Business

Special goods and services tax: Issues and concerns

By Dr Roshan Perera & Naqiya Shiraz

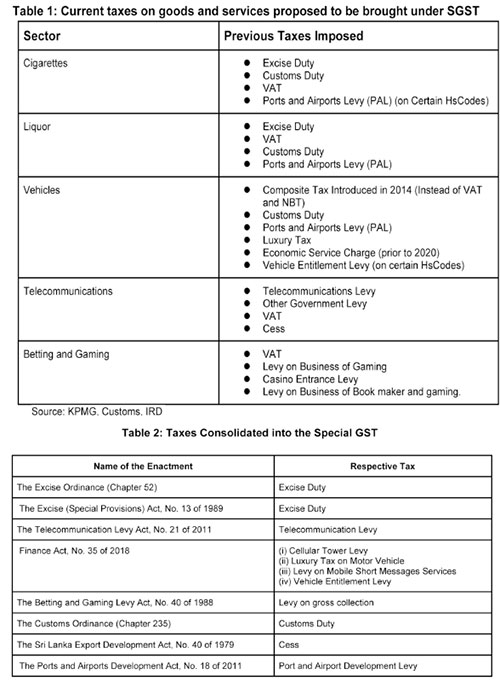

The new bill titled ‘Special Goods and Services Tax’ was published by gazette dated 07 January 2022.1 The Special Goods and Services Tax (SGST) was originally proposed in Budget speech 2021 but was not implemented. It has once again been presented in Budget 2022. The SGST aims to consolidate taxes on manufacturing and importing cigarettes, liquor, vehicles and assembly parts, while also consolidating taxes on telecommunication and betting and gaming (see table 1 for existing taxes on these products and table 2 for taxes consolidated into the SGST as per the schedule in the gazette). The rationale for this new tax as per the bill is “…to promote self-compliance in the payment of taxes in order to ensure greater efficiency in relation to the collection and administration on such taxes by avoiding the complexities associated with the application and administration of a multiple tax regime on specified goods and services.”

Given the multiplicity of taxes and the complexity of the current tax system as a whole, rationalising taxes is necessary to improve collection. However, whether the proposed SGST simplifies the tax system, while ensuring revenue neutrality or even improving revenue collection, needs to be carefully examined.

The SGST Bill is silent on the treatment of the existing VAT on these goods and services. However, according to the Value Added Tax (Amendment) Bill also gazetted on 07 January 2022,1 liquor, cigarettes and motor vehicles will be exempted from VAT while telecommunications and betting and gaming services will still be subject to VAT.

While the gazetted Bill sets out some of the features of the proposed SGST there are many important areas not covered in the Bill. These are expected to be gazetted as and when required by the Minister in charge.

Issues & Concerns

The motivation behind SGST is the simplification of the tax system. Although the objective of introducing the SGST is to improve efficiency by reducing the complexity of the tax system there are many issues and concerns with this proposed tax.

Revenue

Tax revenue which was 13% of GDP in 2010, declined to 8% in 2020. Ad hoc policy changes and weak administration contributed to the decline in tax revenue collection. This continuous decline in tax revenue has led to widening fiscal deficits and increasing debt. One of the main reasons for the current macroeconomic crisis is low tax revenue collection. Hence, any change to the existing tax system should be with the primary objective of raising more revenue.

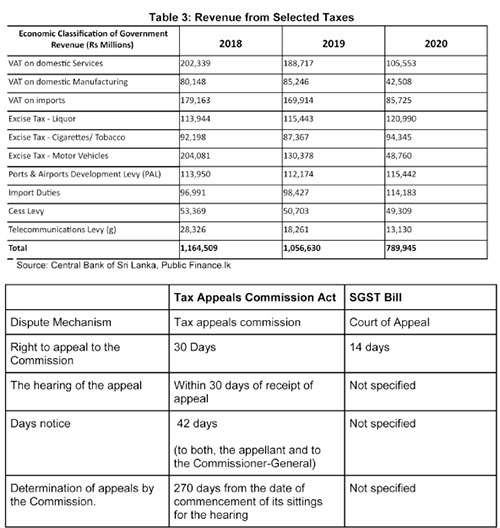

According to the budget speech the SGST is estimated to bring in an additional Rs. 50 billion in revenue in 2022.1 Revenue from taxes proposed to be consolidated under the SGST has significantly declined over the past 3 years. Given the already difficult macroeconomic environment, along with ad hoc tax policy changes raising the additional revenue estimated at Rs. 50 billion seems a difficult task.

Tax Base and Rate

For the SGST to raise taxes in excess of what is already being collected through the existing taxes, the rate and the base for the SGST needs to be carefully and methodically calculated. Further, the existing taxes have different bases of taxation. For instance the basis of taxation of motor vehicles is both on an ad valorem1 basis and a quantity basis while the basis of taxation of cigarettes and liquor is quantity.2 In light of this, the basis of taxation on which SGST isapplied becomes an issue. Having different bases and different rates for various goods and services would complicate the implementation of the tax These issues need to be carefully considered to ensure the new tax is revenue neutral or be able to enhance revenue collection.

Efficiency

One possible revenue benefit of this proposal is the inability to claim input tax credits on the sectors exempted from VAT. However, the issue is the cascading effect that would result where there would be a tax on tax with the end consumer paying taxes on already paid taxes. If the idea was to raise additional revenue by limiting tax credits, it would have been simpler to raise the tax rates on the existing taxes rather than introduce a new tax.

4. Administration

According to the bill, SGST will now be collected through a new unit set up under the General Treasury where a Designated Officer (DO) will be in charge of the administration, collection and accountability of the tax. The existing revenue collection agencies, such as the Inland Revenue Department (IRD) or the Excise Department will not be primarily responsible for the collection of this tax. By removing the IRD and Excise Department, a parallel bureaucracy will be created, at a time when public spending needs to be carefully managed. The General Treasury also has no previous experience and expertise in direct revenue collection. Weak administration is one of the key reasons for the low tax collection and success of this tax would depend on the strength of its administration.

In addition to the above mentioned concerns, as per the Bill the minister in charge of the SGST has been vested with the power to set the rates, the base and grant exemptions. Accordingly, Parliamentary oversight over fiscal matters is weakened under this proposed Bill.

It could also lead to a time lag between the gazetting and implementing of changes to the SGST (such as the rate, base etc) and obtaining Parliamentary approval for those changes.

Dispute resolution

The SGST Bill also focuses on the dispute resolution mechanism. Under the present tax system, with the enactment of the Tax Appeals Commission Act, No. 23 in 2011 the Tax Appeals Commission has the “responsibility of hearing all appeals in respect of matters relating to imposition of any tax, levy or duty”.1 The most recent amendment to the Tax Appeal

Commissions act (2013)1 seeks to address the large number (495) of cases pending before the Tax Appeals Commision2 by increasing the number of panels to hear the appeals.

Under the proposed SGST disputes will be handled through the court of appeal. However, the time period by which specific actions need to be taken is not provided in the bill. In addition, disputes have to be taken to the court of appeal. Hence, the entire process will be more time consuming. This could result in revenue lags and difficulties in revenue estimation until disputes are resolved.

Additionally, in the case that no valid appeal has been lodged within 14 days, any remaining payments would be considered to be in default. Thereafter, the responsibility is shifted to the Commissioner General of the IRD to recover the dues. Given the IRD is completely removed from the normal collection process, the rationale for bringing defaults under the IRD is not clear.

III. Policy Recommendations

As discussed, the SGST Bill has several limitations and much of this is due to the ambiguities in the Bill.

If the tax is implemented, the rate and basis of taxation needs to be revenue neutral to ensure tax collection is maximised and administrative costs minimised.

The rates, basis of taxation, exemptions etc should be specified in the Bill, as done in most other Acts. This would avoid the power for discretionary changes to the tax being placed in the hands of the minister in charge.

Given the already weak tax administration, it would be more sensible to strengthen the existing revenue collecting agencies and address the weaknesses in the existing system without creating a parallel bureaucracy.

In the case where VAT is consolidated into the proposed GST, the issue of cascading effect of input tax credits needs to be addressed. This is relevant particularly in the case of capital expenditure.

Given the critical state of revenue collection in the country the question to ask is whether this is the best time to introduce a new tax. Focus should be on fixing issues in the existing tax system to ensure revenue is maximised. The VAT is the least distortionary tax and it is the easiest to administer. Given these features it can be a very efficient revenue generator for a country. Therefore instead of introducing a new tax, capitalising on systems that are already in place and amending the VAT rate, threshold and exemptions may be a more practical solution to the revenue problem that the country is currently facing.

Dr. Roshan Perera is a Senior Research Fellow at the Advocata Institute and the former Director of the Central Bank of Sri Lanka.

Naqiya Shiraz is a Research Analyst at the Advocata Institute.

The opinions expressed are the author’s own views. They may not necessarily reflect the views of the Advocata Institute, or anyone affiliated with the institute.

Business

Real economic data isn’t in a report: It’s on a bargain table

If you want to understand Sri Lanka’s economy, don’t start with reports from the Ministry of Finance or the Central Bank. Go instead to a crowded clothing sale on the outskirts of Colombo.

In places like Nugegoda, Nawala, and Maharagama, temporary year-end sales have sprung up everywhere. They draw large crowds – not just bargain hunters, but families carefully planning every rupee. People arrive with SMS alerts on their phones and fixed budgets in their minds. This is not casual shopping. It is a public display of resilience, a tableau of how people are coping.

Tables are set up in parking lots and open halls, clothes spilling from cardboard boxes. When new stock arrives, hands reach in immediately – young and old, men and women – searching for the right size, the least faded colour, the smallest flaw that justifies the price. Everyone is heard negotiating, not with desperation, but with a quiet, shared dignity.

“Look at the prices in the malls, then look here,” says a middle-aged mother shopping for school uniforms in Maharagama. “This isn’t shopping for enjoyment. This is about managing life.” Food prices have already stretched her household budget thin. Here, she can buy trousers for half the usual price.

Women, often the household’s purchasing managers, move with determined efficiency. Men are just as involved – checking stiches, comparing prices, trying shirts over their own clothes. Inflation, here, wears the same face on everyone.

Bright banners promise “Trendy Styles!”, but most shoppers know better. These are last season’s clothes, cleared out to make room for next year’s stock. Still, no one feels embarrassment. “New” now simply means something you didn’t own before; the label matters far less than the price.

Not all items are discounted equally. Essentials – work trousers, denims, track pants – are only slightly cheaper. Sellers know these will sell regardless. The steepest discounts are reserved for the items people can almost afford to skip.

This is economic data you won’t find in official reports. Here, inflation is measured in real time. A young man studies a shirt’s price tag and calculates how many days of work it represents. Friends debate whether a slight fade is a fair trade for the price. Every transaction is a careful calculation.

Year-end sales have always existed. But since the economic crisis, they have taken on a new, grim significance. They offer a slight reprieve to households learning to steadily lower their aspirations. While the government speaks of fiscal discipline and a steady Treasury, everyday life remains a tightrope walk.

The Central Bank measures inflation in percentages. On the streets of Kiribathgoda, it is measured in trade-offs: one item instead of two; buying now or waiting for the Avurudu season; choosing need over want, again and again.

As evening falls, the crowds thin. The tables are left rumpled, hangers scattered like fallen leaves. Yet these spaces tell a story more powerful than any quarterly report – a story of business ingenuity, household struggle, and an economy where every single purchase is weighed with immense care.

In that careful weighing lies a quiet, unsettling truth. No matter what is said about replenished reserves or balanced budgets, these bargain tables – if they could speak – would tell the nation’s most heart-rending story. And they do, to anyone who chooses to listen.

By Sanath Nanayakkare

Business

Global economy poised for growth in 2026, says Goldman Sachs, despite uneven job recovery

The global economy is forecast to expand by a “sturdy” 2.8% in 2026, exceeding consensus expectations, according to the latest Macro Outlook report from Goldman Sachs Research. This optimistic projection highlights a resilient recovery trajectory across major economies, albeit with significant regional variations and a persistent disconnect with labour market strength.

Goldman Sachs economists are most bullish on the United States, expecting GDP growth to accelerate to 2.6%, substantially above consensus estimates. This optimism stems from anticipated tax cuts, easier financial conditions, and a reduced economic drag from tariffs. The report notes that consumers will receive approximately an extra $100 billion in tax refunds in the first half of next year, providing a front-loaded stimulus. A rebound from the past government shutdown is also expected to contribute to what chief economist Jan Hatzius predicts will be “especially strong GDP growth in the first half” of 2026.

China’s economy is projected to grow by 4.8%, underpinned by robust manufacturing and export performance. However, economists caution that parts of the domestic economy continue to show weakness. In the euro area, growth is forecast at a modest 1.3%, supported by fiscal stimulus in Germany and strong growth in Spain, despite the region’s longer-term structural challenges.

A key concern outlined in the report is the stagnant global labour market. Job growth across all major developed economies has fallen well below pre-pandemic 2019 rates. Hatzius links this weakness partly to a sharp downturn in immigration, which has slowed labour force growth, with the disconnect being most pronounced in the United States.

While artificial intelligence (AI) dominates technological discourse, Goldman Sachs economists believe its broad productivity benefits across the wider economy are still several years away, with impacts so far largely confined to the tech sector.

Business

India trains Sri Lankan gem and jewellery artisans in landmark capacity-building programme

A 20-member delegation of professionals from Sri Lanka’s Gem and Jewellery sector visited India from 1–20 December 2025 to participate in a specialised Training and Capacity Building Programme. The delegation represented the gemstone cutting and polishing segments of Sri Lanka’s Gem and Jewellery industry.

The programme was organised pursuant to the announcement made by Prime Minister of India, Narendra Modi, during his visit to Sri Lanka in April 2025, under which India committed to offering 700 customised training slots annually for Sri Lankan professionals as part of ongoing bilateral capacity-building cooperation.

The 20-day training programme was conducted by the Government of India at the Indian Institute of Gem & Jewellery, Jaipur, Rajasthan. The curriculum comprised a comprehensive set of technical and thematic sessions covering the entire Gem and Jewellery value chain. Key modules included cleaving and sawing, pre-forming, shaping, cutting and faceting, polishing, quality assessment, and industry interactions, aimed at strengthening practical skills and enhancing design and production capabilities.

As part of the experiential learning component, the participants undertook site visits to leading gemstone manufacturing units, gaining first-hand exposure to contemporary production technologies, design development processes, and modern retail practices within India’s Gem and Jewellery ecosystem.

The specialised training programme contributed meaningfully to strengthening professional competencies, promoting knowledge exchange, and deepening institutional and industry linkages in the Gem and Jewellery sector between India and Sri Lanka, reflecting the continued commitment of both countries to capacity building and people-centric economic cooperation.

-

News6 days ago

News6 days agoMembers of Lankan Community in Washington D.C. donates to ‘Rebuilding Sri Lanka’ Flood Relief Fund

-

News4 days ago

News4 days agoBritish MP calls on Foreign Secretary to expand sanction package against ‘Sri Lankan war criminals’

-

Features6 days ago

Features6 days agoGeneral education reforms: What about language and ethnicity?

-

News6 days ago

News6 days agoSuspension of Indian drug part of cover-up by NMRA: Academy of Health Professionals

-

Sports4 days ago

Sports4 days agoChief selector’s remarks disappointing says Mickey Arthur

-

News3 days ago

News3 days agoStreet vendors banned from Kandy City

-

Editorial6 days ago

Editorial6 days agoA very sad day for the rule of law

-

News6 days ago

News6 days agoUS Ambassador to Sri Lanka among 29 career diplomats recalled