Features

The convoluted LNG–NG story: What do we need? LNG or NG or neither?

By Eng. Parakrama Jayasinghe

parajaysinghe@gmail.com

I am not a fan of natural gas either in its gaseous state NG or the liquefied state LNG, both of which are very much under discussion now locally and at COP 26 in Glasgow. At the same time, I would like to consider myself a realist with the wellbeing and needs of Sri Lanka receiving the highest priority.

Natural gas, mostly Methane (CH4), is present in deep underground strata in large pockets or closer to the surface in a more dispersed manner, emanating from decaying biomass and also unfortunately emitted by ruminating bovine.

Those who enjoyed this natural but diminishing fossil fuel resource in their own territorial land mass or with access to neighbours in the same land mass could do so in it’s gaseous state, commence exploiting by laying extensive gas pipe lines sometimes running thousands of kilometres

But in recent decades , with larger volumes being discovered (with the USA and Canada exploiting environmentally disastrous tar sands and fracking practices), the lure of this seemingly economical and decidedly less polluting fossil fuel, has attracted even those countries not endowed with any indigenous gas resources on their own or neighbours with such resources accessible by pipelines. This has led to the development of the process of liquefaction of the NG by cooling down to about – 160 degrees under high pressure, purely for the purpose of economically acceptable logistics for transport mainly by sea, creating the LNG concept and market.

However, since NG can be used only in its gaseous form, at the recipient’s end re-gasification facilities are required and were implemented on land close to the point of use or in logistical distribution terminals. The oil and gas industry using their ingenuity came up with a further twist by development of the Floating Storage and Re Gasification Units (FSRU), designed to serve those who could not deploy the land based re-gasification facilities located on land as these could be quite expensive. As the name suggests, these are designed as floating vessels moored close to the point of use, and the LNG is delivered to the FSRUs by bulk NG carriers. The re-gasified NG is delivered in relatively short pipelines to the land based consumption units for example power plants.

This is decidedly a simple explanation for the understanding of laymen. There are extensive and detailed explanations given in several articles by Eng. Nalin Gunasekera, a renowned international expert on the subject, in the Daily News of 3, 4 and 5 November and the Sunday Island of 7 November 2021, for those interested in gaining a more in depth understanding of the issues associated with these systems.

However, my purpose in writing this comment is not to discuss such technical intricacies but to examine how Sri Lanka should evaluate the options and the best approach for our benefit if we are to consider either LNG or NG. As already mentioned, given the choice, I would not like having to use NG in any form. It is a fossil fuel and it is now recognised as a very significant contributor to Global Warming, being 80 times more potent than CO2 in the short term. But it has the advantage of being a cleaner burning fuel, devoid of a plethora of dangerous and toxic pollutants released to the entire exosphere.

What are Sri Lanka’s Options ?

Some important issues must be recognised prior to seeking a reply to this query. Viz:

We have now firmly established the target of 70% renewable energy contribution for power generation by 2030

The current forecasts the 30% contribution by fossil fuels in 2030 is 8997 GWh Vs the current contribution of 9000 GWh ( CEB 2020 statistics), which leaves no room for any additional fossil power plants, except as replacements for any due to be retired shortly. The 350 MW Sobhadhanawi plant can be justified only in this context.

The 900 MW Lak Vijaya coal power plant may have a residual economic life of about 25 years.

The price of coal has sky rocketed, reportedly to over $ 240 per ton at source and no suppliers even at that price to Sri Lanka

The price of crude oil too has shot up to $ 85 per BBL and seems to hold at that level.

As such, using NG to meet the 30% gap appears to be an option and environmentally less damaging at least at point of use, provided the cost of generation is acceptable.

The comparison between the CEB tender for the FSRU only, without considering the LNG supply cost and mechanism, with the NFE proposal, which includes a monopoly on supply of LNG at unknown prices, is most illogical and has no meaning, at all. Talk about comparing one rotten apple with an even more rotten orange.

In spite of the grave doubts cast by Eng. Nalin Gunesekera, there is a possibility of attracting investors to develop the Mannar gas resource due to reasons given later on

Where does that leave us? Have we no options at all?

To start with, there can be no justification to continue with this love affair with LNG, given that it will compel Sri Lanka to continue purchase of a fossil fuels with scarce Dollars and at prices on which we have absolutely no control. The attraction of $ 250 Million for the sale of a valuable national asset is no justification, however tight the present foreign exchange situation is, a hollow relief as it will result in draining out several billions of dollars in a few short years.

Next, an FSRU is an inevitable appendage to go with the LNG supplies. Eng. Gunasekera has gone to great lengths to explain the complexities of this system and the high degree of expenditure required for its implementation and operation as well as the great many risks involved in the whole deal. He comes from an expert with decades of experience in this sector, and we will indeed be fool hardy to ignore his warnings and fall into a trap, from which we have no escape.

The whole process of this attempt to get NG as an alternative source of fuel, without anyone competent, establishing the possible means of supply, and compounding the problem by awarding a contract for the construction of a power plant is laughable, if not for the tragic mess that has landed Sri Lanka in. This is even more tragic considering that there has been no in depth re-evaluation on financial and economic feasibility based on current supply and price issues, done before deciding to make an award for a project tendered for in 2016. Sri Lanka having painted itself into a corner, the solution is not to get blackmailed but to dump the LNG and FSRU options even at this late stage. It has been calculated by the SLSEA that even with the most optimistic assumptions on current prices of LNG the cost of generation with LNG will be of the order of Rs 35.00 per kWh. This can only go up with continued depreciation of the rupee and the price trends of the LNG.

Just for comparison, the Siyambaladuwa solar project is expected to generate electricity at Rs 11.00 per kWh and the Mannar Wind Plant is generating at less than Rs 10.00 per kWh. The current cost of adding batteries to make these firm sources of electricity generation is only Rs 8.50 per kWh and is expected to decline sharply in the coming years to Rs. 3.50 per kWh by 2025.

What about Yugadhanawi Power Plant and the supposed share sale of 40% shares to the New Fortress Energy ( NFE)? If this deal is already confirmed and the $ 250 Million is already received, then this share deal on its own would be carried out. But there cannot be any additional conditions such as a monopoly of supply of LNG, attached to this sale. Such conditions are totally illegal and we can only hope that the present litigation will support this point of view.

At present, the Yugadhanawi plant operates at about 30% plant factor. Let it continue to do so using the furnace oil, even though the cost of FO also may have gone up in recent times. The impact on the national economy and the CEB cash flow would be much less worrisome than the proposed misadventure with LNG.

What is the fate of Mannar Oil and Gas Resource?

Although Eng. Gunasekera is of the view that its proven potential is far too little to attract any investors, he has hedged his bets by a surprising comment on the possibility of this resource being supplementary to FSRU and LNG. Given the dire warnings he has sounded against any attempt to implement the FSRU, perhaps he may have an inkling that the Mannar resource may stand on its own.

However, I would like to take a more optimistic view of the possibility and the need for a successful development agreement (taking due notice of warnings given on this count too due to Sri Lanka’s poor record of international negotiations) for two reasons:

It is now becoming impossible to operate the Lak Vijaya coal power plant due to cost of coal.

We don’t seem to have the courage to look beyond the 70% RE target and therefore should look for a least damaging solution, both economically and environmentally.

Both these objectives are served by successful development of the Mannar gas field with the potential of gaining both more economically and financially as the estimated potential of 9 Trillion Cubic Feet of Gas from the currently explored blocks; this is many times our own potential consumption and will yield a substantial surplus.

The World Scene on Natural Gas

I must justify my claim to be a realist in hoping for an acceptable agreement for this development in spite of my opposition to any form of fossil fuels. The fact remains that it is only now that the CEB has accepted the 70% RE goal. So, we need to look for the least damaging means of meeting the balance 30%. In the world scene, in spite of the agreement that NG is a very potent GHG due to leakages at points of extraction, storage and transport, it remains a highly sought after fuel. While there is a widespread agreement to eventually end the use of coal, in some countries even as early as 2025, there is no such agreement in respect of NG.

Even at the current COP 26 summit dubbed as the Green Washing Festival by Greta Thunberg, the commitment is only to reduce the methane emissions by 30% by year 2030, that too with out several major producers and users of NG including India, Russia and China

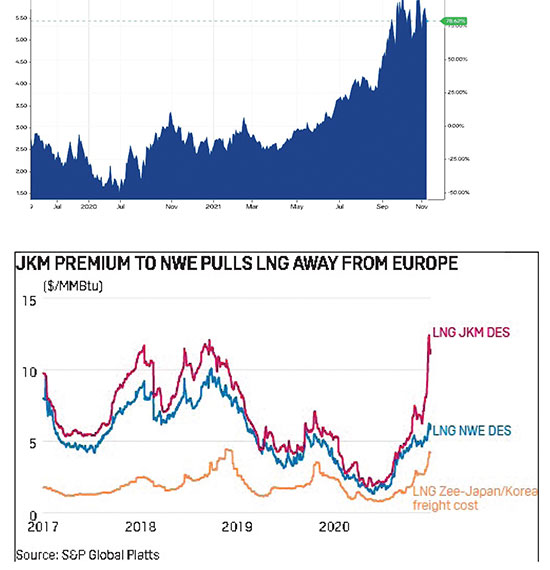

So, the demand and use of NG shall remain high and even escalate as replacement of coal in the foreseeable future. The largest increase is also expected to be in the Asian region. Coupled with this is the fact that there is a great gap between the quoted prices in different NG markets such as Henri Hub and the Japan Korea Market as shown in the graphs.

As such, developing our own resource is attractive and very much in centre stage of the high demand area.

So, while Sri Lanka has committed to reach Zero Carbon status by 2050, there is no reason why we should not aim at the least environmentally damaging and potential economically attractive option of opening up this resource as the transition solution.

The Worst Case Scenario?

What if we are not successful in getting an acceptable agreement and have to do without any gas?

This may be a reality considering the discussions going on at COP 26 against funding for any new fossil fuels. Many including me would view this as the best option in the long run.

Sri Lanka has enough and more indigenous RE resources and the 100% RE option is not impossible. The issue would be more of a financial problem than technical with the need for capital to import the necessary capital goods. There is hope generated at COP 26 on this count too. The project is already at the planning or implementation stage and such as the 100 MW solar and Wind Projects up to some 177 MW of major hydro projects would help bridge this gap in addition to the projected wind, biomass and solar potential .

The tantalising potential of doubling the generation capacity of the Victoria project on which feasibility studies have already been done needs urgent consideration.

Conclusion

The bottom line is clear. There are more than enough reasons for dumping the FSRU option before any more ill-considered commitments are made.

The possibility of attracting credible investors to develop the Mannar resource is reported to be very real and imminent. Therefore, a short sighted commitment to implement FSRUs and therefore the import of LNG would be most foolhardy.

There is the need for much more proactive measures to harness our own RE resources, not limiting such actions to mere rhetoric. The only ingredient lacking is the confidence as well as foresight of the energy authorities, blind to the world trends, both technically and commercially.

A time-targeted action plan towards the 70% RE is urgently needed with much greater emphasis on the next few years’ goals and activities. These would be invaluable in making adjustments to the plans for the next stage, say up to 2027. It is most likely that much more challenging targets could be set with the technical advances and the learning during the first stage.

Can we adopt this “Can Do” attitude at least now?

Features

Tariffs as business deals?

From White House to Wall Street:

I am going to examine the financial market repercussions of President Donald Trump’s 2025 tariff policies, focusing on equities, bonds, derivatives, and interest rates. It explores how asymmetric information and alleged insider trading influenced market dynamics, highlighting the challenges posed to market integrity and investor confidence.

I am going to examine the financial market repercussions of President Donald Trump’s 2025 tariff policies, focusing on equities, bonds, derivatives, and interest rates. It explores how asymmetric information and alleged insider trading influenced market dynamics, highlighting the challenges posed to market integrity and investor confidence.

In 2025, President Donald Trump’s administration implemented a series of tariffs targeting major trading partners, including China, Canada, and Mexico. These policies aimed to protect domestic industries but resulted in significant volatility across global financial markets. The sudden shifts in trade policy introduced uncertainty, affecting various asset classes and raising concerns about the exploitation of insider information.

In response to escalating market turmoil and international pressure, President Trump announced a 90-day deferral on certain tariffs, via social media on April 9, 2025. However, the announcement’s ambiguity led to continued market instability.

Pre-Tariff Market Conditions

(February 2025)

In February 2025, US financial markets were experiencing relative stability. The S&P 500 was trading near record highs, buoyed by strong corporate earnings and positive economic indicators. Interest rates remained steady, with the 10-year Treasury yield hovering around 3.9%, reflecting moderate inflation expectations and a balanced economic outlook. The CBOE Volatility Index (VIX), a measure of market volatility, was subdued, indicating investor confidence.

Impact on Financial Markets

Equities and Traditional Investment Strategies

The announcement of tariffs led to a sharp decline in US stock markets. Major indices, such as the Dow Jones Industrial Average and the Nasdaq Composite, experienced significant losses, with the Nasdaq entering bear market territory after a 5.82% drop. The traditional 60/40 investment strategy, allocating 60% to equities and 40% to bonds, proved ineffective during this period, as both asset classes suffered losses due to rising bond yields and falling stock prices (Figure 1).

Market Indices (S&P 500, Nasdaq, Dow Jones): Major crashes occurred on April 3–4, 2025, following the tariff imposition. Slight recovery or stabilisation followed Trump’s deferral tweet on April 9, but markets dipped sharply again on April 10 (Table 1).

Market Reaction to Tariff Imposition

(April 2–5, 2025)

* April 3, 2025: The S&P 500 plummeted by 4.88%, the Nasdaq Composite fell by 5.97%, and the Dow Jones Industrial Average declined by 3.98%. The Russell 2000 entered bear market territory, dropping over 20% from its recent peak.

* April 4, 2025: Markets continued their downward trajectory. The S&P 500 fell an additional 5.97%, the Nasdaq Composite decreased by 5.82%, and the Dow Jones Industrial Average dropped by 5.50%.

* April 5, 2025: The newly imposed tariffs officially took effect, further exacerbating market volatility and investor uncertainty.

* Over this period, US stock markets lost approximately $6.6 trillion in value, marking the largest two-day loss in history.

Market Response to Tariff Deferral

(April 9–11, 2025)

* April 10, 2025: Despite the deferral, the S&P 500 declined by approximately 15%, and long-term Treasury bonds faced significant selling pressure. The US dollar weakened, and gold prices surged as investors sought safe-haven assets.

* April 11, 2025: Consumer sentiment plummeted, with the University of Michigan Consumer Sentiment Index dropping to 50.8, the second-lowest level since records began in 1952. This decline reflected widespread economic pessimism amid the ongoing trade tensions.

Bond Market and Interest Rates

The bond market reacted to the tariffs with increased yields, reflecting investor concerns about inflation and economic growth. The US 10-year Treasury yield rose to 4.358%, indicating expectations of higher interest rates. This rise in yields contributed to the decline in bond prices, further challenging traditional investment strategies.

10-Year Treasury Yield: Climbed steadily from 3.9% to 4.358% (April 2–21), suggesting increased inflation expectations and risk premium. The bond market experienced significant fluctuations during this period. Therefore, investors demanded higher returns for perceived increased risk. This rise in yields indicated expectations of higher inflation and potential economic slowdown due to the tariffs. (Table 2).

Derivatives and Market Volatility

The derivatives market, including options and futures, experienced heightened volatility in response to tariff announcements. The CBOE Volatility Index (VIX), often referred to as “Wall Street’s fear index,” spiked to its highest level since 2020, closing at 45.31 points. This surge in volatility presented both risks and opportunities for investors, particularly those with access to timely information.

VIX Volatility Index: Rose from 19 on April 2 to a peak of 45.31 on April 4, indicating extreme market fear. The VIX spiked to 45.31, its highest level since 2020, indicating heightened market anxiety (Table 3).

Asymmetric Information and Insider Trading Allegations

Allegations of insider trading emerged during the tariff saga, highlighting concerns about asymmetric information. Congresswoman Marjorie Taylor Greene faced scrutiny for stock transactions made shortly before tariff announcements, including purchases in companies like Amazon and Tesla, and the sale of Treasury bills. While Greene denied insider knowledge, the timing of these trades raised questions about the potential exploitation of non-public information (The Times, 2025).

Additionally, unusual trading patterns in S&P 500 futures preceding major policy shifts suggested possible insider activity. Although direct evidence linking these trades to White House insiders remains inconclusive, the patterns underscore the challenges in detecting and preventing insider trading in policy-driven markets (Los Angeles Times, 2025).

Tariff Decisions as Business Deals

While tariffs are typically seen as instruments of trade policy aimed at protecting domestic industries or rebalancing trade deficits, the Trump administration’s 2025 tariff imposition and abrupt deferral appear less rooted in strategic policy and more akin to short-term market manipulations. These decisions unfolded not through institutional processes or legislative debates, but rather through presidential tweets and sudden reversals, strongly suggesting a deal-making mindset characteristic of business negotiations rather than public governance.

The Role of Asymmetric Information and Market Elites

Insider trading is traditionally associated with illegal access to non-public corporate information. However, in this case, asymmetric political information—known only to a select few close to power—may have created an opportunity to profit.

Market actors with proximity to decision-makers, or even sophisticated algorithms tied to social media monitoring, could have anticipated the tariff deferral.

Billionaire investors and influencers like Elon Musk, who maintain both financial influence and political access, are often speculated to benefit from such opaque decision-making environments. The quick reversal of tariffs led to a surge in tech stocks, many of which form the core holdings of large institutional investors, hedge funds, and elite entrepreneurs.

For example: The Nasdaq rebounded by 1.5% following the deferral tweet. Options trading volumes spiked on tech-heavy indices, indicating pre-positioning by well-informed actors. Reports from Bloomberg and Reuters noted unusual activity in Tesla call options shortly before the deferral (Reuters, 2025; Bloomberg Markets, 2025).

A Business Deal Mindset

Trump’s own language underscores the deal-making philosophy. The President tweeted that the tariffs were a “strong hand in negotiations” and “paused for talks with China”, using terms more common in corporate boardrooms than diplomatic channels. This rhetoric, combined with the lack of institutional transparency, raises serious concerns about the manipulation of public policy for private gains.

In this light, the administration’s behaviour is not reflective of classical economic policy objectives like comparative advantage or strategic protectionism. Instead, it aligns with the wealth-maximising tactics of a private enterprise, where the aim is to control narrative, timing, and volatility to benefit select stakeholders.

Conclusions

More critically, the Trump tariff saga of 2025 blurs the lines between public policy and private profit. The opacity, erratic timing, and informal communication channels—particularly via presidential tweets—suggest that these were less about coherent trade strategies and more akin to orchestrated business maneuvers. The reactive movements of major indices, coupled with unusual options trading patterns and speculative capital flows, indicate that market elites likely capitalised on volatility, benefiting from privileged access or predictive positioning based on asymmetric information.

This raises serious concerns about market integrity and the ethical boundaries between governance and profiteering. When financial markets are left vulnerable to abrupt and opaque political actions, especially ones lacking institutional oversight, the door opens to manipulation, insider trading, and erosion of public trust.

In sum, the 2025 Trump tariff episode serves as a cautionary tale—one that highlights the dangers of politicising economic policy, the vulnerabilities of global markets to personalised decision-making, and the importance of upholding the foundational principles of fairness, transparency, and accountability in modern financial systems.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)

Features

The sea-change after Modi’s visit

The cosy relationship between President Anura Kumara Dissanayake and Indian Prime Minister Narendra Modi is causing concerns, perhaps, for good reasons. The inheritor of the leadership of the party, the JVP, which launched the first insurgency in the modern history of Sri Lanka, way back in 1971 citing ‘Indian expansionism’ as one of the reasons, seems to have undergone a miraculous transformation; it is now cosying up to India. The process started well before the last presidential election, with the astute Indian intelligence sensing which way political winds were blowing in Sri Lanka; AKD was invited as an honoured guest to India, though he did not hold any important position in Sri Lanka. This, no doubt, increased his chances of victory but the bigger beneficiary was India as during that trip AKD showed that he was prepared to reverse the attitude of the JVP towards India. The camaraderie between AKD and Modi has increased, culminating in the latter’s Sri Lanka visit, which Indian media have hailed as a foreign policy success.

Some political commentators have expressed concern that Sri Lanka is heading towards being the 29th state of India. Those in government may attempt to dispel this as a baseless fear but, unfortunately, they fail to realise that it is the very actions of their president that has given rise to such concerns, the way Indo-Lanka Defence MoU/agreement was signed during the recent visit of the Prime Minister Modi. One may wonder why there are no protests but there is a very reasonable explanation for this; those who mounted repeated protests against closer ties with India, from as far back as 1971, are now in government and seem to have metamorphosed to be the most pro-Indian!

During the recent ‘flying’ state-visit of the Indian PM Modi, a large number of MOUs have been signed, including the one on defence corporation, the contents of which are unknown, apparently even to the members of the Cabinet! How come this happens with a government that came to power on the promise of eradicating corruption, establishing transparency, and system change? Neville Ladduwahetty, in an excellent analysis, points out that this agreement would result in Sri Lanka becoming, at least, a vassal state of India (Sri Lanka-India MoUs and their implications, The Island 18 April).

Some of the excuses being doled out are nothing short of hilarious. When questions were raised in parliament about the contents of these MOUs and pacts, the response from a government spokesman was that if anyone is interested, they can obtain details by making a request under the Rights to Information act! Isn’t this the actions of a government which has lost all semblance of transparency in such a short period of time? An even more important question is whether India is exploiting the lack of experience of the politicians in power to its advantage.

One may wonder whether it was a coincidence that this extremely important and closely guarded defence pact was signed on 5 April, 54 years to the very day the JVP launched its first insurrection in Sri Lanka with the rallying-cry, “Motherland or death”! Considering the sinister ways of India’s operations, at times, it is more likely to be a deliberate and subtle reminder to the NPP/JVP government than a coincidence. What an irony it was for the Sri Lankan President, the heir to the JVP throne, to award the highest honour possible to the Prime Minister of India, a country they detested so much! After his very successful trip, PM Modi flew by helicopter, no doubt, gazing at the remnants of the Ram Sethu bridge, probably dreaming of rebuilding it to connect the 29th state to the mainland!

It is high time the government reassured the public by informing at least the context of the defence pact signed, even if details are withheld for security reasons. If it is not done the credibility of the government would be further eroded. It has already lost its credibility on the promise of honesty and integrity. The former speaker, who had to give up the third highest ranking position in the country as he had misplaced the certificates of his doctorate from a private university in Japan, promised to produce the certificates to clear his name. Enough time has passed for him to get even duplicates but despite the obvious dishonesty, unashamedly, he remains an MP! Is this the cleansing of Diyawannawa they promised?

What is happening regarding the Easter terrorist attack is raising concerns too, as it is being reinvestigated to find a mastermind under the supervision of two retired police officers, who were rewarded with top posts for openly supporting the NPP, despite being found fault for neglect of duty by a committee of Inquiry tasked to investigate the failures leading to that attack. Even if they were wrongly implicated by that committee, they should not be a party to any relevant investigation till their names were cleared. The government has demonstrated the lack of good governance by allowing these two officers to be involved in the investigation and the two officers have demonstrated their total lack of integrity by not removing themselves voluntarily. The current investigation reminds one of the Sinhala saying Horage ammagen pena ahanawa wagei (seek help from a female clairvoyant to catch a thief who happens to be her own son.)

This search for a mastermind, which started with the pronouncements of a previous Attorney-General who has refused, so far, to substantiate his claims took a new turn with the notorious Channel 4 programme based on the testimony of an asylum seeker who has produced fraudulent documents. President Sirisena, long after he left the presidency, claimed to know the mastermind! Anyone with an interest in facts ought to watch the excellent “Hyde Park” interview on Ada Derana with Professor Rohan Gunaratna, an internationally acclaimed authority on counterterrorism. He has interviewed key personnel in ISIS and has studied 337 intelligence reports, both local and international including those from FBI, Scotland Yard, Interpol etc. He is of the strong opinion that it was an attack masterminded by ISIS and there is no basis, whatsoever, to consider it to be politically motivated. However, he did not address the issue of whether a foreign nation was masterminded for other reasons.

Attributing a political motivation may suit the government as it has a vested interest. It should not be forgotten that the father of two of the bombers, one of them the leader, was a prominent financial backer of the JVP whose name was on its national list.

The other theory advanced by some is that India’s RAW may be behind the attack, the reasons given being that RAW gave exactingly detailed intelligence regarding the attacks and that the attack on Taj Samudra was aborted, at the last moment, due to a mysterious telephone call the bomber received.

Adding fuel to the fire of speculation is the latest action of AKD. His much-promised exposure of the mastermind on 21 April turned out to be a pus wedilla! The country waited eagerly, but all he did was to hand over the Presidential Inquiry report to the CID, contrary to the recommendation of the commission that it be handed over to the Attorney General for action!

Hasn’t there been a sea-change after PM Modi’s visit?

By Dr Upul Wijayawardhana

Features

RuGoesWild: Taking science into the wild — and into the hearts of Sri Lankans

At a time when misinformation spreads so easily—especially online—there’s a need for scientists to step in and bring accurate, evidence-based knowledge to the public. This is exactly what Dr. Ruchira Somaweera is doing with RuGoesWild, a YouTube channel that brings the world of field biology to Sri Lankan audiences in Sinhala.

“One of my biggest motivations is to inspire the next generation,” says Dr. Somaweera. “I want young Sri Lankans to not only appreciate the amazing biodiversity we have here, but also to learn about how species are studied, protected, and understood in other parts of the world. By showing what’s happening elsewhere—from research in remote caves to marine conservation projects—I hope to broaden horizons and spark curiosity.”

Unlike many travel and wildlife channels that prioritise entertainment, RuGoesWild focuses on real science. “What sets RuGoesWild apart is its focus on wildlife field research, not tourism or sensationalised adventures,” he explains. “While many travel channels showcase nature in other parts of the world, few dig into the science behind it—and almost none do so in Sinhala. That’s the niche I aim to fill.”

Excerpts of the Interview

Q: Was there a specific moment or discovery in the field that deeply impacted you?

“There have been countless unforgettable moments in my 20-year career—catching my first King cobra, discovering deep-diving sea snakes, and many more,” Dr. Somaweera reflects. “But the most special moment was publishing a scientific paper with my 10-year-old son Rehan, making him one of the youngest authors of an international peer-reviewed paper. We discovered a unique interaction between octopi and some fish called ‘nuclear-forager following’. As both a dad and a scientist, that was an incredibly meaningful achievement.”

Saltwater crocodiles in Sundarbans in Bangladesh, the world’s largest mangrove

Q: Field biology often means long hours in challenging environments. What motivates you to keep going?

“Absolutely—field biology can be physically exhausting, mentally draining, and often dangerous,” he admits. “I’ve spent weeks working in some of the most remote parts of Australia where you can only access through a helicopter, and in the humid jungles of Borneo where insects are insane. But despite all that, what keeps me going is a deep sense of wonder and purpose. Some of the most rewarding moments come when you least expect them—a rare animal sighting, a new behavioural observation, or even just watching the sun rise over a pristine habitat.”

Q: How do you balance scientific rigour with making your work engaging and understandable?

“That balance is something I’m constantly navigating,” he says. “As a scientist, I’m trained to be precise and data-driven. But if we want the public to care about science, we have to make it accessible and relatable. I focus on the ‘why’ and ‘wow’—why something matters, and what makes it fascinating. Whether it’s a snake that glides between trees, a turtle that breathes through its backside, or a sea snake that hunts with a grouper, I try to bring out the quirky, mind-blowing parts that spark curiosity.”

Q: What are the biggest misconceptions about reptiles or field biology in Sri Lanka?

“One of the biggest misconceptions is that most reptiles—especially snakes—are dangerous and aggressive,” Dr. Somaweera explains. “In reality, the vast majority of snakes are non-venomous, and even the venomous ones won’t bite unless they feel threatened. Sadly, fear and myth often lead to unnecessary killing. With RuGoesWild, one of my goals is to change these perceptions—to show that reptiles are not monsters, but marvels of evolution.”

Q: What are the most pressing conservation issues in Sri Lanka today?

“Habitat loss is huge,” he emphasizes. “Natural areas are being cleared for housing, farming, and industry, which displaces wildlife. As people and animals get pushed into the same spaces, clashes happen—especially with elephants and monkeys. Pollution, overfishing, and invasive species also contribute to biodiversity loss.”

Manta Rays

Q: What role do local communities play in conservation, and how can scientists better collaborate with them?

“Local communities are absolutely vital,” he stresses. “They’re often the first to notice changes, and they carry traditional knowledge. Conservation only works when people feel involved and benefit from it. We need to move beyond lectures and surveys to real partnerships—sharing findings, involving locals in fieldwork, and even ensuring conservation makes economic sense to them through things like eco-tourism.”

Q: What’s missing in the way biology is taught in Sri Lanka?

“It’s still very exam-focused,” Dr. Somaweera says. “Students are taught to memorize facts rather than explore how the natural world works. We need to shift to real-world engagement. Imagine a student in Anuradhapura learning about ecosystems by observing a tank or a garden lizard, not just reading a diagram.”

Q: How important is it to communicate science in local languages?

“Hugely important,” he says. “Science in Sri Lanka often happens in English, which leaves many people out. But when I speak in Sinhala—whether in schools, villages, or online—the response is amazing. People connect, ask questions, and share their own observations. That’s why RuGoesWild is in Sinhala—it’s about making science belong to everyone.”

‘Crocodile work’ in northern Australia.

Q: What advice would you give to young Sri Lankans interested in field biology?

“Start now!” he urges. “You don’t need a degree to start observing nature. Volunteer, write, connect with mentors. And once you do pursue science professionally, remember that communication matters—get your work out there, build networks, and stay curious. Passion is what will carry you through the challenges.”

Q: Do you think YouTube and social media can shape public perception—or even influence policy?

“Absolutely,” he says. “These platforms give scientists a direct line to the public. When enough people care—about elephants, snakes, forests—that awareness builds momentum. Policymakers listen when the public demands change. Social media isn’t just outreach—it’s advocacy.”

by Ifham Nizam

-

Business5 days ago

Business5 days agoDIMO pioneers major fleet expansion with Tata SIGNA Prime Movers for ILM

-

News4 days ago

News4 days agoFamily discovers rare species thought to be extinct for over a century in home garden

-

Features7 days ago

Features7 days agoNipping the two leaves and the bud

-

Features6 days ago

Features6 days agoProf. Lal Tennekoon: An illustrious but utterly unpretentious and much -loved academic

-

Features7 days ago

Features7 days agoAvurudu celebrations … galore

-

Foreign News4 days ago

Foreign News4 days agoChina races robots against humans in Beijing half marathon

-

News7 days ago

News7 days agoCounsel for Pilleyan alleges govt. bid to force confession

-

Editorial5 days ago

Editorial5 days agoSelective use of PTA