Business

Sri Lanka Insurance declares largest Life Insurance bonus in the industry

Amounting to a staggering Rs. 10.4 billion for the year 2022

Sri Lanka Insurance (SLIC) yet again outshines its own record to declare the largest Life Insurance bonus in the industry amounting to a staggering Rs. 10.4 Billion for the year 2022 to its policyholders. Since 2006 SLIC has triumphed in declaring the highest Life Insurance bonuses year on year in the industry cumulating to a massive Rs. 92.8 Billion making the SLIC bonus declaration unmatchable.

By declaring the highest and largest ever Life Insurance Bonus in the country, Sri Lanka Insurance has upheld the trust placed by the policyholders as the strongest insurance provider in Sri Lanka. Despite the challenging market conditions, Sri Lanka Insurance was able to increase its asset base to Rs. 274 Billion and the life fund to Rs. 156.7 Billion, to further strengthen its position as the largest and strongest local insurer. This affirms the prudent investment management strategies of the company and further emphasis on Sri Lanka Insurance’s commitment towards its policyholders and their well-being. Also Sri Lanka Insurance is the only insurer in the country to be rated with an A(lka) Fitch rating for insurer financial strength in the country.

Customer centricity is one of the key strategic pillars of SLIC’s business drive and therefore the organsiation is determined to look at identifying new market segment and understanding the needs of its customers to develop affordable and suitable products. A unique insurance cover that was introduced by Sri Lanka Insurance last year was the School Fee Protector. This cover takes care of children’s education expenses in an unlikely event of loss or permanent disability of the breadwinner of the family. In addition to engaging in product and process innovations the orgaisation also looks at numerous ways of value additions to its customers. As a result, during 2022 Sri Lanka Insurance introduced a Life Loyalty Rewards scheme enabling SLIC Life customers to enjoy a range of offers and benefits to provide higher value for its loyal customers throughout the policy term. Also during last year SLIC has paid on average Rs. 960Mn per month as Life Insurance claim settlement demonstrating its commitment to delivering its promise to its policyholders.

Furthermore, Educating the Sri Lankan people about the importance of Life Insurance is an aspect Sri Lanka Insurance holds close to its heart from the inception of its existence. The national insurer is at the forefront of propagating the concept of Life Insurance to every corner of the country ensuring the protection for all Sri Lankans.

Business

From Gut Feel to GPS: Why Sri Lankan brands must own their AI intelligence

By Ifham Nizam

Sri Lankan brands are standing at a strategic inflection point. Digital budgets have surged, social platforms have multiplied, and artificial intelligence has moved from novelty to necessity. Yet, despite unprecedented access to data, many organisations remain trapped in reactive decision-making—looking backwards rather than anticipating what lies ahead.

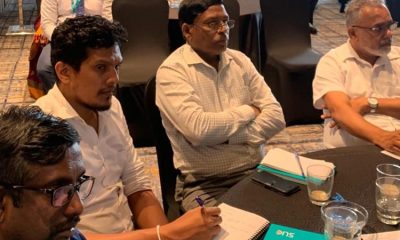

That contradiction was sharply articulated at a industry forum on Tuesday night bringing together global platform experts and local practitioners, where the central question was not whether Sri Lankan brands should adopt AI-powered intelligence, but whether they are prepared to own it.

Angel Calinisan, a global social intelligence leader working across emerging markets from Southeast Asia to South Asia, offered a compelling metaphor that framed the discussion.

“Brands are no longer using social intelligence as a rear-view mirror,” Calinisan said.

“They are starting to use it as a GPS. A rear-view mirror tells you what has already happened. A GPS tells you where you are headed—and warns you before you take the wrong turn.”

According to Calinisan, the most advanced brands are deploying AI-driven listening tools to spot anomalies in real time—early signals that indicate shifts in consumer behaviour, emerging reputational risks, or nascent trends before they peak.

“These anomalies could be negative sentiment during a brewing crisis, or they could be the first signs of a behavioural change,” he explained. “AI does what humans cannot do at scale—monitor conversations 24/7, identify what has changed, where it is happening, and who is driving it.”

Crucially, Calinisan stressed that prediction—not reporting—is where competitive advantage now lies. “You need to know whether a trend is just a fad or whether it has velocity and longevity. That predictive layer is what separates leaders from followers.”

For Sri Lankan companies operating in volatile economic and reputational environments, this ability to anticipate rather than react could be the difference between resilience and decline.

One of the most striking insights from Calinisan was her assertion that data is no longer the currency—time is.

“If you read about an issue in the newspaper or see it trending publicly on social media, you are already late,” he warned. “Conversations move across platforms at incredible speed. The brands that survive are the ones that detect signals early and buy themselves time to respond.”

This shift has significant business implications. Early detection allows organisations to protect brand equity, manage crises proactively, and even capitalise on emerging opportunities before competitors are aware they exist.

Calinisan pointed to metrics increasingly used by global brands, such as share of voice, which he said is “highly correlated with market share,” and net sentiment, a measure closely linked to digital brand equity. “These metrics are no longer for reporting decks—they are guiding business decisions.”

Beyond vanity metrics to boardroom relevance

That evolution from surface-level engagement to boardroom relevance was echoed by Anubhav Khanduja, who works closely with enterprise clients across India, South Asia, APEC and global markets.

“Likes and shares are no longer what boards care about,” Khanduja said. “Leadership teams want to see intent and revenue. They want to know how social media contributes to the funnel—from intent creation to conversion and attribution.”

According to Khanduja, enterprise measurement frameworks are rapidly shifting toward metrics that can be directly linked to business outcomes. “Attribution is critical. If you can connect intent and conversion back to your social platforms, that’s when digital earns its seat at the board table.”

This shift reflects a broader maturation of digital marketing—from a communications function to a revenue and growth driver.

As brands juggle five to seven platforms simultaneously, another challenge has emerged: how to centralise operations without flattening the unique culture of each platform.

Khanduja cautioned against the old model of pushing uniform content everywhere. “Content creation has become easy—anyone can do it. What matters now is not missing the essence of what each platform is built for.”

He argued that AI should be used to improve marketer productivity, not replace human judgment. “You can centralise research, workflows and optimisation, while keeping the authentic voice intact and respecting platform-specific nuances.”

The goal, he said, is “doing more with less—without losing relevance.”

A recurring theme throughout the discussion was the danger of outsourcing intelligence entirely to agencies and consultancies.

Calinisan was blunt: “The brands pulling ahead are bringing these capabilities in-house. They have management support, clear KPIs, and training programmes that allow teams to experiment, fail, learn and iterate.”

This internalisation of intelligence allows organisations to respond faster, protect institutional knowledge, and build long-term strategic muscle—rather than “renting insight” on a project-by-project basis.

Khanduja reinforced this view, noting that as trust deficits grow in an age of AI-generated content and saturated advertising, credibility increasingly comes from authentic voices—especially employees.

“Employees are becoming central to brand amplification,” he said. “People trust people more than ads. When organisations activate employees responsibly, they gain reach, credibility and resilience—especially during times of change or crisis.”

For Sri Lanka’s corporate sector, the message was clear. Digital transformation is no longer about spending more on ads or adopting the latest tool. It is about owning intelligence, embedding predictive thinking into decision-making, and aligning technology with culture.

As Calinisan summed it up: “It’s not about having more data. It’s about knowing sooner than everyone else—and having the time to act.”

In an increasingly competitive and uncertain environment, that early insight may well become Sri Lankan brands’ most valuable asset.

By Ifham Nizam

Business

Dialog sponsors Gangaramaya Navam Maha Perahera

Dialog Axiata PLC, Sri Lanka’s #1 connectivity provider, reaffirms its commitment to preserving national heritage by sponsoring the Gangaramaya Navam Maha Perahera for the fourteenth consecutive year, supporting a revered religious celebration while advancing cultural patronage, community stewardship, and corporate responsibility that strengthens shared values and continuity across Sri Lanka.

The annual Gangaramaya Navam Maha Perahera, one of Sri Lanka’s most significant religious and cultural expressions, was held on 31st January and 1st February, drawing thousands of devotees and visitors to the historic Gangaramaya Temple in Colombo. As a long-term patron, Dialog’s continued sponsorship enables the seamless conduct of this eminent Perahera while reinforcing its role as a leading corporate advocate of Sri Lankan culture and heritage.

Beyond the Gangaramaya Navam Maha Perahera, Dialog has been a long-term patron of many significant national events including the Kandy Esala Perahara, Kelaniya Duruthu Festival, Katharagama Esala Perahara and Gatabaru Esala Perahara. These efforts align with the company’s broader heritage preservation initiatives, which include constructing the vestibule for the Dimbulagala Aranya Senasanaya, launching a website and directory of Amarapura Maha Nikaya Temples, and restoring the Anuradhapura Maha Vihara Sannipatha Shalawa.

Business

Kala Pola – Sri Lanka’s iconic open-air art fair – returns

Sri Lanka’s renowned open-air art fair, Kala Pola, is set to bring alive the streets of Colombo with colour, creativity, and conversation as Kala Pola returns for its 33rd edition on Sunday, 8th February, along Ananda Coomaraswamy Mawatha (Green Path), Colombo 07.

Conceptualised and introduced by The George Keyt Foundation in 1993, and sponsored and co-presented by the John Keells Group through an unbroken patronage since 1994, Kala Pola has grown into a cultural landmark that continues to reshape how visual art is showcased and experienced in Sri Lanka. Remaining true to its founding philosophy, the event is proudly uncurated, providing participating artists and sculptors with the opportunity to showcase their talent, connect with art enthusiasts, learn from and network with other artists, and expand their clientele.

Kala Pola displays a broad variety of forms and styles, ranging from intricate sculptures, humorous caricatures, and abstract paintings to modern and traditional Sri Lankan art. Attracting art lovers, collectors, connoisseurs, and students from all parts of the country and tourists from various parts of the world, the event creates a vibrant, welcoming, and wholesome atmosphere spurred by music, camaraderie, art discussions, children’s art workshops, and an array of cultural performances.

As a longstanding and iconic visual art flagship amidst Sri Lanka’s vibrant calendar of arts and cultural events, Kala Pola continues to stand as a unique open-air platform for visual expression. By bringing together both established and emerging artists in an inclusive, uncurated setting in the heart of Colombo, the event fosters meaningful connections between creators and audiences, offering accessibility, diversity, discourse and a shared appreciation for art among a wide cross-section of the public, while spurring the creative economy of the country. Nations Trust Bank (NTB) also supports Kala Pola as its official banking partner.

Arts falls within the focus area of Social Health and Cohesion which is one of the four focus areas of John Keells Foundation (JKF) – the CSR entity of John Keells Holdings PLC (JKH), Sri Lanka’s largest listed conglomerate in the Colombo Stock Exchange operating over 80+ companies in 7 diverse industry sectors. With a history of over 150 years, John Keells Group provides employment to over 18,000 persons and has been ranked as Sri Lanka’s ‘Most Respected Entity’ for 20 Years by LMD Magazine. Whilst being a full member of the World Economic Forum and a Participant of the UN Global Compact, JKH drives its CSR vision of “Empowering the Nation for tomorrow” through JKF.

-

Opinion6 days ago

Opinion6 days agoSri Lanka, the Stars,and statesmen

-

Business5 days ago

Business5 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business2 days ago

Business2 days agoSLIM-Kantar People’s Awards 2026 to recognise Sri Lanka’s most trusted brands and personalities

-

Business5 days ago

Business5 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business5 days ago

Business5 days agoArpico NextGen Mattress gains recognition for innovation

-

Business4 days ago

Business4 days agoAltair issues over 100+ title deeds post ownership change

-

Business4 days ago

Business4 days agoSri Lanka opens first country pavilion at London exhibition

-

Editorial5 days ago

Editorial5 days agoGovt. provoking TUs