Business

Sri Lanka’s Runaway Inflation and the Limits of Monetary Policy

by Dr Dushni Weerakoon

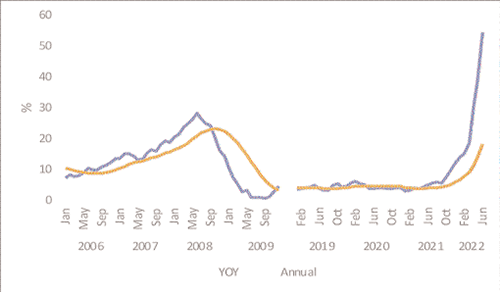

The bad news on inflation keeps coming. As of June 2022, year-on-year (YOY) inflation nationally is estimated at an all-time high of 59%. Annual inflation is lagging significantly behind at around 21%, indicative of the speed at which price inflation has been spiralling in recent months. This is in sharp contrast to Sri Lanka’s previous bout of high inflation in 2008 where the YOY increase was far more gradual (Figure 1). Then too, a similar combination of factors was at play. On the external front, a global financial crisis, a spike in international oil prices and sky-rocketing food prices prevailed. On the domestic front, a depressingly familiar combination of unsustainable fiscal, monetary and exchange rate policies were in place.

This time around too, the inflation bout was triggered by a series of macroeconomic policy blunders in managing the fallout of the COVID-19 pandemic; an untenable red hole in public finances, a massive injection of liquidity within a short time span, and an improbable exchange rate policy combined to bring about Sri Lanka’s harshest economic collapse. The inflation ‘pass through’ from the more than 80% currency depreciation that followed amplified the global price increases in food and fuel. The ban on chemical fertiliser use, import controls on food and high costs of transport added to the shortages, driving up prices further.

While Sri Lanka is still well below the commonly used threshold for hyperinflation (monthly inflation exceeding 50%) the rampant inflation this time around is consistent with a serious crisis of confidence across the economy. Monetary policy – i.e. raising interest rates – is the most appropriate tool at hand to fight inflation, but there are limits to its efficacy.

Today, inflationary pressures have intensified the world over with countries like the US and the UK seeing inflation rates hit 40-year highs. Unlike Sri Lanka, the inflation trigger in many of these economies was set off by buoyant demand and tight labour markets as countries emerged from the COVID-19 pandemic. The Russian invasion of Ukraine that followed went on to fuel energy and food price increases and add to supply bottlenecks – already battling a combination of challenges including a resurgence of COVID-19 in China. Almost everywhere, central banks embarked on a monetary policy tightening cycle, with New Zealand and South Korea starting early and aggressively. The intention is to anchor inflation expectations and cut off more persistent strength in nominal wage growth. Thus, the upswing in inflation and interest rate cycles point to a downswing in growth globally in 2022.

Having kept monetary policy too loose for too long, Sri Lanka started its tightening cycle in August 2021, albeit with timid steps – raising policy interest rates by a total of 200 basis points up to March 2022 even as inflation breached double-digit figures in November 2021. This was followed by an aggressive 700 basis point hike in April 2022. It signalled firm intentions to regain the Central Bank of Sri Lanka’s (CBSL) focus on price stability by engineering a reduction in demand through high interest rates and withdrawing liquidity from the economy. Effectively, in the current dire growth outlook for Sri Lanka, the policy intention means forcing a recession to tame inflation.

In choosing between the options of an aggressive hike that will lead to a recession or tolerating a prolonged inflationary spiral bordering on hyperinflation, the former is preferable. Once inflation takes hold, the damage can be corrosive, especially its deeply regressive impacts on lower income households. But a contractionary strategy to suppress demand will not achieve the desired outcomes if (a) inflation expectations are not well anchored and people expect rapid price increases to continue, and (b) supply side factors remain unaddressed.

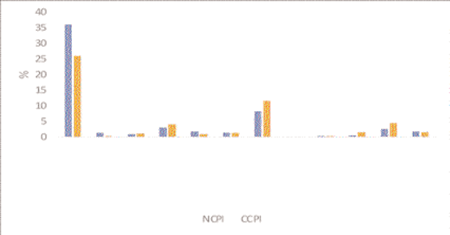

A sector-wise breakdown of the National Consumer Price Index (NCPI) and the Colombo Consumer Price Index (CCPI) of YOY inflation in June 2022 shows that demand-driven domestic inflationary pressures appear to be responsible for much less of the rise in headline inflation. Food price increases are contributing the largest share of 36% towards the YOY national increase in inflation in the NCPI (carrying a weight of 44%) while it contributes a similarly large share of 26% in the CCPI (with a weight of 28%). Transport is the second largest contributor (8-11%) in both indices. Overall, the strength of inflation appears to mainly reflect the large increases in energy and food prices; in fact, when inflation is driven largely by excess liquidity and demand, price increases across goods and services tend to be more uniform.

With runaway inflation, tightening monetary policy hard and fast was almost inevitable to anchor inflation expectations. The policy will work though only if fiscal adjustments evolve in line with monetary policy. Sharp interest rate increases make government debt even more expensive to service, and when interest rates exceed economic growth, a country’s indebtedness keeps rising. Higher interest rates in the current context of a crisis of confidence overall in the economy, and especially on exchange rate risks, means that it will not be reflected in stronger capital inflows to stabilise the rupee either.

Upward pressure on inflation in Sri Lanka will not dissipate immediately. Continued direct financing of Treasury spending by the CBSL, high global energy and food prices, and continuing domestic supply-side factors – food and fuel shortages, import policies, and related market distortions – will add to price increases. Thus, the current upswing in real interest rates will likely go further if it appears that the policy mix is unable to reverse the inflation trend.

At this crucial juncture, prompt action on all macroeconomic policy fronts simultaneously is essential to help the CBSL put price stability at the core of Sri Lanka’s monetary policy framework and better anchor inflation expectations. If workers and businesses are unconvinced that runaway inflation is firmly in check, higher price expectations will feed back into the process, making the fight against inflation even harder. It will also delay the recovery from recessionary conditions – through cuts in investments and shortening of investment horizons that ultimately hurt employment and jobs – as the country looks to ease back from the current economic crisis.

Link to the blog – https://www.ips.lk/talkingeconomics/2022/07/27/sri-lankas-runaway-inflation-and-the-limits-of-monetary-policy/

Business

U.S.-Russia diplomatic thaw ignites Sri Lanka’s hopes for trade windfall

Sri Lanka’s Ministry of Industries and Entrepreneurship Development Secretary Thilaka Jayasundara voiced confidence yesterday that warming U.S.-Russia relations could catalyse economic opportunities for Sri Lanka, during a forum hosted by the National Chamber of Commerce.

Speaking at the ‘Russia-Sri Lanka Development of Trade, Economic, and Banking Cooperation’ event, Jayasundara, a seasoned official with experience across multiple political administrations highlighted that eased secondary sanctions resulting from improved Moscow-Washington dialogue could unlock favorable trade conditions for Sri Lanka. Her remarks drew visible approval from Russian Ambassador Levan Dzhagryan, seated nearby.

“Sri Lanka’s balanced, neutral foreign policy positions us to benefit from any collaborative outcomes of U.S.-Russia talks,” she asserted, underscoring the nation’s potential to leverage evolving geopolitics for trade and investment gains.

Jayasundara didn’t miss the opportunity to urge Sri Lankan trade chambers to collaborate with the Export Development Board (EDB) to diversify exports and maximise foreign exchange earnings.

“Businesses and banks present here should explore to forge stronger B2B linkages for mutual benefit at the breakout sessions,” she added, referencing discussions at the forum that connected SMEs and large firms in agriculture, fintech, pharmaceuticals, industrial manufacturing among other sectors.

The secretary’s optimism aligns with Sri Lanka’s broader strategy to navigate global economic headwinds by capitalising on diplomatic shifts and expanding its export portfolio.

According to the EDB, the total export value from Sri Lanka to Russia was USD 144.25 Mn in 2023 and total imports from Russia to Sri Lanka for the same period were USD 393.55 Mn. Official data for 2024 remains pending.

The Russian delegation that took part in the B2B meetings was headed by Dr. Alexander Rybas, Trade Commissioner of the Russian Federation.

By Sanath Nanayakkare

Business

Hemas Hospitals named Official Healthcare Partner for JOE-PETE Big Match 2025

Hemas Hospitals has proudly partnered with the JOE-PETE Big Match 2025 as the official healthcare provider, continuing its strong tradition of supporting community events and ensuring the safety and well-being of all participants and spectators.

As one of Sri Lanka’s most anticipated annual school cricket encounters, the JOE-PETE Big Match brings together passionate fans, students, and alumni from St. Joseph’s College and St. Peter’s College. With thousands expected to attend, Hemas Hospitals steps in once again, marking its fifth consecutive year of involvement, to provide expert medical support on-site.

“As a leading private hospital network, we’re proud to be a part of this iconic event. Our partnership reflects our commitment to community health and to being there where it matters most,” said Dr. Pradeep Edward, Director General Manager, Hemas Hospital Thalawathugoda. “We want all attendees to enjoy the event with peace of mind, knowing that their health and safety are in good hands.”

During the match days, Hemas Hospitals will deploy on-site medical teams, ambulances, and a qualified sports medicine medical officer to respond to any health emergencies or injuries. From first aid to injury management, the team is equipped to handle a wide range of situations with the efficiency and professionalism that Hemas is known for.

“Our practice of having highly trained medical staff and emergency support continues,” said Anjana Cramer, Business Development Manager. “Our aim is to be proactive, responsive, and accessible throughout the event.”

In addition to healthcare support, Hemas Hospitals will have a strong brand presence at the event, with Hemas flags, A-boards, a branded ambulance, and the medical team visibly positioned throughout the grounds.

“We want this partnership to not only represent medical readiness but also our larger message of promoting health and unity through sport,” said Duwayne Rozario, Executive – Business Development. “It’s about more than just treatment, it’s about being an active part of the community.”

Business

Sun Siyam Pasikudah; unique cluster of luxury chalets looking out to Eastern sea

Weddings on the beach, an aqua platform to be served dinner in the sea; four ocean pavilions, informal camaraderie, more so, come as you are atmosphere for informality and bonhomie un matched in any resort.

What are we talking about? Just a cautious; yet unavoidable blend for a holiday; and an atmosphere of ‘let yourself go’, experience unmatched in a resort hotels.

Where are these ‘happenings’? At the Sun Siyam Pasikudah.

Just so, assuming you’ve been to the Maldives, and factually, it’s a demand driven destination, to the US, so too, we assume, Sun Siyam Pasikudah is a growing destination for holidays in the warm waters of the Indian Ocean surrounding the East coast of this island.

Why surrounding? Simple; just that Sun Siyam Pasikudah perched by the sea, apart from the warm waters bordering the resort; we are also of the positive atmosphere of the shallow sea abutting the picturesque appeal viewed from the sea. Appealing to tourists already enjoying the numerous attractions of this resort facility.

Our observations were French, Germans and other Europeans were already enjoying the facilities of Sun Siyam Pasikudah.

General Manager Arshed Refai was on hand to give us detailed explanation on facilities guests could expect and enjoy and numerous offerings that appeal for long stays. Quite regularly, he said, guests are quite reluctant to depart. Particularly Europeans who we observed enjoying the sun and more so walks along the beach.

Additionally, Ministry of Tourism provided train services as well to encourage tourist traffic to the East to enjoy the growing popularity of this resort and other resorts we observed in the area.

GM Refai further said the dining experience, and varied choice of cuisine catered to each national from West to East; which, he said, was quite in order to cater to choices in food and individual taste desires.

Originally launched in 2014 as Sun Aqua Pasikudah, the property underwent a rebranding in 2020, becoming part of Sun Siyam Resorts Collection and adopting the name of Sun Siyam Pasikudah. ‘Was it popular among local tourists’? He responded positively that its appeal was growing, related to the chain of other destinations in the East. Additionally, its popularity and appeal, particularly to its chalets and Five Star luxury was in reality not an available concept elsewhere.

Chef Dilan Jayasundera, explained varied cuisine and food flavours he was adept in producing to ensure guests were not in need, food vice.

He further said a broad cross section of tastes was catered to.

Asst General Manager Keerthi expanding on additional facilities said 34 rooms were villa style accommodation spread over the land. Four ocean pavilions complemented a formal atmosphere.

GM Refai further said 90 guests at peak accommodation enjoyed international cuisine.Excursions, to the fish market, sea observations in glass bottom boats to observe fauna and flora under water, including the varied amphibian fish population were of great appeal.

Questioned on any Maldivian influence, he said, Sunsiyam was not influenced by the Maldives, but its style was of broad appeal.

The resort’s transformation showcases bold monochromatic interiors balanced with rich golden tones, creating a unique, sophisticated, and chic environment. The resort offers distinct culinary adventures, immersing guests in Sri Lanka’s vibrant flavors and colonial traditions. Noteworthy options include The Cellar, Sri Lanka’s largest wine cellar on the eastern coast, the Tea House with an extensive tea collection for a delightful tasting journey, Slice & Grill, a fast-casual poolside concept with a retro design, and the Beach Shack, a tropical paradise with Caribbean vibes.

By Steve A. Morrell

-

Sports5 days ago

Sports5 days agoSri Lanka’s eternal search for the elusive all-rounder

-

News4 days ago

News4 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

News6 days ago

News6 days agoGnanasara Thera urged to reveal masterminds behind Easter Sunday terror attacks

-

Sports20 hours ago

Sports20 hours agoTo play or not to play is Richmond’s decision

-

Business7 days ago

Business7 days agoAIA Higher Education Scholarships Programme celebrating 30-year journey

-

News5 days ago

News5 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features5 days ago

Features5 days agoSanctions by The Unpunished

-

Features5 days ago

Features5 days agoMore parliamentary giants I was privileged to know