Business

Significance of repatriation and conversion of export proceeds for external sector stability and overall financial system stability

Sri Lanka’s merchandise export sector has shown a notable improvement in 2021 compared to the pandemic-affected 2020. As per the latest Customs data, export earnings have averaged US dollars 985 million during the eight months ending August 2021 compared to a monthly average of US dollars 837 million in 2020, while the average earnings have amounted to US dollars 1,064 million during June-August 2021. This is an appreciable development as the merchandise export sector (comprising diverse products) is the largest foreign exchange earner in most countries, including Sri Lanka.

Sri Lanka has had a trade deficit each year since 1977, and the gap between merchandise imports and exports is typically financed by other inflows to the external current account (such as tourism and other services inflows as well as workers’ remittances), and financial inflows (such as investments and borrowing).

In this background, some recent developments in the foreign exchange market have raised several concerns, particularly as some of these typical avenues of foreign exchange inflows have been affected due to pandemic-related pressures, as explained below:

a) Compared to the monthly average exports as reported by Customs (goods flow) of US dollars 985 million during the eight months ending August 2021, the monthly average repatriation of export proceeds during July/August 2021 has been US dollars 640 million as reported by banks (financial flow). Accordingly, there has been a significant gap of US dollars 345 million between these two figures. This observation therefore, raises the serious question as to whether exporters comply with the regulation on 100 per cent repatriation of export proceeds.

b) It also appears that due to an undue speculation on exchange rate movements, there has been a reluctance to convert export earnings during the period from January 2020 to July 2021, thereby limiting inflows to the domestic foreign exchange market, which situation has then resulted in a buildup of foreign currency deposit balances with the banking sector by a significant US dollars 1.9 billion. In addition, with low rupee interest rates, some exporters have found it more lucrative to borrow and import to meet their input requirements, leading to further tension in the domestic market.

c) As per the data available, it would also be noted that if there had been a 100 per cent repatriation and 100 per cent conversion of export proceeds, the monthly export foreign exchange flow into the domestic market would have been US dollars 985 million, and with the average expenditure on imports of US dollars 1,670 million, that would have resulted in a monthly average gap of US dollars 685 million. This could have been easily financed using other foreign exchange inflows into the country.

d) Based on the above past statistics in general, and the experience during July/August 2021 in particular, the monthly average gap between the conversions of export proceeds with an incomplete repatriation and expenditure on imports has been quite alarming.

It would also be fair to state that there is a necessity for a country to ensure that the foreign exchange generated through export activities are duly repatriated into the country and converted into its currency. In fact, many emerging market economies have repatriation and conversion requirements imposed on merchandise and services exports. Country experiences vary, and over time, with the buildup of a country’s foreign exchange reserves through such non-debt inflows, countries have also gradually relaxed these requirements. Regional economies such as Bangladesh, India, Indonesia, Malaysia, Nepal, Pakistan, and Thailand have export proceeds repatriation requirements currently in place varying from 3 months to 2 years of the export. Bangladesh, India, Pakistan and Thailand have repatriation requirements on both goods and services export proceeds, while in Nepal, Malaysia and Indonesia, the repatriation requirement is only applicable on goods exports. Bangladesh, India, Pakistan and Thailand have rules on conversion to respective local currencies in different percentages based on nature and the amount of repatriated export proceeds and their utilisation. Such repatriation and conversion requirements ensure the fulfillment of the demand for foreign currency, including intermediate and investment goods imports directly required by the export sector, as well as essential fuel and medical requirements of the country, which are indirect inputs to all sectors including the export sector.

Therefore, it would be reasonable for the Government (which supports the export sector through lower taxes and numerous other incentives) and the Central Bank (which is expected to deliver price and economic stability as well as financial system stability) to take steps to ensure the complete repatriation of export proceeds within a reasonable period and the conversion of inflows of export proceeds into the local currency, including the proceeds already accumulated in exporters’ accounts, so that the true purpose of exports is realised.

As would be well appreciated, an export would realise its objective only when it finally culminates in the flow of foreign exchange that is generated by the export into the country’s financial system in its local currency. That objective would obviously not be fulfilled if the final conversion of export proceeds into local currency does not take place. Accordingly, steps must be taken to strengthen the systems to ensure monitoring and to implement measures that lead to this objective. It is only then that the gap between the foreign exchange liquidity provided through exports and the foreign exchange liquidity demand for imports would reduce to the level as published in the Central Bank’s own reports.

Business

Strategic roadmap towards a cleaner, sustainable and people-centric energy future

By Ifham Nizam

As Sri Lanka gears up for a transformative shift in its energy sector, the Results Delivery Framework (RDF) 2025-26 lays out a strategic roadmap toward a cleaner, more sustainable and people-centric energy future.

Eng. Pubudu Niroshan Hedigallage, Director General, Power Sector Reforms Secretariat and a member of the Energy Committee, emphasizes the critical role of public awareness and global integration in achieving these ambitious goals.

“The success of our energy transition depends on people being on the same page, says Hedigallage. “We need a unified approach where policies align with public interest, ensuring energy security while reducing our carbon footprint.”

The RDF focuses on three main pillars:

Affordable and Secure, Cleaner Energy Supply

Smart and Sensible, People-Centric Energy

Strategic Global Integration in the Energy Sector

To achieve energy security and affordability, Sri Lanka is set to establish a National Energy Policy & Planning Office (NEPPO) in the first half of 2025. This office will serve as the central body for policy formulation and planning, ensuring a structured approach to clean energy adoption.

A key initiative is the “Rivi Bala Punarudaya” solar program, aiming to add 2,000 MW of solar energy within five years. “Solar power is one of the most viable solutions for Sri Lanka. It’s time to accelerate large-scale adoption, Hedigallage asserts.

Additionally, the government plans to begin competitive procurement for 1,000 MW of wind energy along the Puttalam-Jaffna coastal belt by mid-2025.

Hedigallage stresses the importance of policy reforms to align industrial and regulatory frameworks. “Introducing the Energy Transition Act in late 2025 will harmonize all sector-related laws, ensuring smoother implementation of new initiatives, he explains.

Other people-centric initiatives include:

Amendments to the Electricity Act to facilitate restructuring within the energy sector.

A Demand Response Program, developed with the Ministry of Digital Economy, to optimize energy consumption.

A techno-commercial collaboration program connecting universities, industries and utilities to drive innovation.

The Women-in-Energy National Program, launching in late 2025, to increase female participation in the sector.

Recognizing the importance of international collaboration, the RDF aims to position Sri Lanka as a key player in the global energy market.

A state agency for green hydrogen initiatives will be established in late 2025 to explore hydrogen as an alternative energy source.

By early 2026, a digital risk management dashboard will be launched to monitor reservoir levels, fuel inventories, and energy demand in real time.

The Green Energy Certification Unit, to be established in 2026, will authenticate renewable energy usage with Renewable Energy Certificates (REC).

ESG (Environment, Sustainability, and Governance) frameworks will be introduced to ensure sustainable energy sector practices.

A global energy forum will be launched in 2026 to connect Sri Lanka to international energy value chains.

With these ambitious plans, Sri Lanka is set to become a leader in clean energy in the region. “Our energy future is not just about technology and infrastructure; it’s about people, policy, and partnerships, Hedigallage added.

Business

Mintpay partners with Burger King and other Softlogic Restaurants

Mintpay, a pioneering financial app reshaping how people pay in Sri Lanka, has announced a landmark partnership with Softlogic Restaurants. This collaboration aims to enhance the dining experience for food enthusiasts by offering convenient, secure, and flexible payment options. Softlogic Restaurants, renowned for its portfolio of beloved brands such as Burger King, Popeyes Louisiana Kitchen, Crystal Jade, Delifrance, and Baskin Robbins, will now enable customers to enjoy a wide variety of cuisines through Mintpay’s seamless digital payment solution.

Mintpay Account Manager Sasra Wickrama Arachchi stated, “At Mintpay, we aim to transform every payment into a rewarding moment, and we believe this partnership with Softlogic Restaurants delivers on that promise, making every meal more rewarding.”

Mintpay Senior Business Development Executive Faziha Farhan added, “At Mintpay, we’re always expanding our network by partnering with brands that share our vision for seamless and rewarding payments. We’re excited to welcome Burger King, the first global QSR brand in Sri Lanka to integrate Mintpay, alongside other renowned Softlogic restaurants. This partnership marks another step in transforming the dining experience for all our customers, offering greater flexibility and convenience whenever they use Mintpay.”

Business

Haleon partners Sri Lanka Dental Association as Official Sponsor for World Oral Health Day 2025

Haleon Sri Lanka formerly known as GlaxoSmithKline Healthcare; the first multinational pharmaceutical manufacturing organization in Sri Lanka, which commenced manufacturing in 1956 with the flagship brands Panadol, Iodex Eno etc., signed a Memorandum of Understanding (MOU) with the Sri Lanka Dental Association (SLDA) as the official sponsor of World Oral Health Day 2025 in Sri Lanka. The formal signing ceremony took take place on Friday, February 28, 2025. The global theme for this year is “A happy mouth is … a happy mind” which emphasises the importance of oral health on quality of life and wellbeing.

The partnership between SLDA and Haleon; Marketers of Sensodyne aims to transform the conventional methods of celebrating World Oral Health Day. The landmark agreement reimagines World Oral Health Day with an awareness-driven approach themed “#BeSensitiveToOralHealth: Take the first step.” The month-long March campaign will educate Sri Lankans about proactive oral healthcare through strategic messaging across traditional and digital platforms, encouraging everyone to prioritize their oral health. The collaboration represents a significant commitment to improving oral health awareness and access to dental care across Sri Lanka.

Haleon and SLDA will work together to extend awareness that results in tangible healthcare benefits nationwide. Free dental screening facilities will be provided across the island, benefiting approximately 50,000 Sri Lankans.

Beginning March 20th, World Oral Health Day, will take place as a national event at Galle Face, Colombo will serve as the campaign centrepiece, offering free dental screenings, oral cancer assessments, and teeth sensitivity tests to increase public understanding of good oral health practices. All SLDA members will actively participate in this nationwide health initiative making quality dental care accessible to communities throughout the country.

-

News7 days ago

News7 days agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

Editorial6 days ago

Editorial6 days agoRanil roasted in London

-

Latest News6 days ago

Latest News6 days agoS. Thomas’ beat Royal by five wickets in the 146th Battle of the Blues

-

News7 days ago

News7 days agoTeachers’ union calls for action against late-night WhatsApp homework

-

Features6 days ago

Features6 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Opinion5 days ago

Opinion5 days agoInsulting SL armed forces

-

Features6 days ago

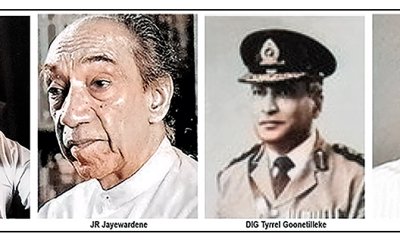

Features6 days agoMr. JR Jayewardene’s passport

-

Editorial7 days ago

Editorial7 days agoPolice looking for their own head