Business

Sri Lanka’s battle against NCDs: Is the Sugar-Beverage Tax doing enough?

Continued from yesterday

Priyanka

Jayawardena

Examining the timeline of SSB tax implementation in Sri Lanka reveals interesting insights. Initially set at 50 cents per gram (c/g) of sugar in 2017, the tax rate has changed, being subsequently reduced to 30 (c/g) per gram. This ad-hoc approach to adjusting tax rates has not accounted for inflation, potentially diluting the tax’s intended impact over time.

Is SSB Tax Effective in Sri Lanka?

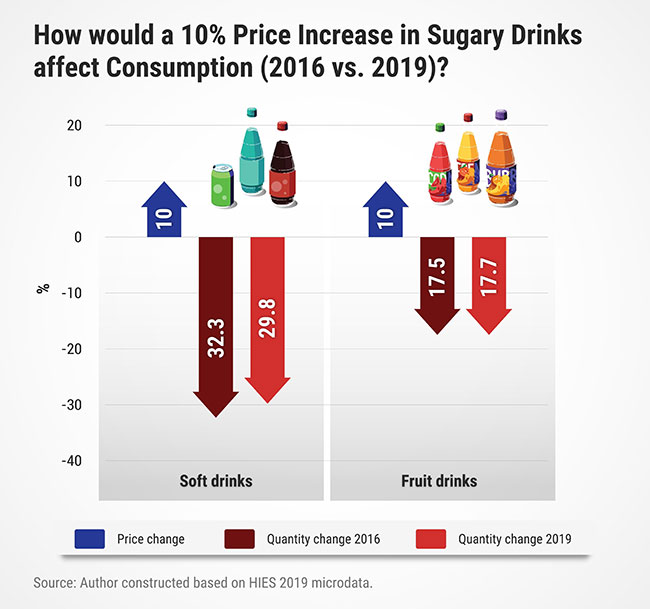

Price elasticity of demand measures how responsive consumers are to changes in price. Thus, understanding the price elasticity of SSBs in Sri Lanka can help predict the impact of the tax. In the context of the SSB tax, the IPS study finds that soft and fruit drinks exhibit a high level of price sensitivity, indicating that consumers are more likely to change their consumption behaviour when prices change.

The study reveals that a 10% price increase is associated with a remarkable reduction in the quantity of soft drinks (32% drop) and fruit drinks (18% drop). This finding underscores the tangible impact of the SSB tax on consumption habits, aligning with the initial intent of the tax – i.e., to lower the consumption of these unhealthy beverages.

While the SSB tax’s positive effects are evident, a nuanced trend merits attention. The study highlights that the potential effect of the tax has somewhat diminished over time. For instance, in 2019, people did not respond as strongly to price changes when buying soft drinks compared to 2016. This implies that when the price of soft drinks increased, it did not affect people’s buying habits as much in 2019 as it did in 2016. This could be due to the prices of other products rising to a higher level or because people’s purchasing power had improved. Additionally, the price sensitivity of fruit drinks remained relatively stagnant between 2016 and 2019. This intriguing finding indicates that while the tax had a significant initial impact on consumption patterns, this impact might be gradually waning.

The critical factor contributing to this trend is the lack of adjustment of SSB tax rates to account for inflation. Unlike other excise taxes that adapt over time, the SSB tax rates in Sri Lanka have not been regularly updated in response to changing economic conditions. Instead, adjustments have been made on an ad-hoc basis. Sri Lanka’s recent bout of spiraling inflation would have further eroded the ‘real’ tax substantially.

Benefits of Effective SSB Taxation

The introduction of SSB taxes in Sri Lanka reflects a commitment to tackling the alarming rise of NCDs. However, the real impact of such taxes can be compromised by inflation and insufficient adjustments over time. For these policies to achieve their intended goals, it is imperative to implement tax rates that factor in economic changes and maintain their potency in discouraging SSB consumption.

By adopting a comprehensive and adaptive approach, Sri Lanka can significantly improve public health outcomes and curb the NCD burden.

Policymakers should consider a proactive and data-driven approach to achieve meaningful reductions in SSB consumption through effective SSB taxes. Regular reviews of the tax rate, aligned with inflation and income growth, can help ensure that the tax remains a potent tool for promoting healthier dietary choices and combatting NCDs.

Furthermore, imposing a tax on unhealthy products such as SSBs will support the government’s continuous efforts to generate revenue without increasing the costs of essential goods at a critical time for the economy.

Business

HNB Finance bags 2 CMA Reporting Awards 2025

HNB Finance PLC has been honoured with two prestigious accolades at the CMA Excellence in Integrated Reporting Awards 2025, reaffirming the company’s commitment to transparency, good governance, and integrated business performance.

At this year’s ceremony, HNB Finance PLC was awarded Second Runner Up – joint in the category of “Best Integrated Report , Finance and Leasing Sector”, and also received a Merit Award in recognition of its continued efforts to enhance reporting quality and strengthen stakeholder communication.

The CMA Excellence in Integrated Reporting Awards, organised annually by the Institute of Certified Management Accountants (CMA) of Sri Lanka, acknowledge organisations that demonstrate superior financial reporting standards aligned with global best practices. Winners are assessed on key criteria such as financial performance and strategic management, corporate governance and compliance, innovation and digital transformation, sustainability practices, and professional excellence.

Chaminda Prabhath, Managing Director/CEO of HNB Finance PLC, commented on the recognition, “These awards reaffirm our commitment to upholding the highest standards of integrated reporting and transparent financial disclosure. At HNB Finance, we remain focused on delivering sustainable long-term value through robust governance frameworks, prudent financial management, and continuous innovation. The acknowledgement by CMA Sri Lanka reflects the disciplined efforts of our teams across the organization and motivates us to further enhance our reporting quality, strengthen ESG integration, and reinforce our stakeholder centric approach.”

Business

ComBank joins ‘Liya Shakthi’ scheme to further empower women-led enterprises

The Commercial Bank of Ceylon has reaffirmed its long-standing commitment to advancing women’s empowerment and financial inclusion, by partnering with the National Credit Guarantee Institution Limited (NCGIL) as a Participating Shareholder Institution (PSI) in the newly introduced ‘Liya Shakthi’ credit guarantee scheme, designed to support women-led enterprises across Sri Lanka.

The operational launch of the scheme was marked by the handover of the first loan registration at Commercial Bank’s Head Office recently, symbolising a key step in broadening access to finance for women entrepreneurs.

Representing Commercial Bank at the event were Mithila Shyamini, Assistant General Manager – Personal Banking, Malika De Silva, Senior Manager – Development Credit Department, and Chathura Dilshan, Executive Officer of the Department. The National Credit Guarantee Institution was represented by Jude Fernando, Chief Executive Officer, and Eranjana Chandradasa, Manager-Guarantee Administration.

‘Liya Shakthi’ is a credit guarantee product introduced by the NCGIL to facilitate greater access to financing for women-led Micro, Small, and Medium Enterprises (MSMEs) that possess viable business models and sound repayment capacity but lack adequate collateral to secure traditional bank loans. Through NCGIL’s credit guarantee mechanism, Commercial Bank will be able to extend credit to a wider segment of women entrepreneurs, furthering its mission to drive inclusive economic growth.

Business

Prima Group Sri Lanka supports national flood relief efforts with over Rs. 300 Mn in dry rations

Prima Group Sri Lanka has pledged assistance valued at over Rs. 300 million, providing essential Prima food products to support communities affected by the recent floods across the island. This relief initiative is being coordinated through the Ministry of Defence to ensure the timely and effective distribution of aid to impacted families.

As part of this commitment, Prima Group Sri Lanka donated a significant stock of Prima dry rations to the Government of Sri Lanka on 30 November. The consignment will be distributed across multiple severely impacted districts. These supplies will support families facing disruptions to daily life, ensuring they receive assistance as recovery efforts continue.

The handover took place at the Ministry, where the donation was received by the Secretary of Defence, Air Vice Marshal (Retired) Sampath Thuyacontha. Representing Prima Group Sri Lanka, Sajith Gunaratne – General Manager of Ceylon Agro Industries Limited, and Sanjeeva Perera – General Manager of Ceylon Grain Elevators PLC, officially presented the donation.

Prima Group has been standing with the people of Sri Lanka for over 40 years, and this donation reflects its broader commitment to the nation during challenging times. As relief operations continue across the island, the company remains focused on helping families rebuild their lives and supporting the ongoing recovery process in collaboration with the Government Authorities.

-

News4 days ago

Lunuwila tragedy not caused by those videoing Bell 212: SLAF

-

News3 days ago

News3 days agoLevel III landslide early warning continue to be in force in the districts of Kandy, Kegalle, Kurunegala and Matale

-

Latest News6 days ago

Latest News6 days agoLevel III landslide early warnings issued to the districts of Badulla, Kandy, Kegalle, Kurunegala, Matale and Nuwara-Eliya

-

Features5 days ago

Features5 days agoDitwah: An unusual cyclone

-

Latest News6 days ago

Latest News6 days agoUpdated Payment Instructions for Disaster Relief Contributions

-

News1 day ago

News1 day agoCPC delegation meets JVP for talks on disaster response

-

News1 day ago

News1 day agoA 6th Year Accolade: The Eternal Opulence of My Fair Lady

-

Latest News7 days ago

Latest News7 days agoLandslide Early Warnings issued to the Districts of Badulla, Colombo, Gampaha, Kalutara, Kandy, Kegalle, Kurunegala, Matale, Moneragala, Nuwara Eliya and Ratnapura