Business

Banking sector counters trigger fresh bull run at CSE

By Hiran H,Senewiratne

The stock market performed bullishly yesterday driven by banking sector counters. The reason being that investors are optimistic with positive financial statements coming from listed companies this quarter, market analysts said.

Amid those developments both indices moved upwards. The All Share Price Index went up by 115.8 points while S and P SL20 rose by 37.65 points. Turnover stood at Rs 5.56 billion with ten crossings.

Those crossings were reported in Sierra Cables, which crossed 23 million shares to the tune tune of Rs 324 million; its shares traded at Rs 14.80, TJLanka four million shares crossed for Rs 204 million and its shares traded at Rs 51.20, Amana Bank 4.7 million shares crossed for Rs 119 million; its shares sold at Rs 25.50, Aitken Spence 697,000 shares crossed for Rs 108 million; its shares traded at Rs 151, CIC Holdings 962,000 shares crossed to the tune of Rs 97.9 million; its shares traded at Rs 102, Commercial Bank 450,000 shares crossed for Rs 65.7 million and its shares sold at Rs 146, JKH one million shares crossed to the tune of Rs 23.8 million; its shares traded at Rs 23.80, Dialog 1.7 million shares crossed to the tune of Rs 23.2 million; its shares sold at Rs 13.20, Central Industries 138,000 shares crossed for Rs 21.9 million and its shares traded at Rs 158 and Access Engineering 600,000 shares crossed for Rs 21 million and its shares fetched Rs 35.

In the retail market, companies that mainly contributed to the turnover were; DFCC Rs 248 million (2 million shares traded), HNB Rs 236 million (719,000 shares traded), Sierra Cables Rs 229 million (16 million shares traded), NDB Bank Rs 160 million (1.3 million shares traded), TJ Lanka Rs 142 million 92.7 million shares traded) and Pan Asia Bank Rs 128 million (3.3 million shares traded). During the day 187 million share volumes changed hands in 31300 share transactions.

It is said that the banking sector was the biggest contributor for the turnover while the manufacturing sector was the second largest contributor to the turnover. The services sector was also very active in the market due to proper market fundamentals.

Yesterday the rupee was quoted at Rs 296.25/35 to the US dollar in the spot market, stronger from Rs 296.40/60 to the US dollar last Friday, while bond yields were flat, dealers said.

Stocks were up 0.39 percent. A bond maturing on 15.12.2026 was quoted at 9.15/25 percent, up from 9.10/25 percent, Friday. A bond maturing on 15.02.2028 was quoted at 10.10/15 percent, up from 10.05/15 percent. A bond maturing on 01.05.2028 was quoted at 10.25/33 percent, up from 10.25/30 percent. A bond maturing on 01.07.2028 was quoted at 10.32/38 percent. A bond maturing on 15.09.2029 was quoted at 10.75/85 percent, up from 10.75/83 percent. A bond maturing on 15.10.2030 was quoted at 11.27/30 percent, up from 11.20/30 percent.

Business

Sri Lankan leaders urged to balance historical wisdom with modern innovation

By Ifham Nizam

Prof. Patrick Mendis, a Sri Lankan-born U.S. diplomat and presidential advisor to the U.S. Department of Defense issued a call to action for Sri Lanka’s leaders, urging them to adopt a pragmatic vision that balances historical wisdom with modern innovation.

Speaking on the topic, `The Power of Geopolitics and Its Implications for Sri Lanka’s National Development’, at a seminar organized by the National Chamber of Commerce last Friday, he said: “Commerce and connectivity have always been the lifeblood of nations. Sri Lanka must harness its strategic position and unique assets to chart a path of sustainable growth and prosperity.”

Mendis provided to the audience at the National Chamber Auditorium deep insights into how global political dynamics shape Sri Lanka’s economic and strategic future.

Drawing from his extensive experience across over 140 countries, Mendis highlighted key opportunities and challenges facing the nation. The event served as a vital platform for engaging discussions among policymakers, academics and industry leaders.

Professor Mendis of the University of Warsaw drew connections between history, trade, and modern geopolitics. His analysis highlighted how nations leverage their geographic and economic strengths to navigate global power dynamics. He outlined the opportunities and challenges for Sri Lanka amidst the shifting tides of international trade and diplomacy.

Opening with a historical lens, Mendis emphasized the role of commerce in shaping global alliances. Quoting Thomas Jefferson, he reiterated the timeless motto: “Commerce with all nations, alliance with none.” This principle, rooted in America’s founding vision, underscores the idea that peaceful trade can serve as a cornerstone for national prosperity. Jefferson’s vision for “practicable water communication across the continent for commerce” resonates even today as countries explore trade routes that minimize conflict while maximizing economic benefits.

Mendis also reflected on historical instances of Sri Lanka’s strategic connectivity. From King Bhatika Abhaya’s diplomatic exchanges with Rome and China in the Anuradhapura Kingdom to the maritime strategies of Parakramabahu I during the Polonnaruwa era, Sri Lanka has long been a hub for trade and cultural exchange. Such historical precedents underscore the island’s potential as a pivotal player in contemporary global trade.

Transitioning to modern geopolitics, Mendis focused on China’s Belt and Road Initiative (BRI). He described it as a transformative project aimed at fostering “a peaceful world built on trade.” By connecting Asia, Europe, and Africa through infrastructure investments, China seeks to rejuvenate the historical Silk Road and assert its economic dominance. For Sri Lanka, this presents both opportunities and challenges.

Sri Lanka’s strategic position in the Indian Ocean has made it a critical node in China’s maritime ambitions. Mendis referred to Sri Lanka as China’s “unsinkable aircraft carrier,” highlighting major investments like the Hambantota Port and Colombo Port City. While these projects promise economic growth, they also raise concerns about sovereignty and debt dependency.

Mendis likened China’s approach to a modern “MIDLIFE Strategy,” where military, intelligence, diplomacy, legal, identity, financial, and economic tools are employed to win battles without war. For example, Chinese survey missions in the Indian Ocean, ostensibly for fiber-optic cable laying and resource mapping, underline its dual-use strategy, blending commercial and strategic interests.

In the face of growing U.S.-China competition, Professor Mendis urged Sri Lanka to adopt a pragmatic and balanced approach. He discussed the implications of key U.S.-India agreements, including the General Security of Military Information Agreement (GSOMIA) and the Basic Exchange and Cooperation Agreement (BECA). These alignments, aimed at enhancing defense cooperation, have significant implications for the Indo-Pacific and Sri Lanka’s positioning.

Quoting Winston Churchill, Mendis reminded the audience: “We have no lasting friends, no lasting enemies, only lasting interests.” He emphasized that Sri Lanka must prioritize its national interests over allegiances, ensuring sustainable development while avoiding entanglements in power rivalries.

Mendis urged businesses to focus on sectors where Sri Lanka holds a comparative advantage, such as tourism, agriculture, and technology. By capitalizing on its rich cultural heritage and skilled workforce, the nation can attract investments that align with sustainable development goals.

Business

Customer service to new heights with Digitalized Contact Centre for Union Bank

Marking a significant milestone in the advancement of digital customer service in the banking sector, Dialog Enterprise, the corporate ICT solutions arm of Dialog Axiata PLC., announces the implementation of a state-of-the-art, cloud-based contact centre solution for Union Bank of Colombo PLC. The cloud-hosted platform offers a unified communication solution that integrates voice, video, unified messaging, VoIP, and automated call flows, reinstating the existing outmoded contact centre system at Union Bank.

Union Bank as part of its digital transformation agenda continues to leverage technology for growth and the upgrade of its existing contact centre infrastructure to a more advanced, scalable, and compliant solution is yet another step towards enhancing customer experience. With the new cloud-based system, the bank aims to improve customer engagement and streamline operations, while adhering to central bank regulations and compliance requirements.

“We are excited to collaborate with Dialog Enterprise to elevate our customer service capabilities,” stated Malinda Perera, Vice President – Head of Cards, Asset Products, Service Quality & Contact Centre of Union Bank. “Our decision to move to a cloud-based contact centre was driven by our commitment to enhance customer engagement and operational efficiency. The new system will allow us to offer more personalized service through various channels, including voice, chat, and social media, ensuring that we can meet our customers’ needs wherever they are. Additionally, the platform’s robust security features will help us comply with regulatory standards, protecting our customers’ data and maintaining their trust,” he explained further.

The new cloud-hosted contact centre will enable Union Bank to achieve greater scalability, reduce operational costs, and increase flexibility for its workforce. With features such as integrated CRM, real-time wallboards, reporting tools, and mobile applications, the solution ensures that agents can provide exceptional customer service from any location, whether working remotely or from the office.

“We are thrilled to present this latest communication interface for Union Bank,” exclaimed Navin Pieris, Group Chief Officer of Dialog Enterprise. “As pioneers in bringing the latest technology to the country, our goal is to provide local enterprises with access to world-class digital solutions at affordable prices. The cloud-based contact centre we are implementing for Union Bank will enhance their operational efficiency while also significantly improving the customer experience through a more responsive, multi-channel communication platform,” he pointed out.

Business

United Kingdom tea importers visit Sri Lankan tea producers, exploring trade opportunities

A delegation of experts and specialists from the UK tea industry is in Sri Lanka this week to strengthen connections with the country’s specialty tea producers and explore business opportunities.

The trade mission – organized under the UK Government- funded Trade Partnerships (UKTP) programme and implemented by the International Trade Centre and– will connect 12 UK tea companies with specialty tea producers and processors across Sri Lanka’s low, mid and upcountry regions, to explore the unique flavours and variations influenced by diverse climatic conditions.

Buyers will experience firsthand the artisanal tea harvesting methods and the distinctive processing techniques used to craft premium, curated teas. They will also gain insights into the environmental, ethical and social practices of each tea producer.

‘This trade mission provides a valuable opportunity for United Kingdom tea buyers to directly engage with high-quality Sri Lankan tea producers. By fostering these direct connections, we aim to strengthen trade relationships and contribute to the sustainable growth of both the United Kingdom and Sri Lankan tea sectors,’ said Jarmila Sarda, UKTP programme manager.

A tea reception hosted by the British High Commission in Colombo will provide a platform for UK buyers and Sri Lankan stakeholders, including the Ceylon Artisanal Tea Association (CATA), to engage, exchange ideas and expand their networks.

-

News6 days ago

News6 days agoFSP warns of Indian designs to swamp Sri Lanka

-

News5 days ago

News5 days agoLatest tax hike yields Rs. 7 bn profit windfall for tobacco companies

-

Features5 days ago

Features5 days agoMyth of Free Education: A global perspective for Sri Lanka

-

Midweek Review6 days ago

Midweek Review6 days agoSC gave country timely reprieve from visa scam:

-

Business6 days ago

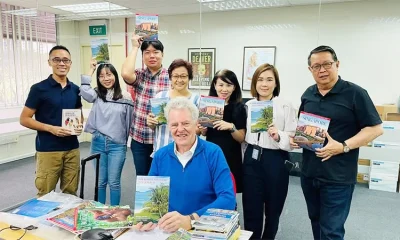

Business6 days agoRenowned British publisher calls on govt. to reconsider clamping 18% VAT on books

-

Features2 days ago

Features2 days agoIS THIS THE FINISH OF THE SRI LANKAN ELEPHANT?

-

Business6 days ago

Business6 days ago‘Amba Yaalu’ changes face of SL’s hospitality industry with all-women operated hotel

-

Opinion6 days ago

Opinion6 days agoSri Lanka’s new govt., Indo-Pacific debt trap, and struggle for the 21st Century – Part 2