Business

The ‘Dirty Dozen’ behind India’s bad loan crisis

By Ifham Nizam

The Reserve Bank of India (RBI) in 2017 shocked the nation by disclosing a list of the country’s 12 largest defaulters, who were responsible for nearly a quarter of all bad loans in the Indian banking system.

This alarming discovery of the “Dirty Dozen” exposed the murky landscape of corporate irresponsibility and regulatory neglect, revealing the harsh reality of gross economic disparity, complacent governance and coordinated deceit.

For the first time, these defaulters risked losing control of the companies they had built. The Insolvency and Bankruptcy Code (IBC), the most significant reform in the financial sector under the Narendra Modi government, ensured the protection of these assets’ economic value, even as promoters were removed and replaced by stronger players with the vision and means to turn around these companies.

In ‘The Dirty Dozen’, business journalist N. Sundaresha Subramanian investigates the causes and impacts of India’s chronic bad loan crisis. By documenting in his book the economic misadventures of Vijay Mallya, Nirav Modi, and Manoj Gaur among others, Subramanian uncovers the intricate web of financial chaos, political plundering and malpractice plaguing the country’s corporate landscape.

Through his work, Subramanian offers a revealing diagnosis of India’s financial health since liberalization. In a country where millions struggle for basic sustenance, ‘The Dirty Dozen’ provides a brave, hard-hitting and much-needed exposé of crooked business moguls who orchestrated deeply damaging financial manoeuvres. Despite accumulating vast wealth, these individuals enjoy impunity, leaving India’s economy on the brink.

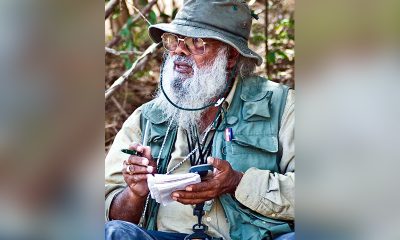

Currently the Executive Editor at Economic Times’ ET Prime, Subramanian began his journalism career with the launch of the Mumbai edition of Hindustan Times in the early 2000s. He has since worked at The Economic Times, DNA Money, Mint, and Business Standard.

Speaking exclusively to The Island Financial Review, Subramanian emphasized that democracy is a great strength for Sri Lanka and expressed hope that citizens would exercise their franchise wisely to elect a government capable of leading the nation towards economic strength and prosperity.

He remarked: “Sri Lanka is a beautiful country, which I had the privilege of visiting a few years ago. The sun-kissed beaches, the greenery of the highlands, and its rich cultural heritage make it a prime destination for global tourists. The new government should focus on further leveraging the tourism sector and developing trade and investments with friendly countries like India and the wider world.”

When asked about the effectiveness of the IBC, Subramanian described it as the most significant financial sector reform under the Modi government. For the first time, promoters faced the threat of losing control of their companies, which were often regarded as family properties passed down from one generation to the next. According to regulatory figures, over INR 3.4 lakh crore has been recovered by creditors, with more than 27,000 cases withdrawn due to the fear of losing companies, leading to settlements worth over INR 10 lakh crore. This, he noted, has contributed significantly to the improved health of India’s banking system.

When asked about the effectiveness of the IBC, Subramanian described it as the most significant financial sector reform under the Modi government. For the first time, promoters faced the threat of losing control of their companies, which were often regarded as family properties passed down from one generation to the next. According to regulatory figures, over INR 3.4 lakh crore has been recovered by creditors, with more than 27,000 cases withdrawn due to the fear of losing companies, leading to settlements worth over INR 10 lakh crore. This, he noted, has contributed significantly to the improved health of India’s banking system.

Reflecting on his research, Subramanian shared that each of the twelve cases was unique. The troubled steel sector, accounting for five of the dozen, played a significant role in the narrative. The cyclical issues affecting steel demand, coupled with the cancellation of coal block allocations due to corruption allegations, were crucial to the story. Additionally, the different personalities behind each of these cases made them all the more intriguing, and Subramanian sought to bring out these complexities in the book.

Since its release, The Dirty Dozen has garnered significant attention and critical acclaim in major publications. Subramanian believes the book has greatly contributed to public understanding of the bad loan crisis and helped advance the discourse on the subject. Prior to its publication, there was no single source that compiled the details of these twelve critical cases. Various professional institutions, regulators, and students have shown interest in studying these cases, which could lead to a better approach if similar problems arise in the future.

Subramanian acknowledges that the introduction and effective implementation of the IBC over the past eight years has changed the equation between creditors and large debtors. With over 7,800 companies admitted to the resolution process, a significant amount of debt has been recovered, and over 1,000 companies have found new life. While the future remains uncertain, Subramanian hopes this new equation will result in a healthier financial system.

For those aspiring to cover complex financial issues, Subramanian advises practising reading financial statements and corporate disclosures. “It can often feel like searching for a needle in a haystack, but if you look hard enough, you will eventually find it,” he says. Since those involved are usually resourceful individuals, he stresses the importance of not only finding something to write about but also being able to defend it.

Business

Embedding human rights, equity and integrity into business leadership

At its 2026 Social Sustainability Programme Kick-Off, the UN Global Compact Network Sri Lanka convened business leaders to advance the translation of global ambition into practical corporate action on inclusion, integrity and human rights.

On 24 February 2026, the UN Global Compact Network Sri Lanka (Network Sri Lanka) convened business leaders at Barefoot Garden Café for its 2026 Social Sustainability Programme Kick-Off, delivered in collaboration with Good Life X.

The gathering did more than introduce a calendar of events. It positioned Sri Lanka’s corporate community within the broader direction of the UN Global Compact’s 2026–2030 global strategy — a strategy anchored in three imperatives: equipping companies to act, catalyzing collective action, and advancing the business case for responsible leadership.

At its core, the 2026 Social Sustainability agenda is designed to move companies from commitment to capability.

Within the Diversity & Inclusion Working Group, this means building practical pathways toward equal pay for equal work and strengthening male allyship as a governance issue rather than a cultural afterthought. It means examining sexual and reproductive health, disability inclusion, and mental health not as employee benefits, but as structural determinants of productivity and retention. It means sharpening strategic communications so inclusion is embedded in brand integrity. It also means applying science-based behavioural change approaches to shift organizational culture in measurable ways.

Across the Business & Human Rights Working Group, equipping companies takes the form of deepened engagement on decent work and living wage implementation, strengthening human rights due diligence processes, and addressing emerging risk areas such as AI and digital rights. It extends to reinforcing business integrity and anti-corruption frameworks, understanding the social dimensions of a just transition, and recognizing the link between child rights, nutrition, and workforce productivity.

Business

Union Bank to raise LKR 3 Bn via Basel III Compliant Debenture Issue

Union Bank of Colombo PLC announced its proposed Debenture Issue 2026, a strategic move aimed at raising up to LKR 3 billion. This issue is designed to bolster the Bank’s Tier II capital base and provide a robust financial foundation for its upcoming growth initiatives.

The offering consists of Basel III compliant, listed, rated, unsecured, subordinated, redeemable high-yield debentures with Non-Viability Conversion. The instrument has been assigned a rating of BB (lka) by Fitch Ratings (Lanka) Ltd, reflecting the bank’s creditworthiness and the structured nature of the subordinated debt.

Investors can choose from three distinct interest structures starting from a high-yield 13% fixed rate per annum (Type A). This option is paid annually, while Type B offers a 12.5% fixed rate paid semi-annually (12.89% AER). For those seeking market-linked returns, Type C provides a floating rate of the 182-days Treasury Bill rate plus a 400-basis point margin, also paid semi-annually.

The debentures are priced at LKR 100 per unit with a 5-year tenure (2026–2031). The initial issue size is set at 20,000,000 debentures with an option to raise 10,000,000 at the discretion of the Bank and is scheduled to open on 10 March 2026.

Shanka Abeywardene, Chief Financial Officer of Union Bank stated “This debenture issue marks a significant step in the Bank’s journey towards enhanced financial stability. By strengthening its capital adequacy, Union Bank is well-positioned to navigate evolving market conditions while fuelling its long-term strategic objectives for sustainable growth”

Business

Sanjay Kulatunga appointed to WindForce Board

WindForce PLC announced the appointment of Sanjay Kulatunga as an Independent, Non-Executive Director to its Board with effect from 03rd March 2026, following the resignation of Dilshan Hettiaratchi. The appointment further strengthens the Company’s governance framework, strategic oversight, and long-term decision-making capabilities.

Kulatunga brings an established track record as a founder, entrepreneur, and senior executive across financial services and export-oriented industries. He is the Chief Executive Officer and Co-Founder of LYNEAR Wealth Management, a boutique investment firm established in 2013, which has since grown to become one of Sri Lanka’s largest private wealth management institutions, serving high-net-worth individuals as well as local and international institutional clients.

Prior to founding LYNEAR, Kulatunga played a pivotal role in the establishment of Amba Research, an investment research offshoring firm rooted in Sri Lanka and now operating as part of Acuity Analytics.

Over the years, he has contributed extensively to several key national institutions. His previous appointments include serving on the Financial Sector Stability Consultative Committee of the Central Bank of Sri Lanka, as well as the Board of Investment of Sri Lanka and the Securities and Exchange Commission of Sri Lanka.

-

Features3 days ago

Features3 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features6 days ago

Features6 days agoAn innocent bystander or a passive onlooker?

-

Opinion3 days ago

Opinion3 days agoSri Lanka – world’s worst facilities for cricket fans

-

Business6 days ago

Business6 days agoAn efficacious strategy to boost exports of Sri Lanka in medium term

-

Features4 days ago

Features4 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features4 days ago

Features4 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone

-

Features3 days ago

Features3 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul