News

Sri Lanka Insurance launches ‘SLIC Jeewana Shakthi’ for the Tea plantation sector

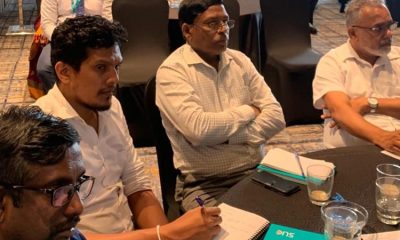

Sri Lanka Insurance, the largest and strongest insurer in the country introduces ‘SLIC Jeewana Shakthi’, a special Life and Health Insurance cover for the Estate and Plantation workers of Sri Lanka. This special cover was developed in collaboration with the Plantation Human Development Trust (PHDT) and the Ministry of Water Supply and Estate Infrastructure Development.

Sri Lanka Insurance, as a responsible insurance solutions provider taps in to new markets with new products to uplift the lifestyles of the people of the country. This stems down from their mandate of providing ‘insurance for all’ Sri Lankans. Understanding the importance of this community and their unique needs SLIC came forward to provide a suitable insurance solution for their well-being. As a result, the state owned insurer introduced ‘Sri Lanka Insurance Jeewana Shakthi’, a special life and health cover for this unique segment of customers.

‘SLIC Jeewana Shakthi’ is a life cover offered exclusively to the Estate employees and Plantation workers of the tea industry as a special insurance solution. It is offered as a family cover and it open for the employees between 18- 70 years of age and it includes critical illness benefits, hospital cash benefits, Life covers etc. The policy covers the policy holders spouse and children as well.

Commenting on introducing the ‘Sri Lanka Insurance Jeewana Shakthi’ insurance cover, Chandana L Aluthgama, Chief Executive Officer of Sri Lanka Insurance stated, SLIC continues to demonstrate its commitment to providing innovative and tailor made insurance solutions that cater to the evolving needs of the people of Sri Lanka by offering unparalleled value and comprehensive protection to its valued customers at an affordable price.

President Counsel Ronald C. Perera, Chairman of Sri Lanka Insurance said, Sri Lanka Insurance as the pioneer insurance provider of the country has always been in the forefront in understanding the pulse of the people and support them in improving their quality of life. The tea industry plays a pivotal role in the country’s economy and as responsible corporate citizens it is every organisation’s responsibility to facilitate such requirements to strengthen the economy of the country.

Barath Arullsamy Chairman of Plantation Human Development Trust said: “We stand on the threshold of a transformative moment with the introduction of ‘SLIC Jeevana Shakthi,’ a ground-breaking insurance scheme born from the collaboration between the Plantation Human Development Trust (PHDT), the Ministry of Water Supply and Estate Infrastructure Development, and Sri Lanka Insurance Corporation.

Jeevan Thondaman Minister of Water Supply and Estate Infrastructure Development of Sri Lanka commented, “Today marks a profound step forward as we unveil ‘SLIC Jeewana Shakthi’ – an exceptional insurance scheme co-crafted by the Ministry of Water Supply and Estate Infrastructure Development, the Plantation Human Development Trust (PHDT), and Sri Lanka Insurance Corporation. This initiative stands as a testament to our unwavering commitment to the welfare of tea estate workers, underpinned by the distinctiveness of this scheme.”

News

Speaker’s personal secretary accused of interference with ongoing bribery investigation

SJB Gampaha District MP Harshana Rajakaruna yesterday told Parliament that the Speaker’s Personal Secretary had written to the Secretary-General of Parliament seeking information on a complaint lodged with the Commission to Investigate Allegations of Bribery or Corruption (CIABOC) by a former Deputy Secretary of Parliament against the Speaker. Rajakaruna called for an immediate investigation into what he described as interference with an ongoing probe.

Raising the matter in the House, Rajakaruna said he had formally requested the Commission to initiate an inquiry into the conduct of the Speaker’s Personal Secretary, Chameera Gallage, questioning the authority under which such information had been sought.

Rajapakaruna tabled in Parliament a copy of the letter allegedly sent by Gallage to the Secretary-General requesting details of the bribery complaint.

Addressing the House, Rajakaruna said that the letter, sent two days earlier, had sought “full details” of the complaint against the Speaker. He maintained that seeking such information amounted to interference with an investigation and constituted a serious offence under the Bribery Act.

“The Speaker’s Secretary has no right to interfere with the work of the Bribery Commission. Under what law is he acting? What authority does he have? The Speaker, like everyone else, is subject to the law of the land,” Rajakaruna said, urging the Commission to take immediate action.

He noted that the Bribery Act treated the obstruction of investigations and the destruction of documents relating to such inquiries as serious offences punishable by law, and said he believed the Minister of Justice would concur.

The allegations sparked sharp reactions in the Chamber, as Opposition members called for accountability and due process in relation to the complaint against the Speaker.

By Saman Indrajith

News

Govt: Average power generation cost reduced from Rs. 37 to Rs. 29

The Ceylon Electricity Board has managed to reduce the average cost of electricity generation from Rs. 37 per unit to Rs. 29, marking a 22 percent reduction, Minister of Power and Energy Eng. Kumara Jayakody told Parliament yesterday.

Responding to an oral question raised by Opposition MP Ravi Karunanayake, the Minister said that electricity tariffs cannot be reduced unless the cost of generation is brought down.

“You cannot reduce electricity tariffs without reducing the cost of generation. What we are currently doing is buying at a higher price and selling at a lower price. When we assumed office, the cost of purchasing and generating electricity was Rs. 37 per unit. We have now managed to bring it down to Rs. 29, a reduction of 22 percent.

Our target is to further reduce this to Rs. 25. Once that is achieved, we will reduce electricity tariffs by 30 percent within three years, as we promised,” Minister Jayakody said.

He added that the government has already formulated a long-term generation plan to further expand the country’s power generation capacity.

According to the Minister, key measures include increasing the absorption of renewable energy into the national grid, expanding the national transmission and distribution network, introducing renewable energy storage systems, and constructing thermal and liquefied natural gas (LNG) power plants to replace aging facilities and meet future demand.

He also said that steps would be taken to enhance the capacity of existing hydropower plants as part of the broader strategy to ensure energy security and reduce long-term electricity costs.

By Ifham Nizam

News

India denies attack on Sri Lankan fishers

The Indian High Commission spokesperson yesterday (5) denied recent accusations regarding Indian naval personnel attacking Sri Lankan fishermen about a week after the incident.

The spokesperson said: “We have seen media reports of Sri Lankan fishermen assaulted at sea on 29 January 2026. On our side, we have ascertained and can confirm that no such assault was inflicted by any Indian Navy or Indian Coast Guard personnel. India has consistently maintained that a humanitarian approach should be adopted to fishermen’s livelihood concerns and that the use of force should not be resorted to under any circumstances. We continue to be in touch with the Government of Sri Lanka on these matters.”

Fisheries, Aquatic and Ocean Resources Minister on Feb 2 Ramalingam Chandrasekar condemned the alleged Indian attack carried out on January 29. The incident involved two fishing vessels carrying 12 men who set out from the Wellamankaraya Fishery Harbour in Wennappuwa. The fishermen are on record as having said that the attack took place in Sri Lankan waters.

President of the All-Island Multi-Day Boat Owners’ Association, Tyrone Mendis alleged that Indian Coast Guard vessels crossed Sri Lanka’s maritime boundary to carry out the assault.

-

Business6 days ago

Business6 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business3 days ago

Business3 days agoSLIM-Kantar People’s Awards 2026 to recognise Sri Lanka’s most trusted brands and personalities

-

Business6 days ago

Business6 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business6 days ago

Business6 days agoArpico NextGen Mattress gains recognition for innovation

-

Business5 days ago

Business5 days agoAltair issues over 100+ title deeds post ownership change

-

Editorial6 days ago

Editorial6 days agoGovt. provoking TUs

-

Business5 days ago

Business5 days agoSri Lanka opens first country pavilion at London exhibition

-

Business4 days ago

Business4 days agoAll set for Global Synergy Awards 2026 at Waters Edge