Sri Lankan merchants to deliver a world-class checkout experience comparable to global e-commerce standards, while giving international customers clarity over costs and greater control over how they pay.

The first Sri Lankan bank with a market capitalisation exceeding US$ 1 Bn., Commercial Bank was also the first bank in the country to be listed among the Top 1000 Banks of the World, and has the highest Tier I capital base among all Sri Lankan banks. The Bank is the largest private sector lender in Sri Lanka and the largest lender to the country’s SME sector. Commercial Bank is also a leader in digital innovation and is Sri Lanka’s first 100% carbon-neutral bank.

Business

CDS accounts on the increase, crosses one million accounts

Central Depository Systems (Pvt) Ltd (CDS), a subsidiary of the Colombo Stock Exchange (CSE), has reached a milestone as total registered accounts surpassed the 1 million mark. This achievement coincides with the approach of the organization’s 35th anniversary in September 2026, marking three and a half decades of providing depository infrastructure for the Sri Lankan capital market.

Since its inception in 1991, the CDS has held the distinction of being the first depository in the South Asian region. In its core capacity as a depository, the institution is responsible for holding a wide array of securities including shares, debentures, corporate bonds, and units belonging to investors in electronic form.

The crossing of the one million account threshold also reflects the aggressive broad basing of the retail investor market over the past five years. This expansion is largely attributed to the comprehensive digitalization of the CSE, which has created accessibility for individuals across the country. Digital tools such as the CSE Mobile App and the “CDS e-Connect” portal have revolutionized how investors interact with the stock market, providing them with real time access to their holdings and a seamless interface for account management. The “CDS e-Connect”, originally launched in 2016 and revamped in 2021, has become a one stop shop for stakeholders, by offering services such as client profile management, real time balance and transaction viewing, eNomination facility, monthly statements and newly introduced dividend payment history viewing option. From 2016, by offering eStatements and SMS alert facilities CDS ensures transparency and security for the CDS accountholders. By decentralizing account openings and introducing online facilities in 2020, the CDS successfully brought the stock market to the fingertips of the general public, moving away from the traditional, paperwork heavy processes that once characterized the industry.

A critical pillar of this 35-year history was the 2011 launch of the full dematerialization drive. This initiative was designed to significantly reduce the movement of physical certificates, which were prone to loss, damage, and forgery. Today, the success of this drive is evident as the CDS holds 97 percent of listed equity and 100 percent of corporate debt in scripless form. This near total transition to electronic records has provided a secure and accessible service environment. The Central Control Unit plays a vital role, ensuring that all functions performed by the depository and its participants align with strict rules and regulatory guidelines. By identifying operational, financial, and market risks early, the CDS maintains the integrity of the ecosystem and fosters trust among both domestic and international investors.

Beyond its primary depository functions, the CDS has significantly expanded its influence through the Corporate Solutions Unit (CSU), established in 2017. The CSU was created to standardize and elevate the benchmarks for corporate action services in Sri Lanka and has since grown through the strategic acquisition of PW Corporate Registrar arm. This diversification allows the CDS to expand registrar services and manage corporate actions for both listed and unlisted companies, providing a holistic suite of services that includes the distribution of dividends, rights issues, and e-applications for Initial Public Offerings (IPOs). The digitization of issuer services has been a hallmark of the CSU’s work, introducing innovations such as eDividend payments, eWarrants, and eNotices. These advancements have streamlined the process for issuers while ensuring that shareholders receive their entitlements promptly and securely.

The strategic outlook for the CDS is now centred on the newly formed Research and Development Unit, which is essential to the organization’s vision for the future. This unit functions as a Project Management Office and is responsible for developing innovative services. By cultivating strategic alliances and international collaborations, the R&D unit ensures that the CDS remains a future forward institution capable of adapting to the evolving needs of the global financial sector.

As the CDS looks toward its 35th year of service, it remains focused on digital transformation, strategic partnerships that power progress, new service offerings and enhanced international relations. The integration of new technologies continues to ensure robust infrastructure for the next generation of market participants.

Head of CDS Nadeera Athukorale commenting on the vision of the CDS, remarked “By balancing its core depository duties with non-core registrar and consultancy services, the CDS has positioned itself for long term sustainability and industry leadership.”

The achievement of one million accounts serves as a testament to the resilience and adaptability of the Sri Lankan capital market infrastructure, demonstrating CDS’ ability to facilitate a growing digitized market while continuing to serve as the backbone of the nation’s investment landscape. (CSE)

Business

TONIK set to become next Sri Lankan hospitality brand reaching the global stage

TONIK, a new hospitality venture under Sri Lanka’s Acorn Group, has unveiled its vision to place culture, storytelling and design at the heart of island exploration, positioning itself as the next Sri Lankan hospitality brand to achieve global recognition.

Built on the Acorn Group’s decades of expertise across aviation, travel, logistics and leisure in multiple Asian markets, TONIK aims to elevate Sri Lanka’s tourism by translating the “soul” of destinations into curated experiences. The brand’s philosophy, “Every Stay Is a Story”, treats villas and boutique hotels as “living narratives” shaped by architecture, memory, craft and community.

The venture addresses a key market gap: while Sri Lanka features exceptional independent villas, many struggle with visibility and global reach. TONIK seeks to resolve this by amplifying each property’s unique value proposition – transforming distinctiveness into revenue -generating potential for owners.

“TONIK’s philosophy aligns with the evolution of our industry- where authenticity and meaningful experiences are no longer optional but essential,” said Harith Perera, Partner at Acorn Group. “Sri Lanka’s narrative deserves platforms that elevate its voice globally.”

For property owners, TONIK offers access to Acorn’s intelligence networks across the Maldives, Middle East, Europe and Asia, including insight into High-Net-Worth travel patterns.

CEO Sundararajah Kokularajah said: “By nurturing properties as living narratives, we aim to shape a new chapter for tourism – authentic, future-ready and deeply Sri Lankan.”

By Sanath Nanayakkare

Business

SDB bank relocates Warakapola branch to enhance customer experience

SDB bank relocated its Warakapola Branch to a new location with a modern, fresh look and ample parking, further strengthening its commitment to delivering an enhanced, customer-centric banking experience. The newly refurbished branch, located at No. 221/E, Colombo Road, Warakapola, will officially open its doors to customers.

The relocation reflects SDB bank’s ongoing efforts to adapt its branch network to today’s banking requirements, ensuring clients enjoy a refreshed, welcoming, and efficient service. The upgraded branch features contemporary design and improved facilities, providing greater convenience and a seamless banking experience for individuals, entrepreneurs, and businesses in the Warakapola area.

As part of its continuous transformation journey, SDB bank has prioritised innovation and service excellence in reimagining the Warakapola Branch. The new premises have been thoughtfully designed to meet evolving customer needs while fostering stronger engagement with the local community and business sector.

Kapila Ariyaratne, Executive Director / Chief Executive Officer of SDB bank, stated, “The relocation of our Warakapola Branch reflects SDB bank’s dedication to providing our customers a modern and enhanced banking experience with convenience and personalised service. This modern space is designed to meet evolving needs while reinforcing our strong ties with the local community. We remain committed to delivering innovative and customer-focused financial solutions that support regional and national growth.”

The enhanced branch environment is expected to serve both existing customers and new clients in the region, reinforcing SDB bank’s growing island wide presence. Through this relocation, the Bank continues to demonstrate its commitment to sustainable growth, service excellence, and meaningful community engagement.

SDB bank invites its valued customers and the Warakapola community to visit the new branch and experience the enhanced facilities firsthand.

A future-ready bank, dedicated to offering customer-centric and comprehensive support tailored to each individual’s needs, SDB bank is a licensed specialized bank regulated by the Central Bank of Sri Lanka, with a listing on the Main Board of the Colombo Stock Exchange and a Fitch Rating of BB +(lka).

Through the network of 94 branches island-wide, the bank provides a comprehensive range of financial services to its Retail, SME, Co-operative, and Business Banking clients across the country. Environmental, Social, and Governance (ESG) principles are deeply ingrained in SDB bank’s ethos, with a steadfast focus on uplifting local communities and businesses through sustainable practices. The bank is particularly committed to promoting women’s empowerment, sustainable development of SMEs, and digital inclusion, aiming to propel Sri Lanka to new heights.

Ceremonial opening of SDB bank Warakapola Branch

From left to right,

Binesh Aravinda – Head of Branch Banking – SDB bank,.A.D.Walisinghe – Chairman Kegalle Sanasa District Union, Kapila Ariyaratne – Executive Director/ Cheif Executive Officer – SDB bank, Chitral De Silva – Cheif Business Officer – SDB bank

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

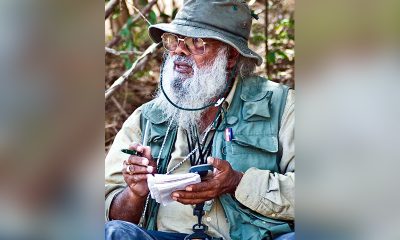

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

Business3 days ago

Business3 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

Features7 days ago

Features7 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features7 days ago

Features7 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone