Business

Spring board to ‘unleashing a new era in start-up driven growth’

In an impassioned call to action, Deputy Minister of Industry and Entrepreneurship Development, Chathuranga Abeysinghe, declared that Sri Lanka was ready to “unleash a new era of startup-driven growth, as he kicked off the prelude to Disrupt Asia 2025 — a four-day mega-event that aspires to redefine the nation’s digital economy and transform it into South Asia’s next innovation hub.

“We are no longer waiting for the future. We are building it, right here, starting now, said Abeysinghe. “With Disrupt Asia, we aim to place Sri Lanka firmly on the map as a gateway to South Asia, the Gulf, and Southeast Asia for global investors, innovators and disruptors.”

Scheduled to run from September 17–20 in Colombo, Disrupt Asia 2025 is more than just another tech event. Backed by the Ministry of Digital Economy and the ICT Agency (ICTA), the platform is being positioned as the national accelerator for startups and innovation—bringing together universities, industry leaders, policymakers, investors, and the general public into one unified ecosystem.

The event is anchored in Sri Lanka’s broader ambition to grow its digital economy from a current estimated transaction volume of USD 3–5 billion to USD 15 billion by 2030. To achieve this, the government is rolling out a multi-pronged strategy: a USD 50 million Fund of Funds to boost venture capital availability, the creation of a Virtual Special Economic Zone (SEZ) and new equity pathways for startups through the Colombo Stock Exchange.

Deputy Minister Abeysinghe noted that the government was working with financial advisory firm KPMG to address longstanding taxation and regulatory hurdles, including the double taxation of venture capital funds and limited frameworks for foreign co-founders.

“These policies are no longer in the shadows, he stressed. “They are being debated, fixed and aligned so that startups can thrive in a globally competitive landscape.”

Heminda Jayaweera, Executive Director at TRACE Sri Lanka, the ecosystem partner and host of the Innovation Festival on September 19, called the event “a confluence of creativity, code, and capital.”

TRACE Expert City will host more than 50 interactive product demos, themed exhibitions spanning HealthTech, AgriTech, FinTech, AI, Tourism, and GovTech, and immersive installations aimed at both the general public and young innovators.

Jayaweera emphasized the importance of creating an “incubation ground” that serves not just the tech elite, but also students, small-town entrepreneurs, and policymakers. “This is where ideas collide and evolve,” he said. “It’s where we disrupt the status quo.”

Sandun Hapugoda, Country Manager of Mastercard Sri Lanka and Maldives, added a private sector perspective to the conversation. “This is not just another tech expo, he said. “It’s a serious commitment to transform Sri Lanka into a digitally inclusive, investor-attractive economy.”

Mastercard’s participation as a strategic partner underscores the importance of collaboration in achieving these goals. “Innovation doesn’t happen in silos, Hapugoda noted. “We are working with entrepreneurs, policymakers, and financiers to build scalable solutions.”

Mastercard’s support extends to FinTech integrations, digital commerce enablement, and cybersecurity solutions — all crucial building blocks for a vibrant digital economy.

Prajeeth Balasubramaniam, Managing Partner at BOV Capital and founder of LAN, said the platform was already working to secure listings for at least two promising startups on the Colombo Stock Exchange. “Equity is not a foreign concept. We’re just late adopters. But now, we’re building the runway, he said.

Disrupt Asia 2025 will also host a “Sundowner Cultural Showcase” that celebrates Sri Lanka’s creative and artisanal identity. Featuring curated culinary offerings from Asaya Sands, gem exhibitions, and artisanal tastings, the event aims to build a bridge between innovation and tradition.

“This is more than a networking mixer, said event curator Ruwani Fernando. “It’s a statement. Sri Lanka is a land of both ancient wisdom and future-focused solutions.”

By Ifham Nizam

Business

Sampath Bank’s strong results boost investor confidence

The latest earnings report for Sampath Bank PLC (SAMP), analysed by First Capital Research (FCR), firmly supports a positive outlook among investors. The research firm has stuck with its “MAINTAIN BUY” recommendation , setting optimistic targets: a Fair Value of LKR 165.00 for 2025 and LKR 175.00 for 2026. This signals strong belief that the bank is managing the economy’s recovery successfully.

The key reason for this optimism is the bank’s shift towards aggressive, yet smart, growth. Even as interest rates dropped across the market, which usually makes loan income (Net Interest Income) harder to earn, Sampath Bank saw its total loans jump by a huge 30.2% compared to last year. This means the bank lent out a lot more money, increasing its loan book to LKR 1.1 Trillion. This strong lending, which covers trade finance, leasing, and regular term loans, shows the bank is actively helping businesses and people spend and invest as the economy recovers.

In addition to loans, the bank has found a major new source of income from fees and commissions, which surged by 42.6% year-over-year. This money comes from services like card usage, trade activities, and digital banking transactions. This shift makes the bank less reliant on just interest rates, giving it a more stable and higher-profit way to earn money.

Importantly, this growth hasn’t weakened the bank’s foundations. Sampath Bank is managing its funding costs better, partly by improving its low-cost current and savings account (CASA) ratio to 34.5%. Moreover, the quality of its loans is getting better, with bad loans (Stage 3) dropping to 3.77% and the money set aside to cover potential losses rising to a careful 60.25%.

Even with the new, higher capital requirements for systemically important banks, the bank remains very strong, keeping its capital and cash buffers robust and well above the minimum standards.

In short, while the estimated profit for 2025 was adjusted slightly, the bank’s excellent performance and strong strategy overshadow this minor change. Sampath Bank is viewed as a sound stock with high growth potential , offering investors attractive total returns over the next two years.

By Sanath Nanayakkare

Business

ADB approves $200 million to improve water and food security in North Central Sri Lanka

The Asian Development Bank (ADB) has approved a $200 million loan to support the ongoing Mahaweli Development Program, Sri Lanka’s largest multiuse water resources development initiative.

The program aims to transfer excess water from the Mahaweli River to the drier northern and northwestern parts of Sri Lanka. The Mahaweli Water Security Investment Program Stage 2 Project will directly benefit more than 35,600 farming households in the North Central Province by strengthening agriculture sector resilience and enhancing food security.

ADB leads the joint cofinancing effort for the project, which is expected to mobilize $60 million from the OPEC Fund for International Development and $42 million from the International Fund for Agricultural Development, in addition to the ADB financing.

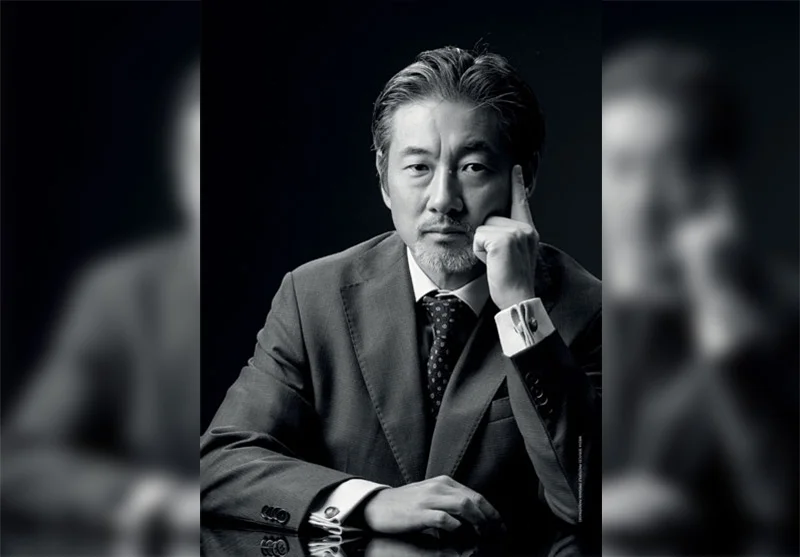

“While Sri Lanka has reduced food insecurity, it remains a development challenge for the country,” said ADB Country Director for Sri Lanka Takafumi Kadono. “Higher agricultural productivity and crop diversification are necessary to achieve food security, and adequate water resources and disaster-resilient irrigation systems are key.”

The project will complete the government’s North Central Province Canal (NCPC) irrigation infrastructure, which is expected to irrigate about 14,912 hectares (ha) of paddy fields and provide reliable irrigated water for commercial agriculture development (CAD). It will help complete the construction of tunnels and open and covered canals. The project will also establish a supervisory control and data acquisition system to improve NCPC operations. Once completed, the NCPC will connect the Moragahakanda Reservoir to the reservoirs of Huruluwewa, Manankattiya, Eruwewa, and Mahakanadarawa.

Sri Lanka was hit by Cyclone Ditwah in late November, resulting in the country’s worst flood in two decades and the deadliest natural hazard since the 2004 tsunami. The disaster damaged over 160,000 ha of paddy fields along with nearly 96,000 ha of other crops and 13,500 ha of vegetables.

Business

ComBank to further empower women-led enterprises with NCGIL

The Commercial Bank of Ceylon has reaffirmed its long-standing commitment to advancing women’s empowerment and financial inclusion, by partnering with the National Credit Guarantee Institution Limited (NCGIL) as a Participating Shareholder Institution (PSI) in the newly introduced ‘Liya Shakthi’ credit guarantee scheme, designed to support women-led enterprises across Sri Lanka.

The operational launch of the scheme was marked by the handover of the first loan registration at Commercial Bank’s Head Office recently, symbolising a key step in broadening access to finance for women entrepreneurs.

Representing Commercial Bank at the event were Mithila Shyamini, Assistant General Manager – Personal Banking, Malika De Silva, Senior Manager – Development Credit Department, and Chathura Dilshan, Executive Officer of the Department. The National Credit Guarantee Institution was represented by Jude Fernando, Chief Executive Officer, and Eranjana Chandradasa, Manager-Guarantee Administration.

‘Liya Shakthi’ is a credit guarantee product introduced by the NCGIL to facilitate greater access to financing for women-led Micro, Small, and Medium Enterprises (MSMEs) that possess viable business models and sound repayment capacity but lack adequate collateral to secure traditional bank loans.

-

Features5 days ago

Features5 days agoFinally, Mahinda Yapa sets the record straight

-

News6 days ago

News6 days agoCyclone Ditwah leaves Sri Lanka’s biodiversity in ruins: Top scientist warns of unseen ecological disaster

-

Features5 days ago

Features5 days agoHandunnetti and Colonial Shackles of English in Sri Lanka

-

Business4 days ago

Business4 days agoCabinet approves establishment of two 50 MW wind power stations in Mullikulum, Mannar region

-

News4 days ago

News4 days agoGota ordered to give court evidence of life threats

-

Features6 days ago

Features6 days agoAn awakening: Revisiting education policy after Cyclone Ditwah

-

Features4 days ago

Features4 days agoCliff and Hank recreate golden era of ‘The Young Ones’

-

Opinion5 days ago

Opinion5 days agoA national post-cyclone reflection period?