Business

Sri Lanka’s battle against NCDs: Is the Sugar-Beverage Tax doing enough?

By Priyanka Jayawardena

Priyanka Jayawardena

Non-communicable diseases (NCDs) lead to around 120,000 deaths in Sri Lanka each year, constituting 83% of the overall recorded deaths. The revised National Policy and Strategic Framework for the Prevention and Control of NCDs is a positive initiative by the government to address this. Such policies can play a crucial role in promoting healthier lifestyles, preventing NCDs, and improving overall public health. However, the question that lingers is, how effective are the existing measures, and where can we make improvements?

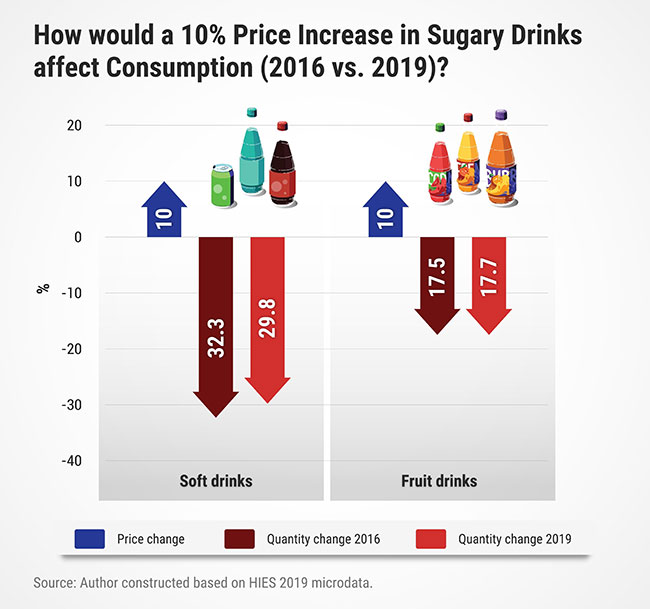

In the battle against NCDs, the government implemented a crucial policy in 2017 – the Sugar-Sweetened Beverage (SSB) tax. This tax aimed to curb the consumption of SSBs closely linked to health problems like obesity, diabetes, and dental issues. While this measure holds great promise, evaluating its effectiveness is difficult owing to data gaps. However, an IPS analysis of how SSB taxes are helping to reduce their consumption in Sri Lanka provides some initial insights.

The Case for Taxing SSBs

According to WHO 2019 estimates, diabetes is the second highest cause of death in Sri Lanka, accounting for 12,460 deaths. As rates of obesity and diet-related NCDs continue to increase, significant attention has been given to reducing the daily intake of sugar.

Taxing SSBs is a globally recommended option among evidence-based policy options to improve food environments. Research suggests several reasons for taxing SSBs, compared to other food products that contain free sugars. This is primarily due to the observed association between SSBs and NCDs, their high sugar content, and very little nutritional value.

By making these beverages more expensive, governments aim to discourage their consumption, ultimately leading to better public health outcomes. Beyond the health benefits associated with reduced SSB consumption, SSB taxes also raise revenue. When introducing the SSB tax in 2017, the government forecasted LKR 5 billion in revenue in 2018. Therefore, these taxes are recognised as a sensible way of reducing the incidence of NCDs.

Sri Lanka’s Sugary Drinks Tax

The effectiveness of the SSB tax can be influenced by its structure and rate. Higher tax rates are generally more effective in driving down consumption. In Sri Lanka, the SSB excise tax is imposed as a specific tax – i.e., applied on sugar content per 100 ml. By imposing higher costs on these beverages, the government intends to deter their consumption.

However, there is a factor that often goes unnoticed but can significantly affect the impact of SSB taxes – i.e., inflation. As the general price level of goods and services rises over time, the purchasing power of money decreases. This means that the same tax rate applied today might not have the same “real” value in the future due to the diminishing value of currency caused by inflation. On the other hand, as people’s average income per person goes up over time, specific tax rates have less impact over time.

Examining the timeline of SSB tax implementation in Sri Lanka reveals

Business

Why Sri Lanka’s new environmental penalties could redraw the Economics of Growth

For decades, environmental crime in Sri Lanka has been cheap.

Polluters paid fines that barely registered on balance sheets, violations dragged through courts and the real costs — poisoned waterways, degraded land, public health damage — were quietly transferred to the public. That arithmetic, long tolerated, is now being challenged by a proposed overhaul of the country’s environmental penalty regime.

At the centre of this shift is the Central Environmental Authority (CEA), which is seeking to modernise the National Environmental Act, raising penalties, tightening enforcement and reframing environmental compliance as an economic — not merely regulatory — issue.

“Environmental protection can no longer be treated as a peripheral concern. It is directly linked to national productivity, public health expenditure and investor confidence, CEA Director General Kapila Mahesh Rajapaksha told The Island Financial Review. “The revised penalty framework is intended to ensure that the cost of non-compliance is no longer cheaper than compliance itself.”

Under the existing law, many pollution-related offences attract fines so modest that they have functioned less as deterrents than as operating expenses. In economic terms, they created a perverse incentive: pollute first, litigate later, pay little — if at all.

The proposed amendments aim to reverse this logic. Draft provisions increase fines for air, water and noise pollution to levels running into hundreds of thousands — and potentially up to Rs. 1 million — per offence, with additional daily penalties for continuing violations. Some offences are also set to become cognisable, enabling faster enforcement action.

“This is about correcting a market failure, Rajapaksha said. “When environmental damage is not properly priced, the economy absorbs hidden losses — through healthcare costs, disaster mitigation, water treatment and loss of livelihoods.”

Those losses are not theoretical. Pollution-linked illnesses increase public healthcare spending. Industrial contamination damages agricultural output. Environmental degradation weakens tourism and raises disaster-response costs — all while eroding Sri Lanka’s natural capital.

Economists increasingly argue that weak environmental enforcement has acted as an implicit subsidy to polluting industries, distorting competition and discouraging investment in cleaner technologies.

The new penalty regime, by contrast, signals a shift towards cost internalisation — forcing businesses to account for environmental risk as part of their operating model.

The reforms arrive at a time when global capital is becoming more selective. Environmental, Social and Governance (ESG) benchmarks are now embedded in lending, insurance and trade access. Countries perceived as weak on enforcement face higher financing costs and shrinking market access.

“A transparent and credible environmental regulatory system actually reduces investment risk, Rajapaksha noted. “Serious investors want predictability — not regulatory arbitrage that collapses under public pressure or litigation.”

For Sri Lanka, the implications are significant. Stronger enforcement could help align the country with international supply-chain standards, particularly in manufacturing, agribusiness and tourism — sectors where environmental compliance increasingly determines competitiveness.

Business groups are expected to raise concerns about compliance costs, particularly for small and medium-scale enterprises. The CEA insists the objective is not to shut down industry but to shift behaviour.

“This is not an anti-growth agenda, Rajapaksha said. “It is about ensuring growth does not cannibalise the very resources it depends on.”

In the longer term, stricter penalties may stimulate demand for environmental services — monitoring, waste management, clean technology, compliance auditing — creating new economic activity and skilled employment.

Yet legislation alone will not suffice. Sri Lanka’s environmental laws have historically suffered from weak enforcement, delayed prosecutions and institutional bottlenecks. Without consistent application, higher penalties risk remaining symbolic.

The CEA says reforms will be accompanied by improved monitoring, digitalised approval systems and closer coordination with enforcement agencies.

By Ifham Nizam

Business

Milinda Moragoda meets with Gautam Adani

Milinda Moragoda, Founder of the Pathfinder Foundation, who was in New Delhi to participate at the 4th India-Japan Forum, met with Gautam Adani, Chairman of Adani Group.

Adani Group recently announced that they will invest US$75 billion in the energy transition over the next 5 years. They will also be investing $5 billion in Google’s AI data center in India.Milinda Moragoda,

Milinda Moragoda, was invited by India’s Ministry of External Affairs and the Ananta Centre to participate in the 4th India–Japan Forum, held recently in New Delhi. In his presentation, he proposed that India consider taking the lead in a post-disaster reconstruction and recovery initiative for Sri Lanka, with Japan serving as a strategic partner in this effort. The forum itself covered a broad range of issues related to India–Japan cooperation, including economic security, semiconductors, trade, nuclear power, digitalization, strategic minerals, and investment.

The India-Japan Forum provides a platform for Indian and Japanese leaders to shape the future of bilateral and strategic partnerships through deliberation and collaboration. The forum is convened by the Ministry of External Affairs, Government of India, and the Anantha Centre.

Business

HNB Assurance welcomes 2026 with strong momentum towards 10 in 5

HNB Assurance enters 2026 with renewed purpose and clear ambition as it moves into a defining phase of its 10 in 5 strategic journey. With the final leg toward achieving a 10% life insurance market share by 2026 now in focus, the company is gearing up for a year of transformation, innovation, and accelerated growth.

Closing 2025 on a strong note, HNB Assurance delivered outstanding results, continuously achieving growth above the industry average while strengthening its people, partnerships and brand. Industry awards, other achievements, and continued customer trust reflect the company’s strong performance and ongoing commitment to providing meaningful protection solutions for all Sri Lankans.

Commenting on the year ahead, Lasitha Wimalarathne, Executive Director / Chief Executive Officer of HNB Assurance, stated, “Guided by our 2026 theme, ‘Reimagine. Reinvent. Redefine.’, we are setting our sights beyond convention. Our aim is to reimagine what is possible for the life insurance industry, for our customers, and for the communities we serve, while laying a strong foundation for the next 25 years as a trusted life insurance partner in Sri Lanka. This year, we also celebrate 25 years of HNB Assurance, a milestone that is special in itself and a testament to the trust and support of our customers, partners and people. For us, success is not defined solely by financial performance. It is measured by the trust we earn, the promises we honor, the lives we protect, and the positive impact we create for all our stakeholders. Our ambition is clear, to be a top-tier life insurance company that sets benchmarks in customer experience, professionalism and people development.”

For HNB Assurance looking back at a year of progress and recognition, the collective efforts of the team have created a strong momentum for the year ahead.

“The progress we have made gives us strong confidence as we enter the final phase of our 10 in 5 journey. Being recognized as the Best Life Insurance Company at the Global Brand Awards 2025, receiving the National-level Silver Award for Local Market Reach and the Insurance Sector Gold Award at the National Business Excellence Awards, and being named Best Life Bancassurance Provider in Sri Lanka for the fifth consecutive year by the Global Banking and Finance Review, UK, reflect the consistency of our performance, the strength of our strategy, along with the passion, and commitment of our people.”

-

News3 days ago

News3 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

News3 days ago

News3 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

News4 days ago

News4 days agoPrivate airline crew member nabbed with contraband gold

-

News2 days ago

News2 days agoPrez seeks Harsha’s help to address CC’s concerns over appointment of AG

-

News2 days ago

News2 days agoGovt. exploring possibility of converting EPF benefits into private sector pensions

-

Features3 days ago

Features3 days agoEducational reforms under the NPP government

-

News6 days ago

News6 days agoHealth Minister sends letter of demand for one billion rupees in damages

-

Features4 days ago

Features4 days agoPharmaceuticals, deaths, and work ethics