Opinion

Trump tariffs and their effect on world trade and economy with particular reference to Sri Lanka – Part IV

(Continued from yesterday)

Critique of the International Trade System

President Trump’s tariffs have also highlighted fundamental inequities in the international trade and financial architecture that governs economic relations between wealthy and developing nations.

The World Trade Organization, theoretically designed to provide a rules-based trading system that benefits all members, has proven largely powerless to prevent unilateral actions by powerful economies like the United States. While China has urged the WTO to investigate President Trump’s tariffs as violations of the “most favoured nation” principle that forms the bedrock of the multilateral trading system, the organization lacks effective enforcement mechanisms against major powers.

Similarly, international financial institutions like the IMF have failed to adequately account for trade shocks in their lending programmes and debt sustainability analyses. As discussed earlier, the IMF’s approach to Sri Lanka’s debt restructuring focused primarily on fiscal consolidation while paying insufficient attention to the country’s

Page 17 of 29

structural trade deficit and vulnerability to external shocks. When Trump’s tariffs suddenly reduce Sri Lanka’s export earnings, the IMF program offers no automatic adjustment mechanisms to accommodate this changed reality.

This situation stands in stark contrast to historical examples of more equitable treatment of indebted nations. The London Debt Agreement of 1953, which restructured West Germany’s external debts, explicitly linked repayment obligations to the country’s trade performance and capped debt service at a sustainable percentage of export earnings. Such an approach recognised the fundamental importance of trade capacity to debt sustainability, a recognition largely absent from contemporary debt restructuring frameworks.

The tariff shock thus reveals not merely technical flaws in trade policy but deeper structural inequities in how the global economic system distributes risks, rewards, and adjustment costs between wealthy and developing nations. While powerful economies can unilaterally reshape trading relationships to serve their domestic political objectives, developing countries must largely accept these changes as given constraints and bear disproportionate costs of adjustment.

Potential Reshaping of Global Trade Patterns

Looking beyond the immediate disruption, President Trump’s tariffs may accelerate several longer-term shifts in global trade patterns with significant implications for developing economies.

First, we may see accelerated regionalisation of trade as countries seek to reduce vulnerability to U.S. policy shifts. Asian economies may deepen integration through mechanisms like the Regional Comprehensive Economic Partnership (RCEP), while African countries might accelerate the implementation of the African Continental Free Trade Area (AfCFTA). These regional arrangements could provide alternative markets for exports previously destined for the United States, though the transition would be neither quick nor painless.

Second, China’s role as both a market and investor for developing economies may expand further. As U.S. tariffs effectively close off portions of its market, developing countries may look more intensively toward China as an export destination and source of development finance. This shift would have significant geopolitical implications, potentially accelerating the fragmentation of the global economy into competing blocs centred around major powers.

Page 18 of 29

Third, some production may relocate to avoid tariffs, creating winners and losers among developing countries. Nations with lower tariff rates or special exemptions could see increased investment as firms restructure supply chains to minimise trade costs. This dynamic could intensify competition among developing countries for foreign investment, potentially triggering a “race to the bottom” on labour and environmental standards.

Fourth, there may be renewed interest in domestic market development and South-South trade as alternatives to excessive dependence on wealthy consumer markets. While the limited purchasing power in many developing countries constrains this option in the short term, over time it could lead to more balanced and resilient development models.

These potential shifts suggest that President Trump’s tariffs may represent not merely a temporary disruption but a catalyst for more fundamental reconfiguration of global trade patterns. For developing economies like Sri Lanka, navigating this changing landscape will require strategic foresight, policy innovation, and international cooperation to ensure that the emerging trade architecture better serves their development needs than the system currently being disrupted.

POTENTIAL MITIGATION STRATEGIES FOR SRI LANKA

Faced with the severe economic challenge posed by Trump’s 44% tariff, Sri Lanka must develop a comprehensive response strategy that addresses both immediate threats and longer-term structural vulnerabilities. This section explores potential approaches at different time horizons, from emergency measures to fundamental economic reorientation.

Short-term Responses

In the immediate term, Sri Lanka’s government and private sector must focus on crisis management to minimise damage to export industries and protect vulnerable workers. Several approaches warrant consideration.

Government Support for Affected Industries

The Sri Lankan government could implement targeted support measures for export sectors most affected by the tariffs, particularly the textile and apparel industry. These might include temporary tax relief, subsidised credit facilities, or reduced

Page 19 of 29

utility rates for export-oriented manufacturers. Such measures could help companies weather the initial shock while they develop adaptation strategies.

However, Sri Lanka’s fiscal constraints present a significant challenge to implementing such support. The country’s IMF programme imposes strict limits on government spending and deficit targets, while tax increases have been a central component of the economic stabilisation strategy. Any support measures would therefore need to be carefully designed to remain within these constraints or negotiated as exceptions with the IMF based on the external nature of the shock.

One potential approach would be to reallocate existing resources rather than expanding overall spending. For instance, funds previously earmarked for export promotion in the U.S. market, if any, could be redirected toward supporting market diversification efforts or providing temporary relief to affected companies.

Diplomatic Engagement with the United States

Sri Lanka should pursue active diplomatic engagement with the United States to seek modifications to the tariff regime. While the country’s limited economic leverage makes a complete exemption unlikely, there may be opportunities to negotiate targeted relief for specific product categories or to secure technical assistance for adjustment.

The Sri Lankan government could emphasise several arguments in these discussions, the disproportionate impact of the tariffs on a country still recovering from economic crisis, the potential humanitarian consequences of mass unemployment in the textile sector, and the strategic importance of economic stability in Sri Lanka for regional security in the Indian Ocean.

One of the most compelling arguments Sri Lanka can make is the need to move beyond narrow fixation on the trade balance and instead consider a broader current account. While Sri Lanka may show a surplus in goods trade with the U.S., that figure is only a part of the story. Our economy is deeply integrated with U.S. linked services. We pay for American banking and credit card services, subscribe to streaming platforms like Netflix and Amazon, purchase of software and apps from Apple and Google, remit interest payment on loans from international banks, bond holders and multilateral institutions, and spend on tourism and education. When all of these outflows are taken into account, the so called “imbalance” is far more nuanced if not fully offset. This is why a fair and modern economic analysist must consider the full current account, not just goods trade in isolation.

Page 20 of 29

Engagement should occur through multiple channels, including direct bilateral discussions, multilateral forums like the WTO, and coordination with other affected developing countries to amplify collective concerns. Sri Lanka might also leverage its relationships with international financial institutions like the World Bank and IMF, which could highlight the risks the tariffs pose to the country’s economic recovery program.

Emergency Economic Measures

If the full impact of the tariffs materializes, Sri Lanka may need to implement emergency economic measures to maintain macroeconomic stability. These could include temporary foreign exchange controls to prioritize essential imports, accelerated disbursement of already-committed international financial support, or emergency borrowing from friendly countries or international institutions.

The Central Bank of Sri Lanka might need to adjust monetary policy to respond to potential currency pressures resulting from reduced export earnings. However, any such adjustments would need to be balanced against inflation concerns, which remain sensitive following the recent crisis.

Social Protection for Affected Workers

Protecting workers who lose jobs or face reduced hours due to the tariff impact should be a priority. The government could expand existing social safety net programs to specifically target affected textile workers, potentially with support from international donors or development agencies.

Measures might include temporary unemployment benefits, retraining programmess for displaced workers, or community-based support initiatives in areas with high concentrations of textile employment. Given fiscal constraints, international support would likely be necessary to fund such programmes adequately.

Medium to Long-term Strategies

Beyond immediate crisis response, Sri Lanka must develop strategies to reduce vulnerability to future trade shocks and create a more resilient economic model. Several approaches deserve consideration.

Page 21 of 29

Market Diversification Beyond the United States

Reducing dependence on the U.S. market represents an obvious but challenging strategy. Potential alternative markets include,

* European Union: Already Sri Lanka’s second-largest export destination, the EU offers preferential access through its GSP+ scheme. Expanding exports to Europe would require meeting stringent standards and potentially adjusting product offerings to suit European consumer preferences.

* Regional Markets: Increasing exports to India, China, and other Asian economies could leverage geographical proximity and growing middle-class consumer bases. This would require navigating complex regional trade agreements and potentially developing new product categories better suited to these markets.

* Emerging Markets: Countries in the Middle East, Africa, and Latin America represent potential growth opportunities, though penetrating these markets would require significant market research and relationship building.

The Joint Apparel Association Forum’s statement that “We have no alternate market that we can possibly target instead of the US” reflects the difficulty of this transition. Established buyer relationships, specialized production capabilities, and compliance certifications all create path dependencies that make market diversification a multi-year project rather than an immediate solution.

Product Diversification Beyond Textiles

Sri Lanka’s heavy reliance on textile and apparel exports creates vulnerability to sector-specific shocks. Diversifying the export basket could create greater resilience, though this too represents a long-term structural challenge rather than a quick fix.

Promising sectors for export diversification include:

* Information Technology and Business Process Outsourcing: Sri Lanka has developed a growing IT/BPO sector that could be expanded with appropriate investment in education, infrastructure, and international marketing.

* High-Value Agricultural Products: Speciality tea, spices, and organic produce could command premium prices in international markets while building on Sri Lanka’s agricultural traditions.

Page 22 of 29

Sustainable Manufacturing: Leveraging Sri Lanka’s relatively strong environmental credentials to develop green manufacturing capabilities in emerging sectors like electric vehicle components or renewable energy equipment.

Tourism Services: While not directly affected by goods tariffs, expanding tourism could help diversify foreign exchange earnings. However, this sector’s vulnerability to external shocks (as demonstrated during the pandemic) suggests it should be one component of a diversification strategy rather than its centrepiece.

Successful product diversification would require coordinated public-private investment in research and development, skills training, quality infrastructure, and international marketing. It would also necessitate a supportive policy environment that reduces barriers to innovation and entrepreneurship.

Value Chain Upgrading

Even within existing export sectors like textiles, Sri Lanka could pursue strategies to capture more value and reduce vulnerability to tariffs. Moving up the value chain from basic contract manufacturing to design, product development, branding, and direct-to-consumer sales could increase margins and provide greater control over market access.

Some Sri Lankan companies have already begun this transition, developing their own brands or establishing direct relationships with consumers through e-commerce platforms. Government support for such initiatives through design education, intellectual property protection, and export promotion could accelerate this evolution.

Regional Trade Integration

Deepening integration with regional trade blocs could provide both alternative markets and opportunities for participation in regional value chains. Sri Lanka is a member of the South Asian Free Trade Area (SAFTA) and has bilateral trade agreements with India, Pakistan, and Singapore, and more recently with Thailand, though implementation challenges have limited their effectiveness.

More ambitious regional integration through mechanisms like the Regional Comprehensive Economic Partnership (RCEP) or the proposed Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) Free

Page 23 of 29

Trade Area could create new opportunities. However, managing domestic concerns about increased competition from larger economies like India and China would require careful policy design and implementation. (To be continued)

(The writer served as the Minister of Justice, Finance and Foreign Affairs of Sri Lanka)

Disclaimer:

This article contains projections and scenario-based analysis based on current economic trends, policy statements, and historical behaviour patterns. While every effort has been made to ensure factual accuracy using publicly available data and established economic models, certain details, particularly regarding future policy decisions and their impacts, remain hypothetical. These projections are intended to inform discussion and analysis, not to predict outcomes with certainty.

(To be concluded)

Opinion

Lakshman Balasuriya – Not just my boss but a father and a brother

It is with profound sadness that we received the shocking news of untimely passing of our dear leader Lakshman Balasuriya.

I first met Lakshman Balasuriya in 1988 while working at John Keells, which had been awarded an IT contract to computerise Senkadagala Finance. Thereafter, in 1992, I joined the E. W. Balasuriya Group of Companies and Senkadagala Finance when the organisation decided to bring its computerisation in-house.

Lakshman Balasuriya obtained his BSc from the University of London and his MSc from the University of Lancaster. He was not only intellectually brilliant, but also a highly practical and pragmatic individual, often sitting beside me to share instructions and ideas, which I would then translate directly into the software through code.

My first major assignment was to computerise the printing press. At the time, the systems in place were outdated, and modernisation was a challenging task. However, with the guidance, strong support, and decisive leadership of our boss, we were able to successfully transform the printing press into a modern, state-of-the-art operation.

He was a farsighted visionary who understood the value and impact of information technology well ahead of his time. He possessed a deep knowledge of the subject, which was rare during those early years. For instance, in the 1990s, Balasuriya engaged a Canadian consultant to conduct a cybersecurity audit—an extraordinary initiative at a time when cybersecurity was scarcely spoken of and far from mainstream.

During that period, Senkadagala Finance’s head office was based in Kandy, with no branch network. When the decision was made to open the first branch in Colombo, our IT team faced the challenge of adapting the software to support branch operations. It was him who proposed the innovative idea of creating logical branches—a concept well ahead of its time in IT thinking. This simple yet powerful idea enabled the company to expand rapidly, allowing branches to be added seamlessly to the system. Today, after many upgrades and continuous modernisation, Senkadagala Finance operates over 400 locations across the country with real-time online connectivity—a testament to his original vision.

In September 2013, we faced a critical challenge with a key system that required the development of an entirely new solution. A proof of concept was prepared and reviewed by Lakshman Balasuriya, who gave the green light to proceed. During the development phase, he remained deeply involved, offering ideas, insights, and constructive feedback. Within just four months, the system was successfully developed and went live—another example of his hands-on leadership and unwavering support for innovation.

These are only a few examples among many of the IT initiatives that were encouraged, supported, and championed by him. Information technology has played a pivotal role in the growth and success of the E. W. Balasuriya Group of Companies, including Senkadagala Finance PLC, and much of that credit goes to his foresight, trust, and leadership.

On a deeply personal note, I was not only a witness to, but also a recipient of, the kindness, humility, and humanity of Lakshman Balasuriya. There were occasions when I lost my temper and made unreasonable demands, yet he always responded with firmness tempered by gentleness. He never lost his own composure, nor did he ever harbour grudges. He had the rare ability to recognise people’s shortcomings and genuinely tried to guide them toward self-improvement.

He was not merely our boss. To many of us, he was like a father and a brother.

I will miss him immensely. His passing has left a void that can never be filled. Of all the people I have known in my life, Mr. Lakshman Balasuriya stands apart as one of the finest human beings.

He leaves behind his beloved wife, Janine, his children Amanthi and Keshav, and the four grandchildren.

May he rest in eternal peace!

Timothy De Silva

(Information Systems Officer at Senkadagala Finance.)

Opinion

The science of love

A remarkable increase in marriage proposals in newspapers and the thriving matchmaking outfits in major cities indicate the difficulty in finding the perfect partners. Academics have done much research in interpersonal attraction or love. There was an era when young people were heavily influenced by romantic fiction. They learned how opposites attract and absence makes the heart grow fonder. There was, of course, an old adage: Out of sight out of mind.

Some people find it difficult to fall in love or they simply do not believe in love. They usually go for arranged marriages. Some of them think that love begins after marriage. There is an on-going debate whether love marriages are better than arranged marriages or vice versa. However, modern psychologists have shed some light on the science of love. By understanding it you might be able to find the ideal life partner.

To start with, do not believe that opposites attract. It is purely a myth. If you wish to fall in love, look for someone like you. You may not find them 100 per cent similar to you, but chances are that you will meet someone who is somewhat similar to you. We usually prefer partners who have similar backgrounds, interests, values and beliefs because they validate our own.

Common trait

It is a common trait that we gravitate towards those who are like us physically. The resemblance of spouses has been studied by scientists more than 100 years ago. According to them, physical resemblance is a key factor in falling in love. For instance, if you are a tall person, you are unlikely to fall in love with a short person. Similarly, overweight young people are attracted to similar types. As in everything in life, there may be exceptions. You may have seen some tall men in love with short women.

If you are interested in someone, declare your love in words or gestures. Some people have strong feelings about others but they never make them known. If you fancy someone, make it known. If you remain silent you will miss a great opportunity forever. In fact if someone loves you, you will feel good about yourself. Such feelings will strengthen love. If someone flatters you, be nice to them. It may be the beginning of a great love affair.

Some people like Romeo and Juliet fall in love at first sight. It has been scientifically confirmed that the longer a pair of prospective partners lock eyes upon their first meeting they are very likely to remain lovers. They say eyes have it. If you cannot stay without seeing your partner, you are in love! Whenever you meet your lover, look at their eyes with dilated pupils. Enlarged pupils signal intense arousal.

Body language

If you wish to fall in love, learn something about body language. There are many books written on the subject. The knowledge of body language will help you to understand non-verbal communication easily. It is quite obvious that lovers do not express their love in so many words. Women usually will not say ‘I love you’ except in films. They express their love tacitly with a shy smile or preening their hair in the presence of their lovers.

Allan Pease, author of The Definitive Guide to Body Language says, “What really turn men on are female submission gestures which include exposing vulnerable areas such as the wrists or neck.” Leg twine was something Princess Diana was good at. It involves crossing the legs hooking the upper leg’s foot behind the lower leg’s ankle. She was an expert in the art of love. Men have their own ways. In order to look more dominant than their partners they engage in crotch display with their thumbs hooked in pockets. Michael Jackson always did it.

If you are looking for a partner, be a good-looking guy. Dress well and behave sensibly. If your dress is unclean or crumpled, nobody will take any notice of you. According to sociologists, men usually prefer women with long hair and proper hip measurements. Similarly, women prefer taller and older men because they look nice and can be trusted to raise a family.

Proximity rule

You do not have to travel long distances to find your ideal partner. He or she may be living in your neighbourhood or working at the same office. The proximity rule ensures repeated exposure. Lovers should meet regularly in order to enrich their love. On most occasions we marry a girl or boy living next door. Never compare your partner with your favourite film star. Beauty lies in the eyes of the beholder. Therefore be content with your partner’s physical appearance. Each individual is unique. Never look for another Cleopatra or Romeo. Sometimes you may find that your neighbour’s wife is more beautiful than yours. On such occasions turn to the Bible which says, “Thou shalt not covet thy neighbour’s wife.”

There are many plain Janes and penniless men in society. How are they going to find their partners? If they are warm people, sociable, wise and popular, they too can find partners easily. Partners in a marriage need not be highly educated, but they must be intelligent enough to face life’s problems. Osho compared love to a river always flowing. The very movement is the life of the river. Once it stops it becomes stagnant. Then it is no longer a river. The very word river shows a process, the very sound of it gives you the feeling of movement.

Although we view love as a science today, it has been treated as an art in the past. In fact Erich Fromm wrote The Art of Loving. Science or art, love is a terrific feeling.

karunaratners@gmail.com

By R.S. Karunaratne

Opinion

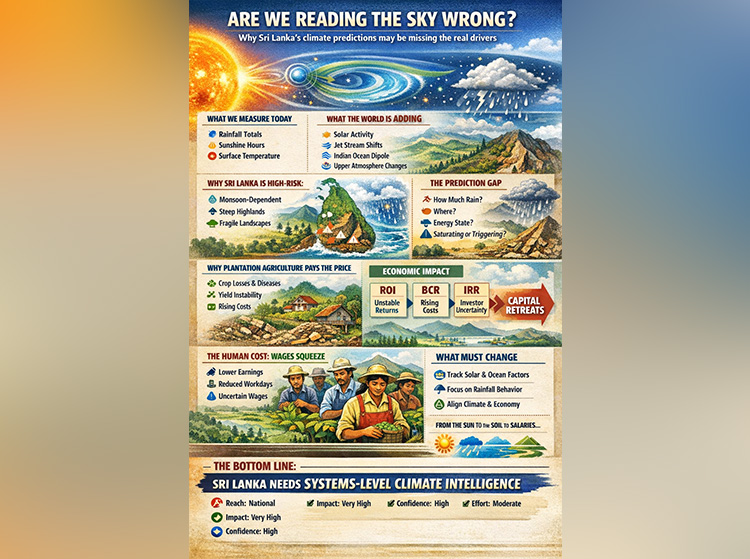

Are we reading the sky wrong?

Rethinking climate prediction, disasters, and plantation economics in Sri Lanka

For decades, Sri Lanka has interpreted climate through a narrow lens. Rainfall totals, sunshine hours, and surface temperatures dominate forecasts, policy briefings, and disaster warnings. These indicators once served an agrarian island reasonably well. But in an era of intensifying extremes—flash floods, sudden landslides, prolonged dry spells within “normal” monsoons—the question can no longer be avoided: are we measuring the climate correctly, or merely measuring what is easiest to observe?

Across the world, climate science has quietly moved beyond a purely local view of weather. Researchers increasingly recognise that Earth’s climate system is not sealed off from the rest of the universe. Solar activity, upper-atmospheric dynamics, ocean–atmosphere coupling, and geomagnetic disturbances all influence how energy moves through the climate system. These forces do not create rain or drought by themselves, but they shape how weather behaves—its timing, intensity, and spatial concentration.

Sri Lanka’s forecasting framework, however, remains largely grounded in twentieth-century assumptions. It asks how much rain will fall, where it will fall, and over how many days. What it rarely asks is whether the rainfall will arrive as steady saturation or violent cloudbursts; whether soils are already at failure thresholds; or whether larger atmospheric energy patterns are priming the region for extremes. As a result, disasters are repeatedly described as “unexpected,” even when the conditions that produced them were slowly assembling.

This blind spot matters because Sri Lanka is unusually sensitive to climate volatility. The island sits at a crossroads of monsoon systems, bordered by the Indian Ocean and shaped by steep central highlands resting on deeply weathered soils. Its landscapes—especially in plantation regions—have been altered over centuries, reducing natural buffers against hydrological shock. In such a setting, small shifts in atmospheric behaviour can trigger outsized consequences. A few hours of intense rain can undo what months of average rainfall statistics suggest is “normal.”

Nowhere are these consequences more visible than in commercial perennial plantation agriculture. Tea, rubber, coconut, and spice crops are not annual ventures; they are long-term biological investments. A tea bush destroyed by a landslide cannot be replaced in a season. A rubber stand weakened by prolonged waterlogging or drought stress may take years to recover, if it recovers at all. Climate shocks therefore ripple through plantation economics long after floodwaters recede or drought declarations end.

From an investment perspective, this volatility directly undermines key financial metrics. Return on Investment (ROI) becomes unstable as yields fluctuate and recovery costs rise. Benefit–Cost Ratios (BCR) deteriorate when expenditures on drainage, replanting, disease control, and labour increase faster than output. Most critically, Internal Rates of Return (IRR) decline as cash flows become irregular and back-loaded, discouraging long-term capital and raising the cost of financing. Plantation agriculture begins to look less like a stable productive sector and more like a high-risk gamble.

The economic consequences do not stop at balance sheets. Plantation systems are labour-intensive by nature, and when financial margins tighten, wage pressure is the first stress point. Living wage commitments become framed as “unaffordable,” workdays are lost during climate disruptions, and productivity-linked wage models collapse under erratic output. In effect, climate misprediction translates into wage instability, quietly eroding livelihoods without ever appearing in meteorological reports.

This is not an argument for abandoning traditional climate indicators. Rainfall and sunshine still matter. But they are no longer sufficient on their own. Climate today is a system, not a statistic. It is shaped by interactions between the Sun, the atmosphere, the oceans, the land, and the ways humans have modified all three. Ignoring these interactions does not make them disappear; it simply shifts their costs onto farmers, workers, investors, and the public purse.

Sri Lanka’s repeated cycle of surprise disasters, post-event compensation, and stalled reform suggests a deeper problem than bad luck. It points to an outdated model of climate intelligence. Until forecasting frameworks expand beyond local rainfall totals to incorporate broader atmospheric and oceanic drivers—and until those insights are translated into agricultural and economic planning—plantation regions will remain exposed, and wage debates will remain disconnected from their true root causes.

The future of Sri Lanka’s plantations, and the dignity of the workforce that sustains them, depends on a simple shift in perspective: from measuring weather, to understanding systems. Climate is no longer just what falls from the sky. It is what moves through the universe, settles into soils, shapes returns on investment, and ultimately determines whether growth is shared or fragile.

The Way Forward

Sustaining plantation agriculture under today’s climate volatility demands an urgent policy reset. The government must mandate real-world investment appraisals—NPV, IRR, and BCR—through crop research institutes, replacing outdated historical assumptions with current climate, cost, and risk realities. Satellite-based, farm-specific real-time weather stations should be rapidly deployed across plantation regions and integrated with a central server at the Department of Meteorology, enabling precision forecasting, early warnings, and estate-level decision support. Globally proven-to-fail monocropping systems must be phased out through a time-bound transition, replacing them with diversified, mixed-root systems that combine deep-rooted and shallow-rooted species, improving soil structure, water buffering, slope stability, and resilience against prolonged droughts and extreme rainfall.

In parallel, a national plantation insurance framework, linked to green and climate-finance institutions and regulated by the Insurance Regulatory Commission, is essential to protect small and medium perennial growers from systemic climate risk. A Virtual Plantation Bank must be operationalized without delay to finance climate-resilient plantation designs, agroforestry transitions, and productivity gains aligned with national yield targets. The state should set minimum yield and profit benchmarks per hectare, formally recognize 10–50 acre growers as Proprietary Planters, and enable scale through long-term (up to 99-year) leases where state lands are sub-leased to proven operators. Finally, achieving a 4% GDP contribution from plantations requires making modern HRM practices mandatory across the sector, replacing outdated labour systems with people-centric, productivity-linked models that attract, retain, and fairly reward a skilled workforce—because sustainable competitive advantage begins with the right people.

by Dammike Kobbekaduwe

(www.vivonta.lk & www.planters.lk ✍️

-

News6 days ago

News6 days agoBritish MP calls on Foreign Secretary to expand sanction package against ‘Sri Lankan war criminals’

-

News5 days ago

News5 days agoStreet vendors banned from Kandy City

-

Sports6 days ago

Sports6 days agoChief selector’s remarks disappointing says Mickey Arthur

-

Opinion6 days ago

Opinion6 days agoDisasters do not destroy nations; the refusal to change does

-

News7 days ago

News7 days agoSri Lanka’s coastline faces unfolding catastrophe: Expert

-

News5 days ago

News5 days agoLankan aircrew fly daring UN Medevac in hostile conditions in Africa

-

Midweek Review7 days ago

Midweek Review7 days agoYear ends with the NPP govt. on the back foot

-

Sports2 days ago

Sports2 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne