Business

Breaking free from conventional investment paths; How to make your money work harder – Part II

Contineud from Yesterday

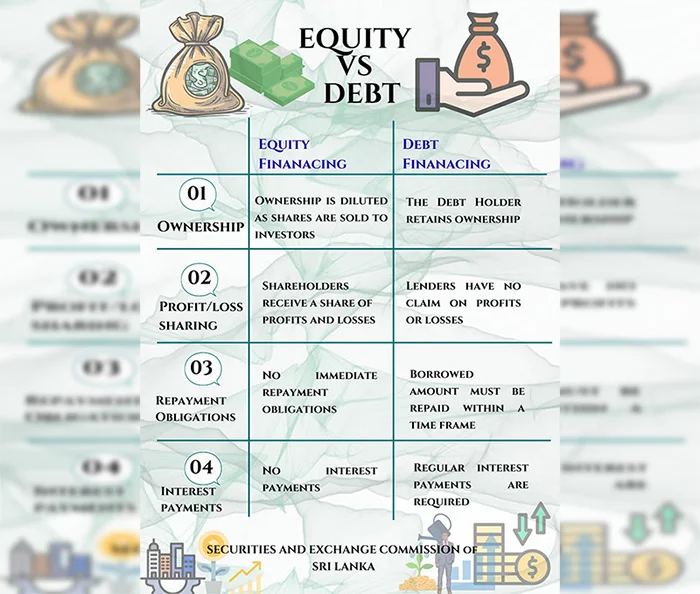

Repayment obligations – No immediate repayment obligations in equity financing. In debt financing however, the borrowed amount must be repaid within a time frame.

Interest payments – In terms of equity financing, there are no interest payments but in debt financing regular interest payments are required.

Debentures Decoded: The Company IOU System

Debentures are essentially formal IOUs that companies give you when you lend them money. What makes them particularly attractive to investors is their predictable nature and security features. They offer fixed returns, meaning you know exactly how much you’ll earn or can predict your return with certainty. Most debentures provide regular income through interest payments made every six months, creating a steady cash flow for investors. Each debenture comes with a specific maturity date when the company must repay the full principal amount you originally lent them. Perhaps most importantly, debenture holders enjoy priority treatment in the company’s capital structure, which means if the company faces financial difficulties, debenture holders get paid before shareholders, providing an additional layer of security for your investment.

The Flip Side: What Could Go Wrong?

Like any investment, debentures come with risks:

Interest Rate Risk – When interest rates rise, existing bond prices fall since newer bonds offer higher yields. Long-term bonds are more sensitive to rate changes than short-term ones. This creates potential capital losses if you need to sell before maturity.

Credit Risk – The borrower may default on interest payments or fail to repay the principal. This is particularly relevant to corporate bonds, high-yield bonds, and emerging market debt. Even government bonds aren’t immune, as sovereign defaults can occur.

Inflation Risk – Fixed-rate debt investments lose purchasing power when inflation exceeds the bond’s yield. Your real return (after inflation) may be negative even if you receive all promised payments.

Liquidity Risk – Potential difficulty in buying or selling a bond at a fair price, especially during periods of market stress. This risk arises because some corporate bonds may have fewer buyers and sellers compared to government bonds, making it harder to execute trades quickly without impacting the price significantly.

Event Risk Corporate restructuring, mergers, natural disasters, or regulatory changes can suddenly impact a borrower’s ability to service debt, even for previously stable issuers.

Prepayment Risk Borrowers may pay off debt early when interest rates fall, forcing you to reinvest at lower rates. This is common with mortgage-backed securities and callable bonds.

Tips on How To Balance The Devil On Your Shoulder; Guide to Risk Management

Build bond ladders with staggered maturities to reduce timing risk and provide regular reinvestment opportunities. Shorter-duration bonds (under 5 years) are less sensitive to rate changes. Consider floating-rate bonds that adjust with interest rate movements.

Diversify across multiple issuers, sectors, and credit ratings rather than concentrating in single borrowers. Research credit fundamentals and consider professional credit analysis for corporate bonds.

The Array of Debt Securities Facilitated; Invest In What You Believe In

The Securities and Exchange Commission of Sri Lanka serves as both the gatekeeper and facilitator of bond investments. Acting like a financial referee, the SEC creates rules and approval processes that allow companies to borrow money from the public through bonds while protecting investors from fraud and misinformation. Their dual role as regulator and facilitator has enabled the development of innovative bond markets, ensuring that when companies want to issue bonds, they must provide complete and honest information about their finances and intentions. Through this careful oversight and facilitation, the SEC has made possible the following bond categories that serve both investor returns and broader societal goals:

Corporate Promises of Economic Affluence: Corporate Bonds

The corporate bond market presents a fascinating risk-reward spectrum. At one end, bonds offered from established corporations with good credit ratings offer reliable returns slightly higher than government securities. At the other end, high-yield or “junk” bonds from less financially stable companies entice investors with premium interest rates to compensate for elevated risk.

The corporate bond market offers remarkable diversity, allowing investors to precisely calibrate their desired balance between safety and yield.

Save the Planet and Make Profit: Unlocking Value Through GSS+ Bonds

GSS+ refers to a category of financial products designed to fund projects with positive environmental and social impacts. The Regulatory Framework for listing and trading the following Bond categories have been enabled at the CSE:

Green Bonds – Green Bonds debt securities specifically designed to fund projects with positive environmental or climate benefits.

Blue Bonds – Blue Bonds are debt securities designed specifically to finance projects related to ocean conservation and sustainable marine activities.

Social Bonds – Social Bonds are debt securities that raise funds specifically for projects delivering positive social outcomes and addressing social challenges. They offer investors a way to generate financial returns while supporting social welfare initiatives.

Sustainability Linked Bonds – Sustainability Linked Bonds differ from the other types of GSS+ Bonds in that their proceeds are not used to finance specific projects but are instead made available for general corporate purposes, with the issuer contractually undertaking to achieve predefined, measurable sustainability targets or Key Performance Indicators (KPIs).

“Faith-Based Finance Finds Home”: Shariah-Compliant Debt Securities

Shariah compliant Debt Securities, commonly known as Sukuk, represent Shariah-compliant financial certificates that embody partial ownership in an underlying asset, usufruct, service, project, business, or investment. Unlike conventional bonds that create debt obligations with interest payments, sukuk are structured as investment certificates that provide returns derived from asset performance rather than interest.

Enabling this product at the CSE is expected to attract previously untapped capital by opening doors to foreign portfolio investments from Shariah seeking investors.

Sri Lanka’s Blooming GSS+ and Faith-Based Bond Market

DFCC Bank Pioneers Green Bond

Sri Lanka’s first Green Bond was issued by the DFCC Bank in September 2024 for a total value of LKR 2.5 billion at a coupon of 12%.

This issue was oversubscribed. In December 2024, the DFCC went on to obtain a dual listing for its Green Bond at the Luxembourg Stock Exchange (LuxSE).

Alliance Finance Issues LKR One Billion Worth of Green Bonds

Alliance Finance Company PLC, a Non-Banking Financial Institution (NBFI) issued LKR 1 billion of Green Bonds in February 2025 at a coupon of 10.75%, which was also oversubscribed.

Sri Lanka’s First Ever Faith Based Bond

Vidullanka, a renewable energy company pioneering Rs. 500 m Sukuk issue (Compliant with Shariah Law) was oversubscribed on the opening day itself.

More GSS+ investment opportunities on the horizon

Several other corporate entities such as Resus Energy PLC and Sarvodhaya Development Finance are in the pipeline for issuing GSS+ Bonds.

“Building Tomorrow Today”: Infrastructure Bonds

The introduction of Infrastructure Bonds marks a significant step toward addressing the nation’s infrastructure financing gap. These specialized debt instruments will channel private capital into critical projects spanning transportation, energy, water, and digital infrastructure.

With extended maturities designed to match the long-term nature of infrastructure assets, these bonds offer investors stable, predictable returns while contributing to national development priorities.

Infrastructure Bonds will create a win-win scenario where investors gain exposure to essential assets with inflation-protected returns, while the country benefits from accelerated infrastructure development.

Capital Fortified: Unlocking value through Basel III Tier 2 Instruments

Basel III-compliant debentures represent a specialized category of debt instruments that adhere to the regulatory standards established by the Basel Committee on Banking Supervision in response to the 2007-2008 global financial crisis. These debentures are designed to strengthen bank capital requirements, stress testing, and market liquidity risk management.

“Endless Opportunities”: Perpetual Bonds

True to its name, Perpetual Bonds are debt securities with no maturity date and pays interest indefinitely. These instruments offer unique advantages for both issuers seeking stable long-term funding and investors looking for consistent income streams.

Unlike conventional bonds, perpetuals remain outstanding until the issuer chooses to redeem them, typically after a specified initial period.

Perpetual Bonds represent financial innovation at its finest. They provide corporates with quasi-equity financing without diluting ownership, while investors benefit from higher yields compared to traditional fixed-income products.

“Higher Risk, Higher Reward”: High-Yield Bonds

Rounding out the new offerings are High-Yield Bonds, sometimes known as “junk bonds,” which carry higher interest rates to compensate for their greater risk profile. These instruments typically come from issuers with lower credit ratings or newer enterprises without established credit histories.

Market participants have welcomed the addition, noting it completes the CSE’s fixed-income ecosystem by catering to investors with more aggressive risk appetites.

High-yield bonds fill a crucial gap in our market. They offer potentially attractive returns in a low-interest environment and provide companies that might not qualify for investment-grade ratings with vital access to capital. Currently this is facilitated for entities regulated by the CBSL or the Insurance Regulatory Commission of Sri Lanka (IRCSL)

Why Capital Markets Matter: The Win-Win Story

For Companies Raising Money:

Cheaper Funding: Instead of paying high bank interest rates, companies can often raise money more cheaply through capital markets.

No Collateral Hassles: Unlike bank loans that require mortgaging property, companies can raise funds based on their business prospects.

Flexibility: They can choose between giving away ownership (equity) or borrowing (debt) based on their needs.

Growth Capital: Access to large amounts of money helps companies expand, hire more people, and in turn contribute to economic growth.

For Everyday Investors:

Better Returns: Instead of earning a lesser return from bank deposits, you might be able to earn significantly higher returns in the capital market

Choice and Control: You decide which companies to support with your money.

Wealth Building: Over time, successful investments can significantly grow your wealth.

Economic Participation: You become part of Sri Lanka’s economic growth story.

The Bigger Picture: Building Tomorrow’s Sri Lanka

Capital markets aren’t just about making money – they’re about building the future. When you invest in a renewable energy company’s debenture, you’re funding clean power for Sri Lanka. When you buy shares in a tech startup, you’re supporting innovation and job creation.

Getting Started: Your First Steps

Ready to explore capital markets? Start small:

Learn the basics through free regulatory sources like Securities and Exchange Commission of Sri Lanka

Open a trading account with a licensed stockbroker

Start with blue-chip companies – established firms with good track records

Diversify your investments – don’t put all eggs in one basket

Think long-term – capital markets reward patience

Still feeling apprehensive? Try Unit Trusts.

Unit Trust Funds are a collective investment scheme that is a pooling vehicle of your funds, offering professionally managed investment pools with various risk profiles suitable for unsophisticated investors.

Minimum investment begins from as low as LKR 1,000.00. Risk level varies based on type of the Scheme who creates a diversified portfolio based on the fund’s parameters to earn a return.

Then your money is used by professional fund managers who know what they’re doing. They take everyone’s money and buy a mix of different investments – like shares in companies, government bonds, and other financial assets.

Steps to follow;

Choose a licensed managing company and open a unit trust account

Open your account with as little as Rs.1000

Choose the Scheme – Once your account is open, you need to choose a fund to invest in. You can choose from a range of funds such as Growth funds, Income funds, Balanced funds, Money Market funds, Sector Funds and Index Funds. Each fund has different risks and returns, so you need to decide which is the best fit for your goals and risk appetite.

Monitor your investment

The beauty of unit trusts is their simplicity – investors receive the benefit of professional management without needing to be a financial expert.

Finally, it’s important to remember, all investments carry risks. Never invest money you can’t afford to lose and always do your homework before making investment decisions.

Capital markets have democratized finance in Sri Lanka, giving everyone a chance to participate in the country’s economic growth, offering opportunities to grow your wealth while supporting businesses that create jobs and drive progress.

To be Continued

by Securities and Exchange Commission

of Sri Lanka

Business

Sampath Bank’s strong results boost investor confidence

The latest earnings report for Sampath Bank PLC (SAMP), analysed by First Capital Research (FCR), firmly supports a positive outlook among investors. The research firm has stuck with its “MAINTAIN BUY” recommendation , setting optimistic targets: a Fair Value of LKR 165.00 for 2025 and LKR 175.00 for 2026. This signals strong belief that the bank is managing the economy’s recovery successfully.

The key reason for this optimism is the bank’s shift towards aggressive, yet smart, growth. Even as interest rates dropped across the market, which usually makes loan income (Net Interest Income) harder to earn, Sampath Bank saw its total loans jump by a huge 30.2% compared to last year. This means the bank lent out a lot more money, increasing its loan book to LKR 1.1 Trillion. This strong lending, which covers trade finance, leasing, and regular term loans, shows the bank is actively helping businesses and people spend and invest as the economy recovers.

In addition to loans, the bank has found a major new source of income from fees and commissions, which surged by 42.6% year-over-year. This money comes from services like card usage, trade activities, and digital banking transactions. This shift makes the bank less reliant on just interest rates, giving it a more stable and higher-profit way to earn money.

Importantly, this growth hasn’t weakened the bank’s foundations. Sampath Bank is managing its funding costs better, partly by improving its low-cost current and savings account (CASA) ratio to 34.5%. Moreover, the quality of its loans is getting better, with bad loans (Stage 3) dropping to 3.77% and the money set aside to cover potential losses rising to a careful 60.25%.

Even with the new, higher capital requirements for systemically important banks, the bank remains very strong, keeping its capital and cash buffers robust and well above the minimum standards.

In short, while the estimated profit for 2025 was adjusted slightly, the bank’s excellent performance and strong strategy overshadow this minor change. Sampath Bank is viewed as a sound stock with high growth potential , offering investors attractive total returns over the next two years.

By Sanath Nanayakkare

Business

ADB approves $200 million to improve water and food security in North Central Sri Lanka

The Asian Development Bank (ADB) has approved a $200 million loan to support the ongoing Mahaweli Development Program, Sri Lanka’s largest multiuse water resources development initiative.

The program aims to transfer excess water from the Mahaweli River to the drier northern and northwestern parts of Sri Lanka. The Mahaweli Water Security Investment Program Stage 2 Project will directly benefit more than 35,600 farming households in the North Central Province by strengthening agriculture sector resilience and enhancing food security.

ADB leads the joint cofinancing effort for the project, which is expected to mobilize $60 million from the OPEC Fund for International Development and $42 million from the International Fund for Agricultural Development, in addition to the ADB financing.

“While Sri Lanka has reduced food insecurity, it remains a development challenge for the country,” said ADB Country Director for Sri Lanka Takafumi Kadono. “Higher agricultural productivity and crop diversification are necessary to achieve food security, and adequate water resources and disaster-resilient irrigation systems are key.”

The project will complete the government’s North Central Province Canal (NCPC) irrigation infrastructure, which is expected to irrigate about 14,912 hectares (ha) of paddy fields and provide reliable irrigated water for commercial agriculture development (CAD). It will help complete the construction of tunnels and open and covered canals. The project will also establish a supervisory control and data acquisition system to improve NCPC operations. Once completed, the NCPC will connect the Moragahakanda Reservoir to the reservoirs of Huruluwewa, Manankattiya, Eruwewa, and Mahakanadarawa.

Sri Lanka was hit by Cyclone Ditwah in late November, resulting in the country’s worst flood in two decades and the deadliest natural hazard since the 2004 tsunami. The disaster damaged over 160,000 ha of paddy fields along with nearly 96,000 ha of other crops and 13,500 ha of vegetables.

Business

ComBank to further empower women-led enterprises with NCGIL

The Commercial Bank of Ceylon has reaffirmed its long-standing commitment to advancing women’s empowerment and financial inclusion, by partnering with the National Credit Guarantee Institution Limited (NCGIL) as a Participating Shareholder Institution (PSI) in the newly introduced ‘Liya Shakthi’ credit guarantee scheme, designed to support women-led enterprises across Sri Lanka.

The operational launch of the scheme was marked by the handover of the first loan registration at Commercial Bank’s Head Office recently, symbolising a key step in broadening access to finance for women entrepreneurs.

Representing Commercial Bank at the event were Mithila Shyamini, Assistant General Manager – Personal Banking, Malika De Silva, Senior Manager – Development Credit Department, and Chathura Dilshan, Executive Officer of the Department. The National Credit Guarantee Institution was represented by Jude Fernando, Chief Executive Officer, and Eranjana Chandradasa, Manager-Guarantee Administration.

‘Liya Shakthi’ is a credit guarantee product introduced by the NCGIL to facilitate greater access to financing for women-led Micro, Small, and Medium Enterprises (MSMEs) that possess viable business models and sound repayment capacity but lack adequate collateral to secure traditional bank loans.

-

Features6 days ago

Features6 days agoFinally, Mahinda Yapa sets the record straight

-

News7 days ago

News7 days agoCyclone Ditwah leaves Sri Lanka’s biodiversity in ruins: Top scientist warns of unseen ecological disaster

-

Features6 days ago

Features6 days agoHandunnetti and Colonial Shackles of English in Sri Lanka

-

Business4 days ago

Business4 days agoCabinet approves establishment of two 50 MW wind power stations in Mullikulum, Mannar region

-

News5 days ago

News5 days agoGota ordered to give court evidence of life threats

-

Features7 days ago

Features7 days agoAn awakening: Revisiting education policy after Cyclone Ditwah

-

Features5 days ago

Features5 days agoCliff and Hank recreate golden era of ‘The Young Ones’

-

Opinion6 days ago

Opinion6 days agoA national post-cyclone reflection period?