Business

Aitken Spence Travels welcomes inaugural flight of Red Wings Airlines from Russia to Mattala

Aitken Spence Travels will be welcoming the inaugural charter flight from Red Wings Airlines, a Russian regional leisure airline, arriving at the Mattala Rajapaksa International Airport (MIRA) on the 29th of December 2022.

Red Wings Airlines will be carrying 400 holiday makers on board the Boeing 777 which is a long-range wide-body aircraft that would be landing for the first time at the southern airport for the year 2022. The airline will be operating two flights per week for four months from Moscow to Sri Lanka till end April 2023.

For passengers on the inaugural flight, Aitken Spence Travels will be offering excursions to showcase the splendour of Sri Lanka. Many of the excursions are focusing on the southern coastal belt areas of Hambantota – Kalutara as well as other non-coastal areas covering the country. The excursions are designed to enable and enhance opportunities for the tourism stakeholders of domestic suppliers and partners around the island.

Ms. Stasshani Jayawardena, Director Aitken Spence PLC and Head of Tourism and Leisure Sector of the diversified conglomerate commented about the flight saying ‘Making meaningful contributions to the development of our country through tourism is a priority for Aitken Spence and we are excited by the strategic interventions taken by Aitken Spence Travels that would undoubtedly put Sri Lanka on the map for many tourists for years to come. Our teams in the sector not only enhance economic opportunities by these targeted interventions but build the industry through specific engagements with local suppliers in the industry. We feel blessed to bid adieu to 2022 and commence 2023 on a positive note’.

Aitken Spence Travels has been at the forefront of marketing destination ‘Sri Lanka’ and Russia has always been one of the key source markets to Sri Lanka as well as for the company. Despite the current situation in Russia, the company continued to maintain its strong relationships with its agents and tour operators always reassuring the safety and comfort of visitors. Russian holiday makers have always been bold and enthusiastic when taking a holiday and the island paradise of Sri Lanka has had a way of making a place in their hearts. The company will take a lead in the visitor seats from ‘Sun and Fun’ tour operator for the inaugural flight and will be sharing the seats subsequently with Anex tours.

As the leading DMC in Sri Lanka, Aitken Spence Travels, has been powering the spirit of travel for 45 years. The number of tourists arriving will continue to grow due to the ongoing charter flight operations, and the ongoing cruise calls that will last until mid-2023. These confirmed numbers will be strengthened with the regular FIT and GIT passenger arrivals as well. This is promising for tourism in Sri Lanka, especially given that these arrival figures are confirmed for the next four months.

As an organisation leading the way in inbound tourism, Aitken Spence Travels will continue to make significant efforts to promote destination Sri Lanka, with the ultimate goal of energizing tourism for a brighter future in Sri Lanka.

Business

Industry and Entrepreneurship Development Minister Handunneththi’s visit to Lumala highlights key industrial concerns

With the aim of assesing the current challenges faced by local industrialists and explore avenues for government support, Minister of Industry and Entrepreneurship Development Hon. Sunil Handunneththi visited City Cycle Industries Manufacturing (Pvt.) Ltd., widely known as Lumala, on March 24 at its factory in Panadura.

During the visit, Minister Handunneththi engaged with senior officials and employees to understand their concerns and operational difficulties. In a statement shared on social media, the Minister acknowledged the pressing challenges affecting Sri Lanka’s manufacturing sector and emphasized the government’s commitment to providing swift and effective solutions.

Minister Handunneththi further reiterated the government’s intent to position local manufacturers as key stakeholders in Sri Lanka’s economy by addressing regulatory hurdles, market imbalances, and supply chain constraints.

The visit comes amid growing concerns from Lumala employees and management regarding the state of Sri Lanka’s bicycle manufacturing industry, in the backdrop of facing significant challenges, including an influx of imported bicycles and components that circumvent regulatory checks. In addition, the high taxes on raw materials used in local manufacturing has further exacerbated production costs, making it difficult for domestic manufacturers to remain competitive.

Earlier this year, Lumala employees called for urgent government intervention to address these challenges, warning that ongoing financial strain could lead to further shutdowns of critical production units, job losses, and setbacks to the broader industrial ecosystem. With a local value addition of 50-70 percent verified by the Ministry, its workforce remains hopeful that government action will help achieve an ethical manufacturing industry.

Lumala, a household name in Sri Lanka’s bicycle industry, has been a key player in sustainable mobility solutions for over 35 years. The company was recently honored with the Best National Industry Brand award under the Large-Scale Other Industry Sector category at the National Industry Brand Excellence Awards 2024.

With a production capacity of 2,000 bicycles per day and a workforce of 200, Lumala continues to cater to both domestic and international markets, producing a diverse range of bicycles, electric bikes and light electric vehicles. In line with Sri Lanka’s goal to expand forest cover to 32 percent by 2030 and cut GHG emissions by 14.5%, Lumala is actively contributing to this mission—both as a company and through its diverse range of products.

As Sri Lanka works towards strengthening its local manufacturing sector, Minister Handunneththi’s visit signals a crucial step toward addressing industrial concerns and reinforcing government support for sustainable and competitive domestic production.

Business

New SL Sovereign Bonds win foreign investor confidence

Sri Lanka’s country rating was upgraded from ‘Restricted Default’ to ‘CCC’ following the successful exchange for the new International Sovreign Bonds (SL ISBs) during December 2024. The three types (03) of exciting new sovereign bonds have restored foreign investor confidence.

The Central Bank of Sri Lanka (CBSL) has performed a remarkable role in guiding the economy out of default status and restored economic stability, and gained Sri Lanka a non-default Country Rating of ‘CCC’. Among the key achievements of CBSL, have been to reduce treasury interest rates under 9% and stabilize the currency while rebuilding foreign reserves to $ 6Bn.

SL offers four Macro Linked Bonds (MLBs) linked to GDP growth, a Governance Linked Bond (GLB) and a short term, Fixed Coupon Bond for unpaid Past Due Interest (PDI). The MLBs offer variable returns depending on SL’s GDP growth from 2024 to 2027, (e.g. haircuts can vary between 16% to 39%). The GLB interest can vary depending on meeting 15.3% and 15.4% of Total Revenue/ GDP thresholds in 2026 and 2027 respectively. The PDI bond offers a fixed coupon of 4% until 2028 and trades at around $94.

This combination of unique, variable returns offers global investors an exciting opportunity to capitalize on SL’s economic revival and US interest rate movements. Sri Lanka’s economic resurgence in 2024 was promising, with a 5% GDP growth rate. With improving investor confidence, SL ISB daily turnover now exceeds $10mn.

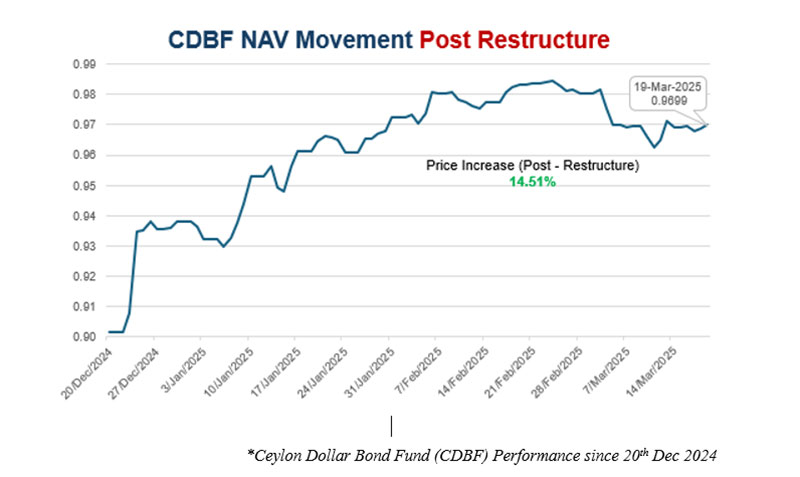

The Ceylon Dollar Bond Fund (CDBF) is the only USD Sovereign Bond Fund that is exclusively invested in SL ISBs with Deutsche Bank acting as the Trustee and Custodian Bank. The Fund reported returns of 53% in 2023 and 39% in 2024.

We invite foreign investors to enter CDBF while Sri Lanka is rated at ‘CCC’ and consider realizing their investment upon SL reaching a Country Rating of ‘B- ‘. Other advantages of CDBF are, the ability to withdraw anytime and being tax exempted.

Ceylon Asset Management (CAM), the Fund Manager, has commenced an advertising campaign to promote the CDBF to the Sri Lankan Diaspora, South Asian, Middle Eastern and Australian Investors. CAM is an Associate Company of Sri Lanka Insurance Corporation (SLIC) and licensed under the Securities and Exchange Commission of Sri Lanka Act, No. 19 of 2021.

Meanwhile, the Ceylon Financial Sector Fund managed by CAM emerged as the top performing rupee fund in Sri Lanka during 2024, with a return of 64%. Investors can find out more on www.ceylonassetmanagement.com or write to us on info@ceylonam.com.

Past performance is not an indicator of the future performance. Investors are advised to read and understand the contents of the KIID on www.ceylonam.com before investing. Among others investors shall consider the fees and charges involved.(CAM)

Business

Share market plunges steeply for second consecutive day in reaction to US tariffs

CSE plunged at open, falling for the second consecutive day yesterday, down over 300 points in mid- morning trade.US President Donald Trump has imposed a 44 percent tax on Sri Lanka’s exports in an executive order which he claimed, spelt out discounted reciprocal rates for about half the taxes and barriers imposed by the island on America.

As a result both indices showed a downward trend. The All Share Price Index dropped 300 points, or 2.32 percent, to 15,294.94, while the S&P SL20 dropped 101 points, or 2.71 percent, to 4,517.37.

Turnover stood at Rs 3.1 billion with six crossings. Those crossings were reported in Sampath Bank which crossed 1.6 million shares to the tune of Rs 181 million and its shares traded at 109, JKH 4.1 million shares crossed to the tune of 80.5 million and its shares sold at Rs 19.5.

Hemas Holdings 400,000 shares crossed for Rs 45.6 million; its shares traded at Rs 114, CTC 25000 shares crossed to the tune of Rs 32.2 million; its shares traded at Rs 1330, Commercial Bank 200,000 shares crossed for 27 million; its shares traded at Rs 135 and TJ Lanka 157,000 shares crossed for Rs 20 million; its shares traded at Rs 46.

In the retail market top six companies that have mainly contributed to the turnover were; Sampath Bank Rs 296 million (2.9 million shares traded), JKH Rs 220 million (11.2 million shares traded), Haylays Rs 195 million (142,000 shares traded), HNB Rs 151 million (519,000 shares traded), Commercial Bank Rs 138 million (1 million shares traded) and Central Finance Rs 129 million (735,000 shares traded). During the day 218 million shares volumes changed hands in 22000 transactions.

It is said the banking sector was the main contributor to the turnover, especially Sampath Bank, while manufacturing sector, especially JKH, was the second largest contributor.

Yesterday, the rupee opened at Rs 296.75/90 to the US dollar in the spot market, stronger from Rs 296.90/297.20 on the previous day, dealers said, while bond yields were up.

A bond maturing on 15.10.2028 was quoted at 10.35/40 percent, up from 10.25/30 percent.

A bond maturing on 15.09.2029 was quoted at 10.50/60 percent, up from 10.45/55 percent.

A bond maturing on 15.10.2030 was quoted at 10.60/70 percent, up from 10.30/65 percent.

By Hiran H Senewiratne

-

Business2 days ago

Business2 days agoStrengthening SDG integration into provincial planning and development process

-

News6 days ago

News6 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

Sports7 days ago

Sports7 days agoSri Lanka’s eternal search for the elusive all-rounder

-

Sports3 days ago

Sports3 days agoTo play or not to play is Richmond’s decision

-

Business13 hours ago

Business13 hours agoNew SL Sovereign Bonds win foreign investor confidence

-

News7 days ago

News7 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features7 days ago

Features7 days agoSanctions by The Unpunished

-

Features7 days ago

Features7 days agoMore parliamentary giants I was privileged to know