Business

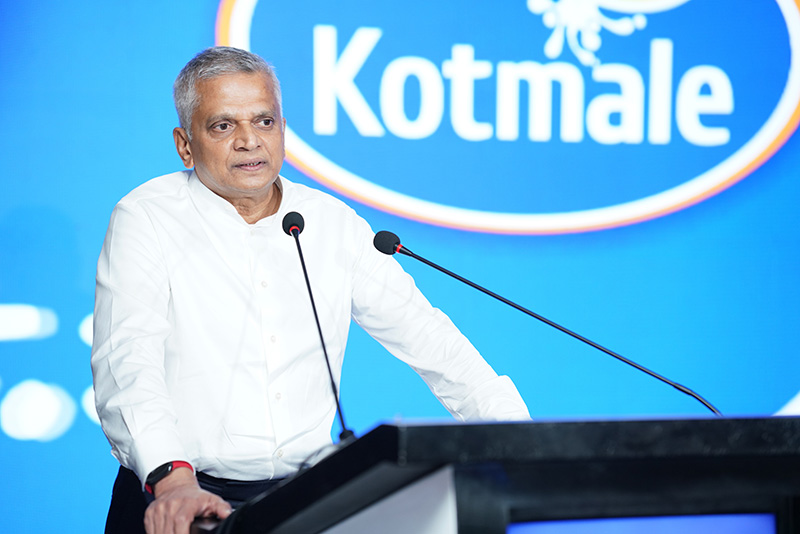

A vision for Sri Lanka: Ranjit Page’s emotional call to empower villages through Kotmale Dairy

The Kingsbury Hotel in Colombo was charged with emotion on the morning of May 29 as Cargills PLC Deputy Chairman Ranjit Page delivered a speech that transcended corporate rhetoric – weaving patriotism, sacrifice, and a bold vision for rural empowerment into a narrative that left the audience deeply moved.

Hundreds of dairy industry stakeholders and media personnel listened in rapt attention as Page honored Sri Lanka’s unsung heroes: the village youth who laid down their lives on the frontlines to bring peace to the nation. His words struck such a profound chord that murmurs spread through the crowd: “If there were an award for the most stirring corporate speech, it would unquestionably belong to Ranjit Page.”

Page began by reflecting on Cargills’ 181-year legacy, from its humble beginnings in 1844 to its evolution into a retail giant with over 500 outlets today. But the heart of his speech lay not in corporate milestones – instead, in a ‘moment of reckoning’ after the war ended in 2009.

“I was haunted by the sacrifices of young soldiers and police officers from villages across Sri Lanka,” he said, his voice thick with emotion. “Since I couldn’t offer my life, I asked myself: How can I serve their families, villages, and communities in return?”

“The answer became Kotmale Dairies, launched in 2010 with a mission far beyond profit: to economically empower villages by creating sustainable markets for fresh milk and produce.”

“Cash flows into villages mostly through migrant labor remittances – this must change,” Page asserted.

“By establishing dairy processing plants, fresh-produce collection centers, and fair procurement systems, Cargills ensured farmers earned better incomes while keeping consumer prices affordable”, he pointed out.

His vision was starkly pragmatic. The WHO recommends 200ml of milk daily per person, yet countless Sri Lankan children – like one schoolboy he met who survived on sugar water – remain malnourished. “Kotmale’s mission is to bridge this gap,” he declared, emphasising that rural prosperity is the bedrock of national progress.

“The war was won by the youth of our villages. Today, those same villages send migrant workers who power our economy. We owe it to them to create opportunities at home because Sri Lanka has given Cargills the opportunity to grow.” When he said so, the audience sat in silent reverence, stirred by his empathy.

With Cargills nearing its bicentennial in 2044, Page issued a rallying cry: “What kind of Sri Lanka will we see then?” His hope rests on Kotmale’s expansion – reducing milk imports, conserving foreign exchange, and nourishing future generations.

“The young team at Cargills has embraced the challenge of steering Kotmale Dairy forward. They recognise their mission: to boost production, ensure affordable milk products, and help achieve the national per-capita milk consumption target,” he said proudly.

As Page concluded, thunderous applause affirmed his message: True corporate leadership means serving the nation. His blend of raw gratitude, strategic foresight, and unwavering commitment to rural Sri Lanka left no doubt that Cargills’ legacy lies not just in supermarkets but in the lives it uplifts.

One attendee was heard whispering, “That wasn’t just a speech. It was a call to arms for all of Sri Lanka.”

By Sanath Nanayakkare ✍️

Business

Sri Lanka’s 2026 economic growth predicted to be around 4-5 percent

Sri Lanka’s economic growth for 2026 will be around 4-5 percent, Central Bank Governor Dr. Nandalal Weerasinghe said.

The Governor indicated the estimated economic growth while announcing the Central Bank’s policy agenda for this year, last Thursday.

‘The Central Bank’s 2026 growth estimation is higher than the growth prediction of the IMF and the World Bank and is achievable, the Governor told the media while announcing the Central Bank’s policy agenda for 2026.

Dr. Weerasinghe added: ‘The Central Bank will introduce a benchmark intra-day reference exchange rate this year to ensure transparency in the foreign exchange market.

‘The absence of a reference exchange rate has held back the expansion of the Sri Lankan forex market and discouraged the trading of rupee-denominated derivatives Governor said.

‘The Central Bank last year carried out the necessary preliminary work to implement the benchmark spot exchange rate.

‘The benchmark intra-day reference exchange rate will be introduced in 2026 to foster a transparent foreign exchange market.

‘This benchmark will guide market participants, help reduce volatility and promote more competitive pricing on a given date, thereby enabling the introduction of more innovative products in the foreign exchange market.

‘Sri Lanka’s foreign exchange market has limited derivatives like currency swaps and options aiming to deepen markets and attract inflows.

‘However, these instruments failed after a lack of reliable reference exchange rate amid concerns over excessive speculation, rupee over-appreciation risks and interventions distorting clean floating rates.’

Meanwhile, currency dealers welcomed the move and said it will help to deepen the market.

“This will expand the market with more products and promote rupee-denominated derivatives, a currency dealer from a local bank said.

“It is something the market wanted to fix in derivative prices. This is a pricing mechanism for the rupee, he added.

By Hiran H Senewiratne ✍️

Business

Sevalanka Foundation and The Coca-Cola Foundation support flood-affected communities in Biyagama, Sri Lanka

With funding support from The Coca-Cola Foundation (TCCF), the Sevalanka Foundation has launched a humanitarian relief programme to support flood-affected communities in Biyagama. The initiative focuses on restoring access to safe water, healthcare services, and essential public facilities during the critical recovery period following the Cyclone Ditwah.

Working closely with the Divisional Secretariat, the program prioritizes the cleaning and rehabilitation of contaminated dug and tube wells, helping address the urgent post-flood challenge of access to safe water. This intervention will also support the cleaning and reopening of essential public spaces, including schools, and Grama Niladhari (GN) offices, enabling authorities and communities to resume daily activities safely. The Sevalanka Foundation and TCCF, as part of the initial response, have also donated water pumps to the Divisional Secretariat to support immediate water extraction and clean-up efforts.

In addition, as the second main component of the project, and based on the guidance of the Medical Officer of Health (MOH), support is being provided to MOH-operated healthcare facilities to restore access to emergency and essential medical services. This support includes sanitization, debris removal, hazard stabilization, and the provision of emergency medical supplies such essential medicines and hygiene products. Medical camps staffed by doctors and senior nurses will be conducted through MOH offices to provide prioritized groups of persons with health, nutrition and hygiene related relief items.

Business

Bourse radiates optimism as UK grants tariff-free concession to local apparel exports

CSE activities were extremely bullish yesterday mainly due to the UK government’s announcement on tariff free access for local apparel sector exports into the UK coupled with Central Bank Governor Dr Nandalal Weerasinghe’s positive outlook on the economy this year.

Amid those developments the turnover level also improved and the All Share Price Index moved up to the 23500 mark during the trading day.

The All Share Price Index went up by 127.17 points, while the S and P SL20 rose by 56.75 points. Turnover stood at Rs 8.5 billion with 18 crossings.

Top seven crossings were: LOLC Holdings two million shares crossed to the tune of Rs 1.18 billion; its shares traded at Rs 575, Renuka Agri 45 million shares crossed to the tune of Rs 594 million; its share price was Rs 13.20, Sampath Bank 1.4 million shares crossed for Rs 215 million and its shares traded at Rs 154.35, Renuka Holdings 1.5 million shares crossed for Rs 75 million; its shares traded at Rs 50, Hayleys 200,000 shares crossed to the tune of Rs 41.3 million; its shares traded at Rs 207, Tokyo Cement (Non-Voting) 400,000 shares crossed for Rs 37.8 million; its shares sold at Rs 50 and NTB 100,000 shares crossed for Rs 326 million; its shares sold at Rs 326.

In the retail market top seven companies that contributed to the turnover were; LOLC Rs 340 million (591,000 shares traded), Sampath Bank Rs 310 million (two million shares traded), Renuka Agri Foods Rs 275 million (19.4 million shares traded), ACL Cables Rs 238 million (2.3 million shares traded), Overseas Realty Rs 215 million (4.9 million shares traded), CIC Holdings (Non Voting) Rs 180 million (6.3 million shares traded) and Wealth Trust Equity Rs 132 million (8.2 million shares traded). During the day 269.3 million share volumes changed hands in 47852 transactions.

It is said the banking and financial sectors performed well, especially Sampath Bank, while a top diversified company, LOLC Holdings, also performed well.

Yesterday, the rupee opened at Rs 309.15/30 to the US dollar in the spot market relatively flat from Rs 309.10/50 the previous day, having depreciated in recent weeks, dealers said, while bond yields opened higher.

The telegraphic transfer rates for the dollar were 305.8500 buying, 312.8500 selling; the British pound was 409.7568 buying, and 421.1186 selling, and the euro was 354.0809 buying, 365.4441 selling.

By Hiran H Senewiratne ✍️

-

News5 days ago

News5 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

News5 days ago

News5 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

Opinion2 days ago

Opinion2 days agoThe minstrel monk and Rafiki, the old mandrill in The Lion King – II

-

Features2 days ago

Features2 days agoThe Venezuela Model:The new ugly and dangerous world order

-

News4 days ago

News4 days agoPrez seeks Harsha’s help to address CC’s concerns over appointment of AG

-

Latest News1 day ago

Latest News1 day agoRain washes out 2nd T20I in Dambulla

-

Business19 hours ago

Business19 hours agoSevalanka Foundation and The Coca-Cola Foundation support flood-affected communities in Biyagama, Sri Lanka

-

News6 days ago

News6 days agoPrivate airline crew member nabbed with contraband gold