Business

Siyapatha Finance records LKR 1 Bn PAT for Fy 2021, an impressive increase of 167%

Siyapatha Finance has continued on its robust performance, despite the pandemic-induced economic challenges, ending the 2021 financial year with the highest ever profitability through its Profit Before Tax reaching LKR 1.53 Bn. Profit after tax increased by 167% from LKR 409.5 Mn in 2020 to LKR 1,094.5 Mn in 2021. Income growth coupled with prudent management of operating expenses resulted in the substantial improvement of the cost to income ratio to 33.56% from 39.28% the previous year. The Company continued to systematically focus on its well performing segments, whilst maintaining its risk management strategies, credit quality and improving the recovery efforts.

Another noteworthy achievement was the management of Non-Performing Advances (NPA). During the year, the Company managed to reduce its gross NPA ratio to 16% from 18% in 2020. Despite the moratoria and drastic decline in economic activities, the Company was able to contain the NPA of the leasing portfolio within the industry benchmark of 12%. This reflects its commitment to driving recoveries and maintaining credit quality despite the downturn in business activities.

The Company held a strong asset base of LKR 42.75 Bn as at 31 December 2021, recording a growth of LKR 1,198.59 Million during the year. Total liabilities of the Company increased marginally to LKR 36.52 Bn as at 31 December 2021 compared to LKR 36.43 Bn as at 31 December 2020. The Company’s Return on Average Assets grew by 163 bps to 2.59% during the financial year 2021, derived by enhanced earnings.

The deposit base of the Company was maintained at a steady level of LKR 17.11 Bn. This reflects the trust and confidence attained by the Company among fund managers and the corporate sector that continued to place substantial fixed deposits.

The Tier I Core Capital Ratio and the Total Capital Ratio stood at 14.74% and 21.36% as at 31 December 2021, well above the respective regulatory capital adequacy requirements of 7% and 11%.

Commenting on the strong performance the Company has demonstrated in 2021, Sumith Cumaranatunga, Chairman, Siyapatha Finance PLC said “We are proud of the financial performance that Siyapatha Finance has delivered despite the challenges posed by the pandemic. This is a testament to the ability of our remarkable workforce, our strength, our dedication and our constant need to improve ourselves through the implementation of our high performing strategies. I am confident that the organization will continue building upwards, leveraging on opportunities that will help deliver positive results in the future.”

“Siyapatha Finance continues to display remarkable resilience and growth even amidst the prevailing challenges in the external environment. Our financial performance has spoken volumes about the Company’s strength and stability. We are cognizant of the challenging path ahead of us and yet we are confident of delivering consistent growth with much optimism and enthusiasm,” stated Ananda Seneviratne Managing Director, Siyapatha Finance.

Business

JICA and JFTC support Sri Lanka’s drive for economic growth through a fair and competitive market

The Japan International Cooperation Agency (JICA) and the Japan Fair Trade Commission (JFTC) have expressed their support for policy reforms and institutional enhancements aimed at ensuring the supply of high-quality goods and services in Sri Lanka while safeguarding both consumers and producers.

This was discussed at a meeting held on Wednesday (12) at the Presidential Secretariat between representatives of these organisations and the Secretary to the President, Dr. Nandika Sanath Kumanayake.

During the discussion, the representatives emphasized that establishing fairness in trade would protect both consumers and producers while fostering a competitive market in the country. They also emphasized how Japan’s competitive trade policies contributed to its economic progress, explaining that such policies not only help to protect consumer rights but also stimulate innovation.

The secretary to the president noted that this year’s budget has placed special emphasis on the required policy adjustments to promote fair trade while elevating Sri Lanka’s market to a higher level. He also briefed the representatives on these planned reforms.

The meeting was attended by Senior Additional Secretary to the President, Russell Aponsu, JICA representatives Tetsuya Yamada, Arisa Inada, Yuri Horrita, and Namal Ralapanawa; and JFTC representatives Y. Sakuma, Y. Asahina, Y. Fukushima, and M. Takeuchi.

[PMD]

Business

World seen to be at crucial juncture as competition mounts for strategic resources

By Ifham Nizam

The intersection of climate change, energy security and global politics has never been more crucial, with geopolitical conflicts increasingly driven by competition over fossil fuels and critical minerals. Mayank Aggarwal, an energy and climate expert from The Reporters’ Collective, highlights this in his work, ‘Geopolitical Energy Chessboard’.

“Climate change and energy security are two of the most pressing global challenges, Aggarwal explains. “Urgent climate action is needed to mitigate its impact, but reducing fossil fuel use and transitioning to cleaner energy is a politically charged issue, he told The Island Financial Review.

His research highlights the complex web of energy politics, particularly in South Asia, where one in four people on earth reside. “South Asia is a major importer of fossil fuels and its energy security is critical. But the region also lacks a comprehensive dialogue framework to address climate and energy challenges collectively, he notes.

Aggarwal emphasizes that energy conflicts are not just national concerns but extend to the global stage. “From Libya and Iraq to Ukraine and Venezuela, conflicts over oil, gas, coal and critical minerals are shaping international relations. These disputes threaten economic stability and development goals worldwide.”

Despite the urgent need for a clean energy transition, political and economic interests delay global cooperation. “Countries are pulling out of climate agreements, favoring bilateral deals that often sideline developing nations. While global clean energy transition is essential, the geopolitical hurdles remain significant, Aggarwal warns.

He calls for a “Just Energy Transition” that ensures energy security and independence while engaging communities in decision-making. “We need regional cooperation, transparent negotiations for resource-rich areas and strong political will to drive climate and energy discussions at all levels, he concludes.

As the world grapples with escalating climate disasters and energy crises, Aggarwal’s insights highlight the urgent need for a balanced, just, and cooperative approach to energy politics.

Business

SEC Sri Lanka engages in interactive knowledge-sharing forum with University of Ruhuna

The Securities and Exchange Commission (SEC) of Sri Lanka recently participated in the Capital Market Forum 2025, organized by the Department of Accountancy and the Department of Finance of the Faculty of Management and Finance at the University of Ruhuna, in collaboration with the Colombo Stock Exchange (CSE). This interactive knowledge-sharing forum aims to enhance financial literacy and promote capital market participation among undergraduates and academics.

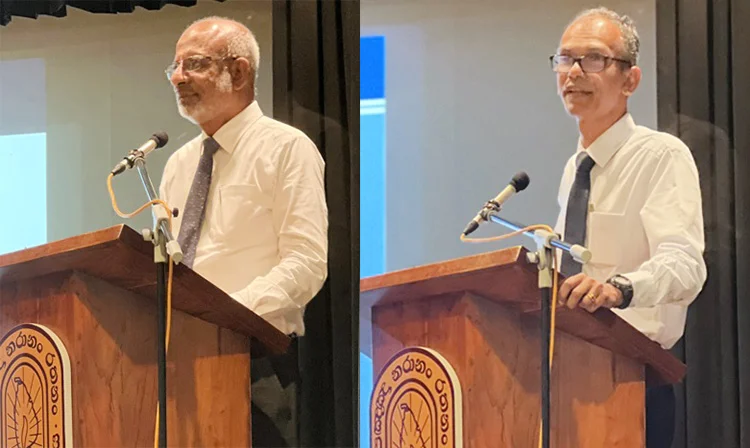

A key highlight of the forum was the workshop on “Nurturing Future Investors: The Role of Capital Markets in Personal and Economic Growth,” which featured distinguished speakers, including Senior Professor Hareendra Dissabandara, Chairman of the SEC, and Tushara Jayaratne, Deputy Director General of the SEC.

Senior Professor Hareendra Dissabandara delivered a compelling lecture on the crucial role of capital markets in fostering economic development. He emphasized how capital markets facilitate efficient capital allocation and contribute to long-term economic stability. A key focus of his discussion was the significance of capital formation as a sustainable alternative to debt financing for government projects. He illustrated this by comparing the market capitalization of a leading Sri Lankan company with the costs of several major government initiatives.

Professor Dissabandara highlighted the historical reliance on borrowing for infrastructure development in Sri Lanka, leading to fiscal imbalances, high-interest burdens, and economic vulnerabilities. He underscored the importance of equity financing in business sustainability, emphasizing that an efficient financial market channels surplus funds from households, institutions, and foreign investors into businesses and government projects. He explained that for over 70 years, successive governments have relied on borrowing to fund infrastructure and development, causing fiscal imbalances, rising interest burdens, high taxation, and economic vulnerabilities. He also noted that corporate professionals often overlook the importance of equity financing for sustainable growth.

-

News5 days ago

News5 days agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

Features6 days ago

Features6 days agoShyam Selvadurai and his exploration of Yasodhara’s story

-

Editorial4 days ago

Editorial4 days agoRanil roasted in London

-

Latest News5 days ago

Latest News5 days agoS. Thomas’ beat Royal by five wickets in the 146th Battle of the Blues

-

News5 days ago

News5 days agoTeachers’ union calls for action against late-night WhatsApp homework

-

Editorial6 days ago

Editorial6 days agoHeroes and villains

-

Features4 days ago

Features4 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Opinion3 days ago

Opinion3 days agoInsulting SL armed forces