Business

BOC to continue effective handling of finances and resource build-up

by Sanath Nanayakkare

As the 3rd and 4th quarters of the Year 2022 are also likely to gravitate towards a tough time, the Bank of Ceylon needs to continue to focus on efficient handling of its resources and finances, BOC Chairman Kanchana Ratwatte said yesterday.

He made these remarks when the Bank marked its 83rd Anniversary at the BOC headquarters in Colombo yesterday, where a large number of key employees of the Bank were present whose work interfaces with accounts, transactions, remittances, Export Circle, SME Circle, international trade etc.

“Do not forget that that the significant increase in interest rates has impacted most businesses and the 3rd and 4th quarter recoveries are going to be impacted. So if we are not careful about how we handle our finances, we are going to make life difficult for our end-customers. We need to look after our customers because they pay for our wages,” he told BOC employees.

Further speaking the BOC Chairman said: “We made a per-tax profit of over Rs.43 billion in 2021. However, the Bank reported a pre-tax profit of Rs. 9.5 billion for the period ended 31 March 2022. As a result of the fuel shortage and power interruptions almost all industries and all segments of the society have been adversely impacted. So, we at BOC will see its impact on our balance sheet. In this context, we have to be careful as to how we manage our resources.”

“More than 40% of the income of the Bank of Ceylon comes from the public sector. Our profit is earned significantly from that segment. The balance 60% comes from the private sector. In this scenario, we have to be all the more careful in the third and fourth quarters of the year, which are going to be even more impacted due to the current scenario.”

“My expectation is if there is any assistance that is coming from outside it will be in the last quarter of this year. And if it doesn’t come in the last quarter of this year, we are not going to survive as a country. I am confident that in the 3rd and 4th quarter we should have something to look forward to. BOC on its own is looking at a number of funding sources. We have formed committees for the purpose and we are trying to ensure that any funding gap is bridged.”

“The challenge would be the impact of everything that is happening now. The lack of fuel has an impact on the transport sector as well as the power sector. When there are power cuts and when people can’t commute to work, the spillovers connected with that would be reflected in the next quarter’s financial statement.”

“The impact of the rupee devaluation is being felt now. The exchange rate shot up from Rs. 200 to Rs. 360. That is being reflected on our imports. I believe that over a period of time, that should settle.”

“BOC made significant achievements in the past two years by supporting the national effort in the fight against COVID-19. We spent a lot on the vaccination programme. At that time the country was running short of hospital beds and everyone was helping to install beds at which time the BOC conceptualized a home care system and implemented it successfully. We reached the milestone of 154, 000 home care patients under this programme”.

“Apart from this, the Bank set up a business Revival and Rehabilitation (BRR) department and expanded its operations to all provinces furthering its assistance to local business organisations to come back to life from the adverse effects of the pandemic, in addition to moratoriums.”

BRR unit has already accounted for over Rs. 30 billion worth of business revivals. It directly came to the balance sheet in addition to peripherals worth Rs. 17 billion.”

“So these were the significant milestones the Bank achieved during the critical period.”

“Today we face a number of issues and they could be even more severe in the ensuing year and we need to be mindful of that fact,” BOC chairman said.

To mark this special day, BOC symbolically launched “My Health” account emphasising its innovative spirit in delivering novel value additions to customers. The Bank also launched BOC Foreign Circle, a specialised unit geared to delivering superior quality to overseas based customers.

Business

Sri Lanka’s 2.3% inflation is a useful macro indicator, but it acts as a veil, says analyst

Disconnect between national statistics and household sentiment illustrated

Although official data points to a stable headline inflation rate of 2.3%, an independent economic analyst told The Island Financial Review that the public should look beyond this single figure.

Speaking on condition of anonymity, the analyst said, “That 2.3% is a crucial macroeconomic indicator for policymakers, but for the average household, it acts more like a veil. It obscures the sharply different economic realities in different sectors of the economy and, consequently, in different people’s lives.”

“You see, the aggregate is an average, a blend of everything from falling transport costs to soaring medical bills. But no family buys the ‘average’ basket. Your personal inflation rate is dictated by your unique spending pattern, and right now, those patterns are creating winners and losers in a low-inflation environment.”

He illustrated this by taking three contrasting Sri Lankan households.

“Consider a retired couple: their budget is dominated by healthcare, which is inflating at 4.2%, and perhaps occasional treats at restaurants, up 4.0%. For them, the cost of living is rising nearly twice as fast as the headline suggests. That 2.3% figure is of poor comfort to them.”

“Conversely, take a young professional who commutes; they are a direct beneficiary of the 0.9% deflation in transport. Their major expenses – fuel and vehicle maintenance – are supposed to be getting cheaper. Even if education inflation is high, it doesn’t affect them. This individual might feel almost no pinch, experiencing a personal inflation rate of about 1%. The headline number overstates their hardship.”

The analyst expressed his deepest concern for the typical family. “This is where the veil is most dangerous,” he said. “A family with school-going children is hit from multiple sides: Education at 3.9%, daily groceries at 3.3%, and clothing at 3.6%. The slight relief from cheaper transport is negligible against these heavy, non-negotiable expenses. Their budget is being squeezed relentlessly, a pressure the calm 2.3% aggregate completely masks.”

The analyst concluded that this sectoral divergence explains the disconnect between national statistics and household sentiment.

“When people hear ‘inflation is low and stable,’ but feel their wallet straining, it’s not ignorance. It’s because their personal basket is heavy with the sectors that are heating up – essential services, education, and food. The 2.3% is a useful indicator for the economy at large, but it should not blind us to the fact that many families are experiencing a much harder personal financial reality. Lifting that veil is key to understanding the true cost of living.”

by Sanath Nanayakkare

Business

Sri Lanka explores climate finance after Cyclone Ditwah

SLYCAN Trust convenes key forum on loss and damage funding

As Sri Lanka seeks funds as a climate-vulnerable nation, SLYCAN Trust convened a High-Level Forum on Climate Finance and Climate-Related Extreme Events in Colombo on January 20, 2026. The forum focused on improving access to finance for recovery and resilience, particularly following the severe impacts of Cyclone Ditwah in late 2025.

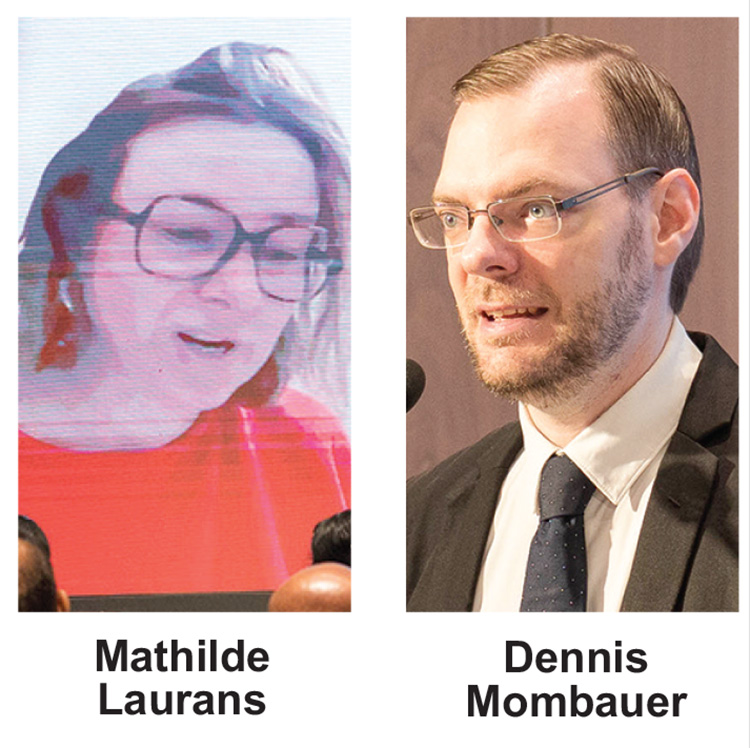

Dennis Mombauer, Director of Research and Knowledge Management at SLYCAN Trust, emphasised the urgency of building long-term resilience and addressing loss and damage.

“This Forum convenes key actors to identify pathways for accessing finance and managing climate risks,” he stated.

In a virtual keynote, Mathilde Laurans, Deputy Executive Director of the Fund for Responding to Loss and Damage (FRLD), announced that the fund opened its first call for proposals on December 15, 2025, with submissions accepted until June 15, 2026. “This milestone means that countries like Sri Lanka can now engage with us for support,” she said.

K.K.A. Chamani Kumarasinghe, Additional Director at Sri Lanka’s Climate Change Secretariat, highlighted the extensive damage caused by Cyclone Ditwah and stressed the need to strengthen response systems. She commended SLYCAN Trust for creating platforms that connect global climate processes with national priorities.

The forum included panel discussions with representatives from international climate finance institutions and technical experts, focusing on practical steps to enhance Sri Lanka’s climate resilience and improve local-level access to finance.

Business

Browns Hotels & Resorts brings a century of tea heritage to life at Newburgh Ella

In the mist-veiled heart of Sri Lanka’s hill country, where Ella has earned global recognition as one of the island’s most photographed destinations, Browns Hotels & Resorts introduces a new chapter in experiential hospitality with Newburgh Ella – The Tea Factory Resort. Once a working tea factory, the century-old estate, originally established in 1903 by the legendary Scottish tea planter George Thomson, has been carefully transformed into a luxury resort, preserving its industrial character and historical soul while elevating it into an immersive experience. Set against dramatic mountain backdrops and defined by its iconic orange chimney, the resort commands world-famous views of the Ella Gap, framed by Ella Rock and Little Adam’s Peak — where landscape, legacy, and luxury converge.

On 30 January 2026, Newburgh Ella officially opened its doors to travellers from around the world with a ceremonial launch attended by Eksath Wijeratne, CEO of Browns Hotels & Resorts; Gangadaran Velsamy, General Manager of Newburgh Ella; Priyal Perera, Head of Projects and Procurement; Nishad Rajapakse, Manager – Engineering; along with key officials from Browns Hotels & Resorts. The event featured traditional regional performances and a ceremonial presentation of the first keycards to Newburgh Ella’s inaugural guests by the resort staff.

This unveiling marks the soft opening of Newburgh Ella, with the property currently progressing through its LEED and green certification processes. As part of its sustainability journey, the resort operates on a fully paperless concept, with digital check-in and digital menu systems in place, reinforcing Browns Hotels & Resorts’ commitment to responsible and future-ready hospitality.

Located on the Ella–Passara main road, near the Nine Arch Bridge and Pekoe Trail, Newburgh Ella features 41 thoughtfully designed rooms, categorised as Silver, Gold, and Bronze — inspired by the hierarchy of tea tips. The resort includes special family rooms, exquisite suites, and full wheelchair accessibility, offering inclusivity without compromise. Guests can witness sunrises and sunsets unfold directly from their rooms, framed by emerald vistas, connecting them to the rhythm of the hills.

Dining at Newburgh Ella celebrates the estate’s relationship with tea, land, and craft. 1903 – The Dining Room offers all-day dining with local and international flavours. Eastern Valley, an open-air restaurant, presents Pan-Asian cuisine, while Three Tips, the tea lounge, invites guests to savour the estate’s finest teas. The resort’s bar, George Thomson – The Founder’s Tavern, features specially curated beverage menus inspired by the region, reflecting the warmth of Browns hospitality. Together, these experiences offer the luxury of tea factory living, blending heritage, craft, and modern comfort.

Beyond its spaces, guests can explore Ella through curated experiences — from estate walks and visits to Ravana and Diyaluma Falls to scenic railway journeys. SKY, the resort’s observation deck, offers breathtaking vistas over tea-carpeted valleys and the world-famous Ella Gap.

Commenting on the launch, Eksath Wijeratne, CEO of Browns Hotels & Resorts, said:

“Tea is one of Sri Lanka’s most powerful global stories, and with Newburgh Ella, we wanted to honour that legacy while creating an experience that goes beyond aesthetics. Guests can connect with the very process, the people, and the land that give Sri Lanka tea its global recognition. At the same time, this project supports the local community, with many former factory staff now part of the resort team, ensuring heritage, sustainability, and hospitality thrive together.”

With the unveiling of Newburgh Ella – The Tea Factory Resort, Browns Hotels & Resorts continues to expand its portfolio of story-led destinations across Sri Lanka, inviting travelers to experience tea country differently — where the finest grade of tea meets the finest grade of stay, steeped in history, character, and heart.

- A Gold Tip Room at Newburgh Ella with a private balcony

- Eksath Wijerathne, Chief Executive Officer with Priyal Perera, Head of Projects and Procurement with Gangadaran Welasamy unveiling the property signage for Newburgh Ella

- Eksath Wijerathne, Chief Exceutive Officer of Browns Hotels and Resorts addressing the gathering

- An aerial view of Newburgh Ella – The Tea Factory Resort set against the hills of Ella

- A Silver Tip Room with the iconic Orange Chimney and the scenic Ella Gap in the background

-

Business4 days ago

Business4 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion3 days ago

Opinion3 days agoSri Lanka, the Stars,and statesmen

-

Business2 days ago

Business2 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business2 days ago

Business2 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business2 days ago

Business2 days agoArpico NextGen Mattress gains recognition for innovation

-

Business1 day ago

Business1 day agoAltair issues over 100+ title deeds post ownership change

-

Business1 day ago

Business1 day agoSri Lanka opens first country pavilion at London exhibition

-

Editorial2 days ago

Editorial2 days agoGovt. provoking TUs